AntonioGuillem/iStock via Getty Images

The Thesis in a Nutshell

Tencent Music Entertainment (NYSE:TME), known as a music streaming competitor of Spotify (NYSE:SPOT), is actually a social media company with a highly sophisticated business model. TME has a dominating 80% market share in China and a monthly active user base of 841m. In addition, not only has TME lots of untapped potential to monetize its current business, but also enjoys an excellent opportunity to leverage its social music ecosystem into the metaverse.

From its all-time-high in March 2021, the TME stock has sold off more than 77%. Tencent Music appears to be extremely undervalued at the current trading price. A DCF valuation calculates a fair target price of $12.15 per share, implying an upside potential of 71%.

Understanding Tencent Music

Let us start with a brief company overview of Tencent Music Entertainment Group, because many analysts on Wall Street seem to define the value proposition of the company to narrowly.

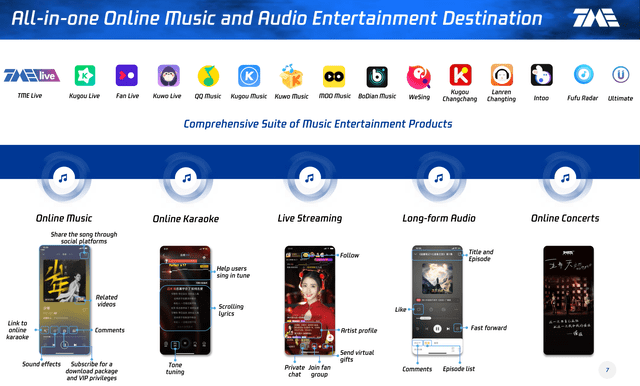

Tencent Music Entertainment is the leading online music and audio entertainment platform in China, with a dominating market share in music streaming of approximately 80%. The company operates 4 out of 5 most popular music apps in China, including QQ Music, Kugou Music, Kuwo Music and WeSing, and commercializes services such as online music, online karaoke and online concerts.

It is important to understand, that these apps don’t just focus on music streaming services, but on a broad community for music fans to discover, listen, sing, watch, perform and socialize around music. Moreover, social interactions such as sharing content, liking, commenting, following and virtual gifting, are deeply integrated in TME products and highly complementary to the core music experience. TME describes itself as follows: ”Our platform is an all-in-one music and audio entertainment destination that allows users to seamlessly engage with music in a highly social setting.”

Thus, in my opinion, TME should be regarded as – and potentially also valued like – a social media company.

As of September 2021, TME has a monthly active user base of 841 million.

A Sophisticated Business Model

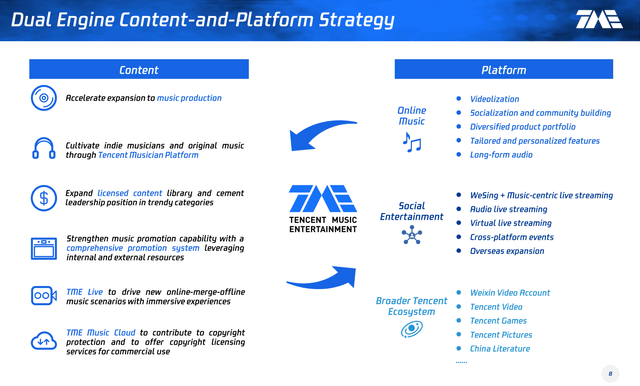

The business model and monetization of TME are very much in alignment with a social media company. While other music-streaming platforms such as Spotify generate most of their revenues from online music services such as paid subscriptions, advertising and royalties, these businesses accounted for just 1/3 of TME’s sales in 2021. In fact, most of TMEs revenues come from social entertainment services (e.g, virtual-gifting culture as promoted in other social media streaming companies).

The idea is as follows: TME’s business model acquires users through the provision of music downloads and streaming. Once users are in the TME music ecosystem, the company monetizes its massive user base through the offering of diverse social entertainment services. Thus, TME not only provides a more comprehensive music experience than global peers but enjoys a cost-effective acquisition of users paired with higher-value monetization.

