Michael Gonzalez

T-Mobile (NASDAQ:TMUS) recently announced a partnership with Elon Musk’s SpaceX (SPACE) for providing mobile coverage throughout the United States. This will be done using the mega-constellation of low-orbit satellites deployed by Starlink (STRLK) connected together with T-Mobile’s cellular network.

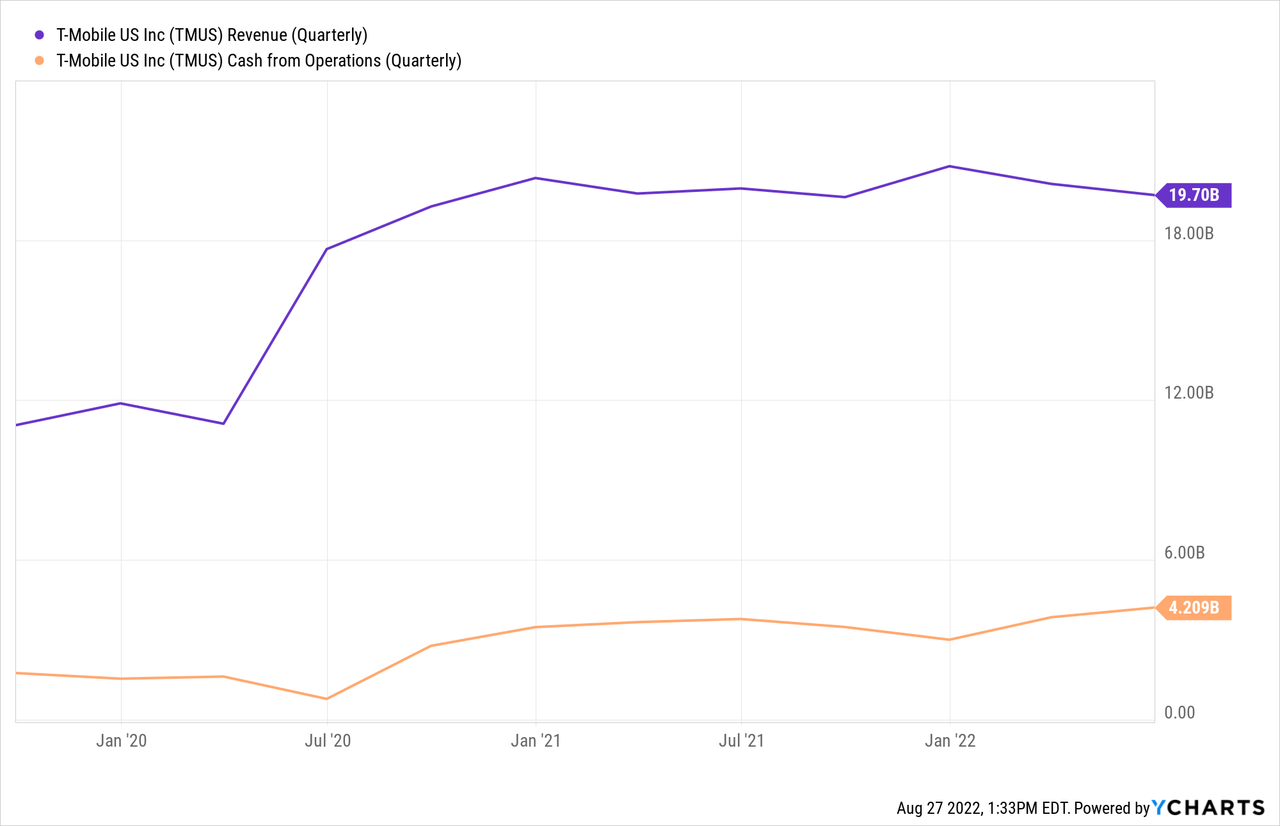

Now, my objective with this thesis is to show how the deal can have an impact on T-Mobile’s topline as well as cash flow, whose quarterly evolutions are shown in the charts below.

