skodonnell

I spend a lot of time researching, reading, and watching videos on the economic landscape and outlook. Part of it is to be better informed for the articles that I write here on Seeking Alpha, but it is also driven by my curiosity to know what is going on the world. When it comes to the actual buying and selling of investments, I have spent most of the last couple months watching and waiting, but one of the companies on my short watchlist is T. Rowe Price (NASDAQ:TROW).

Investment Thesis

T. Rowe Price is an asset manager that should be on the shortlist for investors looking for best of breed companies in the sector. The company has essentially no debt on the balance sheet, impressive margins, and a long streak of dividend raises that income investors will appreciate. After nearly a 40% selloff YTD, shares now trade at an earnings multiple of 10.5x with a dividend yield of 4.1%. If shares continue to selloff with the market, I will be looking to add shares below $100. That puts shares a single digit P/E ratio with a yield approaching 5%. I wouldn’t call shares a strong buy yet, but they are getting closer as the selloff has continued over the last couple months.

High Margins Despite Declining AUM

The last time I wrote about T. Rowe Price I talked about the AUM and the margins. Anyone familiar with T. Rowe Price knows that the long-term growth story is going to be driven by AUM growth. Anyone looking at the short-term picture is likely have questions about AUM. At the end of 2021, AUM was at $1.7T. They have since declined to $1.4T at the end of May. While the AUM might decline in the short term, I still think the company has the potential to grow AUM for years to come.

Even with a weaker operating environment, T. Rowe Price still had net margins well over 25%. Despite the fact that AUM has been declining in 2022, I think that investors with a long term horizon could do themselves a favor by buying the recent weakness. The valuation is attractive right now, and if the share price continues to grind lower, the valuation is going to get very attractive.

Valuation

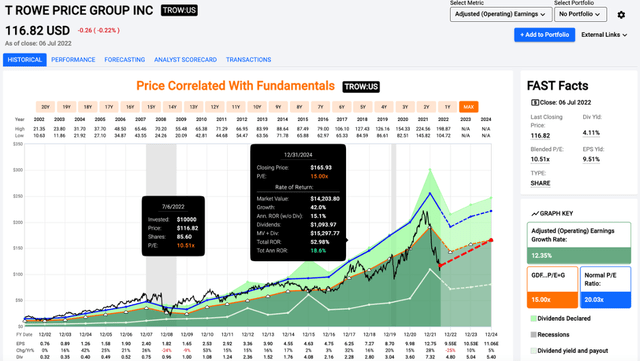

T. Rowe Price typically follows market cycles, and this year has proven to be no different. Shares bottomed out in 2009 and the COVID crash near 10x earnings, and while I’m not a short-term trader, I think the risk/reward is skewed to the upside. Shares are now trading at 10.5x earnings, which is well below the average multiple of 20x. To be clear, I don’t expect T. Rowe Price to trade at or near 20x earnings while the broader markets are struggling. The operating environment has been bad in 2022, and there are no guarantees that it will get better in the second half of 2022.

Price/Earnings (fastgraphs.com)

While multiple expansion is not guaranteed in the short term, I think we are bound to see some multiple expansion if you time horizon is longer than a year. Companies with a margin profile of T. Rowe Price don’t stay near a single digit P/E ratio for an extended period of time. If shares head for 15x earnings and the estimates are accurate, investors are looking at double digit returns from here. Another reason to be bullish is the generous capital return program that T. Rowe Price has.

Dividends and Repurchases

T. Rowe Price is a part of the exclusive dividend aristocrat club. While we might not see another special dividend like we saw in 2021 for a while, I think the annual dividend hikes will continue. With their balance sheet and track record of raises, it doesn’t take much of a crystal ball to predict that. The yield currently sits at 4.1%, which is attractive given the dividend growth track record.

They are also repurchasing shares at a decent clip. They repurchased 2.1M shares in Q1, at an average price of $152 per share. This represents just under 1% of the shares outstanding. While we will have to wait a month or so for the next quarterly report, my guess is that they continued to repurchase shares in Q2. I wouldn’t be surprised if repurchases accelerated a little bit as the share price declined and the company was able to repurchase more shares at a more attractive valuation.

Conclusion

T. Rowe Price is a high-quality business now trading at an attractive valuation. I will be the first to admit that they are not immune to broader market weakness, which is evident in their declining AUM balances in the first half of 2022. While bullish investors would certainly prefer to see a growing AUM balance, the share price weakness is a buying opportunity for investors with a long-term time horizon. Shares are trading at 10.5x earnings, which is a steal for a company with the margin profile of T. Rowe Price. Income investors also have a reason to be excited, with a dividend yield of 4.1% and a long and proven track record of dividend growth. I will be looking to add to my position if the share price weakness continues, but I think the risk/reward is skewed to the upside for investors with a longer term time horizon.

Be the first to comment