Baloncici

Dear readers/subscribers,

The downward pressure for Telenor (OTCPK:TELNY) continues, even if we’ve seen a slight relief in conjunction with the upward trend about a month ago or so. The reasons for this pressure is well-established over the past couple of articles on the company.

I remain a major investor in Telecommunications in terms of my portfolio exposure/s – and this holding is among the larger ones. While the companies in this sector will likely see only limited amounts of overall growth going forward, the stability of their earnings and their attractive, well-covered yields makes them still attractive as businesses and investments.

Let’s revisit Telenor and see what news warrants an update here.

Revisiting Telenor

It shouldn’t be surprising at this point that my focus is on the very long term, in terms of investment horizons. I don’t mind if companies trade at poor valuations for years – as long as I’m being compensated for my waiting, and as long as there’s a visible upside to the business.

Such is the case, I believe, for Telenor.

The past few quarters, including this latest one, have clarified the picture of the overall ebb and flow of the company’s business.

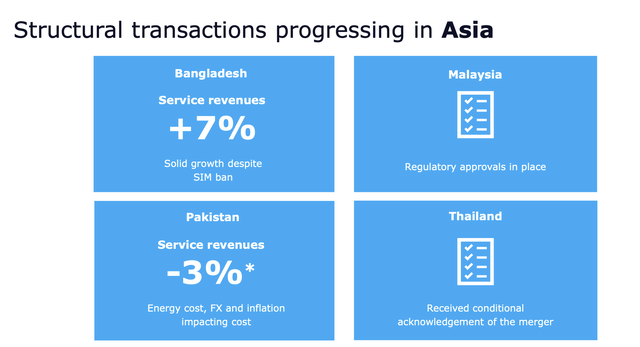

While overall mobile performance for the company is an unerring, stable business over time, and the company’s investments are paying off, the company is seeing increased competition in emerging markets – meaning above all Thailand.

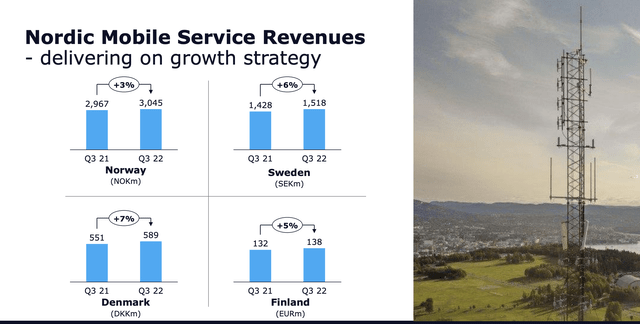

Because mobile service growth and ARPU have been solid – in every home nation (Scandinavia). For several years, there hasn’t been any home-market trend breaking that could have justified what has happened here in terms of the share price. The company can really do very little “better” in those geographies, given how mature these markets are. 0.5% organic growth is really some of the best results which can be expected here.

What’s driving the market mood, if we call it that, is the company’s emerging markets. 3Q22 is out, and the latest quarter was yet another report that highlights the above-quality fundamentals of the company.

We know from experience that the market can remain extremely negative on a company for a very long time – longer than is perhaps warranted by the actual challenges faced by the business.

In this case, home market challenges were impacted really only by copper price and energy price charges, which lowered EBITDA by a few points for the quarter.

But what we should highlight instead is the company’s focus and ongoing movements with its Asian transaction, which are going according to plan.

The company is also moving ahead with its divestment plans, such as the sale of the Norwegian fiber division, currently valued at close to €4B, which should bring home proceeds of 10.8B NOK. The company proposes a massive share buyback to mitigate some of the dividend leakages that’s ongoing here, and the transaction is expected to close in early 2023.

The company’s priorities for 2025E are very clear. First, profitable growth and stability in legacy, while focusing on modernization of the asset base here. Second, strengthen growth market cash flows, which are ongoing. Third, unlock the infrastructure value, among other things by divesting Fibre and focusing back on its core.

Telenor remains a cash-minting machine, generating upwards of 5B NOK in quarterly free cash flow at a rate of 2.5% organic EBITDA and organic service revenue growth.

While OpEx is up, this is primarily due to projects and energy costs – which no company at this time is spared from. Energy costs worsened in 2H22, but are currently in a better position for 4Q22 – but Telenor remains exposed to energy cost trends.

But the company still managed net income to holders of 1.5B for the year, and the leverage remains low at only 2.1x. The company maintained its outlook for 2022, which is low single-digit growth and stable organic EBITDA, excluding the Malaysia segment. Capex in terms of sales is at 16-17% expected, but this is higher than say Orange (ORAN) because Telenor still has more investments to do. Telcos always have that sort of balance between investments and sales, and while Telenor’s is higher, it’s not worryingly high as such.

Fundamentals in terms of debt maturities remain stellar. over 60% of the company’s debt is not due until 2027 or later, and the main company Telenor ASA does not have any debt coming due in 2022. Despite pressured markets, Telenor is managing a ROCE that’s above any level from 2012-2017, and with the exception of 2021, is excellent. ‘

The market is continuing to miss several things with the company, as I see it. Telenor is one of the best-rated Telcos in the entire market. Why? It’s at an A rating, and there are no signs that this is changing.

Compare this to any of its telco peers in the EU and what they’ve been doing, and the company has kept steadily paying dividends. That’s also why, even after this drop, I’m significantly in the green on my investment.