I start by providing investors some insights as to satellite communications before assessing how the partnership with Starlink will be beneficial to the mobile network operator or MNO. For this purpose, according to a live video streaming of the event on August 26, this is more of a technology partnership rather than a product launch.

Satellites Extending Ground-Based Networks

First, for those who are new to satellite-based communications, SpaceX which owns Starlink had already put over 3,000 small satellites in LEO (low earth orbit) as of July. These communicate with ground transceivers to provide wireless service on a paid subscription basis to over 400,000 customers in several parts of the world including the U.S.

Noteworthily, Starlink proved crucial in Ukraine in April of this year in partially restoring communication services after the invading force had crippled down most of the infrastructure. While satellites beamed signals to the earth, technicians from Vodafone (VOD) Ukraine hooked Starlink antennas atop some of the disabled tower masts so that Ukrainians could talk to their loved ones who had to flee the country and were in neighboring countries.

Looking at the modus operandi, Starlink’s gear is analogous to installing a satellite dish on your roof (picture below), the associate WiFi router inside, and getting the signal on your laptop or iPhone in order to be connected to the internet. It is primarily used by those who live in remote locations where the cost of laying fiber connectivity is prohibitively expensive and even erecting a tower mast for cellular mobile connection is not feasible because of the terrain.

This is the reason why for Starlink’s signal to work on cellular networks, a new generation of Starlink satellites will be required, equipped with longer phased array antennas. This signifies that the Falcon 9 rockets will also have to be slightly tweaked to carry the new satellites. Additionally, some reconfiguration will be needed namely in using the mid-band 1.9 GHz personal communication services frequency spectrum. For this reason, the first experiment will only begin at the end of 2022 with the service scheduled to be operational in certain areas from 2023.

For investors, all of this can be envisioned as extending T-Mobile’s ground-based network to cover the whole of the U.S mainland, Hawaii, parts of Alaska, Puerto Rico, and the territorial waters, implying the end of mobile dead zones.

Revenue Prospects

One of the advantages of the partnership is that T-Mobile’s subscribers will not require any additional equipment such as satellite phones. Instead, for most of them, their smartphones will be enough. This signifies that there is no need for the MNO to wait for new phone models to monetize the service.

The aim is to charge a service fee for the low-cost plans, but at a lower rate than most satellite providers, but for most plans, it will be a free add-on. As for connectivity, according to Elon Musk, it will be 2 to 4 Mbits per cell zone, which can primarily support voice calls and texting, not for browsing the internet. Therefore, the appeal would be for people who travel often, to remote locations and need to make phone calls in case of emergency situations like being lost when hiking, stranded in an isolated location, or lost at sea around the U.S.

Currently, the alternative for these people is to buy a satellite phone from Iridium (IRDM), Globalstar (GSAT), Inmarsat, or Thuraya. These can cost anywhere from $375 to $1,295 plus there is a yearly service fee varying from $348 to $750. Additionally, depending on the provider, voice calls vary from $0.99 to $1.30 per minute.

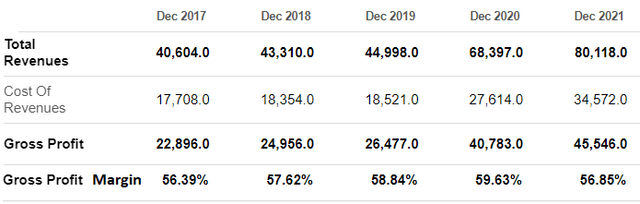

Coming to the monetization part, no specific product has been announced, but T-Mobile’s CEO pointed out that there would be a service fee for the low-cost plans, but at a lower rate than most satellite providers. Now, assuming that the MNO charges an average of $800 as an annual service fee and garners just 10 million customers by the end of 2023, this would mean revenues of $8 billion. Dividing this figure by two assuming that it is a 50:50 partnership, then you have $4 billion for T-Mobile. This is about 5% of last year’s revenues (table below).

