Urupong

A Quick Take On TaskUs

TaskUs (NASDAQ:TASK) reported its Q3 2022 financial results on November 7, 2022, beating revenue and EPS estimates.

The firm provides enterprises with a variety of outsourced digital services for customer care and content security applications.

TASK may see increasing client demand in the quarters ahead as the ‘China reopening’ narrative begins to take hold and customers seek new services.

But until we see evidence of that, I’m on Hold for TASK.

TaskUs Overview

New Braunfels, Texas-based TaskUs was founded to provide labor outsourcing services to enterprises seeking to accommodate increased demand.

Management is headed by co-founder and CEO Bryce Maddock, who received a B.A. in International Business from New York University.

The company’s primary offerings include:

-

Digital Customer Experience

-

Content Security

The company provides services to firms in industries including general technology, streaming media, food delivery and ride sharing, financial technology, and health technology.

TASK pursues client relationships in high-priority industry verticals such as various technology verticals and food delivery and ride sharing.

TaskUs’ Market & Competition

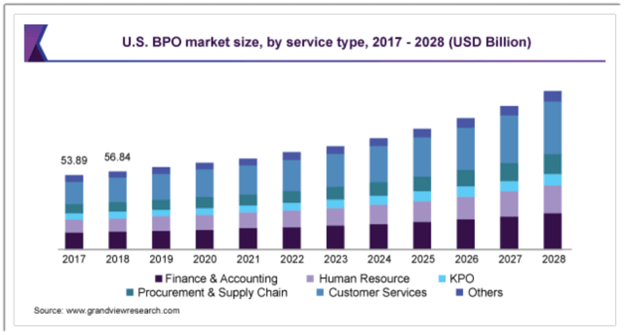

According to a 2021 market research report by Grand View Research, the global market for business process outsourcing was an estimated $232 billion in 2020 and is expected to reach $446 billion by 2028.

This represents a forecast of 8.5% from 2021 to 2028.

The main drivers for this expected growth are increasing usage of digital tools and delocalized talent to maximize business efficiencies.

Also, the versatility of outsourcing services is increasing as other types of service process automation and intelligence adds to return on investment for enterprises.

Below is a chart showing the historical and expected future growth trajectory of process outsourcing services in the U.S.:

U.S. BPO Market (Grand View Research)

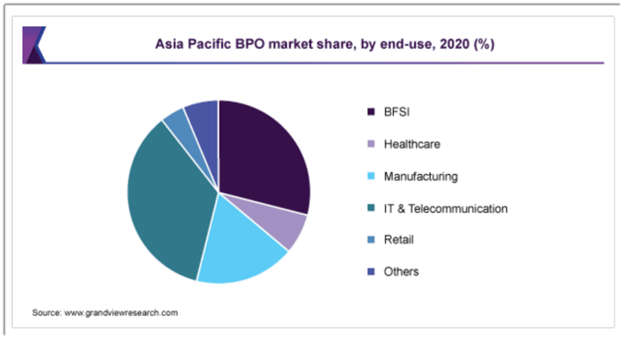

The Asia Pacific market is forecast to see the highest CAGR from 2021 to 2028, and the chart below indicates the breakdown of that market by end-use industry in 2020:

Asia Pacific BPO Market (Grand View Research)

Major competitive or other industry participants include:

-

24/7 Intouch

-

Appen (OTCPK:APPEF, OTCPK:APXYY)

-

Teleperformance (OTCPK:TLPFF, OTCPK:TLPFY)

-

TTEC (TTEC)

-

VXI

-

Sutherland

TaskUs’s Recent Financial Performance

-

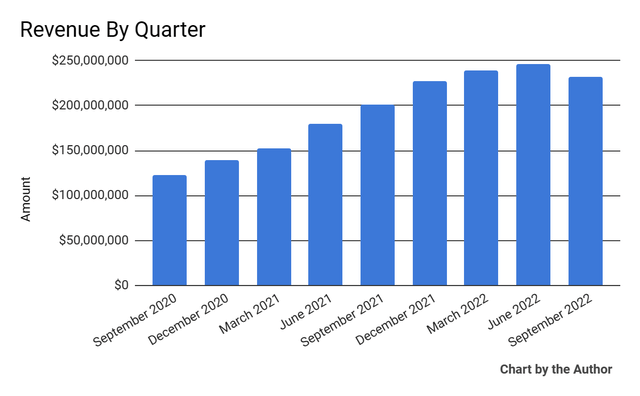

Total revenue by quarter has risen according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

