Despite the broader market sell-off, shares of virtual healthcare company Teladoc (TDOC) have been on fire this year as the recent Coronavirus (COVID-19) pandemic has accelerated the ongoing digital transformation. This article reviews Teladoc’s business, its ongoing growth opportunities, the current valuation, risks, margin of safety and concludes with our opinion about investing.

Overview

Teladoc Health, Inc. provides virtual healthcare services. It covers a widening variety of clinical conditions. The company’s platform enables patients and providers to have an integrated smart user experience through mobile, Web, and phone-based access points. It serves employers, health plans, health systems and more.

Teladoc’s shares have performed particularly well this year, in light of the Coronavirus pandemic, which we view as accelerating the large secular digital transformation (more on this in a moment). We also believe the very recent share price pullback (despite this year’s strong gains for TDOC), provides some additional margin of safety for investors to consider (although in the long-run it will matter little compared to the vast upside potential).

(Image source: iPhone stocks app)

Coronavirus Impacts

The ongoing coronavirus pandemic has brought a lot of attention to Teladoc in recent weeks as its virtual healthcare solutions are an attractive option for those who wish to minimize their potential exposure to the virus. For example, the CDC recently encouraged people to use telehealth services as the coronavirus outbreak spreads. Further, just this week Vice President Mike Pence announced that health insurers will pay for telemedicine services during the COVID-19 outbreak. At a time when the overall market is plunging, Teladoc shares have been very strong year-to-date.

The Digital Transformation

According to CIO Digital Magazine, “Digital transformation is a foundational change in how an organization delivers value to its customers… [it] marks a radical rethinking of how an organization uses technology, people and processes to fundamentally change business performance.” It’s basically an enormous secular trend that is greatly benefiting organizations that can stay in front of it, such as Teladoc. And according to popular blogger Josh Brown, regarding Teladoc specifically, “I think the nature of work has been a… secular trend in hiding all this time. Feb 2020 was a mass realization.” We agree because as shares of Teladoc (and other digital transformation companies) have perked up, there remains a tremendous amount of room to run in the long term.

Teladoc’s Growth

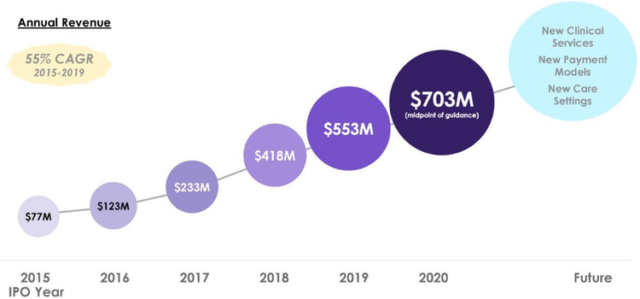

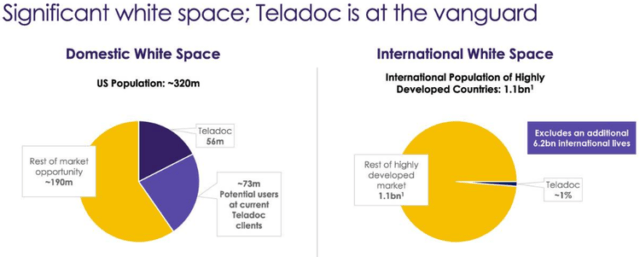

Teladoc has been growing, and will likely continue to grow rapidly, because it is a leader in an industry with a lot of room to run considering the large and expanding total addressable market. For a little perspective, here is a look at Teladoc’s historical revenue growth, and the size of the total addressable market.

(image source: Investor Day Presentation)

Worth mentioning, Teladoc has been experiencing strong revenue growth (both organic and inorganic). For example, according to CFO Mala Murthy during the most recently quarterly call:

“Total revenue increased 27% to $156.5 million in the fourth quarter, that revenue growth was entirely organic, but for the small impact of the Medicine Direct acquisition. For the full year of 2019, total revenue increased 32% to $553.3 million or 24% on an organic basis.”

And for 2020 (excluding the impact of the recently announced InTouch Health acquisition):

”For the full year 2020, we expect revenue to be in the range of $695 million to $710 million representing 26% to 28% growth versus the prior year, which again is substantially all organic.”

