lasalus/iStock via Getty Images

Current power demand growth rate is double the global average

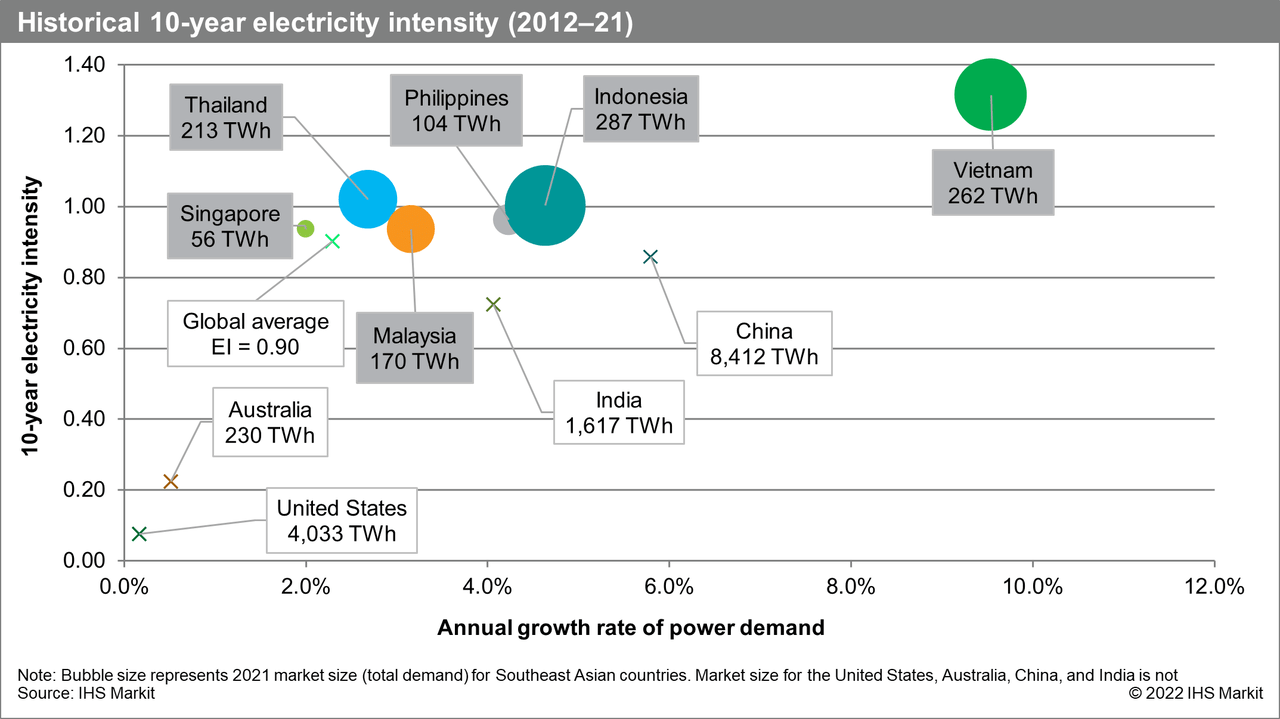

Southeast Asia’s power demand growth has averaged an impressive 5.7% annually from 2010 to 2019, making it one of the fastest-growing markets in the world. In the same period, global power demand growth averaged at 2.5%, less than half that of Southeast Asia. Electricity supply remains the engine of economic growth in this region. Hence, Southeast Asia’s strong economic growth and accompanying high EIs are the key driving forces behind the large overall increase in power demand.

