Hulton Archive

Investment Overview – BMY, Ventyx, And Now Takeda – The Market For TYK2 Inhibitors Just Got Even Hotter

At the end of September this year I wrote a post for Seeking Alpha titled “Bristol Myers Squibb’s Sotyktu Approval Sends Ventyx Stock Soaring: Consider Buying Both.”

The explanation for this advice was firstly based on BMY’s (BMY) securing approval that month for yet another drug with “blockbuster” (peak sales >$1bn per annum) revenue potential.

The drug in question was Sotyktu (deucravacatinib) – approved for adults with moderate-to-severe plaque psoriasis, based on the compelling results of two separate Phase 3 studies, which saw the drug comfortably outperform Amgen’s standard of care Otezla – a drug BMY actually sold to Amgen back in 2019 as part of its $77bn takeover of Celgene.

It must have therefore been a doubly satisfying approval for BMY, and its plans to offset the patent expiry of its best-selling drug Revlimid and another blockbuster, Pomalyst, with >$10bn of revenues from newly-approved drugs – including Sotyktu, which management believes can achieve ~$4bn in peak sales.

BMY may launch as many as 12 new drugs that go on to achieve blockbuster sales between 2020 and 2030, and grow revenues at a CAGR of ~5% based on my forecasting, which is an outstanding achievement that’s underpinning the big pharma’s ~30% share price growth over the past 12 months, and why I advised readers to buy the stock.

Ventyx Lies In Wait

In the case of Ventyx (VTYX), this biotech is developing a drug, VTX958 – with the same mechanism of action as BMY, being a TYK2 inhibitor – that also is chasing approval in psoriasis, plus psoriatic arthritis and Crohn’s Disease. Ventyx believes it may have the edge over Sotyktu in terms of efficacy and safety.

The investment thesis here is therefore straightforward – while BMY is making the case for TYK2 inhibitors in the marketplace, using its vast marketing resources and deep infrastructure, Ventyx is working on its version of Sotyktu 2.0, which physicians will be unable to ignore once approved thanks to its superior safety and efficacy profile.

Ventyx’ share price sprung from $22, to $39 – up 77% – on news of Sotyktu’s approval, and this week, its share price has been on the rise again, up to $34, as news of another major event involving a TYK2 inhibitor surfaced.

Takeda Joins The Party

On Dec. 12, the ~$48bn market cap Japanese Pharma Takeda (NYSE:TAK) announced that it had agreed to acquire the oral, selective allosteric tyrosine kinase 2 (“TYK2”) inhibitor candidate NDI-034858 from Nimbus Therapeutics in exchange for a $4bn upfront payment, and two milestone payments of $1bn each to be paid should the drug achieve annual net sales of $4bn and $5bn.

Takeda has likely decided to act sooner rather than later after BMY’s Sotyktu approval was granted without any black box warnings over the safety of the drug, making it much easier to market to insurers, physicians, and patients.

Boston-based Nimbus recently released data on NDI-034858 from a Phase 2b study in >250 patients with moderate-to-severe plaque psoriasis, showing that it met the study’s primary efficacy endpoint, with a statistically significant greater proportion of patients reaching PASI-75 (a 75% improvement in skin lesions as measured by the Psoriasis Area and Severity Index) compared to placebo at 12 weeks.

That sounds impressive, and given Sotyktu met the same endpoint in its own pivotal study, appears to give the candidate a good chance of being the second TYK2 inhibitor approved to treat autoimmune inflammatory conditions. Takeda certainly seems to be confident the drug can generate blockbuster sales, and if that should happen, paying only $4bn upfront seems like a bargain.

For context, BMY paid >$13bn to acquire Myokardia and its lead asset Mavacamtem in 2021. Now approved as Camzyos, peak sales expectations are ~$4bn. Takeda may have paid one third of that figure for a drug with similar peak sales potential. The effect on the company’s share price suggests investors like the deal – shares traded on the NYSE have risen in value from a low of $12.4 in mid-October, to $15.4 at the time of writing.

With that said, although autoimmune markets are highly lucrative – likely worth >$100bn in peak sales – they’re also congested and competitive, with almost every large Pharma continuously innovating to launch new drugs with better safety and efficacy profiles.

Is there room in the marketplace for three commercially-available TYK2 inhibitors? If not, which of the three will succeed and which will fail? And from an investment perspective, which is the best company to buy?

Having already discussed BMY / Sotyktu, and Ventyx / VX958 in some detail in my previous post, let’s begin by looking more closely at the product Takeda has just bought.

Takeda, Nimbus Lakshmi, And NDI-034858 – How Does This TYK2 Compare

By the terms of the deal Takeda is set to buy all of the shares of Nimbus Therapeutics subsidiary Nimbus Lakshmi, meaning it will own NDI-034858 outright. According to a statement on Nimbus Therapeutics website:

The TYK2 protein catalyzes the phosphorylation and activation of STAT proteins downstream of several cytokine receptors, including the IL-23, IL-12 and type I interferon receptors.

