Viorel Poparcea/iStock via Getty Images

Tandem Diabetes Care (NASDAQ:TNDM) was formed in 2008. Headquartered in San Diego, CA, the company focuses on a user-friendly, comprehensive approach to diabetes equipment development. That philosophy guided the company, formerly known as Phluid Inc., to develop the revolutionary t:slim insulin pump. The pump boasts a design that is 38% smaller than any other design on the market. Despite the smaller size, the pump still holds the same amount of insulin as competitor pumps. Since that time, the company has done nothing but grow in terms of both its reputation and accolades. In 2016, the company was named on the Deloitte Fast 500 North America with a ranking of #39, and in 2018 it was named a top workplace in San Diego by the San Diego Tribune.

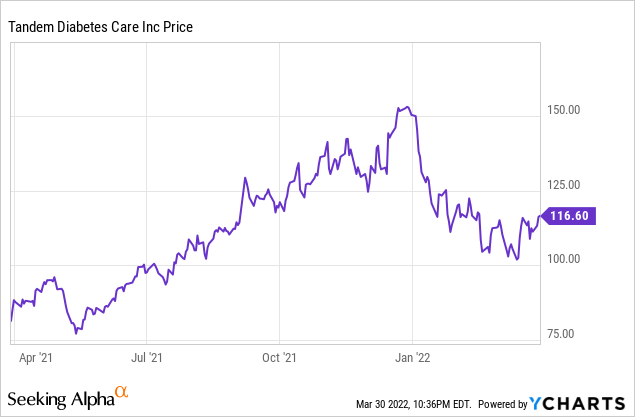

YCharts

In this article, I will show that Tandem Diabetes Care is a company that has shown consistent growth and shows no sign of slowing down. The revenues have constantly increased, and the company has continued to expand its resume and reputation, earning its spot at the forefront of both the medical supply market and the global insulin pump market. Being part of both markets also gives it an advantage as it enjoys the benefits of both growth rates and the projected success of both industries. Stability, consistency, growth, and innovative new technologies propel this company into the buy now list. For these reasons, I believe investors should pursue this stock with a bullish investment strategy.

Dual Market Dominance

One of the most appealing aspects of investment in Tandem Diabetes Care is that its products serve two markets. They serve as a company that falls under the purview of the medical supplies market, in addition to the global insulin pump market. The medical supplies market is far broader, but this helps accelerate the company’s pipeline. It also leaves the opportunity to veer off into the development of other medical supplies in the future. The global insulin market is significantly smaller, with the singular focus being on insulin pumps. Because of Tandem Diabetes Care’s innovative new technologies, they stand near the top of this market. This means that they also rank near the top of the medical supplies industry.

