isayildiz/E+ via Getty Images

An idealist is one who, on noticing that a rose smells better than a cabbage, concludes that it makes a better soup. ― H.L. Mencken

Today, we turn our glaze for the first time to a small cap health care concern that is focused on improving outcomes in the organ transplant setting. An analysis commences below.

Company Overview

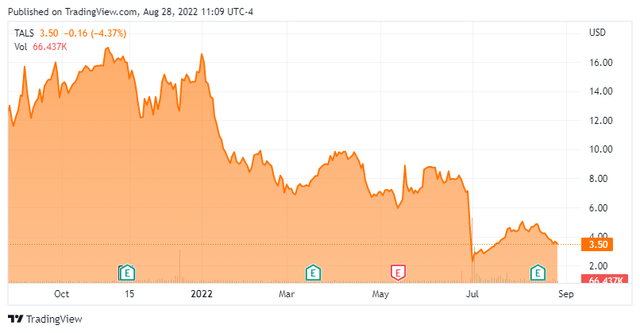

Talaris Therapeutics, Inc. (NASDAQ:TALS) is a Wellesley, Massachusetts based late clinical-stage cell therapy concern focused on improving outcomes in the organ transplant setting. The company has one asset undergoing evaluation in three clinical trials, including a Phase 3 study involving kidney transplantation patients. Talaris was founded as Regenerex in 2002, changed to its current moniker in 2019, and went public in 2021, raising net proceeds of $139.5 million at $17 per share. The stock trades for $3.50 a share, translating to a market cap of approximately $145 million.

Approach

Although organ transplant surgeries have improved survival rates for patients since emerging as a viable option in the 1980s, the risk of rejection by recipients’ immune systems in the form of graft-versus-host disease (GvHD) necessitates a lifelong intake of immunotherapy drugs with all their attendant side effects. Talaris’ endgame is to eliminate the need for these medications through the development of an allogenic cell therapy comprised of stem and immune cells from the organ donor. Currently, before an organ is transplanted, the recipient typically receives myeloablative conditioning, consisting of chemotherapy and radiation that destroy the hematopoietic stem cells [HSCS] in the patient’s bone marrow, which normally evolve into blood and immune cells. Their destruction reduces the likelihood of organ rejection, but this procedure has to be rescued by stem cell transplant post-surgery to resume the production of blood cells and platelets. A nonmyeloablative conditioning can be performed, where the bone marrow and lymphocytes are not destroyed but ‘diminished’ to a level that prevents an autoimmune response. This less harsh approach does not require stem cell support for the recipient to resume the production of blood cells post-transplant and has a lower mortality rate, but the tradeoff is a greater chance of organ rejection.

