onurdongel/E+ via Getty Images

TC Energy Corporation (NYSE:TRP) is one of the largest midstream companies in North America, boasting a network of pipelines and other infrastructure that stretches over much of the United States and Canada. The midstream sector in general tends to be very well appreciated by investors that are seeking income because of the stable cash flows and high yields that the sector tends to pay out. TC Energy Corporation is no exception to this as the company’s stock yields 5.31% as of the time of writing, which is better than most other things in the market. Unfortunately, though, the stock has generally underperformed the energy sector as it is only up 5.64% over the past year. This is still better than the losses that some sectors have delivered recently, however. TC Energy also has significant growth potential in the liquefied natural gas sector, which is one of the most aggressively growing sectors in the energy industry today. This is something that could prove to be very rewarding for the company and its investors between now and 2030. Overall, the company may prove to deliver an impressive total return when its growth is combined with that dividend yield.

About TC Energy Corporation

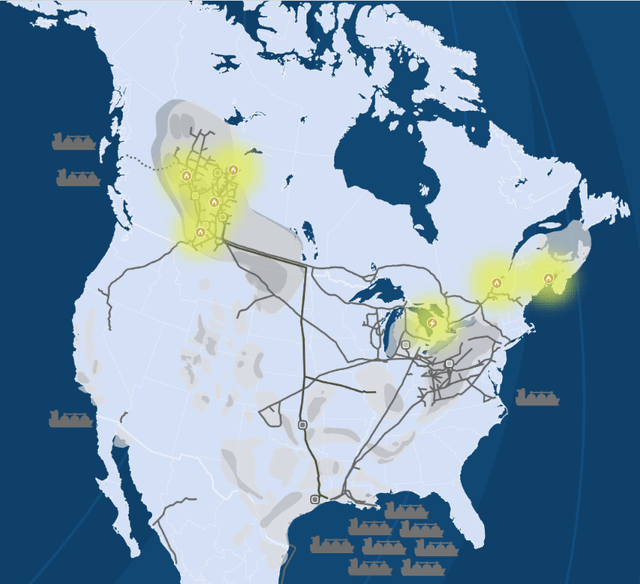

As stated in the introduction, TC Energy Corporation is one of the largest midstream energy companies in North America, boasting approximately 93,300 km of natural gas pipelines, 4,900 km of liquids pipelines, and more than 4.3 gigawatts of electric generation capacity. The company’s operations stretch all across the United States and Canada:

The one thing that we notice here is that TC Energy is much more focused on the transportation of natural gas than of crude oil, although its pipelines do transport approximately 20% all of the crude oil produced in Western Canada. This is quite nice to see because of the fact that natural gas has much stronger fundamentals than crude oil. We will discuss this in just a bit. This could result in growing production of natural gas, which will increase the demand for TC Energy’s transportation services.

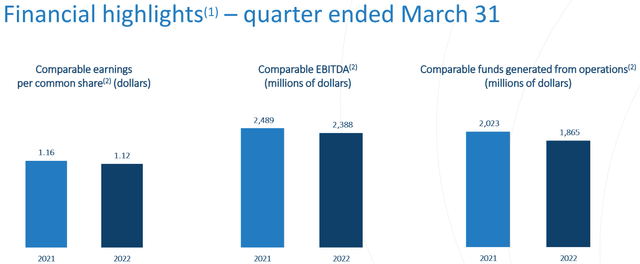

This is critical because of the business model that TC Energy uses. In short, the company transports crude oil and natural gas through its infrastructure and charges its customers a fee based on the volume of resources that it handles. Ultimately, this provides the company with a great deal of insulation against any fluctuations in commodity prices, which can be an advantage or a disadvantage. This proved to be a benefit in 2020 when commodity prices collapsed but unfortunately it was a problem recently as the company was unable to take advantage of the significant price appreciation that we saw in both crude oil and gas prices in 2021. We can clearly see this by looking at the company’s first quarter 2022 performance. As we can clearly see here, the company actually saw many measures of financial performance decline year-over-year:

The majority of the weakness came from regular business fluctuations in volumes or changes in regulated tariff rates and is nothing to worry about. Overall, we can see that the company does tend to enjoy very stable financial performance regardless of the broader business environment as the year-over-year changes here were very minor. This is a very attractive thing for risk-averse income investors due to the support that it provides for the dividend. This stability should thus ensure that the company can maintain its dividend going forward. This is something that should prove quite appealing to anyone seeking a steady and sustainable source of income.