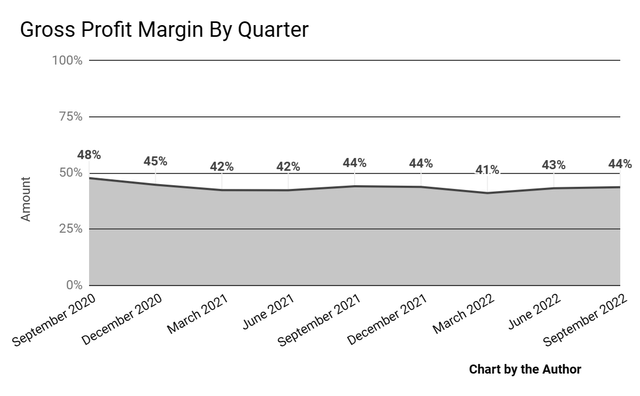

Gross profit margin by quarter has flattened in recent quarters as the chart shows here:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

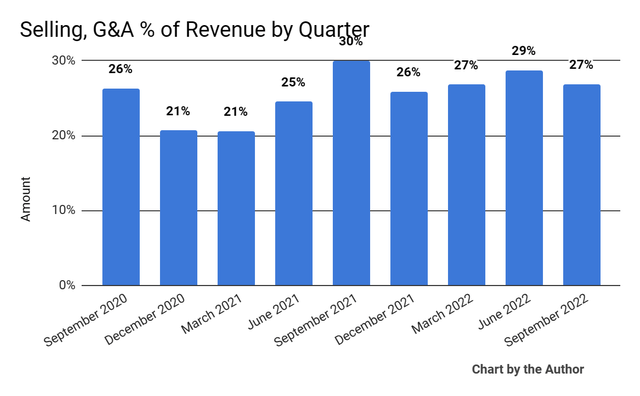

Selling, G&A expenses as a percentage of total revenue by quarter have fluctuated, trending slightly higher in recent quarters:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

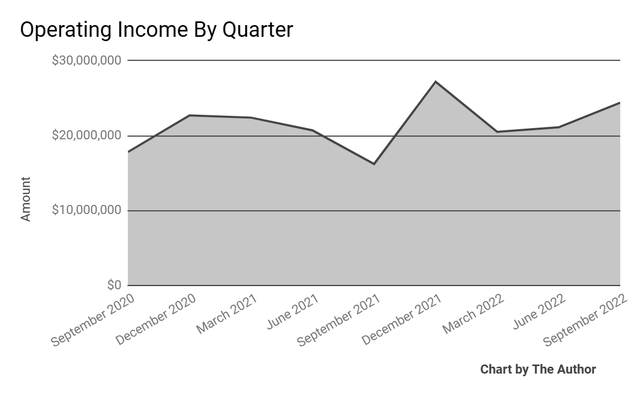

Operating income by quarter has varied in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

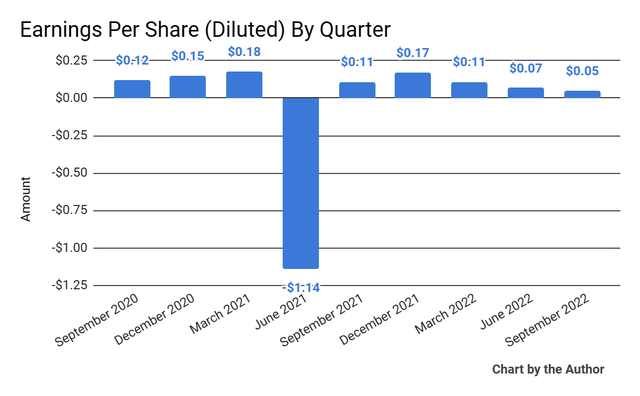

Earnings per share (Diluted) have trended lower recently, as the chart shows here:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in the above charts is GAAP)

