damircudic/E+ via Getty Images

One interesting company that is new to the market for investors to consider buying into is System1 (NYSE:SST). The owner of some major iconic websites, the company itself is certainly not a household name. But odds are, you have visited at least one of its sites in the past. Recent growth achieved by management has been rather impressive. And although the fundamental condition of the company is still somewhat vague because of some recent transactions, shares are priced at levels that should generally be considered attractive.

System1 – An owner of key internet assets

Today, System1 describes itself as an omnichannel customer acquisition platform. The company says that its main focus is on delivering high-intent customers to its advertisers and to their own subscription products. The company achieves much of its success through an acquisition marketing platform called RAMP. This platform has three primary components that investors should be aware of.

The first is that the platform utilizes machine learning in order to identify and direct marketing campaigns to customers across significant advertising networks. Second, once these potential customers respond to or interact with the firm’s marketing efforts, the platform then directs them to the firm’s own network of 40 owned and operated websites which, in turn, places an emphasis on further qualifying the customers’ purchase intent, as well as providing the business with valuable data. From that point, the business then works to monetize customers by delivering them advertisements that they are likely to click on.

At present, System1 has a significant portfolio of Internet properties. For instance, the business currently owns search engines such as info.com and Startpage.com. It also owns digital media sites such as HowStuffWorks, Mapquest, and WalletGenius. For the most recent quarter the company reported, it said that its portfolio of digital assets received an average of 185 million visits per month. That represents a significant amount of traffic, all things considered. Prior to this year, System1 was not a publicly-traded company.

Another property the company owns is Protected.net, which offers software that provides online security to its customers. It was only in January of this year that the business closed a combination with Trebia, which technically purchased System1 before changing its name to that.

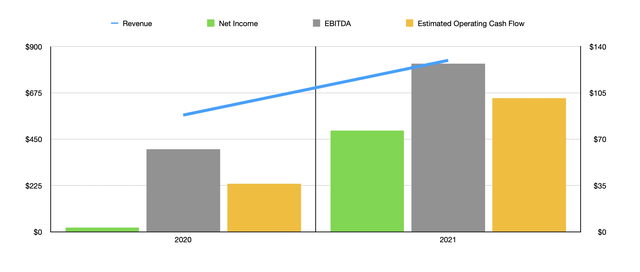

Author – SEC EDGAR Data

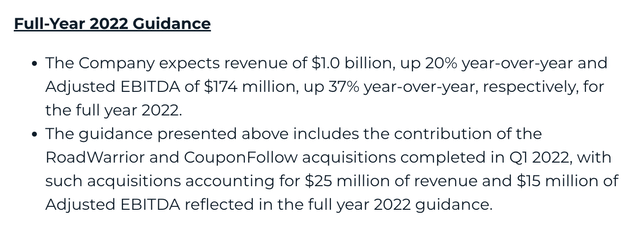

Although System1 has been around for a while, fundamental data on the business is rather limited. We do know, however, that, in its 2020 fiscal year, the company, on a pro forma basis, generated revenue of $566.9 million. Revenue growth has been rather strong for the company, with sales rising to $832.9 million in 2021. That represents an increase of 46.9% over with the company generated in 2020. For investors who might fear that this was a one-time increase, the answer is that it probably wasn’t. For its 2022 fiscal year, the company currently anticipates revenue climbing to about $1 billion. That would represent an increase of 20% year over year. Most of this growth will be organic. But the company also acquired two other major properties, RoadWarrior and CouponFollow, in transactions that alone will add $25 million to its top line. This revenue is included in management expectations for the year.

When it comes to the company’s bottom line, the picture has also been improving. Net income, for instance, rose from $3.1 million in 2020 to $76.5 million last year. There are, of course, other profitability metrics to pay attention to. One of these is EBITDA. According to management, this came in at $62.5 million in 2020 before surging to $127.1 million last year. If we use EBITDA less interest expense as a proxy for cash flow, then that metric would have risen from $36.4 million in 2020 to $101 million last year. When it comes to guidance for the year, management has said that it expects EBITDA to total around $174 million. That includes about $15 million associated with its aforementioned acquisitions. Based on my estimates, this implies operating cash flow of about $147.9 million.

System1

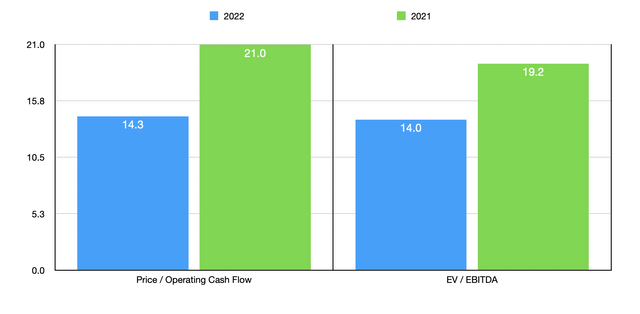

Given these figures, we can attempt to price the company. On a price to operating cash flow basis, using the company’s 2021 results, we can see it trading at a multiple of 21. If, instead, we were to rely on the estimates for 2022, then this multiple would drop to 14.3. Another way to look at the company is through the lens of the EV to EBITDA multiple. This would give us a reading of 19.2 if we rely on the 2021 results for the company. The 2022 results, meanwhile, would give us a reading of 14.

Author – SEC EDGAR Data

Generally speaking, when I write about any company, I like to try and value the company relative to similar players. The fact of the matter is that there are not very many similar companies here. But I did look at five that I felt were closest. Four of these had a positive price to operating cash flow multiple, while all five had a positive EV to EBITDA multiple. On a price to operating cash flow basis, these companies ranged from a low of 9.1 to a high of 48.9. Three of the four businesses that had a positive reading were cheaper than System1. Meanwhile, using the EV to EBITDA approach, the range for the five businesses was from 12.8 to 73.8. In this case, two of the five businesses were cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| System1 | 21.0 | 19.2 |

| CarGurus (CARG) | 48.9 | 24.6 |

| DHI Group (DHX) | 9.1 | 17.8 |

| trivago (TRVG) | 20.7 | 12.8 |

| Yelp (YELP) | 12.3 | 22.0 |

| Taboola.com (TBLA) | N/A | 73.8 |

Takeaway

At this moment in time, System1 serves as an interesting prospect for investors to consider. The company continues to grow rapidly and seems to be under-followed because it only recently went public. All things considered, shares of the business do not look all that pricey. Factoring in the rapid growth management has achieved, I would be so inclined to acknowledge that the company is perhaps slightly undervalued.

Be the first to comment