imaginima

Talos Energy (NYSE:TALO) is an independent oil and gas producer in the U.S. Gulf of Mexico (or GoM). In addition, TALO is also developing a carbon capture and storage (or CCS) business through collaborations along the GoM coast. For background on the company and my investment thesis, I will refer to my prior article.

The key points were:

- Talos’ core business is priced very cheaply in terms of net asset value (or NAV) and cash flow.

- Additional optionality is present from the Puma West discovery and Zama.

- The carbon capture offering may also add value in the future.

The company’s Q2 earnings and commentary indicate steady progress on these fronts. The stock rose to $25 a few weeks ago, but is again trading at attractive levels. In that sense, the valuation thesis hasn’t changed much.

The two new aspects I discuss below arise from the so-called Inflation Reduction Act now in Congress:

- Significant increase in the Section 45Q carbon sequestration credit and greater fungibility of these credits.

- Reinstatement of the leases awarded via Lease Sale 257 and a rule that would make future offshore wind development contingent on ongoing oil and gas lease sales.

The bill hasn’t been enacted by Congress yes, but if this indeed happens, the TALO investment thesis will benefit further.

A look at Q2

The highlights from the Q2 earnings included:

- Production of 65,400 boe/d (67% oil, 75% liquids)

- Revenue of $519.1 million (before hedges)

- Adjusted EBITDA of $250.8 million including hedges and of $411.0 million excluding hedges

- Capex of $85.9 million, inclusive of plugging and abandonment

- Free cash flow of $134.1 million

- Achieved 1.0x leverage ratio and record liquidity of $702.2 million; net debt reduction by $344.1 million since March 31, 2021

- Brought in Chevron (CVX) as a 50% partner in the Bayou Bend CCS project in exchange for $50 million of gross consideration.

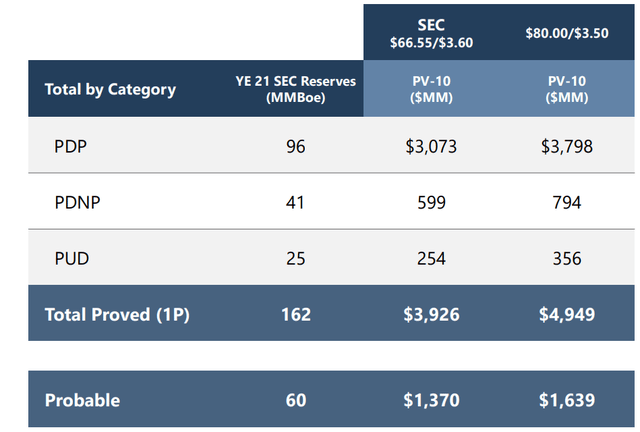

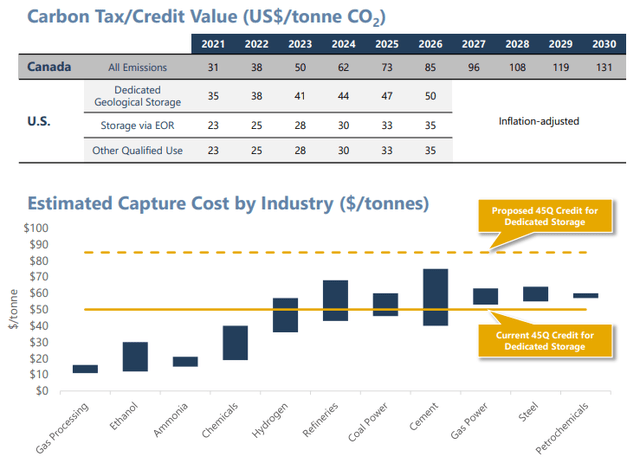

An investor day presentation from May suggests the PV-10 value of 1P reserves, as of 2021 year-end, is almost $5 billion at $80 oil/$3.50 gas:

I will refer to my prior article for more valuation scenarios, but there should be little doubt the company remains very cheap:

A $5 billion 1P NAV plus $1.6 billion 2P NAV, even after adding asset retirement obligations, hedging losses, G&A and debt, should compare very favorably to a $2.2 billion enterprise value (or EV).

Annualized unhedged EBITDA based on Q2 is about $1.6 billion and $1.0 billion hedged. This implies EV/EBITDA multiples of 1.3x (unhedged) or 2.2x (hedged).

