The Good Brigade

At this point in time, the home building space is incredibly interesting. On one hand, you have a nationwide housing shortage that has been instrumental in pushing prices higher over time. And on the other hand, you have concerns over a potential recession, inflation, and rising interest rates aimed at battling that inflation. From the data I have seen by looking at a number of players in this space, prices are still elevated but backlog from a unit perspective is declining. But to make matters even more interesting, the fact of the matter is that shares of many of the players in this space look to be trading on the cheap. Where these companies go next will be determined by market conditions. And one prospect that investors should be wise to keep a close eye on is Taylor Morrison Home Corporation (NYSE:TMHC). Although the pricing of the company is mixed compared to similar firms, shares are still cheap on an absolute basis. As such, I’ve rated the company a soft ‘buy’ for now, indicating that I think that shares will likely outperform the broader market moving forward.

Performance remains strong… for now

Back in late January of this year, I wrote a bullish article about Taylor Morrison. In that article, I said that the company had seen attractive growth in recent years, with that growth continuing through the 2021 fiscal year. This was driven by a couple of factors, including an increase in the number of homes constructed and an increase in pricing for the homes that it did produce. I was worried at that time about a potential return to more normal levels of activity. But even in that scenario, I said that shares offered a favorable risk-to-reward opportunity. Ultimately, this led me to rate the business a ‘buy’. Unfortunately, things have not gone exactly as planned. While the S&P 500 has dropped by 3.9% since I wrote about the company last, it has generated a loss for investors of 4.6%. This is not a significant disparity, but it is still the opposite of what I wanted to take place.

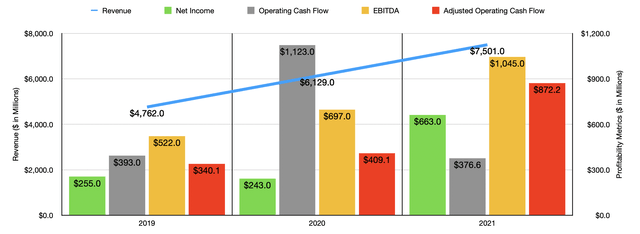

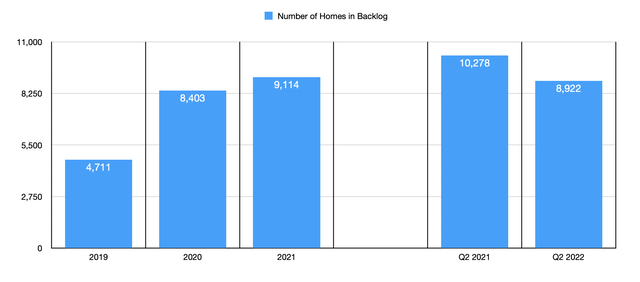

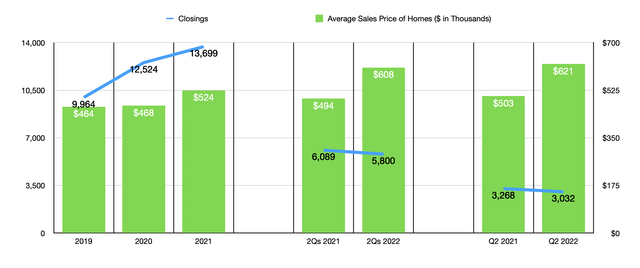

Given this modest decline, you might reasonably think that the company’s fundamental performance had suffered. But that’s definitely not the case. Let’s consider, for instance, how the company finished its 2021 fiscal year. For that year, sales came in at $7.50 billion. That’s 22.4% above the $6.13 billion generated the same time one year earlier. This increase was driven by a few factors. First and foremost, the number of home Closings the company reported rose from 12,524 to 13,699. In addition to this, the average sales price of the homes increased from $468,000 to $524,000. Other fundamental data was also promising. The Number of units in backlog grew from 8,403 to 9,114. On top of that, the average price of a unit in backlog also increased, climbing from $503,000 to $632,000. In theory, this rise in backlog, combined with the higher pricing, should indicate further strength for the foreseeable future.

With revenue rising, profitability has followed suit. Net income rose from $243 million in 2020 to $663 million in 2021. Operating cash flow did decline, dropping from $1.12 billion to a modest $376.6 million. But if we adjust for changes in working capital, it would have risen from $409.1 million to $872.2 million. Another metric to pay attention to is EBITDA. This ultimately rose from $697 million to $1.05 billion.

