Khanchit Khirisutchalual

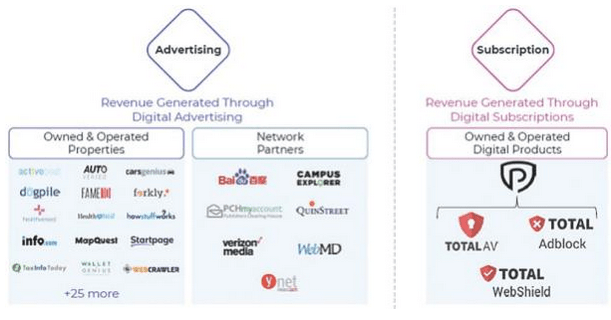

System1 Inc (NYSE:SST) is a digital marketing company that became public via SPAC in April. It uses its proprietary platform, RAMP, to drive the business and claims that its competitive advantage comes largely from this. SST owns a portfolio of legacy-like web pages such as mapquest.com, info.com, howstuffworks.com, and others. In addition, the company generates subscription revenue through the privacy and consumer security software.

investor presentation

The company was founded in 2013, but financials only go back to 2018. Most of SST’s direct competitors are private, so comparing public peers is more difficult. Below are the margins and return metrics.

|

Year |

2018 |

2019 |

2020 |

2021 |

TTM |

|

Revenue |

266 |

407 |

476 |

317 |

|

|

Gross Margin |

35.5% |

32.3% |

28.3% |

25.2% |

25.9% |

|

Operating Margin |

9.5% |

12.8% |

9% |

-4.2% |

29.4% |

|

Net Margin |

-0.7% |

2.2% |

13.4% |

10.4% |

14.7% |

|

ROIC |

n/a |

19.4% |

58.4% |

6.5% |

1.8% |

|

EPS |

-0.2 |

0.11 |

0.78 |

0.40 |

0.14 |

|

FCF/Share |

0.15 |

0.32 |

0.49 |

-0.02 |

-0.42 |

Growth

There is no room for doubt room on company’s growth but you must be realistic as to how much of the TAM for US digital advertising(currently around $150 bil) can be taken by the company. Revenue hit an all-time high in 2020 at $476 million, there is zero chance of SST getting to the level of META or GOOG, so don’t take the TAM as any sort of guaranteed runway. SST actually depends on GOOG for their business model to work with a majority if revenue being dependent on GOOG, and MSFT to a lesser extent. This doesn’t mean there can’t be meaningful growth, but we have to be realistic about long term expectations and competitive positioning.

Since SST is still in this growth phase, ROIC likely won’t be stable for a while. Operating margins have been positive most years and free cash flow has only been negative for the past two.

They pay no dividend and reinvest all profits. Long term debt is $413 and they have a $37 million cash balance.

Valuation

There aren’t many direct peers for multiple comps, but we can see the price paid for by the SPAC sponsor to see what a private buyer just paid for it. Based on the transaction, enterprise value was 1.4 billion. Current EV is 1.36 billion, so only slight undervaluation when looking at it this way. This doesn’t necessarily mean the purchase price was “correct” or even rational. Keep in mind that the company has almost $1 billion in goodwill.

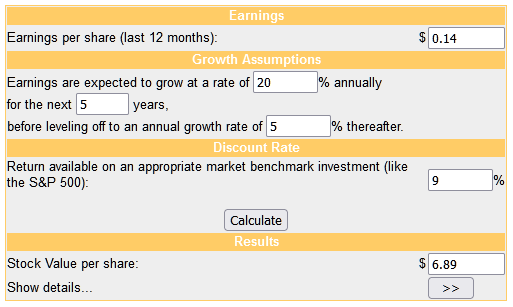

moneychimp

Using a pretty conservative estimate for earnings growth, SST is still a bit too expensive, but overall I don’t dislike the company. Shares are down almost 60% since the initial high from the merger in April. The growth isn’t yet worth the price in this case.

One big positive for me is the percentage of insider ownership. The company certainly doesn’t need to become the next mega-cap tech titan to enjoy good growth under the radar. The biggest question isn’t if they will grow or not; it’s how much can they grow and how much will that growth cost.

Conclusion

SST is an interesting growth story that isn’t highly followed yet. I really like the high levels of insider ownership and the fact that the CEO was a co-founder. Founder-led companies aren’t guaranteed to outperform but it aligns incentives as much as possible. The current price is a discount to what was paid to take this company public via SPAC, but for me it is still slightly overvalued. I will wait to see if a better price is offered.

Be the first to comment