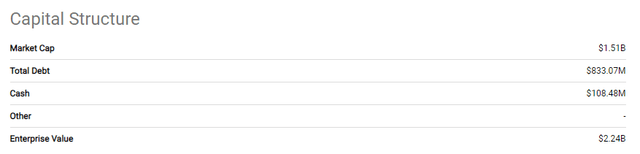

The stock rallied in May, but after the correction in June, we again stand at a relatively attractive entry point:

It seems that the short interest is still a factor, so the stock price would probably remain volatile in the near term. I tend to view the TALO dips as buying opportunities, but partially trading your position also makes sense, especially for a non-taxable investment account.

In the long term, I think the valuation thesis remains very robust, and this doesn’t even include Puma West, Zama or the carbon business, which have all been discussed before.

The Inflation Reduction Act

After Senator Joe Manchin opposed the Build Back Better Act, the democrats scaled back their ambitions to where Manchin would be comfortable with the legislation. It seems that after many months of negotiations, Manchin and the democrats have arrived at a budget reconciliation bill that has been now dubbed the Inflation Reduction Act:

A $369 billion climate and energy spending package unveiled by Senate Democrats last week could impact the oil and gas industry on multiple fronts, namely with regard to leasing, royalty rates and methane emissions.

Senate Majority Leader Chuck Schumer and fellow Democratic Sen. Joe Manchin announced an agreement late Wednesday to add the energy and climate provisions to a budget reconciliation bill that could be voted on as soon as this week.

The proposed legislation, dubbed the Inflation Reduction Act of 2022, targets a roughly 40% reduction in greenhouse gas emissions by 2030, “and would represent the single biggest climate investment in U.S. history, by far,” according to a fact sheet.

I won’t go into whether the bill would indeed reduce inflation because this is probably more of a political discussion. Instead, I will emphasize the two aspects that I find very relevant to Talos.

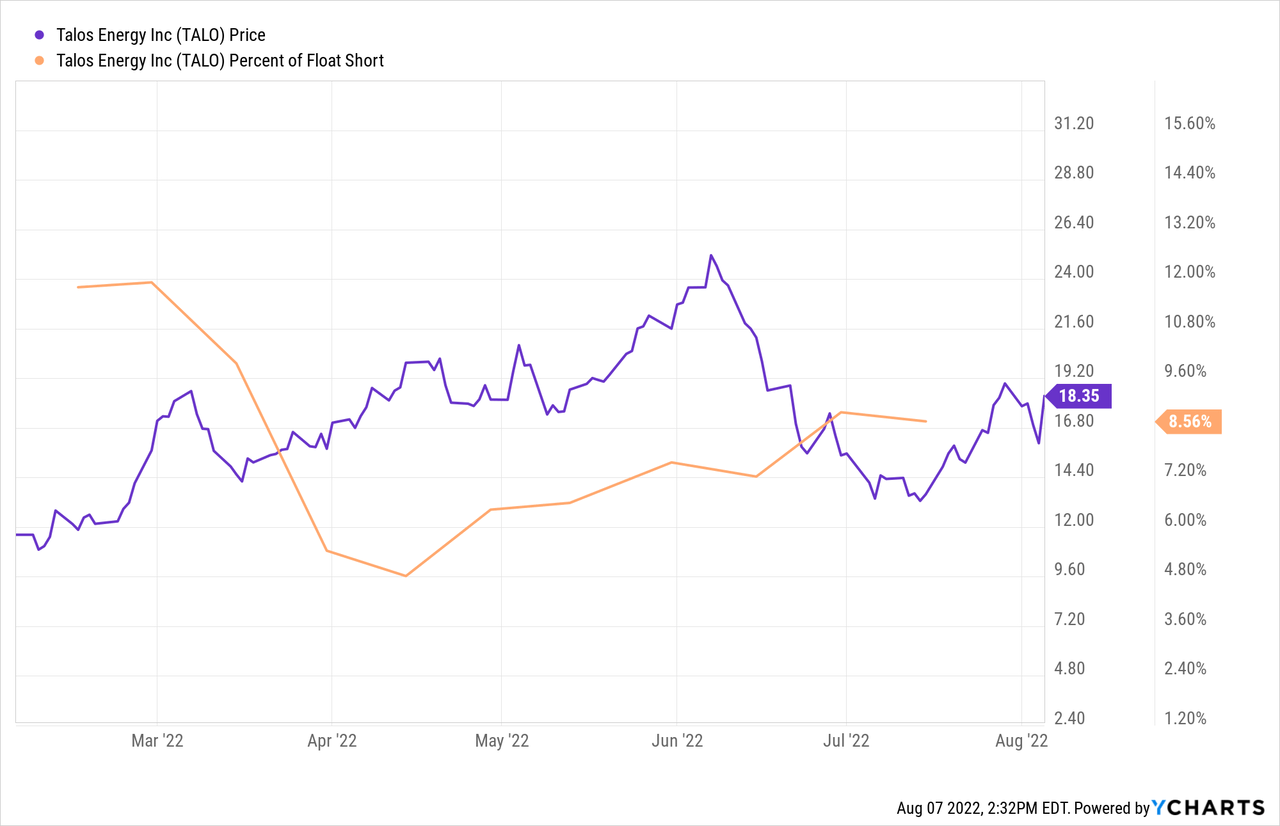

Section 45Q carbon sequestration credits

The first aspect is the proposed revision to the Internal Revenue Code (or IRC) Section 45Q which governs the carbon sequestration tax credit mechanism.