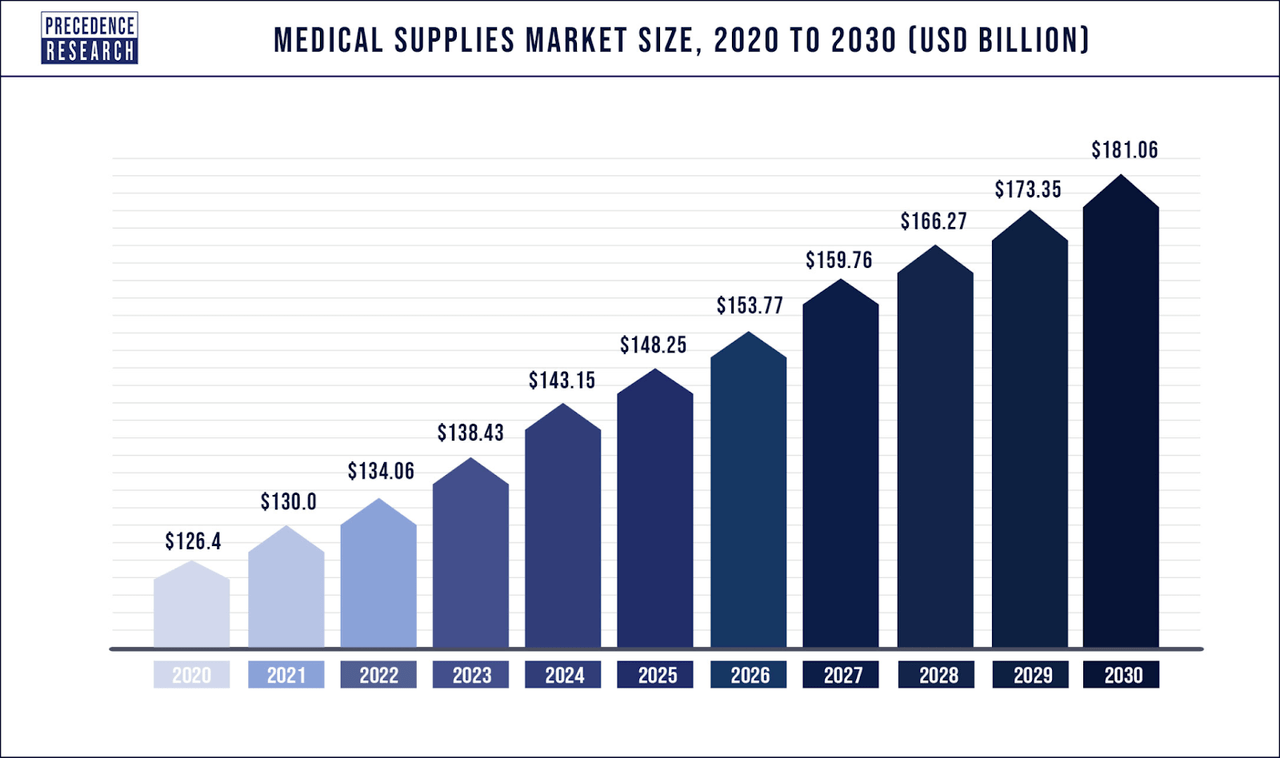

The medical supplies market had a cap of around $132 billion in 2020. This number is expected to rise steadily through 2028 at a CAGR of a respectable 4.5%. The market is driven primarily by an influx of disorders and diseases globally. This increased the need for specialized equipment within hospitals and medical clinics. As the rates for disease continue to rise globally, so too will the demand for supply, which will ultimately be beneficial for Tandem Diabetes Care. Should they wish to branch out beyond diabetes and insulin pumps, those options will be open for them, with the caveat of having a specialty in one of the factors already driving the market.

precedenceresearch.com

The global insulin pump market is far more focused. As expected, this market is limited to people suffering from diabetes who are eligible for the installation of an automated medical pump. However, because the demand is so specific, the demand is also severely limited, making it one of the most lucrative markets in the medical industry. In 2020 the market cap stood at $3.8 Billion. That number is projected to explode to a massive $13.3 billion by 2030, growing at a CAGR of a massive 13.5 %.

Innovative Technologies

The invention of the first t:slim insulin pump put Tandem Diabetes Care on the market map. The size was the most appealing factor, making it functional for both children and working adults, making it enormously popular. That in combination with the technology it boasted made it quickly one of the most sought-after insulin pumps on the market. Durable housing made it shatter-resistant, a rechargeable battery made it easy to charge with a USB cable without having to worry about disposable batteries. A Bolus calculator allows the user to enter multiple carb values, and the pump does the math according. Best of all, integrated continuous glucose monitoring means finger sticks are no longer necessary with this pump.

ccsmed.com

As if all of those features are not amazing enough, the company has taken it one step further, earning clearance on their new t:slim X2 Insulin Pump. In addition to all of the features that make the original t:slim pump the most sought after on the market, the company has added an even slimmer design, with a streamlined app for smartphones and other devices that interacts directly with the pump. This allows one to enjoy all the features of the pump without having to handle it simply by using an app installed on their phone. There is little doubt that this model will be as popular, if not more popular, than the existing model and will further propel the company into financial success.

Financial Overview

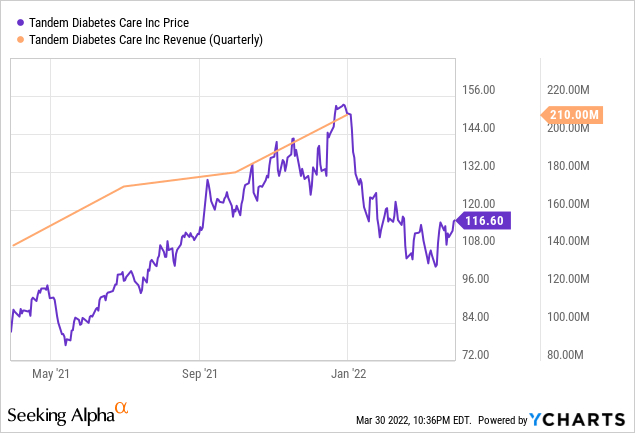

Company revenues have increased every year since 2018. In 2018 the company made $183.8 million. In 2019 that number nearly doubled to $362 million. In 2020 the company saw another revenue increase, closing the year with $498.8 million. 2021 marked the company’s most prosperous year yet, raking in $702 million. Company profits have largely reflected revenues, posting a ratio of around 43% compared to revenues. This is indicative of a company with a healthy structure, as the profit margin is healthy, which indicates a company that will continue to grow.