Quarterly Revenues and Gross Margins (www.seekingalpha.com)

More importantly, gross margins should improve as this is not about upgrading the network to transport 5G traffic, but rather connecting with Starlink and making use of the existing infrastructure for low-bandwidth consuming text messages and voice calls.

On the other hand, the MNO may have to spend more on its terrestrial network (towers and fiber, and microwave for the backhaul) when the partnership moves from initially covering messaging applications and voice to satisfying data demands required for internet browsing. This involves challenges in covering mountainous areas, deserts, maritime zones, or national parks and requires a high level of capital expenses, but partnering with a satellite provider can make a difference.

Less Capex and More Cash

Now, cellular networks require radio antennas in order to function. These are the ones you typically see atop tall towers which often contrast with the green countryside. MNOs like T-Mobile have to constantly increase the number of antennas in order to expand coverage to new geographies as well as add more in existing locations to respond to surging traffic demand.

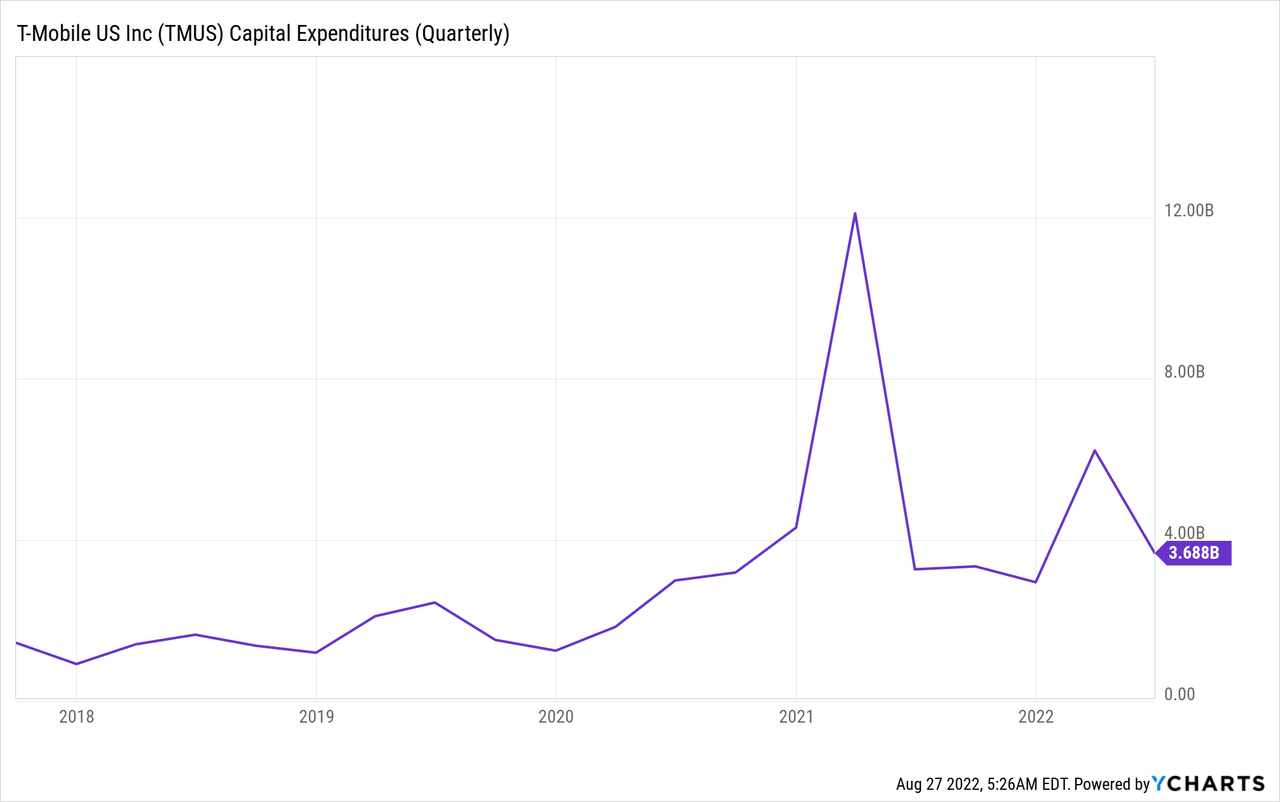

For this purpose, it signed a new 12-year agreement with Crown Castle (CCI) to support the continued build-out of its nationwide 5G network with T-Mobile paying more money for leasing towers and small cells. Now, tower leasing activities form a substantial portion of overall 5G spends and have translated into higher quarterly Capex for T-Mobile since 2018 as shown in the chart below.

In order to get an idea of the Capex savings, I make a parallel with AST SpaceMobile (NASDAQ:ASTS) which plans to use the antenna aboard its BlueWalker satellites to transmit 4G and 5G signals directly to standard mobile phones. To this end, the U.S. company has already signed an agreement with Globe Telecom (OTCPK:GTMEY) of the Philippines back in April.

I estimated that it would cost Globe 9.5 times (after considering the costs of satellites) less in deploying 4G and internet services using satellite technology than the traditional ground-based technology. Using the 9.5x multiple, T-Mobile could potentially reduce its Capex from $3.68 billion to roughly $400 million (3,680/9.5), which is a huge reduction. This would in turn increase its cash flow substantially.

Valuing With a Dose of Realism