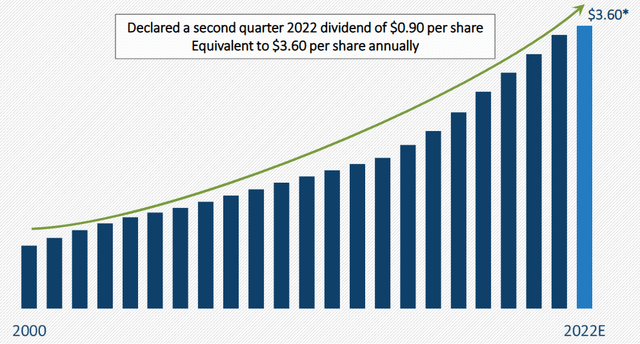

TC Energy Corporation historically does much better than this, however. In fact, the company has increased its dividend during every year since 2000:

This is a trend that TC Energy plans to continue going forward. The company has guided to grow its dividend at a 3% to 5% compound annual growth rate, which is quite reasonable. This is something that is very nice to see, especially in today’s inflationary environment. This is because the rising dividend causes your income to increase every year, which helps to offset the rising costs of living that we all have to deal with in our daily lives. Anyone that has to depend on their portfolios for income can almost certainly appreciate this.

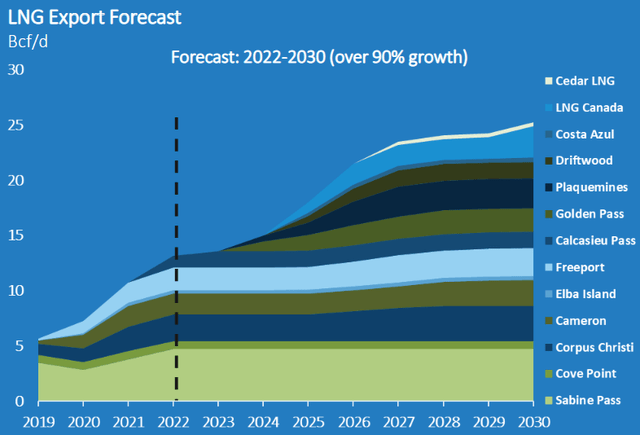

As investors, we are interested in much more than just stability and income. We also want to see growth. Fortunately, TC Energy has some very real potential here as the company has already identified about $3.89 billion of growth projects, although it has not yet embarked on all of them. With that said though, the company expects to start work on them within the next few years. That does not mean that it does not have anything under construction, though. In fact, TC Energy is quickly moving to support the emerging liquefied natural gas export industry. I discussed the incredible growth potential of this industry in a recent article. In short, the demand for liquefied natural gas is expected to grow by at least 40% over the 2022 to 2030 period. However, it is expected to increase by much more in the United States. Indeed, S&P Global believes that the amount of natural gas required to provide feedstock to liquefaction plants in the United States and Canada is expected to increase by 90% over the 2022 to 2030 period:

TC Energy/Data from S&P Global

TC Energy Corporation is positioned to take advantage of this by constructing pipelines that will carry the natural gas to a variety of liquefaction plants. The company currently has four such projects that are currently at various stages of completion. The most significant of these is the Louisiana XPress Project, which consists primarily of the installation of three compressor stations in Louisiana that will increase the capacity of TC Energy’s pipeline network in that area by 0.8 billion cubic feet of natural gas per day in order to support the various liquefied natural gas plants in the area. Perhaps the nicest thing about this project is that TC Energy has already obtained contracts from numerous customers for the use of this new capacity. This is nice because we can be certain that the company is not constructing infrastructure that nobody wants to use. The second nice thing is that TC Energy knows in advance how profitable this project will be, which is about a 7% to 9% internal rate of return, which is the level that the company seeks to achieve with any of its infrastructure projects. This is certainly not an unreasonable rate of return that we can accept.