As Tencent Music has conquered already 80% of the relevant music market in China, and the company’s MAU will likely level out at current levels, I expect TME to focus more on monetization of the business. And there are still lots of untapped opportunities for TME to monetize its music business. I attribute this argument to three facts: Firstly, as of November 2021, only approximately 11% of TME massive active user base are paid subscribers. Secondly, advertising space in TMEs platforms could easily triple before the ads negatively impact user experience. Thirdly, a broader integration with the Tencent (OTCPK:TCEHY) ecosystem could drive new business opportunities. In this context, it is worth noting that Tencent owns a 51% stake in Tencent Music.

Moreover, I strongly believe that some chapters in the growth and innovation story of Tencent Music might yet to be written. With reference to the current entertainment and social music ecosystem of Tencent Music, the company has built amazing prospects to leverage its business into the metaverse.

Great Financials

Whenever I make an equity investment, I need to be comfortable with the following three data points: Growing revenues on the income statement, positive net operating cash-flow, and a healthy balance sheet.

First, let us look at the income statement. In the period 2017 until 2020, revenues grew at a compounded annual growth rate of 27.8%. Moreover the company is profitable, with a net-profit margin of approximately 12.3%.

Macrotrends – TME Income Statement

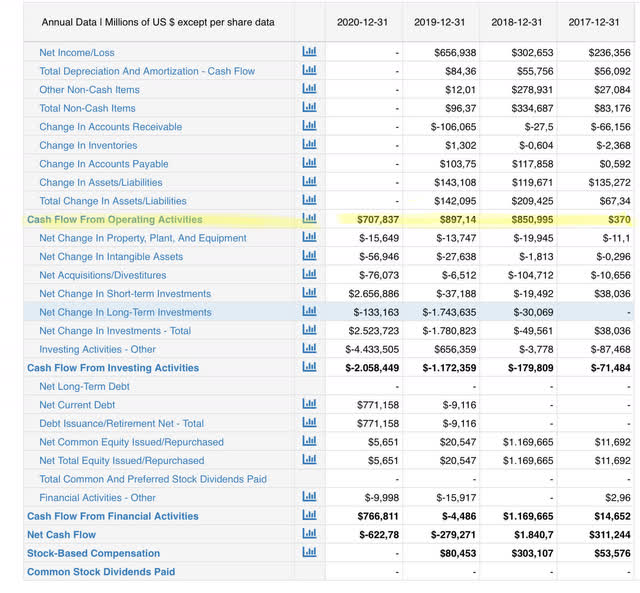

Second, the cash flow statement shows that TME has strong operating cash flow. In fact, the operating cash flow is higher that the net income, which I consider to be a very strong signal of a high quality business.

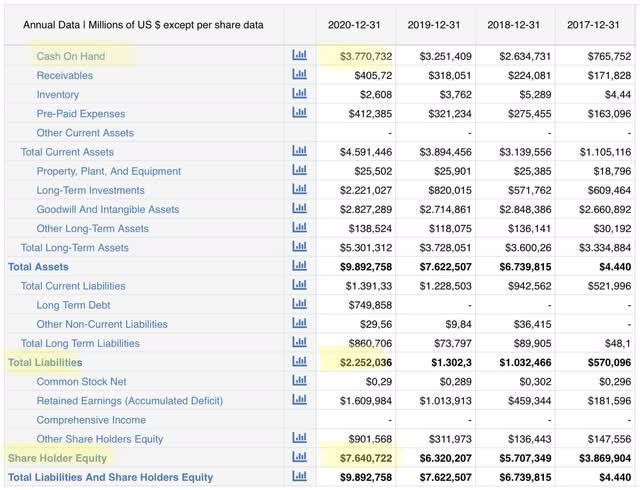

Finally, let us analyze the balance sheet. With $3.7b US cash on hand, which is more than 30% of the company’s market capitalization, Tencent Music is in a very healthy financial position. The company can definitely absorb some multi-year headwinds, while also making considerable investments in long-term growth opportunities such as the metaverse.

Given the healthy cash-flow, the strong balance sheet, and the low market valuation, a share repurchase program is highly likely.

