Paul Bradbury/iStock via Getty Images

Sunworks, Inc. (NASDAQ:SUNW) is a provider of solar power systems and energy storage solutions. Rising utility costs have supported the growing adoption of rooftop solar applications with the number of residential installations accelerating this year as a strong point in the company’s operating profile. The attraction here is the positive market outlook, particularly amid the “Inflation Reduction Act” that includes billions in incentives towards clean energy solutions.

On the other hand, the challenge for Sunworks is to translate that momentum into positive earnings with the latest quarterly result highlighted by a widening loss. We view management plans to improve margins going forward which we view as a step in the right direction. We like the stock which benefits from several bullish tailwinds although the recurring negative earnings and a cash flow bleed are likely to limit the upside in the near term.

SUNW Key Metrics

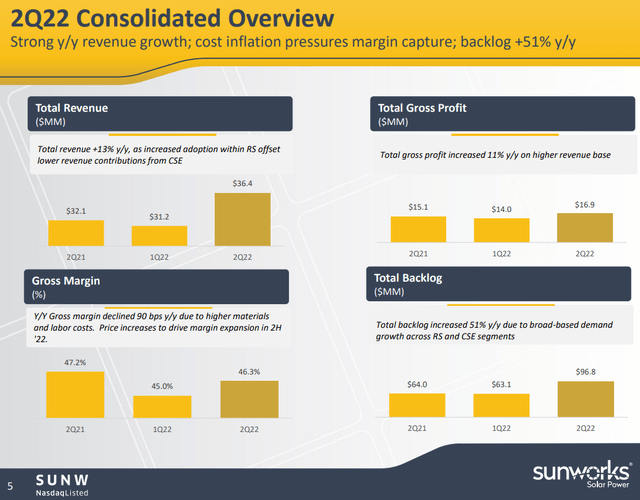

The company last reported its Q2 earnings back in early August with a GAAP EPS loss of -$0.23 which missed the consensus by $0.02. Revenue of $36.4 million climbed by 13% year-over-year, coming in above estimates. The context here considers stronger growth from its core Residential Solar segment with revenue of $32.5 million, which climbed by 42% y/y, balancing a 19% decrease in the smaller Commercial Solar Energy or CSE group to $3.9 million.

The gross profit at $16.9 million increased by 11% even as the margin declined by 90 basis points reflecting higher materials and labor costs. Negative adjusted EBITDA at -$5.7 million grew compared to -$1.7 million in the period last year.

source: company IR

Management explains that the poor performance from the CSE segment was based on lower orders from previous quarters while activity picked up in Q2. The firmwide backlog reached $96.8 million, up by $33 million sequentially from Q1 and 55% y/y. By this measure, the outlook is for a stronger second half of the year with both segments contributing positively to the top line.

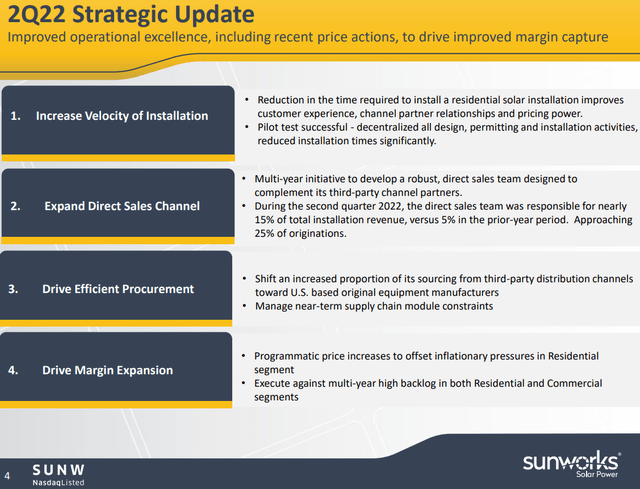

During the earnings conference call, a big theme from Sunworks was the strong residential market demand that has been hard to keep up with. To address the issues and improve financials, the strategic update is focusing on 4 key points.

The plan is to increase the speed and number of installations to help make the company more efficient. The company is also pushing more towards a direct sales model in addition to its third-party distribution channels. The early success has been positive with the Q2 direct sales team responsible for 15% of installation revenue compared to just 5% in Q2 2021. Finally, the main goal here is to drive margin expansion. Clearing the backlog while making its procurement process more efficient is expected to support higher earnings over the long run.

