Sezeryadigar/E+ via Getty Images

Investment Thesis

Hindsight is 20/20. In my initial research before starting to invest, I learned that time in the market trumps timing the market. As such, my mindset was the find strong companies with long-term growth opportunities, so that I could invest in them for many years. Without having to worry about trading.

However, the macro environment over the last two years has caused such big fluctuations in valuations that this did not turn out to be the right strategy. Nevertheless, as I recognized that the “right” time to sell was back in February 2021. So given that I did not sell back then, I have simply continued to add.

Although my portfolio has had a bit of a Cathie Wood-esque performance over the last two years, I have refrained from selling or reshuffling the portfolio (“buy high, sell low”).

Internet comment: Wow, the slaughter of pandemic growth stocks is simply incredible. So many rookie investors are getting burnt and learn a valuable lesson. Brutal.

Background

I have been detailing the swan song of my portfolio for a while now, most recently here: My Tech Portfolio Has Collapsed – Part 2.

Portfolio updates

As I have done for the last year or more, I have spread my additions over multiple stocks, although some may argue that this isn’t really diversification since they are all tech/growth stocks. Still, all of these are vastly different businesses.

Additions

- PubMatic (PUBM)

- Pinterest (PINS)

- IronSource (IS)

- Teladoc Health (TDOC)

- JFrog (FROG)

- Upstart (UPST)

- SentinelOne (S)

- Sumo Logic (SUMO)

- Invitae (NVTA)

- Didi (DIDI)

- Lemonade (LMND)

- Asana (ASAN)

- Alteryx (AYX)

- Roku (ROKU)

- Global-E (GLBE)

- Twilio (TWLO)

- Affirm (AFRM)

- Elastic (ESTC)

- Smartsheet (SMAR)

New positions

Discussion

Earlier this year I called Pinterest my 2022 top stock, but I have since reconsidered this stance, in the wake of its Q4 report. Although the MAUs have finally stabilized, there isn’t any indication that revenue growth will reaccelerate soon. Hence, at this point I consider this more an investment for 2023 for upside in the stock.

While some people have expressed that this is a poor stock, the fact of the matter is that Pinterest is diligently investing in its business. Although I admit the slowdown has been steeper than perhaps anticipated, the stock was trading for something like 30x P/S at the beginning of 2021.

Similarly, PubMatic was my top stock last year, and it has become my biggest nest egg. But after a series of beats and raises last year, PubMatic’s Q4 and guidance did point to a bit of a slowdown too. Although I continue to consider this to be a strong long-term investment (for example the company’s long-term goal is to quintuple market share), one of the main reasons I invested so much in PubMatic last year was due to its very favorably valuation.

However, given the sell-off in the two quarters (Q4-Q1), many other growth stocks have become investible again as well, so I have added to other names too. To provide one example, currently IronSource is my top stock that I have most substantially added to in the last few months.

There are many other names that I thought had declined way too much, and have been adding to at least a bit in order to profit from their historically cheap valuations. A few examples are Elastic, Roku, Twilio, Affirm, Alteryx and Asana. These are all solid growth stocks.

Then, there are a few more “controversial” names such as Didi, Invitae and Lemonade. Didi I consider to be “bottom fishing”. About the other two I am more bullish as I do not think these two names have any real issues. Investors are always wining about Lemonade’s losses, but they are forgetting Lemonade is basically still a startup. This name isn’t going to pay out a fat dividend like AT&T (T).

Lastly, I bought three more stocks with Monday.com, SoFi and UiPath.

Wishlist

Although I think I have a decent basket of names in my portfolio where I can add to, there are a few stocks I am considering. First, Snowflake (SNOW) becomes interesting under $200. Secondly, Digital Turbine (APPS), although it is less of a priority since I have already invested so much in PINS, PUBM and IS.

Braze (BRZE) and GitLab (GTLB) are two other stocks on my watchlist for some more examples.

Portfolio performance

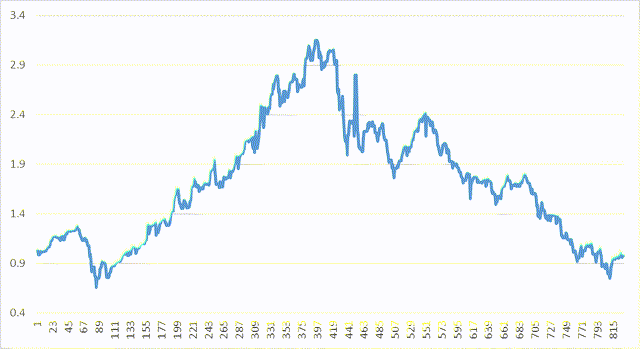

Tis a sad story. The graph below details my journey from hero to zero over the last 800+ days. Altogether, the portfolio performance came down from +200% to +0% over the last year.

As I see it, in the wake of the COVID-19 rally growth stocks gained a decade worth of gains in just half a year. Hence, I assume at this point it might take a decade to recover the paper losses from the last 12 months.

This isn’t necessarily an issue as I was initially planning to hold all my stocks for at least a decade anyway, but clearly my “buy and hold” growth stock strategy didn’t turn out to be the right one in the macro environment of the last year.

Portfolio allocation

The portfolio has not substantially changed from last update, so I will just provide a list with the top 8 allocations and positions. The main change is that I have substantially added to my IronSource position in the wake of its Q4 report.

Top 8 allocations (~64% of allocation dollars): PUBM, PINS, IS, TDOC, FROG, UPST, BABA (BABA), S

Top 8 positions (~63% of portfolio value): PUBM, PINS, IS NIO (NIO), TDOC, FROG UPST, S

Investor Takeaway

I explicitly did not want to be a trader when I started the portfolio, hence I did nothing when I saw basically all my stocks selling for all-time high prices around February 2021. Then a year full of buzzwords like interest rates, inflation, tax-loss selling, gas and oil and Ukraine started. In Cathie Wood-esque fashion, my portfolio went from hero to zero. It was a 3-bagger and it is currently about a 1-bagger. The portfolio shed about 45% in value since November, as measured at the bottom in mid-March.

In my last update in January, I was cautiously optimistic that my portfolio was positioned for a recovery after about six straight weeks of selling, but the sell-off instead continued for the rest of Q1. Recognizing that I was a year too late with selling, I just continued to buy those beaten down stocks at what in hindsight hopefully will be bargain prices (similar to the initial COVID-19 bear market).

As mentioned, among the bargains that currently can be found in the market, I am especially bullish about IronSource. This stock is growing faster than more established names like Unity (U) and The Trade Desk (TTD), but trades for literally a fraction of the valuation (both P/S and P/E).

Be the first to comment