The above are only estimates as there are different topographies in the U.S. and the Philippines, but, they have the merit of showing that satellite communications which were only within the realms of sophisticated and cost-prohibitive applications just five years ago have now become sufficiently economically feasible to extend phone connectivity on the earth. Here, I also like the complementary nature of the T-Mobile-SpaceX endeavor which uses both space and ground-based infrastructures to provide an end-to-end service to T-Mobile’s subscribers.

This, said, the technology which will receive and transmits signals from space to the earth still needs to be tested and there may be some delay before subscribers can finally hook it. This is the reason why I do not value the company based on the estimated revenue gains or Capex savings.

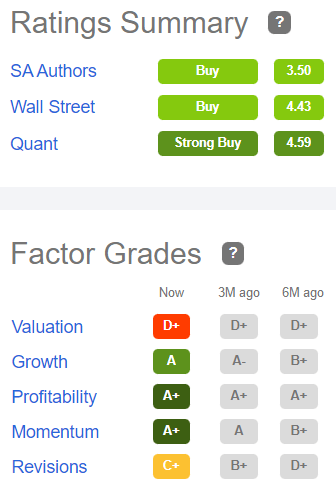

Still, as an innovative company with an overall buy rating and A+ momentum grades, T-Mobile could again flirt with the $147-$148 level following further news updates around the project.

Ratings and Factor Grades (www.seekingalpha.com)

This said, after the Chairman of the Federal Reserve provided clarity as to the interest rate trajectory last week, it is better to exercise caution and wait for the dust to settle before investing as there may be further market volatility.

Moreover, there could also be regulatory scrutiny by the Federal Communications Commission as is usually the case with such projects, but one strong point which plays in Elon Musk’s favor is the ability to make emergency texts or calls when someone is stranded, signifying that the endeavor can save lives. In this respect, the aim is also redundancy in the mobile service when events like floods and other natural disasters lead to outages or delays in existing networks.

Conclusion

Moreover, since Starlink is also an internet service provider, there may be areas of overlap as the partnership expands to add the data component to its service offerings. Thus, an extension of T-Mobile’s reach may land it on Starlink’s turf. Ultimately, this may all come down to the partnership and the type of revenue-sharing model, with details most likely to be obtained during the product launch. Therefore, for those who want to invest in T-Mobile because of the partnership, there are still some uncertainties to grapple with, but this remains a fascinating space to watch out for.

Finally, investors will note that I have refrained from making a comparison with Amazon (NASDAQ:AMZN) which signed an agreement with Verizon (VZ) for the Kuiper project in October 2021 as no satellite has been launched yet.

Be the first to comment