eyenigelen/iStock via Getty Images

Main Thesis / Background

The purpose of this article is to evaluate the First Trust NASDAQ Technology Dividend Index Fund (NASDAQ:TDIV) as an investment option at its current market price. The fund “seeks investment results that correspond generally to the price and yield of an equity index called the NASDAQ Technology Dividend Index”, which includes Tech stocks with a history of paying dividends.

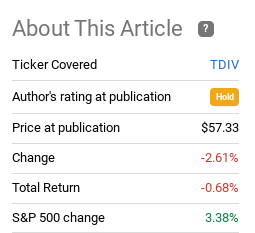

This is a fund I have recommended on multiple occasions, but turned cautious on it during my last review. In hindsight, this was a reasonable outlook, as TDIV has seen a flat return while the broader market has risen:

Fund Performance (Seeking Alpha)

Looking ahead, I think this relative weakness offers a buying opportunity for TDIV. To be fair, risks do exist in the market as a whole, especially for the Tech sector. Inflation is rampant, encouraging more hawkish action by central banks, which is pressuring investor risk appetite. Yet, I like that TDIV holds the more established players in the space, given its exclusion of non-dividend payers. Further, top holdings in the semi-conductor space should continue to perform well given the lack of supply and rising demand for those products. Finally, the Tech sector has actually seen earnings estimates rise as 2022 has progressed, which is a bullish sign.

The Challenges Are Real, But Prices Reflect That

To begin, I want to take a look at some of the risks facing the Tech sector, and TDIV by extension. This is important because while I am optimistic going forward on this fund, we should reflect on the recent weakness. After all, buying on dips/corrections can be very profitable, but not in the underlying fundamentals are breaking down. If they are, that can signal plenty of more pain ahead.

Fortunately, when it comes to Tech, the concerns mainly stem from macro-factors, and not necessarily because of weakness within the sector itself. Rising inflation and the expectations for more Fed rate hikes are pressuring growth names, which dominate the Tech sector broadly. This is why funds like TDIV have been hit so hard in 2022. Specifically, the fund is down by more than the S&P year-to-date, although it is just as important to note it has out-performed the more inclusive Technology Select Sector SPDR ETF (XLK), as shown below:

YTD Performance (Google Finance)

The purpose of this simple graphic is two-fold. One, to demonstrate Tech investing this year has not been fruitful so far. Two, to support why I favor TDIV over other Tech options. The fund’s inclusion of dividend payers means that these are often more established companies, with more stable revenues. This provides a bit of a buffer against the market decline, to the point where it is holding up better than the broader sector it represents.

Of course, a 12% loss for the year is still quite poor, even if it does best a 16% decline in the XLK. The concern going forward is that part of the reason for this drop is that interest rates are going up to combat inflation. As investors can earn higher income elsewhere, they tend to shy away from growth names as a result. This has been playing out so far this year, and it could very well continue to be the case in Q2 as well.

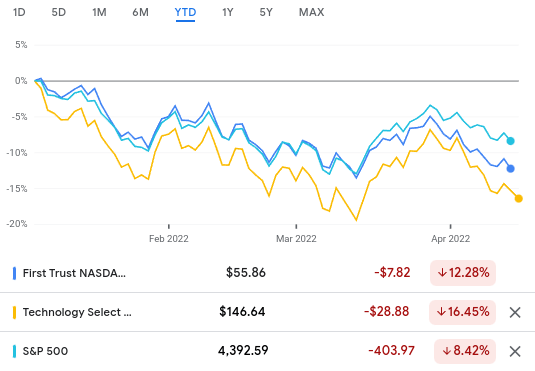

Fed Hike Expectations (Edward Jones)

I bring this up because I want to manage expectations. I will explain in the following paragraphs why I do think TDIV will see gains going forward, but this is not a “risk free” thesis. Rising inflation and interest rates are a major headwind, and that is something readers need to evaluate when deciding if this is the right option for them.

Why TDIV? Stability, Exposure To Semi-Conductors

Now that I have discussed some of the major risks, I want to talk about the opportunity. As I mentioned, I believe TDIV is a reasonable way to play this space because I tend to prefer dividend payers as a rule. The income is clearly advantageous, and the underlying principle for me is that if a company can generate stable dividends, then they are a less risky or volatile option. That is a generalization of course, but I believe it is especially relevant for the Tech sector in particular which tends to see a lot of major growth names and/or high valuation stocks.