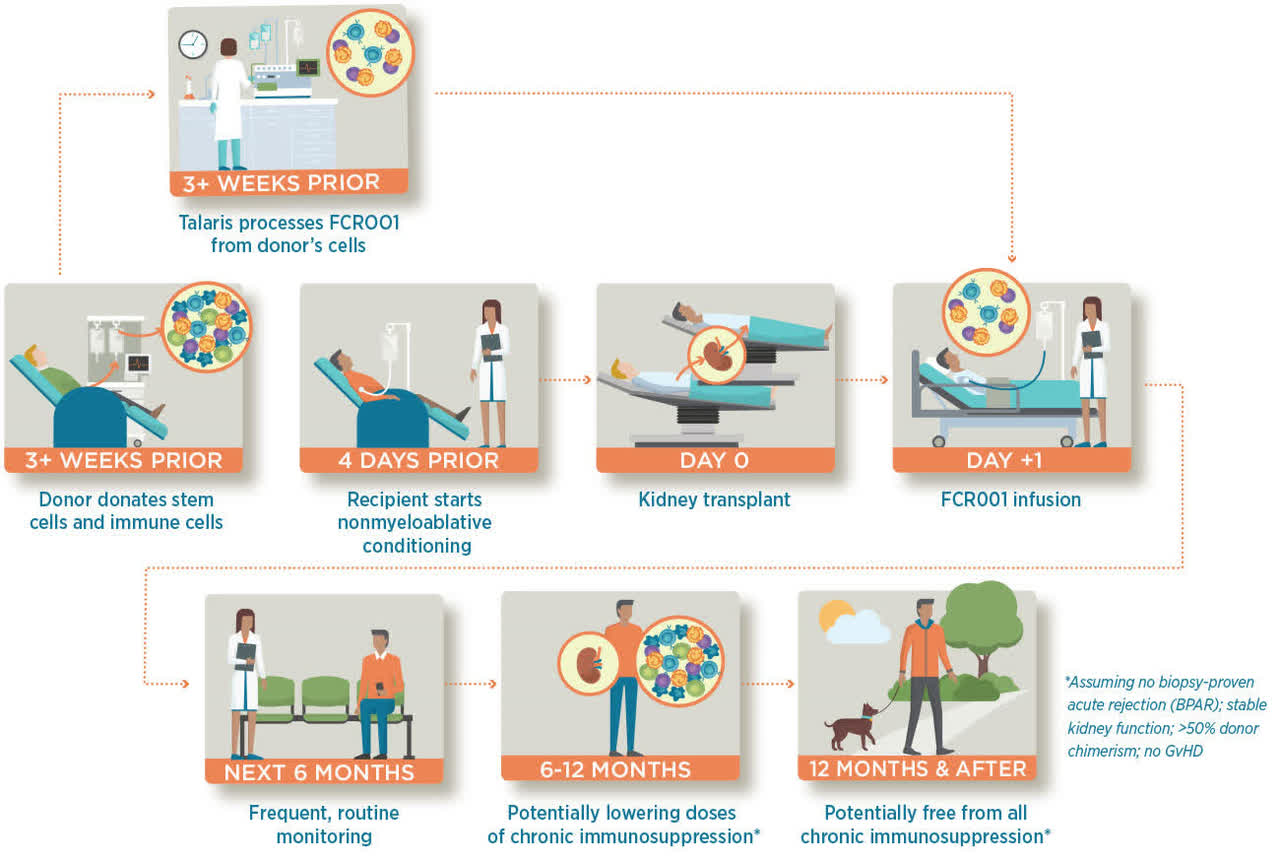

Company Website

FCR001

Talaris is attempting to reimagine this modality with FCR001, a single-dose, facilitated allogenic-HSC transplant therapy that is derived from the donor’s stem cells, essentially providing the recipient with a ‘second immune system’, creating a state of ‘chimerism’. The donor’s HSCs, now embedded in the recipient’s bone marrow, recognize the transplanted organ as their own, preventing the recipient’s legacy immune system from attacking the new organ. This concept is known as immune tolerance and if proven effective, will allow for nonmyeloablative conditioning and the eventual elimination of the need for a lifetime of immunosuppressive drugs.

In a Phase 2 trial, FCR001 was introduced into 37 patients who received a living donor kidney transplant (LDKT). Twenty-six (70%) were able to stop immunosuppressive therapies completely and permanently approximately one year after transplantation, including patients who were not a perfect match, which could broaden the population of potential organ donors. Furthermore, after mid-course revisions to the trial protocol, 14 of the last 17 patients (82%) were able to discontinue immunosuppression. It should be noted that there were four deaths and two cases of GvHD in the study.

Despite the GvHD concerns, these results prompted the initiation of an open-label Phase 3 study (FREEDOM-1) evaluating FCR001 in 120 first-time, adult LDKT recipients, randomized 2:1 between FCR001 versus standard of care. Primary endpoint is proportion of FCR001 recipients who are free from chronic immunosuppression without organ rejection at month 24. However, a June 30, 2022 update triggered a significant selloff.

On the surface, the results appeared positive with all three patients dosed with FCR001 and separated twelve months or longer from transplantation successfully weaned off immunosuppressive therapy. However, three patients of the seven total who received FCR001 contracted low-grade acute GvHD. All three cases were treatment-responsive and resolved. The company decided to modify the trial’s protocol by eliminating immunosuppressant plerixafor while adding a second dose of post-transplant chemotherapy cyclophosphamide in the FCR001 recipients. This news actuated a two-day, 68% selloff from $7.13 to $2.30 a share in the company’s stock.