High electricity intensity shows regional demand growth outpacing GDP growth

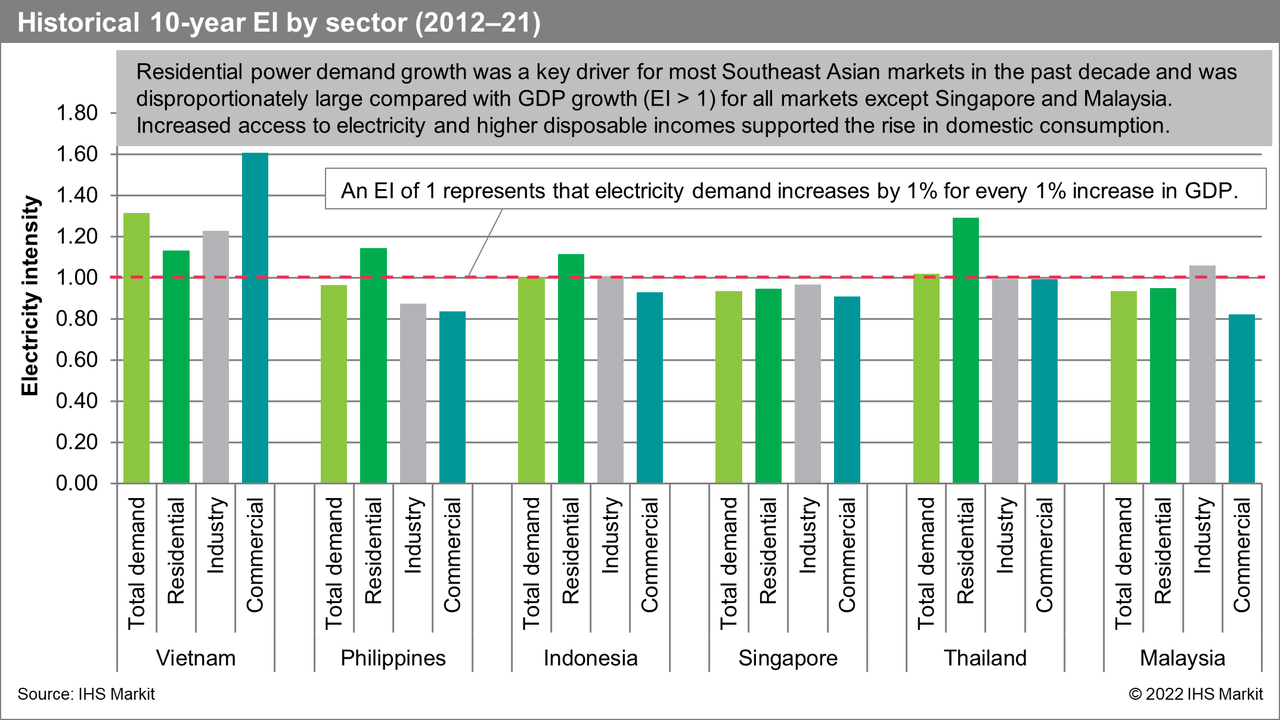

The six key markets in the Southeast Asian region have averaged a high electricity intensity of 1.18, even including the COVID-19 impact in the past decade. Electricity intensity, or EI, is defined here as the ratio of power demand growth to GDP growth over a 10-year period (2012-21). Southeast Asia’s EI of 1.18 is almost a third higher than the global average EI of 0.90 in the same period. High EI reflects an outsized increase in electricity demand in relation to economic growth, an indicator that power-intensive sectors are driving economic growth (e.g., during industrialization). It also indicates that electricity demand is elastic: in a market with an EI of 1, for every 1% increase in national income, the electricity demand likewise increases by 1%. Hence, increases in incomes and electricity access lead to an outsized surge in power demand in high-EI markets.

The sectors that have historically driven growth vary by market, with the three broad sectors of commercial, industrial, and residential power demand playing different roles. In Vietnam, commercial EI and growth were high, but industrialization was the main demand driver. Meanwhile in Thailand, Indonesia, and the Philippines, residential demand grew by 58% and was the main driver of growth. In contrast, residential demand was a less significant driver in Malaysia and Singapore. Per capita residential power consumption in Singapore and Malaysia was already the highest in the region in 2012 and grew moderately compared with other regional markets in the past 10 years. Industrial growth played a larger role in these two markets instead.