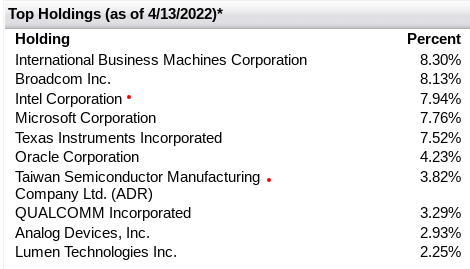

Beyond that, if we drill down to some of TDIV’s individual holdings, we see there is a fair bit of exposure to the semi-conductor sub-sector. This chip shortage has been making plenty of headlines this year, and I like that both Intel (INTC) and Taiwan Semiconductor Manufacturing Company (TSM) are included in the top holdings list. These two, along with Samsung (OTC:SSNLF), are the major players in this space:

Top Holdings (First Trust)

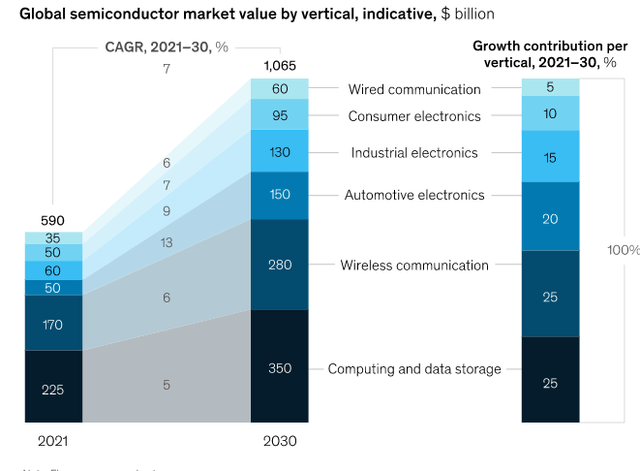

Why is this an attractive quality? Well, for one, this is a growing sub-sector that continues to command premium prices due to a global shortage. Importantly, this is an arena that is expected to grow handsomely over the next decade, not just the next few years. So, while we may see a post-pandemic bump in revenue and supply, the trend is it may go well beyond that:

Projected Semiconductor Growth Rate (McKinsey & Company)

Ultimately, with chip demand set to rise over from now until at least 2030, the semiconductor manufacturing and design companies are going to see the benefit in their bottom-lines. This should provide a multi-year tailwind for the funds that hold these companies, such as TDIV.

TDIV Has Seen Strong YOY Dividend Growth

Another positive attribute of TDIV is the dividend growth recently seen. While the fund’s yield is not at all “high”, at around 2%, it is certainly higher than where it started the year. This is due to a combination of a declining share price as well as a rising dividend payout. In fact, if we compare the Q1 payout this year to last year, we see a strong growth metric:

| March 2021 Distribution | March 2022 Distribution | YOY Growth |

| $.163/share | $.22/share | 35% |

Source: First Trust

The takeaway here for me is simple. I like TDIV’s relative stability, its underlying holdings, and the dividend growth as well. These all add up to a buy case in my opinion.

Tech Sector Seeing Earnings Estimates Rise

My final point looks at the Tech sector more broadly. While I highlighted some challenges facing the sector, this is always true for any sector and the market. We have to manage these risks against the positives always, and then determine if the risk is worth it. In this environment, given that we have already seen a sharp sell-off in Tech stocks, I absolutely see merit to building on, or starting, positions.

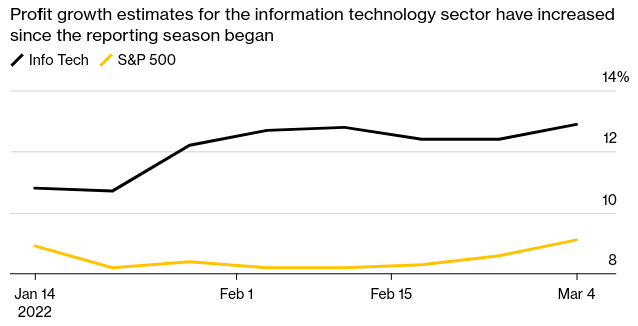

One supporting reason for this thesis is that earnings for the sector have been rising, and are expected to keep rising throughout 2022. In fairness, the S&P 500 is always set to see earnings growth this year, but it is noteworthy that Tech’s estimated earnings are likely to rise by a larger percentage:

Earnings Estimates (Bloomberg)

Sure, we live in a complicated and uncertain world right now. But what drives markets (and sectors and individual stocks) over time is earnings. And on that front, Tech is set to do pretty well this year. Of course, estimates are just that, and can change, but so far, the changes we have seen year-to-date have been all positive. That gives me confidence in TDIV as an investment in the months ahead.

Bottom-line

Growth and Tech stocks are under pressure, and for valid reasons. While TDIV may continue to see more weakness in Q2, I think a turnaround may be in the cards. The fund holds stable companies, has a growing dividend, and has top holdings set to benefit from a decade-long trend of growing demand for semiconductors. Further, while Tech often goes hand-in-hand with rosy valuations, readers should note that TDIV has a P/E around 18. That is not “low” on the surface, but it much lower than the Tech SPDR XLK, which is trading at a P/E of 24 at current valuations. I use this to illustrate that while investors may be unnerved of paying for growth stocks in this climate, that outlook is really not relevant for TDIV.

As a result, I think TDIV is poised to benefit by grabbing a share of rising Tech earnings, continued dividend growth, and investor’s focus on quality going forward. Therefore, I will be considering a position in TDIV, and I encourage readers to take a serious look at the fund at this time.

Be the first to comment