This setback aside, if ultimately successful, FCR001 could alter the standard-of-care for approximately 6,500 LDKT patients per annum in America. Talaris is not the only company pursuing this cell therapy approach in kidney transplant patients. Privately held Medeor Therapeutics is evaluating its MDR-101 in human leukocyte matched kidney transplant patients in a Phase 3 trial. However, that study has been extremely slow to enroll and Medeor has not issued a press release since 2020.

Management believes FCR001 also has applications in patients who have already received a kidney transplant. To that end, Talaris initiated a Phase 2 trial (FREEDOM-2) in 4Q21 that is evaluating FCR001’s ability to induce durable immune tolerance in post-LDKT patients. Administered three to twelve months after transplantation, a successful trial could set the stage to expand the addressable patient population by 6,000 to 10,000.

Along those lines, the company is developing a therapy similar to FCR001 (FCR002), which is designed to be employed in deceased donor kidney transplants, a market encompassing another ~16,500 patients annually.

Beyond transplantation, FCR001 is being assessed as a therapy in autoimmune diseases. Specifically, it was entered into a Phase 2 trial (FREEDOM-3) during 4Q21 to evaluate it in the treatment of scleroderma, an autoimmune disorder that affects multiple connective tissues and organs, characterized by progressive fibrosis of the skin and vasculopathy. The most severe form of the disease, known as diffuse cutaneous systemic sclerosis, afflicts ~30,000 Americans with a five-year survival rate of only 60%. It is currently treated with tyrosine kinase inhibitor nintedanib, but HSCT has emerged as a potentially promising therapy. No timeline for data has been forwarded.

Any guessing as to the ultimate potential of the now troubled FCR001 is riddled with many assumptions, but simply using the cost of nintedanib (~$140,000 per annum) and just the annual LDKT population in the U.S. would generate an addressable market of $910 million. The post-LDKT market would bring the potential to north of $2 billion.

Balance Sheet & Analyst Commentary

To finance the clinical advancement of FCR001 and preclinical work on FCR002, Talaris held cash and marketable securities of $207.1 million as of March 31, 2022, which should provide the company a runway well into 2024 given it has burned approximately $37 million through the first half of 2022.

The emergence of GvHD in three patients in the Phase 3 trial was enough uncertainty to move both Morgan Stanley and SVB Leerink off their previously bullish stances, both downgrading shares of TALS from an outperform to a hold. Previously around $20 a share, their respective price objectives are now $8 and $7. Evercore ISI (outperform) and Guggenheim [BUY] have yet to respond to the FREEDOM-1 update.

Board member Francois Nader and CEO Scott Requadt have used the post-update selloff as an opportunity to add to their positions, purchasing 138,500 and 48,826 shares (respectively) between $3.52 and $4.25 a share on July 19th – 29th.

Verdict

With cash of slightly more than $200 million and a market cap of less than $100 million two days after its Phase 3 update, it wasn’t surprising to see Talaris’ stock move up a bit since then. However, the equity still trades at a discount to cash and the to-date results of the Phase 3 trial (as well as the Phase 2 study) were encouraging, excepting (of course) the GvHD data. Given the nature of what Talaris is trying to accomplish with FCR001, the clinical trials are slow to produce data. However, with current immunosuppressant therapy involving more than 20 pills a day, a one-time single dose of FCR001 would be a significant quality-of-life improvement for kidney transplant patients, even if outcomes don’t improve versus immunosuppressants.

That said, the protocol adjustments to FREEDOM-1 will likely determine the medium-term prospects of Talaris. Plenty of potential upside remains. While a bit too risky for a large stake at this time, Talaris warrants at least a small ‘watch item‘ holding pending further developments.

A cynic is a man who, when he smells flowers, looks around for a coffin. ― H.L. Mencken

Be the first to comment