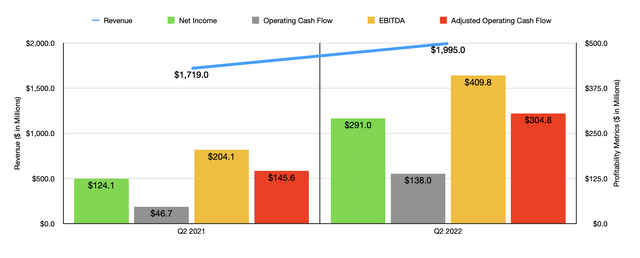

Strength for the company continued into the 2022 fiscal year. For the first half of the year as a whole, revenue came in at $3.70 billion. That’s 17.9% higher than the $3.14 billion generated just one year earlier. However, the only real driver of this was a surge in the average sales price of a property. This number rose from $494,000 to $608,000. Meanwhile, the number of closings declined from 6,089 to 5,800. Part of this can be chalked up to a reduction in orders. However, the company also saw the cancellation rate for its contracts rise from 5.8% to 8.5%. When you focus on just the latest quarter alone, that picture looks even worse. Yes, revenue did come in at $2 billion. That compares favorably to the $1.72 billion generated in the second quarter of 2021. However, the increase came solely as a result of average sales prices rising from $503,000 to $621,000. Offsetting this to some degree was a reduction in the number of closings from 3,268 to 3,032. To make matters worse, the total number of units in backlog dropped from 10,278 to 8,922, driven in large part by a surge in the cancellation rate from 5.2% to 10.8%.

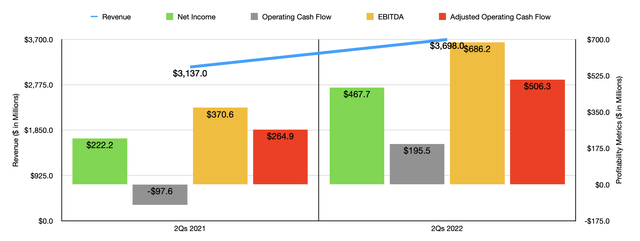

These leading indicators suggest that the future for the company might not be quite as bright as the recent past has been. But so far, bottom line performance has been quite robust. Net income for the first half of the 2022 fiscal year came in at $467.7 million. That’s more than double the $222.2 million generated the same time one year earlier. Operating cash flow went from negative $97.6 million to $195.5 million. If we adjust for changes in working capital, it would have risen from $264.9 million to $506.3 million. Meanwhile, EBITDA for the company also improved, rising from $370.6 million to $686.2 million.

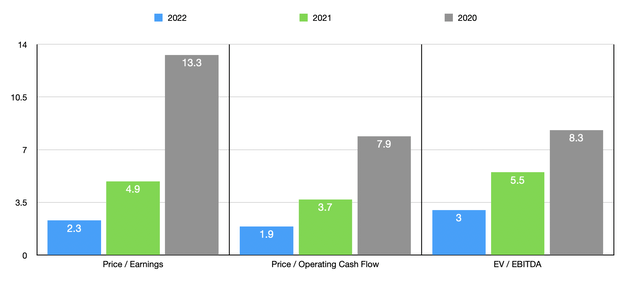

Management has not provided any real guidance for the current fiscal year. But if we analyze results experienced so far, we should anticipate net income of roughly $1.40 billion. Adjusted operating cash flow would be $1.67 billion, while EBITDA would be somewhere around $1.94 billion. If these numbers come to fruition, shares would look quite cheap, with a forward price to earnings multiple of 2.3, a forward price to adjusted operating cash flow multiple of 1.9, and a forward EV to EBITDA multiple of 3. Even if results revert back to 2021 or even 2020 levels, as the chart above illustrates, these multiples would still imply a fairly cheap company.

To put the pricing of the firm into perspective, I compared its 2021 results to the performance of five similar firms. On a price-to-earnings basis, these companies ranged from a low of 2.9 to a high of 8.2. In this case, four of the five firms were cheaper than our prospect. Using the price to operating cash flow approach, only two of the companies had positive results, with their multiples at 3.2 and 6.8, respectively. In this case, Taylor Morrison was in the middle of the two. And finally, using the EV to EBITDA approach, the range is from 3.2 to 6.9. In this case, our prospect is more expensive than three of the firms.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Taylor Morrison Home Corporation | 4.9 | 3.7 | 5.5 |

| Legacy Housing Corporation (LEGH) | 8.2 | 6.8 | 6.9 |

| Meritage Homes (MTH) | 3.5 | 3.2 | 3.2 |

| Century Communities (CCS) | 2.9 | N/A | 3.7 |

| Beazer Homes USA (BZH) | 2.5 | N/A | 6.6 |

| KB Home (KBH) | 4.3 | N/A | 5.1 |

Takeaway

Based on the data provided, it looks to me as though the near-term outlook for Taylor Morrison it’s quite promising. Of course, we are starting to see some significant cracks in the space. Declining backlog and increased cancellations look to be a pain point for investors. But given how cheap shares are, even a return to more normal levels would indicate some upside potential. So because of this, I have decided to keep my ‘buy’ rating on the enterprise.

Be the first to comment