source: company IR

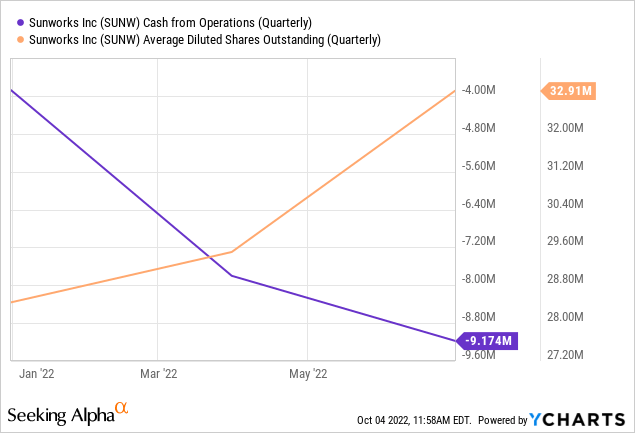

While the company does not provide forward earnings guidance, the expectation is for further sales growth through the second half of the year. As it relates to the balance sheet, Sunworks ended the quarter with $12 million in cash against zero long-term financial debt. Still, keep in mind that company cash flow from operation was a negative $9 million in Q2 with liquidity being funded by regular equity issuances.

SUNW Stock Price Forecast

Amid a challenging macro environment considering persistent inflation, and climbing interest rates, solar has been one of the hottest sectors this year. As mentioned, record high oil and gas prices have added demand for renewable energy alternatives.

According to the Solar Energy Industries Association (SEIA), Q2 was a record quarter for residential installations in the United States with 1.4GW capacity installed, up 37% from Q2 2021. Sunworks‘ 42% revenue growth in the residential segment implies the company grew above the industry rate.

SEIA is also very bullish on the impact of the Inflation Reduction Act as a major growth catalyst over the next few years. The forecast is for total solar deployment to increase by 40% from the current installed capacity by 2027. The opportunity is for Sunworks to capture an increasing portion of that underlying demand as part of the bullish case for the stock.

Favorably, shares of SUNQ are trading above $3.00 per share which is up more than 100% from its Q1 low of $1.23 back in March. The initial Inflation Reduction Act enthusiasm sent shares to a high near $5.00 in August which now represents an important level of resistance following the recent correction. As a nano-cap stock with a market value still under $100 million, the wide trading range and ongoing volatility are to be expected. To the upside, the stock would need to make a move above $4.00 to get the bulls firmly back in control.

Seeking Alpha

Again, the trend of recurring negative cash flows and a recurring loss is likely the most bearish headwind limiting the upside in the share price of SUNW. In our opinion, this dynamic is likely to continue for the foreseeable future. The company will need to significantly accelerate the top line momentum for operating income or even adjusted EBITDA to begin approaching breakeven.

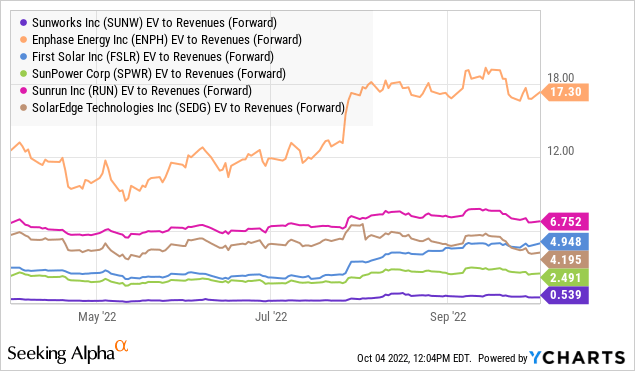

The other issue is that the solar industry is highly competitive and even crowded among several larger and more capitalized players that benefit from scale. Notably, shares of SUNW trade at a discounted sales multiple with the EV to forward revenue metric at just 0.5x compared to peers like SunPower Corp (SPWR) at 2.5x, SolarEdge Technologies Inc. (SEDG) at 4.2x, and First Solar Inc. (FSLR) at 4.9x. In these cases, the valuation spread reflects stronger earnings with a clearer path to profitability in contrast to SUNW which has some deficiencies.

Our take is that the market is pricing in the expectation of further stock issuances by SUNW that will be necessary to support liquidity and growth plans. Ultimately, investors looking to gain exposure to the solar market have many options that benefit from stronger fundamentals while SUNW is higher risk and more speculative.

Final Thoughts

There are plenty of reasons to get excited about solar stocks. Sunworks as a smaller player in the industry is presenting encouraging operational trends that keep the door open for stronger earnings down the line. The setup here is that it will likely take a few quarters of solid execution to confirm a true financial turnaround. We rate shares as a hold, representing an otherwise neutral view of the stock at the current level. Monitoring points into 2023 include the trends in margins and installation activity.

The main risk to consider would be that cash flow trends deteriorate requiring a larger capital raise which would dilute existing shareholders. Weaker than expected results in the next few quarters would also pressure the stock into more downside.

Be the first to comment