bjdlzx

(Note: This article was in the newsletter on September 18, 2022 and has been updated as needed.)

Tamarack Valley (OTCPK:TNEYF) has grown through acquisition whereas competitors like Headwater Exploration (OTCPK:CDDRF) has grown through organic growth. Then there is Baytex Energy (OTCPK:BTEGF) that has diversified and is therefore not a pure play on the emerging Clearwater basin. This gives investors a choice of risk levels as all three managements are reasonably competent.

There are individual risks inherent in each strategy choice. Organic growth has geologic risks whereas growth by acquisition has the risk of paying too much for the acquisition. Then there is the evaluation of each management. So, the discussion can get complicated very quickly whenever one compares different companies that choose different ways to grow. Nonetheless, in this case it is probably worth an overview of the whole situation so that investors can later decide to investigate on their own knowing the overall situation.

Tamarack Valley

Management has decided to pay others for their work. This often leads to a fast growth rate through accretive acquisitions. In the process, investors gain from each acquisition from the mix of stock and debt used. What is given up is the growth each company had prior to the acquisition in exchange for what each management has demonstrated.

Management recently reported third quarter earnings. But the latest acquisition changes the company materially enough to make forward guidance more important. Even then there could be a fair amount of “noise” in the quarterly reports as management optimizes operations by combining the various acquisitions.

In the process, management achieves that minimum size for all important institutional backing that often results in a better valuation. Of course, there is always the risk that one of the acquisitions backfires. But the low debt ratio ensures that the company survives to have more chances. Also, should one of the now large investors decide to sell their stock and move on, the stock price could be temporarily depressed as a result.

However, the success of putting together an attractive package for potential company suitors often outweighs the risk of failure. It does, however, make management experience important.

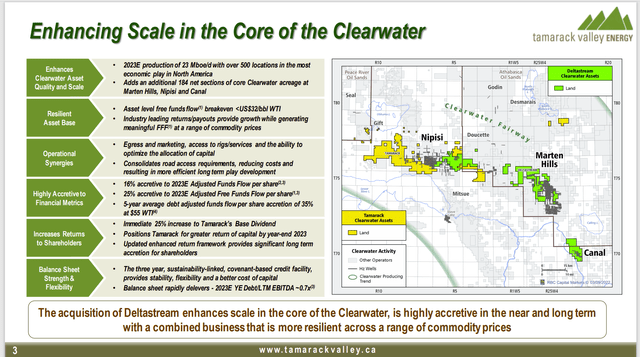

Tamarack Valley Summary Of Deltastream Acquisition (Tamarack Valley Presentation September 2022)

One of the reasons that the company is more than willing to pay more for the acquisition is the sizable amount of acreage that is adjacent or “bolt-on”. The combination of acreage into a larger position often results in the ability to drill wells that are more profitable. There is also the possibility of combining operations like midstream assets for considerable savings than was the case when the operations were distinctly separate.

Anytime there is rapid growth and lots of acquisitions, there is some additional risk. This management appears to have the experience to handle the strategy as they have done this type of thing before and sold companies. Similarly, the board also appears to have the relevant experience. In the short history of the company, so far, the strategy appears to have worked well.

This type of growth can be seen as less risky than organic growth where initial exploration wells can be disappointing. That results in wasted management time and potentially delayed growth. For some investors, the organic way is not worth the risk. There is also the small company risk that is avoided by getting to a decent size rather quickly.

Note that the current strategy is a relatively recent occurrence. Therefore, the past history of the stock price before the current strategy was implemented may not be relevant to investors.