This is not me saying the company does not have risks.

It does – but those risks are inherent to around 40% of its operating revenue and EBITDA, related to the geopolitical instability of its markets. The company had to leave Myanmar, which resulted in a significant loss below $600 when accounting for the sales price. These geopolitical instabilities and uncertainties are part of what drives the company’s valuation “story” here – with FX because FX losses can really drive things down as well.

However, its other growth markets are not Myanmar – and this means that Telenor is a telco with a superb yield, market position, and above all, at a great valuation.

Telenor’s Valuation

Telenor is now at a very interesting double-digit share price, really hovering back and forth between triple and double for some time now.

A company like Telenor provides me with a very good yield, throwing off thousands of dollars every year, and also have given me very good capital appreciation at times, and now the potential for it.

Take Tele2 (OTCPK:TLTZF), for instance. The company is up more than 50% since I invested in it a few years back. I rotated small parts of my investments, only to buy the shares back when Tele2 dipped in conjunction with the other telco’s dipping.

I don’t own companies like Tele2 and Telenor for supposed earnings or massive amounts of revenue “growth”. However, at the current valuation, Telenor’s upside from 107 NOK is, based on both growth and reversal. Assuming even a below-GDP growth of 1% in EBITDA and only a 2% terminal growth rate per year, as well as a 1.2% CapEx growth, the company, comes in at an implied EV of well over 220 NOK/share, even with recent cost headwinds. This may sound ridiculous, as it would imply an over 100% upside, but it’s due to the company’s massively low WACC due to a very low cost of debt (low leverage), and its appealing home areas, which essentially throw off cash like a bond proxy.

The company might be more volatile than your typical telco because of its Asian projects, but the fundamental substance of the company is beyond stable.

Let’s see recent target changes for Telenor given how the share prices have moved. We’re down from a high of 175 NOK to a high of 170 NOK, but the average is down around 8 NOK to around 130 NOK from 137 NOKfor the native. This spells an upside well over 30% here, even with analysts being relatively conservative (only 8 out of 16 are at a “BUY” or equivalent here), with Telco’s not being viewed as “good” at this time.

However, by any measure given by forecasts, estimates, and analysts, this company is currently trading at a substantial discount. Less than a year ago, the average PT was over 170 NOK/share, and the current P/E is below 12x at a realistic, normalized level of earnings.

Telenor is A-rated but has used its cash to drive accretive M&As over the past few years. Much of what the company could deliver over the next 5 years is still percolating, and investors should view an investment into Telenor as a mid-term investment at the very least – if not very long-term. That is how i view it.

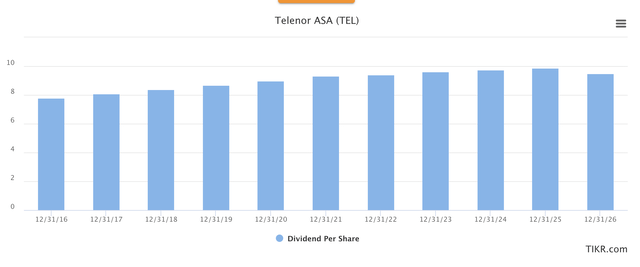

I expect my Telenor investment to double in the long term. The yield is now over 8% – and it’s well-covered – though. That puts it on par with Orange, which is amazing to me. The average for these peers around the EU is around 11-12X P/E with a 5.5X EBITDA and a 1.12X book multiple, updated for lower valuations. As of yet, there is no expectation for a dividend cut due to the FibreCo sale – but we’ll see what happens here. The current forecasts are slowly growing dividend bumps until 2025 at the very least.

Telenor Dividend Forecast (Tikr.com/S&P Global)

The company’s higher upside is primarily growth-driven, as well as being one of the lower-traded telcos in a collection of low-valued Telcos on the European market.

Here is how I view things as they currently stand.

Telenor ASA has a valuation price target of between 105 NOK and 170 NOK on the high end.

None of these valuation assumptions take into account a full success of growth in Asia, which would push the premium up above 230-250 NOK. The ~100 NOK is essentially assuming a complete failure in anything but the home market (and the company is currently trading below this level), while the 175 is a balanced approach between growth and legacy.

Current averages are 125-145 NOK per share – and this is also where most current analysts land – somewhere in the middle.

That means this company is still, as it was before, extremely undervalued.

Remember me beating the drum on Norsk Hydro (NHYDY)?

I sold that investment at above 70 NOK/share at a massive profit well into the triple digits. This is much the same, despite vastly different sectors. Telenor is undervalued quality.

I “BUY” undervalued quality happily, whenever it’s being offered to me.

Thesis

My thesis for Telenor is as follows:

- I view Telenor as one of the safest telcos in all of Europe, based on its fundamentals and markets. Safer than Orange, and safer than Tele2/Telia. Perhaps Deutsche Telekom (OTCQX:DTEGY) might be as safe, but less than half the current yield.

- Based on this safety and this yield as well as this upside, I’m marking this company as a “BUY” and considering it with a PT of 150 NOK/share. I am not lowering my PT here.

- I believe the right way to invest in the business is native shares only, not ADRs. The native share trades on the Oslo Share exchange under the symbol TEL.

Remember, I’m all about :

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

Thank you for reading.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment