simonbradfield/iStock via Getty Images

In 08/2021’s “Supernus: Well Prepared For Upcoming Challenges”, I described how Supernus (NASDAQ:SUPN) was responding to its impending patent cliff with new deals and products. Since that time Supernus has been motoring ahead and has closed on yet another deal.

In this article I report on its progress with an assessment of its current prospects.

Supernus’ middling Q4, 2021 was counted as a revenue beat.

Supernus reported preliminary Q4, 2021 earnings on 02/28/2022; its revenue of $155M (+10.2% Y/Y) beat expectations by $5.58M. During its Q4, 2021 earnings call (the “Call”), CEO Khattar outlined the following achievements in his introductory remarks; Supernus:

- launched [in 05/2021] Qelbree (viloxazine extended-release capsules, SPN-812), ADHD therapy;

- closed on the acquisition of Adamas adding GOCOVRI as another key growth asset;

- resubmitted the NDA for SPN-830, the apomorphine infusion device (the submission has been accepted with a 10/2022 PDUFA date);

- tallied record revenues for Supernus of approximately $580 million, up 11% compared to 2020;

- advanced the clinical development of SPN-820 (novel product candidate for treatment-resistant depression) to Phase II;

- nominated SPN-443 and SPN-446, two internally discovered novel CNS drug candidates, for development in CNS indications.

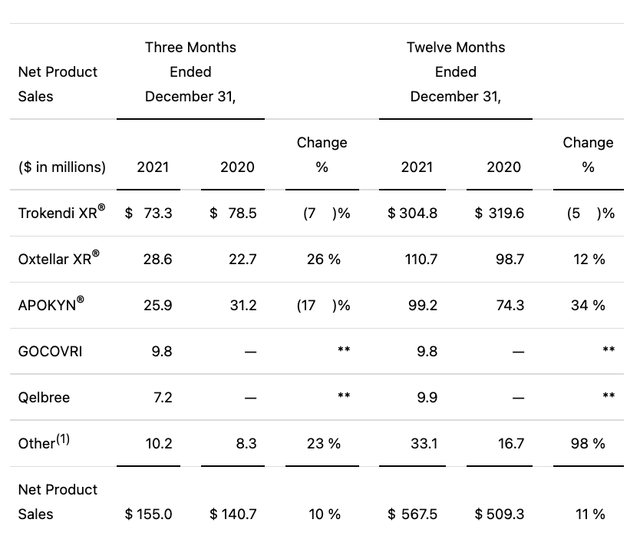

Unfortunately, because of a ransomware attack, it had to rework its accounting system which has caused delays in publishing its 10K (expected 04/04/2022) and finalizing its accounts. Its Q4, 2021 earnings PR reported the following preliminary rundown of its product revenues:

Supernus Q4, earnings press release (Seeking Alpha)

Supernus’ lead revenue generator, Trokendi XR (topiramate) migraine therapy with ~53% of 2021 net revenues, is showing both Y/Y and Q/Q revenue declines. Wisely, Supernus has been out in front of this issue with new deals and products.

Of the five named products above, Trokendi XR and Oxtellar XR (oxcarbazepine) are Supernus’ old warhorses. It acquired APOKYN (apomorphine hydrochloride) in its 04/2020 deal with US WorldMeds and GOCOVRI in its 10/2021 deal with Adamas.

Supernus has pegged Qelbree as a key component of its growth; yet it faces serious competition.

Supernus has been developing Qelbree (viloxazine extended-release capsules) in clinical trials since 2010. Supernus finally secured FDA approval of Qelbree for treatment of pediatric patients with ADHD in 04/2021. Supernus’ sNDA for Qelbree for the treatment of ADHD in adult patients is pending with an 04/29/2022 PDUFA date.

Supernus launched Qelbree in late 05/2021. It generated so-so revenues of ~$7.2 million as shown above in its first half year on the market. In response to an analyst question during Supernus’ Q3, 2021 earnings call, CEO Khattar discussed his expectations for Qelbree compared to Lilly’s (LLY) Strattera.

He hopes Qelbree can generate sales way above Strattera’s, as they settled out at ~6-7%. A Jeffries analyst has pegged a 4-5% market share as generating $400 million in sales. Under Khattar’s optimistic take, Qelbree revenues would peak above $0.5 billion.

Obviously it has a long way to go before it can move, from its initial half year run of $7.2 million to $0.5 billion. Will it be able to pull this off? Not easily. Qelbree’s big selling point is that it is a non-stimulant; Goodrx.com has an article comparing Strattera, also an on-stimulant, and Qelbree.

In terms of differentiating between the two it concludes that they are similar in terms of therapeutic impact and in common side effects. However it notes that:

- Qelbree can be opened and the drug administered by sprinkling on a teaspoon of applesauce, an option not available for Strattera;

- for uninsured patients there is a major cost difference with generic Strattera available as low $30 a scrip; Qelbree costs upwards of $300;

- there are also differences in onset of action but these differ from patient to patient.

Uninsured patients are going to be heavily inclined to take the generic. For insured patients a lot may depend on the tier at which their policy places Qelbree. In response to a question, CEO Khattar provided the following insurance coverage update during Supernus Q3, 2021 call:

As far as the payer access, …[w]e’ve signed up one of the very important key PBMs. So they’re on board and the product is now covered, and we’re already seeing tremendous traction because of that. And also, we’ve made similar progress on the Medicaid. So we have now about 50% of the Medicaid lives approximately with a Tier 2 or even better coverage. … It’s taking time but we expected that and that’s why, obviously, for this year, our guidance on Qelbree is where it is as far as the net sales. …

Surprisingly to me, the coverage issue did not come up during the Call. One would think it would have if there was good news to share on this front.

Supernus has a nice PD franchise that it is developing.

Supernus has four approved Parkinson’s Disease [PD] therapies acquired as follows:

- APOKYN (apomorphine hydrochloride injection) for the acute, intermittent treatment of hypomobility, “off” episodes in patients with advanced PD, acquired in its 04/2020 US WorldMeds deal;

- MYOBLOC (rimabotulinumtoxinB) injection, in treatment of certain conditions associated with PD also acquired from US WorldMeds, produces only nominal revenues (lumped with “other” in excerpt above);

- GOCOVRI (amantadine) extended release capsules approved for patients receiving levodopa-based therapy in treatment of dyskinesia and in PD patients experiencing OFF episodes, acquired in its 10/2021 Adamas deal;

- OSMOLEX (amantadine) indicated for the treatment of PD was also acquired in the Adamas deal, like MYOBLOC it produces minimal revenues and is lumped with “other”.

During the call CEO Khattar noted that APOKYN had a new generic competitor. In response to a request for specific APOKYN guidance, he pointed out that the competition was new and somewhat muddled in that its injection cartridge would still need to be paired with the pen; nonetheless he acknowledged it could be substantially less than the previously anticipated $100 million run rate.

On a more encouraging note, Supernus also has its SPN-830, the apomorphine infusion device (the “Pump”), with its upcoming PDUFA in October. During the Call Khattar pegged this as a source of significant potential growth. The Pump has attributes which make it clearly superior to the pen currently used for APOKYN.

In 09/2020’s “Supernus: Launch Preparations In Progress”, I discuss such issues as potential cannibalization between the Pump and the pen. With the pen now under generic competition, approval of the Pump takes on renewed significance.

APOKYN and GOCOVRI are the two PD therapies with potential to support Supernus’ ongoing share price. For the APOKYN side it seems destined to be a laggard. With FDA approval, the Pump could make up for this and then some.

As for GOCOVRI, it is new to Supernus. Where it will fit in in terms of growth is necessarily uncertain. In response to questions, Khattar steered clear of providing product guidance. He did however note the following during his introductory remarks for the Call:

…we made significant progress with the integration of the business with our Parkinson’s sales force that is now fully trained in the field promoting GOCOVRI.

GOCOVRI recorded a total of 3,330 prescriptions in the month of January, the product’s first full month under Supernus in 2022 representing a 30% increase compared to the month of January in 2021.

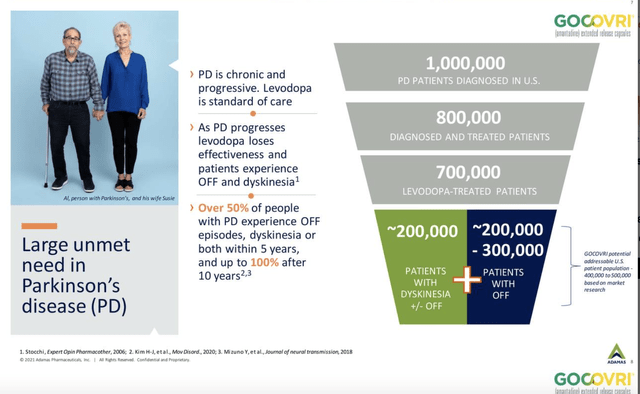

The best way to judge the potential for GOCOVRI comes from an Adamas Q1, 2021 corporate presentation. It sets the size of the market below:

GOCOVRI addressable market (Seeking Alpha)

GOCOVRI was first FDA approved in 08/2017 for dyskinesia, with a second 02/2021 approval in those experiencing OFF episodes. GOCOVRI’s net product sales for Adamas for the first six months of 2021 were $37.7 million. GOCOVRI’s actual potential in its two approved indications will await further data points as Supernus reports quarterly results.

I found one headline setting a $750 million peak sales target for GOCOVRI. The article supporting this was behind a paywall. I can say that it is a pricey therapy, some say entirely too much so. If Supernus can find traction with it, it could well hit $750 million given the size of its addressable market as shown by the graphic above.

Conclusion

As I write on 03/27/2022, Supernus sports a $1.7 million market cap and has a PE of 26. In order for it to sustain, much less to grow its value, it is going to have to prove that it can achieve sustainable revenue to counter falloff in Trokendi and APOKYN.

I currently consider Supernus a solid hold with significant potential for growth in Qelbree and GOCOVRI. The Pump offers an additional contributor to growth at years end.

Be the first to comment