Annabelle Chih

Taiwan Semiconductor Manufacturing Company (NYSE:TSM) has reported strong financial numbers related to 3Q 2022, and free cash flow is now expected to improve markedly due to higher margins and lower capital expenditures. Its shares are trading at the cheapest valuation of the past five years despite the company’s strong fundamentals, being a good time to buy for long-term investors.

As I’ve analyzed previously, I like TSMC’s business profile due to its technological leadership in the foundry segment and a strong market share that is not easy to challenge. As I’ve not covered TSMC since last January, I think it is now a good time to revisit its investment case and look at its most recent earnings, to see if TSMC is still a good long-term investment in the semiconductor investment theme, or if the global economic slowdown is affecting the company’s fundamentals.

Taiwan Semiconductor Q3 2022 Earnings Analysis

TSMC has announced today its Q3 2022 results that were quite positive, reporting quarterly revenue of $20.2 billion, an increase of 36% YoY, and $1.14 billion above expectations. Its net income for the last quarter was $8.8 billion, up by 79% YoY, and also above street estimates.

While the semiconductor industry as experienced a setback in the past few months, TSMC has shown a great resilience during the past quarter, which is a strong sign that is has a superior fundamentals due to its undisputed technological leadership.

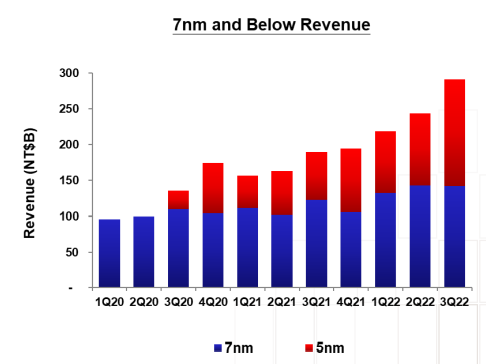

Its revenue growth was impressive in a tough environment, supported by strong demand for its 5nm and 7nm technologies, which together accounted for some 54% of total revenue in Q3, and are gradually increasing its weight on the company’s overall top-line while older technologies lose importance.

Revenue (TSMC)

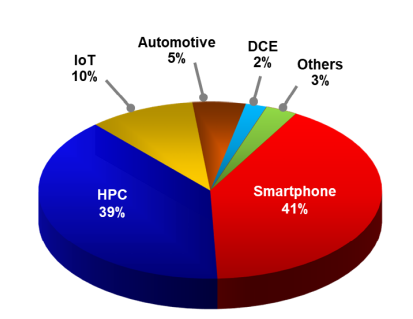

By platform, High Performance Computing (HPC) and smartphones continue to represent the bulk of revenues (80% of total revenues in the quarter), while other platforms have much smaller weight. However, Internet of Things (IoT) is the platform that is increasing more rapidly (+33% quarter-on-quarter) and already represents 10% of TSMC’s total revenue as shown in the next graph, thus the expected growth of IoT applications is another strong support for TSMC’s growth in the coming years, and this is a platform that should gradually increase the weight on TSMC’s revenue mix over the medium to long term.

Revenue by platform (TSMC)

As demand for chips was very strong at the end of 2021, TSMC decided to cut price discounts for some customers a few months ago, has been producing near full capacity in recent months, and also benefited from currency gains, explaining why its gross margin improved to 60.4% in Q3 2022, setting a new gross margin record. This was above the company’s own guidance and much higher than its reported gross margin of 51.3% in Q3 2021, being another positive factor for its earnings growth.

As the company has a good cost control, operating expenses represented 9.8% of total revenues, as compared to 10% in the previous quarter, thus TSMC’s gross margin gains were all reflected in its operating income. Indeed, TSMC’s operating margin in the quarter was 50.6%, above its own guidance of 47-49%, due to better operating leverage and were way above its reported operating margin of 41.2% in Q3 2021. Net income was $8.8 billion (+79.7% YoY), while its return on equity was 42.9%.

Regarding cash flow generation, TSMC generated some $13.7 billion from operations during Q3 2022, while its capex amounted to $8.8 billion and distributed $2.4 billion in cash dividends. Therefore, TSMC generates enough cash to finance investments in capacity and return cash to shareholders, which is key to maintain a rock-solid balance sheet.

The company maintains a solid financial position, considering that at the end of last quarter, it had a net cash position which allows it to invest in business growth and distribute excess cash to shareholders at the same time. As TSMC’s share price has declined in recent months, it is now offering a dividend yield of close to 3%, which is quite interesting within the technology sector.

TSMC Guidance & Cash Flow

While its business has been firing on all cylinders, TSMC is not immune to some headwinds in the semiconductor industry, of which weakening demand from the consumer electronics industry and U.S. restrictions on companies doing business in China are two main issues.

While TSMC will continue to operate older technologies in China, the U.S. is trying to curb China’s progress in more developed technologies, of which TSMC is clearly a leader. New restrictions will make more difficult for chip companies to export some chips used in supercomputing or artificial intelligence, which means it is likely that will happen an inventory correction in the coming months. TSMC expects this impact to occur during the first half of 2023, even though it said the impact on total revenue will be manageable.

Considering this background, TSMC’s guidance for the next quarter is to generate revenue between $19.9-20.7 billion, which is practically flat on a quarterly basis, while gross margin should be between 59-5%-61.5%, and operating profit margin is expected to be between 49-51%.