Human genetic studies have shown that mutations in TYK2 that reduce kinase activity and downstream signaling are protective in a large number of autoimmune and inflammatory diseases, including psoriasis.

Inhibition of TYK2 is expected to impact psoriasis pathogenesis primarily through its effects on the IL-23/Th17/Th22 axis.

TYK2 inhibitors are a member of the JAK family of kinases, and 11 JAK inhibitors have already made it to market – most notably Pfizer’s (PFE) Xeljanz and Cibinqo, Eli Lilly’s (LLY) Olumiant, AbbVie’s (ABBV) Rinvoq, and Gilead’s (GILD) Jyseleca. Xeljanz makes annual sales >$2.5bn for Pfizer, and Rinvoq – first approved in 2021 – is expected to drive peak sales of >$7bn.

No JAK inhibitor has been approved to treat Psoriasis however due to safety concerns, with clinical trials exposing side effects such as respiratory tract infection, nasopharyngitis, diarrhea and headaches, as well as more serious conditions such as anemia, leukopenia, dyslipidemia, and cardiovascular events.

Sotyktu showed a very strong efficacy profile in its pivotal studies compared to standard of care (“SoC”) Otezla, which I summarised as follows in my last note:

The co-primary endpoints were the percentage of patients who achieved Psoriasis Area and Severity Index 75 (“PASI 75”) and the percentage of patients who achieved static Physician’s Global Assessment score (“sPGA”) of 0 or 1 at Week 16 versus placebo.

At week 16, Sotyktu had a 58% pass rate, and Otezla a 25% pass rate for PASI 75, and a 54% pass rate for sPGA versus Otezla’s 32%. At week 24, Sotyktu’s pass rate for PASI 75 increased to 69%, and pass rate for sPGA to 59%, versus Otezla’s respective scores were 38% and 31%.

It was the safety profile that really put the seal on the approval, however, with BMY observing last week, in a press release discussing new two-year data:

Adverse events (“AES”) continued to be predominantly of mild or moderate severity, with the most common AEs continuing to be nasopharyngitis, upper respiratory tract infection and headache. Serious AEs and AEs leading to discontinuation remained low for up to two years, and no emerging safety signals were observed.

The FDA opted against adding a black box warning to Sotyktu, which must have delighted BMY, since even AbbVie’s mega-blockbuster – which has dominated the psoriasis market for over a decade – carries one, and safety concerns also prevent the likes of Rinvoq or Xeljanz entering the market.

When releasing its own Phase 2 results, however, Nimbus – a private company – declined to include safety data, or break down efficacy. That could be interpreted as a red flag, although, as part of its due diligence it’s probably safe to assume that Takeda was allowed to see all safety data pertaining to NDI-034858, and concluded it was satisfactory. Otherwise the pharma is unlikely to have made the deal. Another way of looking at it is that there are still some lingering doubts about safety, which is why Takeda paid a relatively low price.

Nimbus said it planned to initiate a Phase 3 study of NDI-034858 in psoriasis in 2023, with additional trials including a Phase 2b in psoriatic arthritis and studies in inflammatory bowel disease (“IBD”) and lupus. It seems likely that Takeda will continue with all of these trials.

Ventyx Drug A Long Way Behind But Early Data Is Compelling

If Takeda opted to take the plunge and complete a buyout of Nimbus, what does this tell us about Ventyx and VTX-958? Surely, Takeda would have studied this drug closely alongside NDI-034858, but ultimately opted to purchase the latter.

It could mean that Ventyx was approached but did not want to sell, or that the price was too high, or – a worst case scenario for Ventyx – Takeda realised that NDI-034858 was a better drug than VTX-958.

Certainly, VTX-958 has made the least progress through the clinic to date. Whilst NDI-034858 will enter a Phase 3 study next year, with Takeda throwing its considerable weight of resources behind it, VTX-958 has not yet initiated its Phase 2 study.

That hasn’t prevented Ventyx making some bold claims however, with a recent investor presentation suggesting that VTX-958 has superior binding qualities and selectivity to Sotyktu thanks to its superior targeting of the allosteric domain, which translates to better inhibition of signalling, which translates to better safety and efficacy.

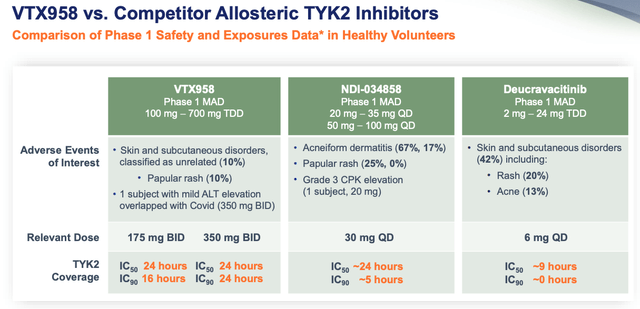

In its presentation, Ventyx makes the following safety comparison between all three TYK2 inhibitors as shown below.