Southeast Asia’s power demand growth forecast to remain strong at 4.5% (2022-31)

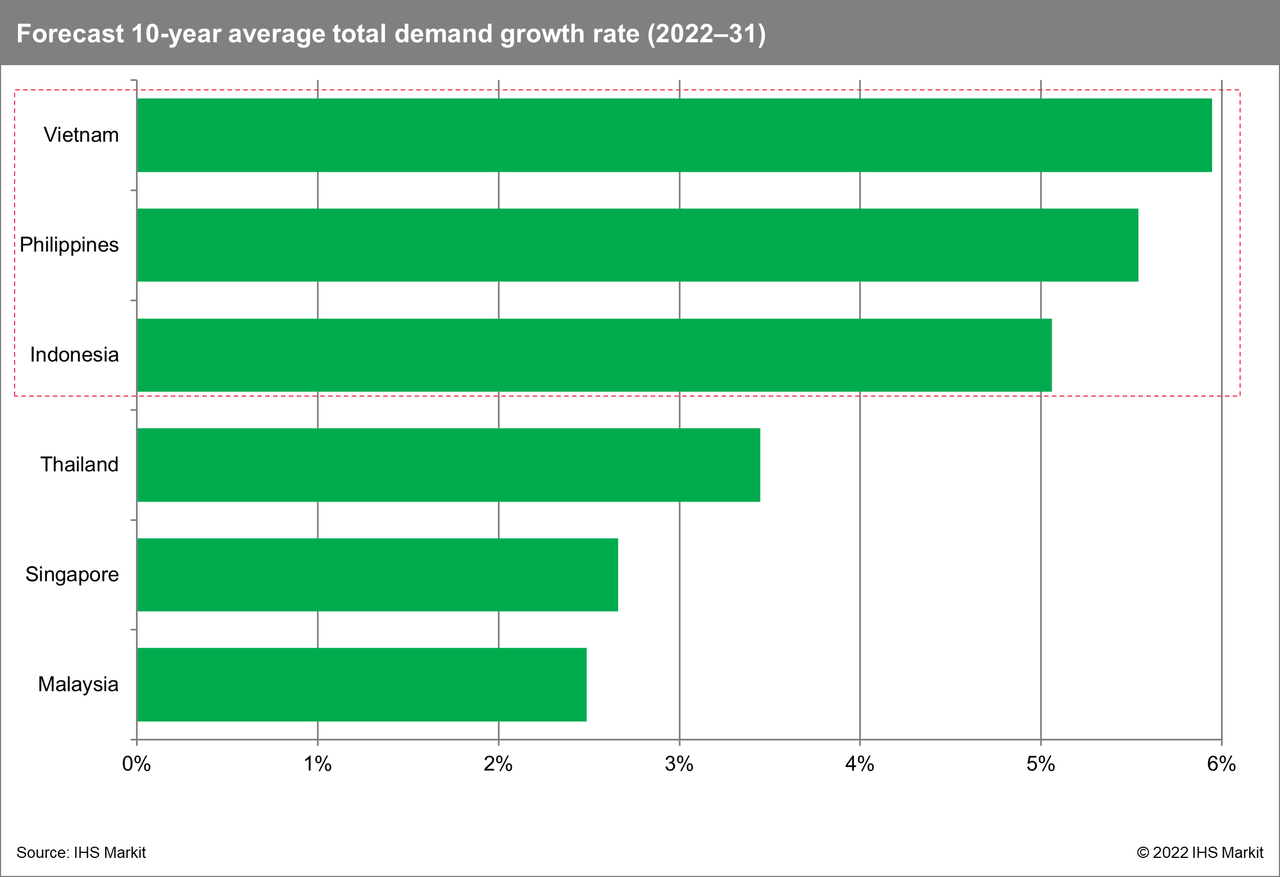

Southeast Asia’s power demand growth will continue to be stronger than in most other markets. Regional power demand growth is forecast to reach 4.5% in the next decade (2022-31), nearly 1.5 times higher than the global average of about 3.1%. Following a rapid post-COVID-19 recovery, Vietnam, the Philippines, and Indonesia are forecast to lead power demand growth, each with growth rates of over 5% from 2022 to 2031.