ycharts.com

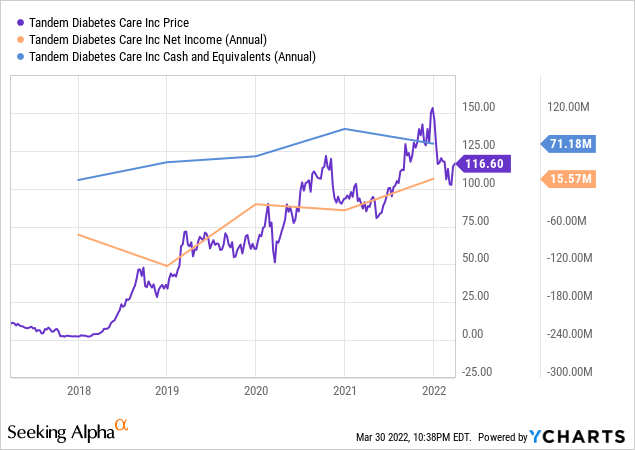

While gross profits and revenues tell a positive story, net income tells a bit of a different tale. As surprising as this may be, the company has posted a negative in the net income column for 3 out of the last four years. In 2018 the company posted a net loss of $122.6 million. In 2019 the company followed up with another negative net income posting of negative $24 million. 2020 saw yet another negative net income totaling a loss of $34 million. Finally, in 2021, the company managed to break into the positives, posting a net income total of $15 million. While the string of negatives could be a cause for concern, the fact that the company has consistently increased its profits and finished 2021 in net income positive shows the company is continuing to grow and has a very bright future.

The company has been a bit up and down in terms of cash in hand over the last four years. In 2018 the company held $41.8 million in cash. In 2019 that number increased to $51 million. 2020 saw yet another rise, with company cash in hand totaling $94.6 million. That number saw a decline in 2021, however, with the company closing the year at $71 million in cash. This is a positive because the company has undergone some expansion, and the fact that they were able to increase cash flow overall is a positive thing.

ycharts.com

The company did have to take on some debt to achieve this, however, finishing 2021 with a long-term debt total of $281.4 million. With that being said, the debt is inconsequential in the face of the $905 million in total assets that the company holds.

Risks

In the medical device market, the primary risk comes from competition. When such high R&D costs are combined with a limited market, even a single viable competitor can drastically reduce a new product’s revenue below what is projected. That said, while Tandem has some competitors in its sector, this is not a concern.

Tandem is already one of the market leaders in the insulin pump market. Its tslim:X2 pumps’ reputations precede them, and with strong reliability and ease of use, it is clear why. This market dominance is furthered, however, with their ease of integration with the G6 continuous glucose monitoring (CGM) system by DexCom (DXCM). Dexcom is already among the leaders in the glucose monitoring sector, and this will only grow due to its well-reputed CGM system. With direct compatibility alongside the tslim:X2 pump, Tandem and Dexcom can benefit hand-in-hand from each other’s continued market dominance. It is unlikely any pump-monitor combination will be more reliable or be able to achieve market dominance in the near future, as this would not begin to happen without clear warning through a steady decline of sales in Tandem’s pumps over time.

Conclusion

Tandem Diabetes Care Inc is a young company on the rise to stardom. It represents one of those stocks that screams “buy now” while also carrying the shame of not buying into the hype sooner. This company has solid financials, a treasure trove of assets, a consistent increase in revenues and profits, a positive net income rating, and some cash on hand. The company has navigated not one but two different markets simultaneously with one product that has revolutionized the global insulin pump market. Their newest design, which just received FDA approval, will only skyrocket this company even further in the future. Their innovative designs will likely lead the medical supplies market as well as the global insulin pump market for years to come, and that combination will be highly lucrative. I believe Tandem Diabetes Care is a buy for those reasons, and I believe investors should pursue this stock with a bullish investment strategy.

Be the first to comment