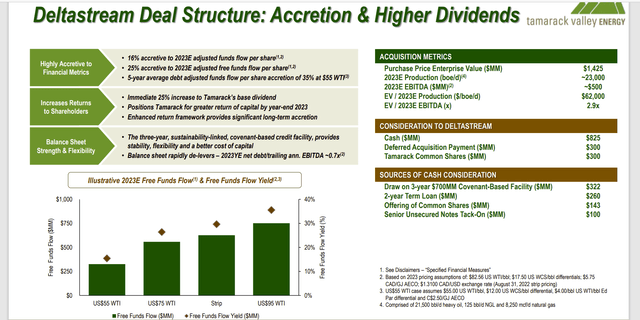

Tamarack Valley Energy Presentation Of Deltastream Acquisition Update (Tamarack Valley Energy Corporate Presentation October 2022)

The largest consideration of the slide above is the payback period and projected free cash flow. Now that we are further along with the industry recovery, robust pricing makes a lot of these acquisitions look like bargains. But the key consideration has to be debt levels during the next cyclical downturn that all of a sudden become a burden due to lower commodity prices.

I followed a lot of companies that posted this type of optimistic forward projection during the early parts of the recovery. Those companies are now rapidly repaying debt from better-than-expected cash flows. This type of strategy of making an acquisition when commodity sales prices are clearly strong can be very risky when debt is involved. Too many times, the next downturn results in some very high debt level ratios that concern the debt market and lenders.

Headwater Exploration

Headwater Exploration has decided to grow organically. Therefore, progress will be slower. But the profitability growth may turn out to be greater over time because management intends to do the work that was paid for by Tamarack Valley management itself. This management believes that the risks are outweighed by the potential gains of organic growth.

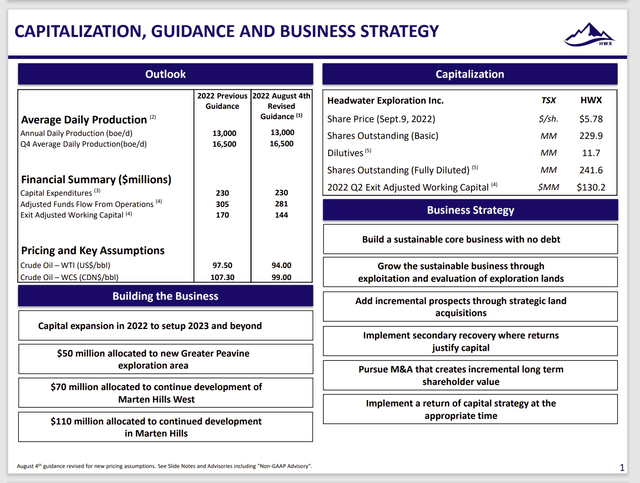

Headwater Exploration Latest Management Guidance (Headwater Exploration September 2022, Corporate Presentation)

This management has been enticed by the robust commodity prices to acquire acreage and evaluate the acreage themselves. The budget includes the costs of exploration wells while management continues to develop acreage that has been derisked.

The profitability of the basin and management’s own abilities make this a logical choice for this company. Like the first company, Tamarack Valley, this management has built and sold companies before. It similarly lowers the risk of rapid growth. There is a large cash balance and no debt that offer considerable downside protection in case something unexpected happens.

Similarly, the exploration risk is somewhat mitigated by the extremely high rate of success that typically accompanies an emerging basin in the early stages of exploration. However, that risk will rise over time.

What makes this strategy competitive with the acquisition strategy discussed before is the emerging play itself. Just about any map of the basin shows a decent amount of acreage that has not yet been claimed. Therefore, managements that are willing to risk their expertise of evaluating acreage and going through the bidding process, can grow a company through this process successfully. Overcoming these particular risks is likely to result in superior price appreciation.

Lowering really any new company risk of this particular strategy and really just about anything risky about a new company, is the choice of the high cash balance combined with no long-term debt. Any mistakes or unexpectedly poor outcomes (not just the usual upstream risks, but also management depth for example) can simply be overcome by trying again. Given the history of this management in the time, I have followed them, there is likely to be more good outcomes than there is bad.

Baytex Energy

The last of the group is a very established management that has operations in more than one basin. Baytex Energy is not tied to any one outcome but rather the result of a fairly diversified effort.

