Lukas Schulze/Getty Images News

Tellurian Inc. (NYSE:TELL) is a $2 billion company with a volatile stock price. The company’s goal is to build the Driftwood LNG plant, a project that’s expected to start at $12 billion and go up towards $30 billion once fully complete. As we’ll see throughout this article, the company has a peer-leading asset, however, rising interest rates could make it too late for the company to accomplish its goals.

Tellurian Summary

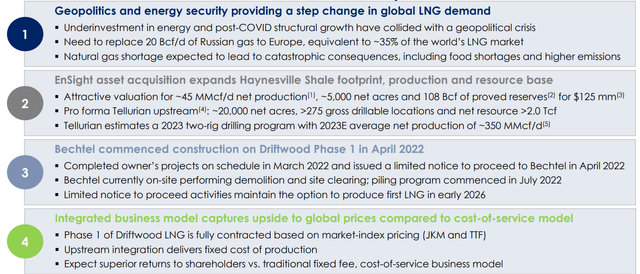

Tellurian has an impressive portfolio of assets.

Tellurian LNG Investor Presentation

Tellurian is investing in a market that is in shortfall. The chronic underinvestment as a result of COVID-19 didn’t help to solve anything as seen from the recent volatility and price spikes. The move away from Russian gas will help accelerate demand for U.S. natural gas, especially in Europe, which is well positioned to be supplied by Gulf Coast routes.

The company has had Bechtel commence construction on Driftwood Phase 1. The company has started on a limited notice to proceed, which gives the company the option to produce first LNG in early-2026 without the company committing to full financing yet. The company has fully contracted Phase 1 and is no longer looking at new customers.

EnSight Acquisition

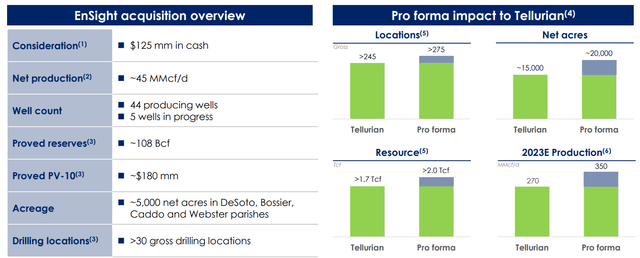

The company has spent $125 million on the acquisition of EnSight, and honestly, we’re not a fan.

Tellurian LNG Investor Presentation

The company spent $125 million in cash on an acquisition with an NPV-10 of $180 million. Not a bad deal, but not one to write home about, either. The production of the asset is currently 45 million cubic feet/day and is expected to move towards 2023E production of 350 million cubic feet/day with >2 trillion cubic feet of total resources for the company.

For perspective, the Driftwood Phase 1 consumption is expected to be 550 billion cubic feet/year, meaning the company’s expected 2023e production is expected to be almost 25% of its consumption. At that level of production, the company would have a multi-decade reserve life added to its portfolio. However, at the same time, it represents a changing focus.

The company needs to move towards an FID on Driftwood LNG, raise financing, and get started on the project. It needs more than $10 billion to make that happen. Small side acquisitions might be the company protecting its worst-case scenario, however, until it gives up on Driftwood LNG, each dollar of capital matters.

Debt Raises and Interest Rates

The company has consistently slowed down and has yet to announce the consortium of financing it needs to build Driftwood LNG.

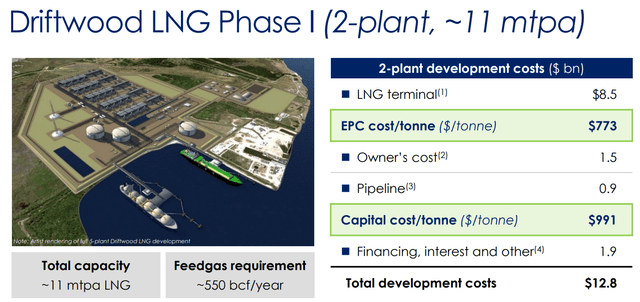

Tellurian LNG Investor Presentation

The company’s total development costs are expected to be $12.8 billion. Out of that, the core LNG terminal cost is expected to be $8.5 billion. The company’s net capital cost is expected to be $991/tonne, not a bad deal when LNG is trading at a $37/million BTU margin premium or almost $2000/tonne.