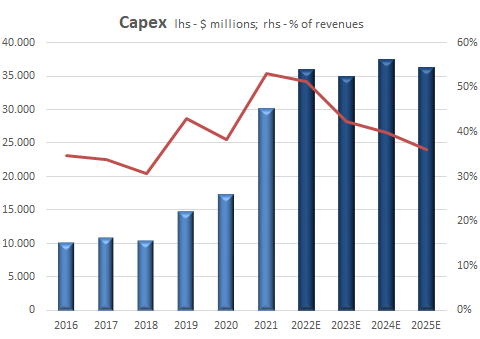

Another sign that demand is weakening was TSMC’s cut in capital expenditures expected during 2022, from a previous range of $40-44 billion, to about $36 billion. This represents a 10% cut from the bottom of its previous range, a move that was not completely unexpected, as other companies in the industry already have warned about falling demand for chips, due to weakness in consumer electronic products, such as smartphones, and weak demand also in the PC industry.

Considering that Apple (AAPL) is TSMC’s largest customer and demand for the new iPhone and other products has been below expectations in recent weeks and Apple has revised its plans to increase iPhone production, it is normal that TSMC is adjusting its capex plans. This seems to be a sensible move by TSMC, as a high capacity utilization of its factories is key to maintain high levels of profitability, thus investing too much in capex right now could be negative for its margins next year. Also, by lowering its capex plans, TSMC will not be in an excess capacity position in the near future, a key factor to maintain its pricing power.

Nevertheless, spending $36 billion in annual capex is still a very large investment compared to its history, and is an increase of 20% YoY, showing confidence on the industry’s long-term growth prospects, even though the industry is currently facing a cyclical slowdown after very two strong years.

Indeed, TSMC’s capital intensity (capex-to-revenue ratio) is expected to around 51% this year, a higher level than its historical average of 40% during the previous five years. Going forward, TSMC should continue to spend about $35-37 billion in capex, but its capital intensity should gradually decrease as revenue grows in the coming years.

Capex (Bloomberg & Author calculations)

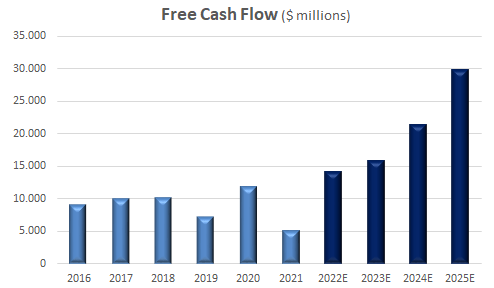

Another positive factor of lower capex spending is that TSMC’s free cash flow (FCF) generation will be higher than expected in 2022. As I’ve analyzed in a previous article, I was not expecting much FCF generation during 2022-23, which was a negative factor for TSMC’s valuation. Indeed, FCF was only $5 billion in 2021, a relatively small amount for a company of this size, and I was expecting FCF to be about $5-6 billion in 2022. However, FCF is now expected to improve to $14 billion this year, justified by higher business margins and lower capex, thus TSMC will generate almost three times more FCF than expected some months ago.

In the next few years, FCF should continue to grow to new record highs, as TSMC’s investments in capex lead to higher revenue and capital intensity return to more normal levels, which should lead FCF to double to about $30 billion by 2025.

Free cash flow (Bloomberg & Author calculations)

As FCF reaches more than $20 billion by 2024, TSMC should be in a position to grow its dividend and perform large share buybacks, which would be certainly a positive driver for its share price.

Conclusion

TSMC reported a very good quarter, beating market expectations, and reported financial figures above its own guidance. This shows that its business is quite resilient, supported by its leading position in the industry which helps to make its business less cyclical than other companies in the semiconductor industry.

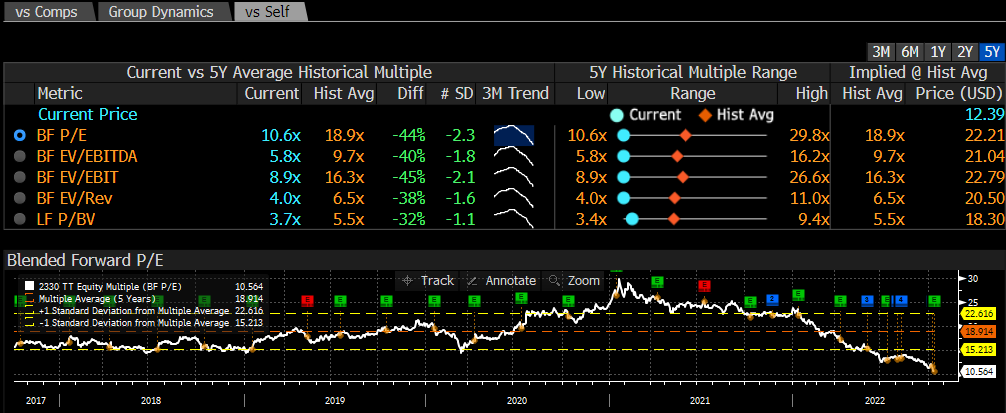

However, TSMC is not immune to weakness in end markets and lower capex plans are a sign of that, even though it will boost its free cash flow generation this year and make its shares more attractive for investors. Moreover, its current valuation is quite cheap, considering that its shares are trading at the lowest multiple compared to the previous five years, based on forward earnings, as shown in the next graph.

Valuation (Bloomberg)

Indeed, TSMC’s current forward P/E is only 10.6x, much lower than its historical average of 18.9x during the past five years, showing that right now is a good time for long-term investors to buy its shares.

Be the first to comment