Macrotrends – TME Balance Sheet Statement

Now Available at a Bargain Price

Every investment opportunity is a function of price. You can make a bad investment in an amazing company, if you pay too much. Reversely, you can make an amazing speculation in an almost-bankrupt company, if you buy at a bargain price. Thus, for me, price is very important.

From its all-time-high in March 2021, the TME stock has sold off more than 77%.

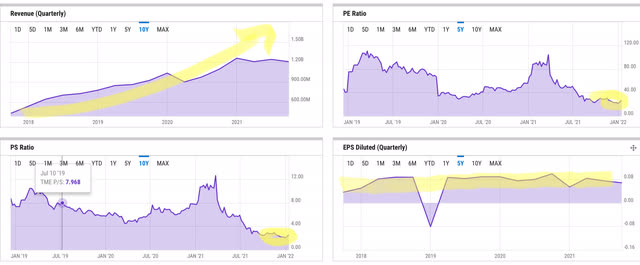

But this sell-off is not connected to any fundamental change. As you see in the following graphs, the discrepancy between the stock performance and the business performance produced all-time-low valuation multiples such as price-to-sales and price-to-earnings. In my opinion, Tencent Music appears to be extremely undervalued at the current trading price.

Valuation

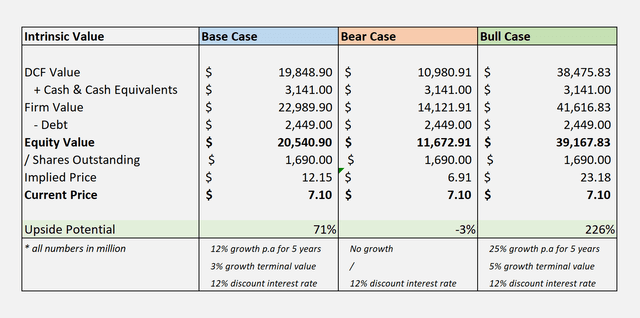

So TME appears undervalued. But what would be a reasonable valuation? I have constructed a DCF valuation with a sensitivity analysis of key assumptions. The results of my analysis are termed Base-, Bear- and Bull Case. (Some assumptions for the analysis are listed under the respective case).

As you see, possible valuations for Tencent Music, given the current knowledge about the company, should be between $6.91/share and $23.18/share. Since the latest trading price for TME has been quoted at $7.10/share, the presented opportunity is skewed towards a winning bet.

Risks and Challenges

Although I think that the market has priced in a lot of negativity for TME already, there remain some risks. Besides the usual sources of possible challenges that may affect the profitability of every company, — such as macroeconomic headwinds, industry competition, or poor managerial execution of strategy, — I have identified three major possible sources of risks which are idiosyncratic to Tencent Music.

Competition. Some analysts believe that the music entertainment industry in China will become more competitive in the next few years. Firstly, new entrants try to push into the market, and secondly, the Chinese government has eliminated exclusive content rights for Tencent Music. I believe however, that due to the massive scale advantage of TME, the company should easily be able to keep its current competitive edge. Furthermore, synergies with parent company Tencent’s social networks and a broadly growing market also support its prospects.

Regulatory Headwinds in China. Another main risk for the TME stock is obviously a continued pressure coming from the Chinese government. I don’t want to politicize the discussion, or present myself as an expert on China, which is why I would like to encourage every investor to assess the risk-reward of investing in China for himself. For me personally, the valuations are pushed to such ridiculously low levels that I regard investments in China as justified

ADR Delisting Fears. This risk is closely tied to the previous concern of regulatory headwinds. I personally am not afraid of an ADR delisting, but the thereby negative market sentiment and fear could definitely keep the stock price depressed for some time.

Conclusion & Recommendation

When I feel that a company is valued cheaply, I like to wait for an additional discount of 30%. If the additional discount never comes, I lose nothing — because opportunities come and go. If however, the target buying price is met, the risk reward becomes highly favorable.

When I first thought TME is cheap, the company was trading at $14/share. Thus, since my first assessment, TME lost not 30%, but 50% of its market capitalization! At the current valuation level, I definitely think the company is cheap and I am confident to take a long position in TME. I will hold the stock until the misunderstanding, underappreciation and undervaluation of Tencent Music corrects.

Be the first to comment