The Russian invasion of Ukraine has forced Europe’s hand, and across the board, the continent has sworn off Russian gas. That’s a major opportunity for U.S. LNG and Driftwood LNG is in a prime position to take advantage of that. However, on the flip side, interest rates are rising. Fast. The 30-year treasury is now at almost 3.2% versus 1.8% a year earlier.

With talks of another 1% rate increase in the next week, that rate could easily cross 4% if not move towards 5% by the end of the year. No bank is going to lend Tellurian money at 3% at that rate. Cheniere (LNG), which was built using a similar process, yields almost 3% on its debt, and based on that, we expect Driftwood’s rate to be in the 5-6% range.

On a potential $10 billion in debt, that’s an extra ~$300 million in annual interest. Tellurian might have to utilize additional equity issuance to make ends meet, diluting shareholders.

Driftwood Potential

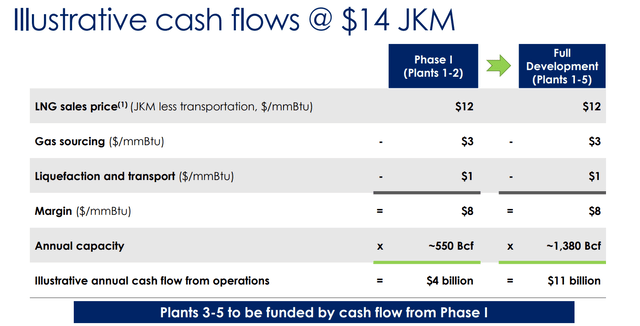

On a more positive note, Tellurian does have significant cash flow potential from Driftwood.

Tellurian LNG Investor Presentation

It’s worth noting that the company is assuming $14 JKM, however, in the past through COVID-19, LNG prices at JKM dropped as low as $4. The company’s breakeven is $6/mmBtu. However, at $14 JKM which is a fair long-run pricing, the company’s annual cash flow from operations would be $4 billion per year.

That would of course be enough for the company to become a multi-bagger and generate substantial shareholder rewards. We expect the company would pay down debt from Phase 1 towards a reasonable interest rate before redirecting all available capital towards a full development of Plants 1-5 expected to cost as much as $30 billion.

That’d be very affordable for the company, but of course, it still needs to get over the first hurdle.

Our View

Our view is that it’s tough to put a valuation on Tellurian. Capital markets remain receptive to the company, however, over the past 3 years, the company has more than doubled its shares outstanding. It’s building up a respectable natural gas business, but it’s also diluting shareholders and building up debt at the same time.

We’d like to see the company focus on protecting its shareholders while achieving Driftwood Phase 1. The project is expected to have $4 billion in cash flow when it comes online, but over the past 3 years, that cash flow number has gone from $16/share to $8/share. That’s a significant impact to shareholders for a company in a project that hasn’t gotten off the ground.

The company’s recent 35 million share offering diluted shareholders by 7% and raised $100 million, less than the cost of the EnSight acquisition, which at NPV-10 might generate 50% returns at the end of the day. We recommend investing based on Driftwood LNG’s cash flow potential and increased gas demand from Europe, but it’s a risky investment.

We recommend only a partial size investment at this time until the company gets over this hurdle.

Thesis Risk

The largest risk to the thesis, of course, is Phase 1 of Driftwood LNG. The company needs to raise massive financing for the project, and there’s no guarantee yet that it’ll be able to do so. If the company can’t do, so its natural gas production alone doesn’t justify the valuation and your equity will continue to dwindle as the company makes attempts to continue the project.

That’s a risk worth paying close attention to.

Conclusion

Tellurian LNG has recently made another acquisition in the natural gas space for $125 million. The company can now provide 25% of the natural gas that Driftwood LNG Phase 1 will consume if it does happen, however, the company still has a substantial amount of financing that it needs to put together, which is a massive risk.

The company has the risk of rising interest rates. Interest rates can go up more than another 1% before the end of the year, and this could add hundreds of millions of dollars to the company’s interest costs. It still hasn’t announced financing, and while the project has significant potential, there’s no guarantee that it pans out.

Be the first to comment