VTX958 vs deucravacatinib vs NDI-034858 (presentation)

It seems favourable toward VTX958, although not by a great deal, particularly in comparison to deucravacatinib, and personally, although I’m not a medical expert and there may be an innocent explanation for this – I’m struck by the much higher dose of VTX958 compared to its rivals.

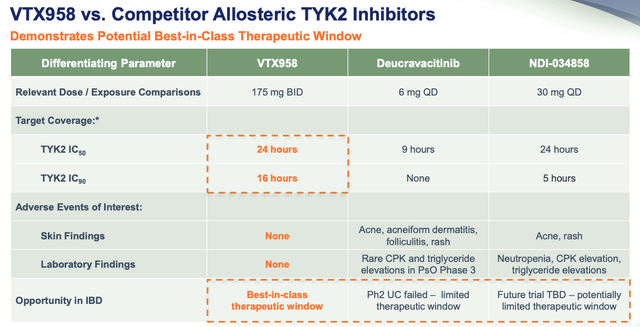

VTX958 vs deucravacatinib vs NDI-034858 efficacy (presentation)

Next, Ventyx asks us to consider its apparently superior target coverage and greater therapeutic window, allowing the drug to potentially claim approvals in a wider range of autoimmune conditions, such as in ulcerative colitis, where Sotyktu failed its Phase 2 study.

Conclusion – Takeda’s Deal For Nimbus May Hand TYK2 Field Even More Momentum – But BMY’s First Mover Advantage Is Most Valuable

It’s important to remember that TYK2 inhibitors is not the only way to treat Psoriasis.

Tumor Necrosis Factor inhibitors such as AbbVie’s all conquering, >$20bn per annum selling may have had their day, since Humira loses patent protection next year and TNF-inhibitors also come with safety warnings.

But, there are other options – interleukin inhibitors such as Johnson & Johnson’s (JNJ) >$7bn per annum selling Stelara, Novartis’ (NVS) Cosentyx, and AbbVie’s Humira replacement for psoriasis Skyrizi, with a peak sales expectation of ~$7bn per annum.

As such, blockbuster sales of any TYK2 inhibitor are not guaranteed, although of the three contenders, I would rather be in BMY’s position than Takeda’s or Ventyx’.

That’s because the clinical trial process is a high risk endeavor and drugs that display best in class credentials in preclinical studies, Phase 1 studies and even Phase 2 studies more often than not fail to show that same efficacy and safety profile in pivotal trials.

To have already gotten Sotyktu over the line – and approved without a safety label – is a slam dunk that gives BMY unfettered access to the Psoriasis market with best in class data at least a year before Takeda, and at least 2-3 years ahead of Ventyx.

Takeda will have done extensive due diligence of its candidate and believe it is capable of surpassing Sotyktu, but it still has to obtain its pivotal data and prove its drug is as safe as Sotyktu. These risks are significant, and especially so because investors have no insight into what the Phase 2 safety data looked like and must take Takeda’s word for it that it is satisfactory.

Ultimately, however, even if Takeda brings NDI-034858 to market with a safety and efficacy profile that is comparable or better than Sotyktu, I actually believe that having two TYK2 inhibitors on the market may not be bad for either company.

It will serve as validation of the drug class and may help to take market share away from other drugs such as Skyrizi, Stelara, etc. Patients will ultimately decide which therapy suits them better, but just as Apple (AAPL) needs a Samsung, and Uber (UBER) needs a LYFT (LYFT), Sotyktu may be easier to market and sell in a world where there is twice as much marketing for and attention on, its specific MoA.

Finally, I would probably be most worried about prospects for Ventyx and VTX958, but this also is where the greatest potential reward for investors lies. Since it has the longest road to market, the chances of a mishap occurring along the journey are higher. The fact that Takeda opted to buy Nimbus and not Ventyx may or not be significant, but as a smaller company, it lacks the funds to spend on R&D, or a large scale commercial launch and marketing campaign.

Ventyx has a high market cap of nearly $2bn for a company with no Phase 2 stage assets, and a study failure will see that share price fall by perhaps as much as 50%. Even so, at present, if I were a Ventyx shareholder I would not necessarily be panicking.

The company surely remains an intriguing acquisition target for any big pharma, given Psoriasis alone is independently estimated to be a ~$15bn market, and it has plenty of data milestones upcoming, as well as another exciting candidate in its S1P modulator VTX002, indicated for Ulcerative Colitis.

My conclusion then is that in the case of TYK2 inhibitors, there’s room in this game for three-in-a-bed. Investors have the most to gain – and lose – from buying Ventyx stock, given it has no other commercial products.

For BMY, Sotyktu is another blockbuster in waiting – one of 17 by 2030, I calculate, and for Takeda, the Nimbus acquisition looks to be a bargain with the caveat that only Takeda knows exactly what it has purchased, as investors remain in the dark until interim Phase 3 results appear, perhaps in late 2023.

Be the first to comment