Competition

Teladoc is the largest in the telehealth business with the widest spectrum of doctors, specialties and coverage of consultation services, ranging from mental health to general and complex consultations including niche advice and care. Nonetheless, it still faces competition from a range of innovative companies, including specialized software and solution providers that offer similar solutions, often at lower prices. Competitors include MDLive, American Well Corporation and Doctor On Demand, which are all private companies.

Valuation

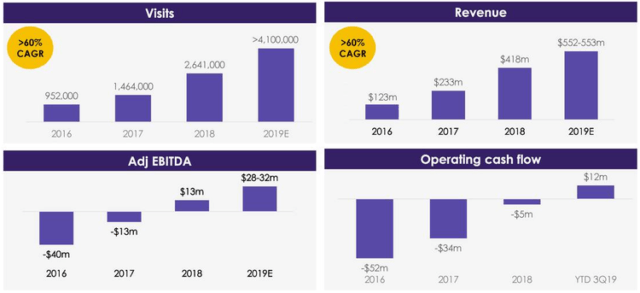

Despite TDOC’s rapid revenue growth and patient visits, it’s still only recently “operating cash flow” positive and earnings remain negative.

(Image source: Investor Day Presentation)

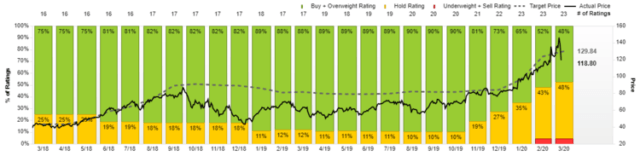

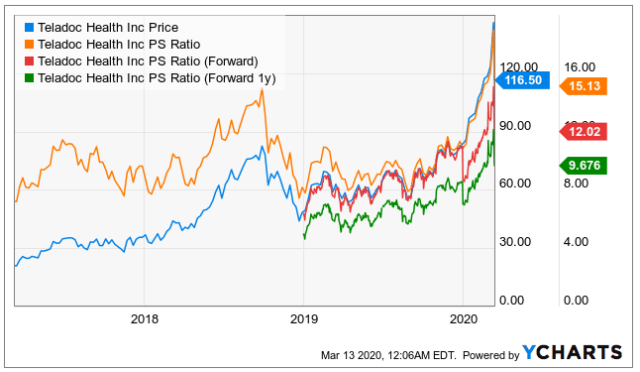

And on a price-to-sales basis, Teladoc’s has become increasingly expensive in the short term relative to its own history, however it is not unreasonable considering its long-term growth potential (the 23 Wall Street analysts reporting to FactSet assign TDOC a 32.5% long-term growth rate, and the shares continue to trade below their aggregate price target

(Source: FactSet)

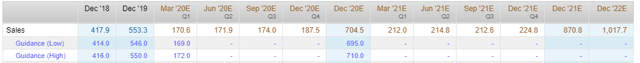

Worth mentioning, these analysts are notoriously short-term focused, generally looking ahead only a few quarters or a couple of years (for perspective, here are the analyst sales estimates, as per FactSet).

However, it is Teladoc’s long-term growth potential that is most compelling. And at a price of 9.7 times 1-year-forward sales, the shares are not unreasonable.

Risks

Teladoc does face a variety of risks that should be considered. For example, competitors are expanding their range of services, and this could threaten Teladoc’s moat and pricing power. Further, revenue generation is somewhat inconsistent as the company relies on large contracts and some acquisitions. Further still, the share price is volatile thereby presenting downside risks (and buying opportunities). Also, healthcare policies and regulations are subject to change. For example, more stringent policies around telehealth could negatively impact the industry as a whole. Nonetheless, the strong secular digital transformation and benefits of telehealth are attractive.

Conclusion

Teladoc is a rapidly-growing company that benefits from the ongoing digital transformation. The shares have recently performed well as coronavirus concerns have shed a positive light on the business and added acceleration to the secular digital trend. Further, the very recent share price pullback has provided a small margin of safety. For these reasons, and relative to the long-term growth potential, we’ve ranked Teladoc #7 on our recent list of top 7 growth stocks to benefit as coronavirus accelerates the digital transformation worldwide. There may likely be continued volatility ahead, however, over the long term, Teladoc shares continue to have significant price appreciation potential. If you are looking for a powerful growth stock to add to your prudently-diversified portfolio, Teladoc is worth considering.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Left Brain Investment Research has no positions in any of the aforementioned securities. However, affiliate companies Left Brain Capital Management and/or Left Brain Wealth Management are long TDOC.

Be the first to comment