jetcityimage/iStock Editorial via Getty Images

Written by Nick Ackerman. This article was originally posted to members of Cash Builder Opportunities on April 9th, 2022.

With the latest options expiration, we had our short strangle expiring with shares of Ford (NYSE:F). This was our second short strangle that we were able to execute with this stock. This time, however, we are taking the assignment of F shares. The call leg had expired worthless at the $23 strike price. In our first short strangle, we closed the put leg early and let our calls expire worthless. This is the second batch of shares being loaded up now.

The original batch was assigned at $23 when we sold puts all the way back on January 12th, 2022. Not so long ago, but with the market volatility over the first quarter of the year, it seems like an eternity ago. That was the original assignment that allowed us to utilize a short strangle since we could write covered calls. Of course, we are free to write puts all we want.

With this trade, we took shares at a strike price of $16. That reduces the cost basis substantially down to $19.50. We also collected $0.56 from the short leg and then a token of $0.06 for the covered calls.

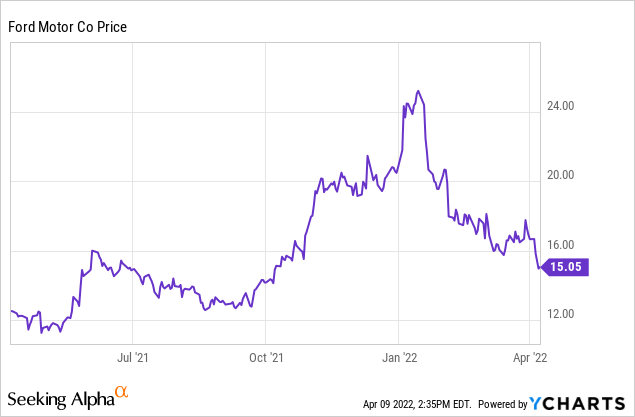

Shares of F have been under significant pressure after what was a blistering nosebleed rally that started last October 2021. Unfortunately, as fast as things were going up, they began going down quickly.

Ycharts

Some of the major factors hitting the company are the further shortage of chips after Russia’s invasion of Ukraine. The reason for this is that computer chips are already in short supply; this only restricts the supply chain even further.

So while their plans are ambitious, pushing into the EV space, it doesn’t necessarily help them if they can’t come up with all the components. They could have all the plant capacity in the world, but missing one crucial part means halts in production.

That being said, their EV sales have increased with the latest figures report. It is the trucks, cars and SUV sales that have taken a massive hit.

Truck sales fell 34.4% Y/Y to 74,420 units, Cars sales down 67% Y/Y to 3,628 units, Electrified vehicles sales +16.9% Y/Y to 13,772 units and SUVs -9.4% Y/Y to 81,280 units.

The other factor that I believe is working against shares is that it is a cyclical stock. The Fed is in the middle of financial tightening by raising rates and will be reducing its balance sheet. We also have seen the yield curve invert lately. On that subject, some believe that this time is different, though. So it might not be as dire as history suggests.

A U.S. recession is not imminent despite the inversion of a part of the U.S. Treasury yield curve which has been “artificially pressured” by some investors, BlackRock Inc (BLK), the world’s largest asset manager, said in a note on Friday.

The closely watched gap between two-year and 10-year yields, whose inversion has preceded past recessions, turned negative last week, fueling a debate on whether the signal presages a downturn this time around.

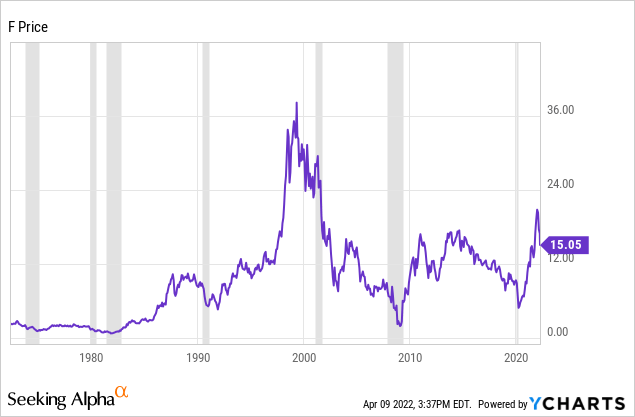

These are signs that a slowdown or recession could be coming on the horizon. Ford requires a stable and growing economy to perform well; that’s just the nature of their business as a cyclical business. Below is a chart showing the share price of F, and the gray marks U.S. recessions. We can see how shares have generally sunk in recessions. However, not all share declines happened during recessions.

Ycharts

Trade(s) Recap

As mentioned above, this trade netted us a total of $0.62 in premium. That’s 6.2x their quarterly $0.10. Of course, that’s quarterly, too; the duration of this trade was 36 days.

Since this is our second assignment (receiving shares at $23 and at $16), that puts our breakeven at $19.50. If we factor in the $0.62 received in this latest trade and the $0.22 we collected from our original assignment, our breakeven would drop to $18.66.

These weren’t our only trades, though; these were just the trades where we ended up taking assignment that we are touching on. In our original short strangle that we had executed, we closed out the put leg early and collected a net $0.55 (from the put and call minus the $0.01 to close.)

We also had two other trades where we had sold puts, but those expired worthless. We collected $0.55 and $0.44 in each of those trades.

In total, we have generated $2.39 per contract in premium collected, which is quite a meaningful amount, thanks primarily due to the greater volatility of the stock and the market overall. The first trade goes back to December 10th, 2021.

What’s Next?

From here, I still have some room to add more to my Ford position in my portfolio. That means I’ll consider looking at further opportunities for short strangles going forward. With the reduced cost basis after taking assignment of the second batch of shares, we can also lower the covered call strike price that we are looking at without generating a potential loss.

On the other hand, I’ll also be looking for more conservative trades for the short put leg, those that are fairly deep out-of-the-money trades. I often target around a 15% potential annualized return when selling puts. (I also tend to target trades around 30 days out.) As an example, the potential annualized return for the put leg in this short strangle was 35.48% if we could make a similar trade every 36 days for a whole year.

So that might mean not getting the 15% target. Now that I have a reasonable size position in Ford, I’ll want it to reduce my cost basis meaningfully if I am assigned more shares. For example, I am looking at the May 13th, 2022, expiration at the $12 strike. It last traded at $0.15, which would come out to a roughly 13.42% potential annualized return. That would be if we could complete the same trade every 34 days.

Given the $15.05 closing price on Friday, though, that leaves us with a decline of 20.27%. That is on top of what the stock has already shed in the last couple of months. It still provides us with a decent potential annualized return, and if assigned at that price, it will materially drop our cost basis. If it were a double down from the series of trades so far, it would mean a cost basis of $15.75 from $19.50. That’s not accounting for any premium that has also reduced our breakeven.

Conclusion

In summary, Ford has been a position I wanted to add to my portfolio since they reinstated their dividend. This has now been accomplished. The stock has been sliding about as rapidly as it rose due to uncertainty going forward. I’ll monitor for more opportunities to collect premium through short strangles. However, I’ll leave substantial room for a downside cushion between the current share price and the strike price when doing so.

Be the first to comment