Marc Bruxelle

Investment Thesis: Telus Corporation could be poised for longer-term upside on the basis of significant growth in revenue and ARPU, as well as a potentially attractive valuation from an earnings standpoint.

In a previous article back in March 2021, I made the argument that Telus Corporation (NYSE:TU) may see pressure on revenues going forward – owing to lower roaming revenues as a result of COVID-related travel restrictions at the time, as well as lower overage revenues as a result of a growing preference for unlimited plans on the part of customers.

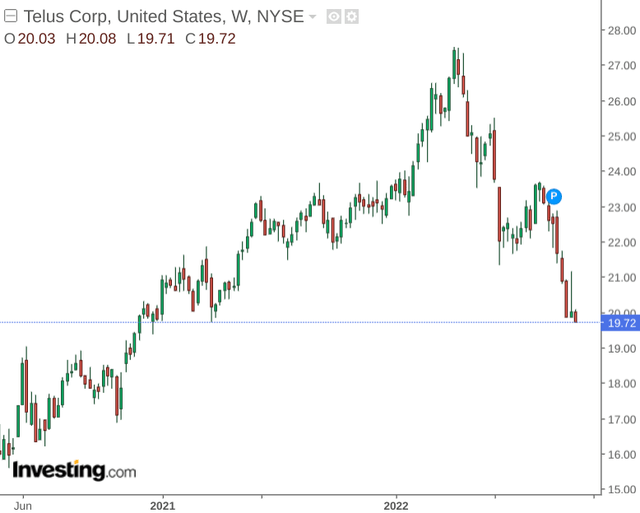

In spite of this assessment – the stock subsequently saw strong upside before seeing a sharp decline this year.

The purpose of this article is to assess whether my aforementioned reasons for taking a cautious view on Telus Corporation were justified, and whether we could see a renewal of upside going forward.

Performance

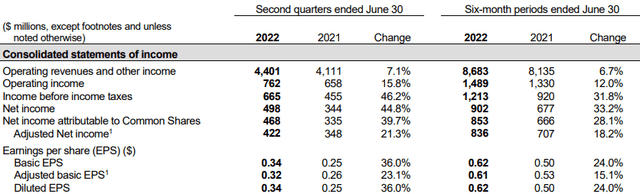

For Q2 2022, Telus Corporation saw growth in diluted EPS of 24% for the six months ended June 30, with growth of nearly 7% in operating revenues and 12% growth in operating income.

Telus Corporation: Q2 2022 Management’s Discussion and Analysis

Particularly, a strong driver of the growth in revenue has been driven by growth in ARPU (or mobile phone average revenue per subscriber per month), which came in at $57.74 in the second quarter of 2022 – representing a $1.18 or 2.1% increase as compared to the same quarter in the previous year. This was driven in significant part by an increase in roaming volumes due to higher travel demand.

More broadly, overall mobile network revenue grew by $97 million or 6.4% in the same quarter. Additionally, mobile network revenue is higher than that of the same quarter in 2019 by 6.6%. Across fixed products and services, revenues were up by 4.5% as a result of increased revenues across internet and data services as well as a 6.9% increase in internet subscribers over the previous 12 months.

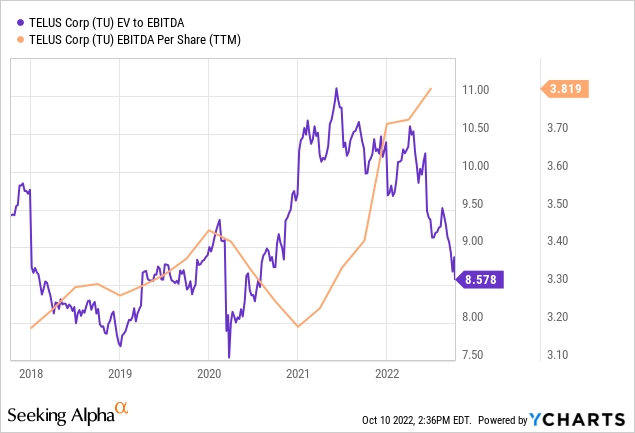

In terms of the stock’s broader earnings trajectory, we can see that EBITDA per share has climbed to a five-year high while the EV to EBITDA ratio has declined significantly from highs seen in 2021.

ycharts.com

This could indicate that the stock might be more attractively valued at this point and have room to rise should earnings growth continue.

When looking at the company’s quick ratio (calculated as current assets less inventories all over current liabilities), we can see that the ratio has seen a very slight decline:

| December 2021 | June 2022 | |

| Current Assets | 5032 | 4851 |

| Inventories | 448 | 437 |

| Current Liabilities | 8273 | 8366 |

| Quick Ratio | 0.55 | 0.53 |

Source: Figures sourced from Telus Corporation Management’s discussion and analysis2022 Q2. Figures provided in CAD millions, expect the quick ratio. Quick ratio calculated by author.

This indicates that the company’s ability to cover its current liabilities using its current liquid assets remains approximately the same as in December 2021.

Looking Forward

Going forward, inflation and macroeconomic considerations are likely to be a consideration for Telus Corporation going forward – as they would be expected to be for other companies in the telecommunications industry.

While we have seen a strong recovery in areas such as roaming revenue, for instance, this might be expected to plateau in the medium-term as travel demand stabilises to pre-COVID levels.

Moreover, should inflation mean that the company is forced to pass on further price increases to customers – we could see a situation where the rebound in demand that we have been seeing across certain offerings also starts to plateau.

With that being said, the strong decline that we have been seeing this year appears to be market-related. In terms of the company’s performance – revenue has been seeing a significant rebound across areas that originally saw a decline during COVID, while the company seems to be more attractively valued than previously from an earnings standpoint.

From this point of view, I foresee that Telus Corporation could have longer-term upside from here and take a bullish view on the stock.

Conclusion

To conclude, my view on Telus Corporation is that in spite of short-term market pressures – the stock could be poised for longer-term upside on the basis of significant growth in revenue and ARPU, as well as a potentially attractive valuation from an earnings standpoint.

Be the first to comment