Under the current rules, the credit is set at $50 per metric ton. Under the new bill, this could go up to $85 per metric ton if certain other requirements are also met:

This would be a huge boost to the commercial viability of Talos’ developmental projects and the company seems to agree. From the earnings call:

On the carbon capture side, the bill proposes an increase of the 45Q credit from $50 a ton to $85 a ton and introduces direct pay mechanisms, both of which we believe are key attractors for potential industrial partners around our projects and moving towards long-term carbon sequestration solutions. We believe this bill will be meaningful for Talos in both of our business lines and we’re closely monitoring future developments.

Additional benefit would be provided by the enhanced fungibility of these credits:

- The construction start date of the eligible carbon sequestration facilities would extend from 2026 to 2033, allowing more future projects to be eligible;

- The minimum volume requirements would be reduced;

- While now the credit can only be offset against taxable income, which frequently requires bringing in a “tax equity” investor into a renewables project, under the proposed changes a “direct pay” option would be potentially available;

- Credits would also possibly be eligible for sale, allowing Talos another monetization channel.

I don’t want to harp on too much here because the final text of the bill will most likely change by the time this is over, but it looks that Manchin (who, by the way, represents a coal state) has managed to put carbon capture on equal footing as solar and wind. In the past years, the “ESG status” of solar and wind resulted in capital flooding these sectors, so maybe that is a sign of good things to come for Talos, and also Occidental (OXY), which is too trying to make something happen in this area.

I would like to emphasize again I’m not opining here on whether the new legislation makes sense from overall policy perspective, but assuming political commentators, who now say it is likely to go through, are correct, it would be unwise for anyone following Talos to ignore this.

Better days for GoM leases ahead

The second key aspect, supposedly also introduced by Joe Manchin, is a linkage between new offshore oil and gas leases on federal land and the sanctioning of new offshore wind projects:

In a positive development for the industry, the Department of the Interior would not be allowed to issue a lease for offshore wind development without first conducting at least a 60-million acre offshore oil and gas lease sale.

In my view, and if I read this right, this could be huge. Assuming the current or future administrations want to develop offshore wind, they would have to make sure enough oil and gas leases are offered in order to clear the hurdle. I think this will grant additional security to GoM players, like Talos or W&T Offshore (WTI), that they won’t be left behind in the energy transition. Together with the enhanced status of carbon sequestration, this would also signal that policy makers now accept there is no “net zero” path to 2050 without a prominent role for fossil fuels. But let’s see.

On a more micro level, the Inflation Reduction Act will also reinstate the leases that were awarded via offshore Lease Sale 257 in November 2021. As reminder, these sales were nullified by a federal judge in January 2022.

From the earnings call again:

On the upstream front, if signed into law, as is initially proposed, the Inflation Reduction Act would reinstate Lease Sale 257 from last November, in which we were one of the most active bidders and won deepwater blocks. This bill would also ensure future lease sales in a prescriptive manner and remove more the regulatory uncertainty.

The bill is probably not all good news, as it also tries to increase the minimum royalties on federal land from 12.5% to 16.66%, but on balance, I think Talos will be one of the clear winners should this pass Congress.

The takeaway

Talos Energy is a small and very undervalued GoM offshore player, who, among other things, is very active in the novel carbon sequestration area. The recent political developments in Washington, which suggest the proposed Inflation Reduction Act may become law, surprisingly carry two strong positives for Talos.

First, the increased magnitude and usability of the U.S. carbon capture credits will greatly improve the commercial viability of TALO’s carbon capture ventures. Second, as a GoM operator itself, TALO can rest assured that the federal government won’t work to prevent offshore drilling, at least for the next 10 years. But, more importantly, I think these provisions in the bill could also signal some rethinking of the U.S. energy paradigm and acknowledgement that fossil fuels with some carbon offset, and Gulf of Mexico production in particular, should be part of both the environmental and energy security solutions for the next decades.

Be the first to comment