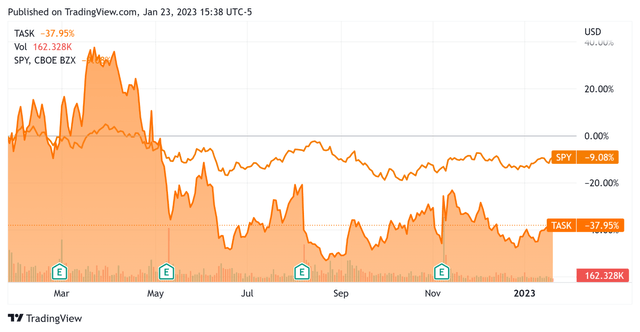

In the past 12 months, TASK’s stock price has fallen 38% vs. the U.S. S&P 500 index’s drop of around 9.1%, as the chart below indicates:

Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For TaskUs

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

2.0 |

|

Enterprise Value / EBITDA |

12.3 |

|

Revenue Growth Rate |

40.5% |

|

Net Income Margin |

4.6% |

|

GAAP EBITDA % |

16.5% |

|

Market Capitalization |

$1,728,048,380 |

|

Enterprise Value |

$1,914,201,340 |

|

Operating Cash Flow |

$145,216,000 |

|

Earnings Per Share (Fully Diluted) |

$0.40 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be TDCX (TDCX); shown below is a comparison of their primary valuation metrics:

|

Metric [TTM] |

TDCX |

TaskUs |

Variance |

|

Enterprise Value / Sales |

3.5 |

2.0 |

-42.0% |

|

Enterprise Value / EBITDA |

13.9 |

12.3 |

-11.2% |

|

Revenue Growth Rate |

23.4% |

40.5% |

73.2% |

|

Net Income Margin |

16.9% |

4.6% |

-72.7% |

|

Operating Cash Flow |

$103,750,000 |

$145,216,000 |

40.0% |

(Source – Seeking Alpha)

Commentary On TaskUs

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted its revenue and adjusted EBITDA results above the top end of its previous guidance despite how many of its clients ‘have shifted their focus from growth to cost.’

The firm also continued its focus on reducing G&A spending to improve its margins, although stock-based compensation has been very high over the past 12 months.

This was no doubt due to a drop in revenue from its largest client and from clients in the crypto and equity trading sectors.

Management is seeking to reduce its client revenue concentration through increased client diversity.

As to its financial results, total revenue rose 15.5% year-over-year, led by digital customer experience growth of 20.9%.

The company’s employee retention rate has improved recently, especially ex-U.S., and management said it has ‘seen an improvement in the market for talent compared’ to the first half of 2022.

Operating income continued to meander without any clear trend, while earnings per share continued a recent downward trend.

For the balance sheet, the firm ended the quarter with $122.5 million in cash and equivalents and $268.1 million in total debt.

Over the trailing twelve months, free cash flow was $88.4 million, of which capital expenditures accounted for $56.8 million. The company paid a hefty $75.9 million in stock-based compensation.

Looking ahead, management increased its full-year 2022 guidance to $950 million in total revenue and adjusted EBITDA margins of 23.1%.

Regarding valuation, the market is valuing TASK at a much lower EV/Sales multiple than TDCX despite its higher revenue growth rate.

The primary risk to the company’s outlook is a continued shift by clients toward cost reduction efforts due to lower growth results and/or forecasts.

Notably, TASK’s EV/Sales multiple [TTM] has dropped by 46.5% in the past twelve months, as the Seeking Alpha chart shows here:

Enterprise Value / Sales Multiple (Seeking Alpha)

A potential upside catalyst to the stock could include a short and shallow global downturn as China’s reopening after halting its Zero-COVID policies could ignite new demand from customers and prospects alike.

However, until we see evidence of that growth source translate into more optimistic clients, I’m on Hold for TASK in the near term.

Be the first to comment