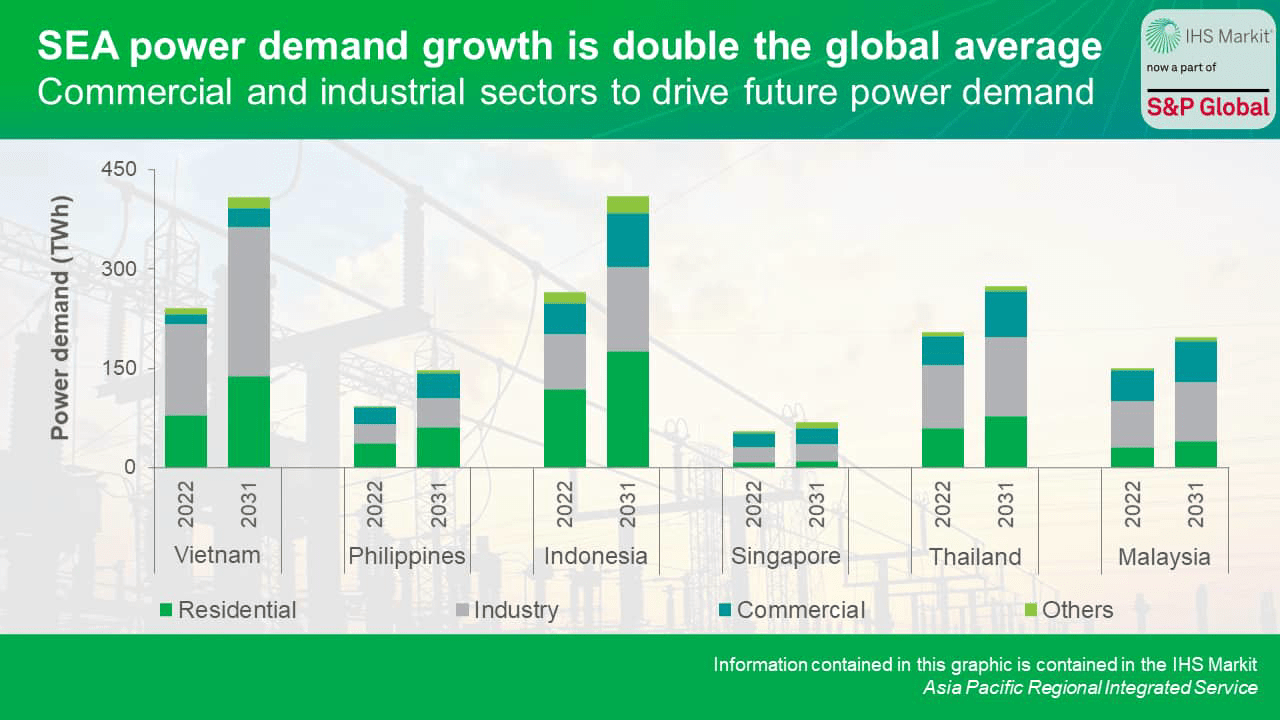

Commercial and industrial demand to drive future growth

While economic performance remains linked to power demand, the economic sectors driving demand growth will shift. This is a result of three key trends within the commercial and industrial sectors: general expansion of the two sectors, changes in subsector composition, and electrification of commercial and industrial spaces and processes.

Both commercial and industrial demand growth is set to increase in Thailand, the Philippines, and Indonesia, where overall demand growth is also forecast to exceed that of the previous decade. Unlike the other three industrializing markets, Vietnam’s demand growth is forecast to moderate in all sectors as it continues on its industrialization pathway and its early-stage commercial development. In Singapore and Malaysia, commercial power demand growth is forecast to increase while industrial growth moderates.

Key contributors that will broadly support growth in the region include the newly implemented Regional Comprehensive Economic Partnership (RCEP) agreement and fixed investments into infrastructure. Other market-specific growth sectors and drivers vary, including Thailand’s efforts to transition to “Thailand 4.0”, Philippines’ business process outsourcing industry, Vietnam’s trade and exports growth, and Singapore’s data centers.

Developments in technology are also introducing new dimensions to the power demand outlook. Emerging trends that governments have allocated substantial resources into supporting include transport electrification and energy efficiency considerations, which will be important disruptors in the coming decade.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment