zoranm/E+ via Getty Images

Investment Thesis

The Tattooed Chef (NASDAQ:TTCF) hype is fading fast. The company recently reported an abysmal quarter. It missed both revenue and earnings estimates and gross margins fell to just 1.3% during the quarter.

At this point, the company’s strong revenue growth makes up the primary bull case for the company. But with poor profitability prospects and a weak balance sheet, this is a risky prospect. I recommend avoiding this company at the current time.

Is Top Line Growth Enough?

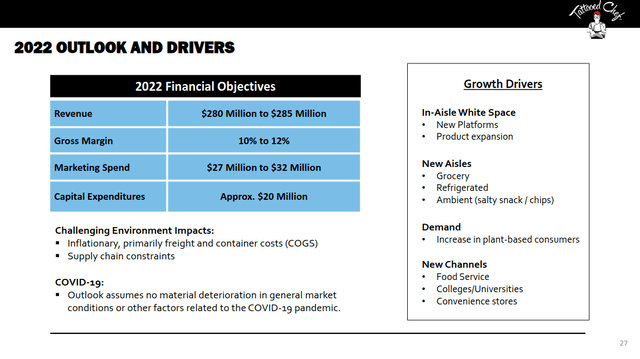

The most notable positive about Tattooed Chef is the company’s strong revenue growth. The company grew its top line by 44% in 2021 and again by 37% in the first quarter. Growth has tapered off with a top line increase of only 15% during the last quarter. But the company still reaffirmed its guidance, calling for $280 million to $285 million in revenue this fiscal year.

Tattooed Chef May 2022 Investor Presentation

But this doesn’t tell the whole story. According to the company’s 10-Q filing, only a fraction of this growth was organic. Of the net sales increase of $7.8 million, only $1.1 million of growth was from the company’s core brand. $3.8 million was driven by private label products and $2.9 million in other revenues. The company attributes most of this revenue growth to its acquisitions of New Mexico Food Distributors, Karsten Tortilla Factory, and Belmont Confections.

Organic revenue growth from the Tattooed Chef brand was up only 3.4% year over year. This is a bad sign for a company valued almost entirely for its revenue expansion.

However, these results may improve later in the year. The company reaffirmed its revenue guidance of $280 to $285 million. This implies a mild acceleration in the back half of the year.

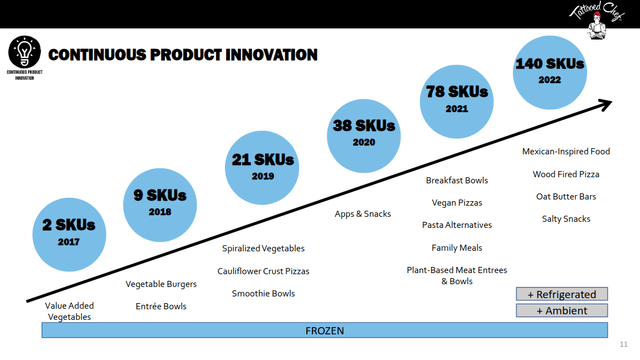

So far, the company has grown primarily by releasing new products and expanding distribution for these products. Management recently announced that they’re also increasing prices in the fourth quarter. This might help boost revenues and profitability. It could also reduce the number of units sold.

Tattooed Chef May 2022 Investor Presentation

Grocery stores have reported a trade down effect, where consumers buy lower cost products to save money. This may cause low margin, premium products like Tattooed Chef to feel some pressure.

I think that Tattooed Chef might be more resilient to these headwinds. The company has reported that half of its customers have an income of over $100 thousand.

It remains to be seen how the company will hold up against current economic headwinds. But I don’t think that the company’s revenue growth is as strong as it may seem. The current environment may blunt the high growth the company relies on.

Profitability In Focus

The key issue facing Tattooed Chef is the firm’s profitability. During the last quarter, the business reported abysmal gross margins of just 1.3%. The company vaguely blamed inflation and shipping costs for this decline. Management then reduced their full year gross margin guidance from a range of 10% to 12% down to a range of 8% to 10%.

The company has described its profitability model as being based on operating leverage. The company plans to offset its fixed costs with volume.

Management hasn’t focused much on profitability in the past. Their previous guidance and earnings have focused on top line growth. But now they’ve guided for breakeven adjusted EBITDA by the end of 2023. Management described this plan on their last earnings call.

It’s very, we’re very unique. It’s why our model we feel is so important to what most of the other companies are. So we’re vertical. We have our price increases. We have our robotics going on, and then we have our revenue growth that’s coming. So you add all of these things up together and we really feel confident by the end of ‘23, we’re going to be profitable. So absolutely, by doing all of these things, our labor numbers by bringing in these robotics are going to come down significantly too… And it’s like, because we’re this new company that we’re just introducing all of these products, we have inefficiencies. As the more product we make, the more we streamline our operations, the more that we’re going to be able to be profitable.

I’m cautious about this guidance. The company repeatedly praises its fixed cost models, but their operating expenditures have increased by almost 50% year over year. This is faster than top line growth. It might also be difficult to capitalize on operating leverage with declining organic growth rates. I think the company can benefit from its existing distribution strategy. The newest distribution agreement with Walmart might be a tailwind, but I think that increased competition and inflation could easily offset any gains. The company has very low margins for a premium food product.

High Cash Burn Makes The Valuation Expensive

Even after an 80% decline, Tattooed Chef is trading at a premium valuation. Shares are priced at a forward P/S of about 1.7 times. The company is trading at 18.5 times its full year gross profit guidance. I think this is expensive for a company with this profile. I acknowledge that the company might be able to continue growing its revenue for some time, but it’s unlikely that the business will be able to achieve the profit margins that this type of valuation implies.

This investment seems quite risky when you consider its dwindling cash reserves. The business has under $28 million in cash on its balance sheet. This is down from $140 million in the year ago quarter. Compare this to the company’s free cash flow burn rate of over $20 million for the past few quarters.

Management has taken some steps to improve their situation. They are planning to reduce expenses in the back half of the year. Capital expenditure guidance is under $5 million for the rest of the year, down from $15.6 million year to date. The business also added a $40 million asset backed line of credit. This should provide some immediate liquidity.

The company’s low debt load and declining enterprise value could make it an eventual strategic acquisition. A larger company could use its infrastructure to improve profitability and distribution. But I don’t think that this speculation is a good reason to buy.

Final Verdict

Tattooed Chef’s valuation has come back down to reality, but profitability issues continue to hound the business. While it’s possible the company could turn around, I don’t see any compelling reason to buy the stock. The growth outlook isn’t strong enough to offset poor profitability. The valuation isn’t cheap enough to make this a turnaround play. For these reasons, I recommend avoiding the stock at the current time.

Be the first to comment