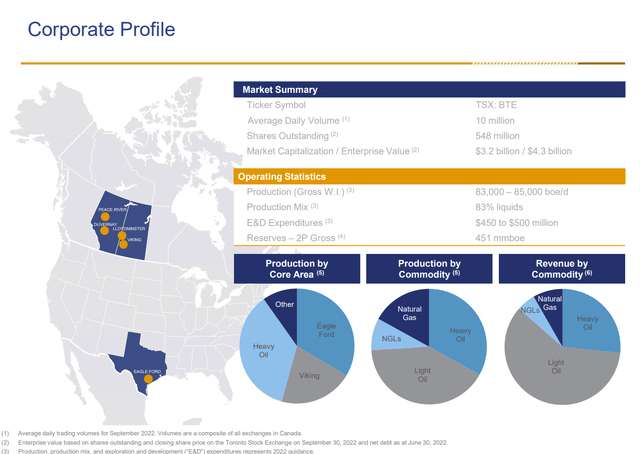

Baytex Energy Company Location Of Operations Map (Baytex Energy October 2022, Corporate Presentation)

Baytex Energy had acreage in the Clearwater Play to start with. This heavy oil producer has recently (meaning the last decade) diversified into lighter oil plays as a way of mitigating the effects of cyclical downturns.

As a large company, this company was able to demonstrate some of the best well results in the play. The effect of this is to change priorities with money going to Clearwater at the expense of the legacy heavy oil acreage.

Therefore, the more profitable heavy oil production growth of Clearwater should lead to profit gains even if total production does not grow. The company possesses some light oil production as well from the Eagle Ford (a very much known low-cost basin with light oil production) and the Viking. Therefore, should discount margins (for heavy oil) widen during the inevitable next cyclical downturn, the company has premium products to sell that should provide sufficient cash flow.

This company has more diversification than Tamarack Valley and Headwater Exploration as the light oil production is a larger percentage of the mix. That of course could change with the next Tamarack Valley acquisition.

Clearwater appears to be an unusually profitable heavy oil play. Therefore, decent cash flow in a downturn is a good possibility. It all depends upon whether or not a widening heavy oil discount causes received pricing to be unacceptable.

Baytex also has another promising play for light oil that may become competitive in the future. Currently, that play is in the development stage in that management is trying to determine the optimal drilling and completion strategy for decent costs.

Baytex offers a number of ways to benefit in the future while providing diversified upstream protection in a downturn.

The Results

None of the three strategies is “wrong”. It is simply a matter of the risk an investor wants to take for involvement in the emerging Clearwater Play. I happen to own all three and will juggle the relative holdings as things develop in the future.

There is (of course) substantial due diligence needed by an investor before investing in any of the three.

Currently, I prefer Headwater Exploration because I believe that the “safe” acreage has not been totally claimed at the current time. Therefore, I think the results will far outweigh the risks until more acreage is claimed. At that point, the Tamarack Valley strategy is likely to prove a more profitable way to go.

Tamarack Valley has likely reached the size to attract institutional investors that are likely to push the stock price higher. Against this, there are a number of large shareholders that may want to exit oil and gas. This may be why they sold to Tamarack Valley in the first place. That could cause the stock price to “wobble” when there is a major shareholder exit (or worse).

Tamarack Valley currently has a low leverage ratio. There is the risk of assimilation of a large acquisition like the last one. A preferred strategy would be to continue to acquire “bolt-on” suboptimal holdings that are usually sold at a large discount and are very profitable to combine.

The last Tamarack Valley risk is the risk of too much debt when the next commodity price downturn begins.

There is certainly a lot of room for other opinions and my own is not necessarily correct for everyone else. Some investors will like Tamarack Valley simply because management overcame the small company risk quickly with accretive transactions. Management is now in a position to grow organically in the future.

Some will like Baytex Energy for the Clearwater play because the company has a potential winner in a light oil play and current light oil production. In exchange for diversification comes some additional safety that an upstream focus upon one basin just does not have.

This can easily be a far more complicated discussion. The point of the article was to allow investors to see they have choices of risk levels in the upstream business. Each way of investing has its benefits (and deficiencies). The winning choice depends upon the investor themselves. All three are likely to succeed in their own way given the current situation. But that may not be true as the future unfolds. Now let us see what happens.

Be the first to comment