Macro-Economic Fundamentals

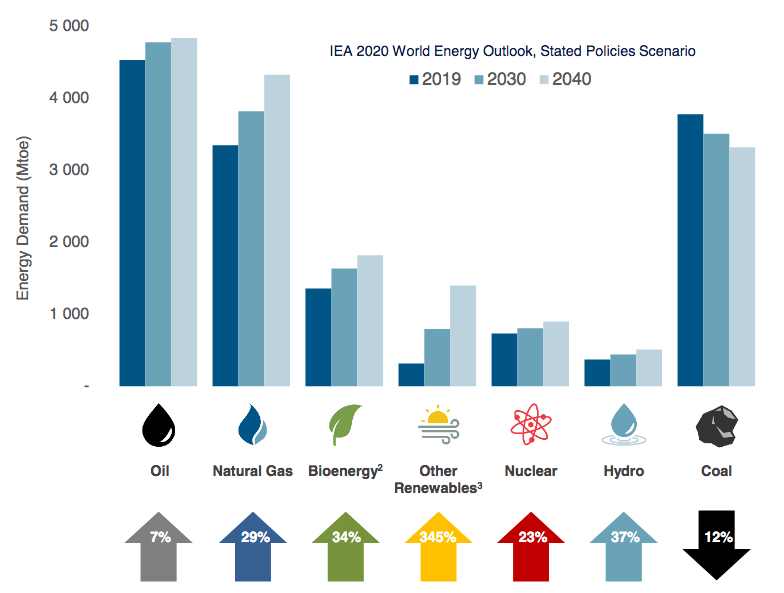

As mentioned earlier, TC Energy has substantial natural gas infrastructure, which is nice to see because natural gas has remarkably strong fundamentals. We can see this quite clearly in the growing demand for liquefied natural gas as that is the only way to transport natural gas across large bodies of water, such as the ocean. However, it is also true for domestic demand in the United States, as I discussed in articles such as this one. According to the International Energy Agency, the global demand for natural gas is expected to increase by 29% over the next twenty years:

Pembina Pipeline/Data from IEA 2021 World Energy Outlook

The reasons for this are the same as the reason for the growing demand for liquefied natural gas. That is the growth in renewable demand and the desire for a reduction in carbon emissions. This is very true in Asia where the smog from coal-fired power plants and heavy industry is causing very serious problems. Natural gas and renewables both burn much cleaner than coal so many utilities and officials in the region see them as a good solution to this problem. Renewable energy sources are not reliable enough to completely support a modern grid on their own, however. Thus, one popular solution is to utilize natural gas turbines to supplement the grid by supplying electricity when renewables are unable to do so effectively.

This growing demand for natural gas is one major reason why the liquefied natural gas sector is growing so quickly, especially in the United States. This is mostly because the United States and Canada are among the only places in the world that can significantly increase their production of natural gas to meet this climbing demand. We have already seen that TC Energy Corporation is positioned to grow due to this by transporting natural gas to serve the needs of its liquefaction plant customers. It seems likely that the company will see further growth opportunities as this story play out.

Dividend Analysis

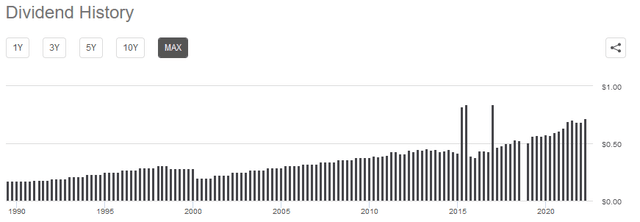

As we have briefly discussed, one of the most attractive things about TC Energy Corporation is its relatively high yield and history of dividend growth. Indeed, the company has consistently grown its dividend since 2000:

Admittedly, we do not exactly see that when we look at Seeking Alpha’s quote page because that depicts the company’s dividend in US dollars whereas TC Energy Partners pays its dividend in Canadian dollars (although anyone buying the ADR on the American exchange will receive the dividend in US dollars). Thus, currency fluctuations will play a role in the dividend that you actually receive. However, we can still clearly see that the company’s dividend has generally grown over time even in US dollar terms. This is something that is quite nice to see today because inflation is slowly reducing the value of your money so the fact that the company increases the amount that it gives you every year helps to offset that. As is always the case though, we want to ensure that the company can actually afford the dividend that it pays out. After all, we do not want it to suddenly be forced to reverse course and cut the payout because such a move would reduce our incomes and most likely cause the stock price to decline.

The usual way to evaluate a company’s ability to pay its dividend is by looking at its free cash flow. This is the amount of money that was generated by the firm’s ordinary operations and is available after the company pays all of its bills and makes all necessary capital expenditures. This is therefore the money that is available to do things such as reduce debt, buy back stock, or pay a dividend. Unfortunately, TC Energy Corporation had a levered free cash flow of negative $1.657 billion over the trailing twelve-month period. This is hardly enough to pay any dividend, let alone the $2.8331 billion that the company actually paid out over the same period.

However, we can almost treat TC Energy Corporation as a utility due to its slow but steady growth and relatively stable cash flows. One thing that utility companies frequently do is pay their dividends out of operating cash flow and then cover their dividends by using operating cash flow. TC Energy Corporation had an operating cash flow of $5.5439 billion over the trailing twelve-month period. This was easily enough to cover the $2.8331 billion paid out in dividends with money left over for other purposes. Overall then, it does appear that this dividend is reasonably secure.

Conclusion

In conclusion, TC Energy Corporation appears to be a reasonably attractive investment for someone seeking stability and growth of income. The company can be thought of like a utility in that way. However, its 5.31% yield is significantly higher than most utilities possess and the company has some significant growth potential as liquefied natural gas continues to grow into a major sector of the American economy. Overall, this company may be worth considering.

Be the first to comment