Laser1987/iStock Editorial via Getty Images

Introduction

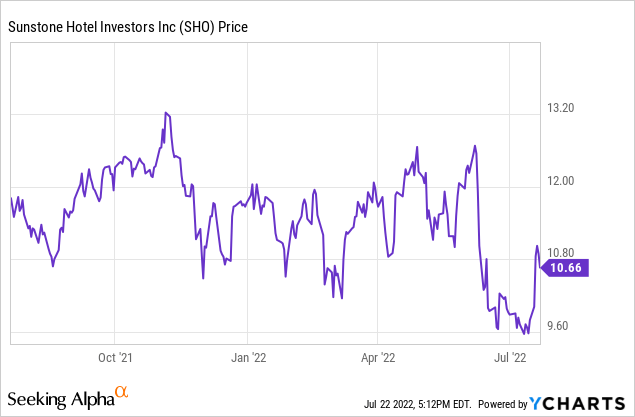

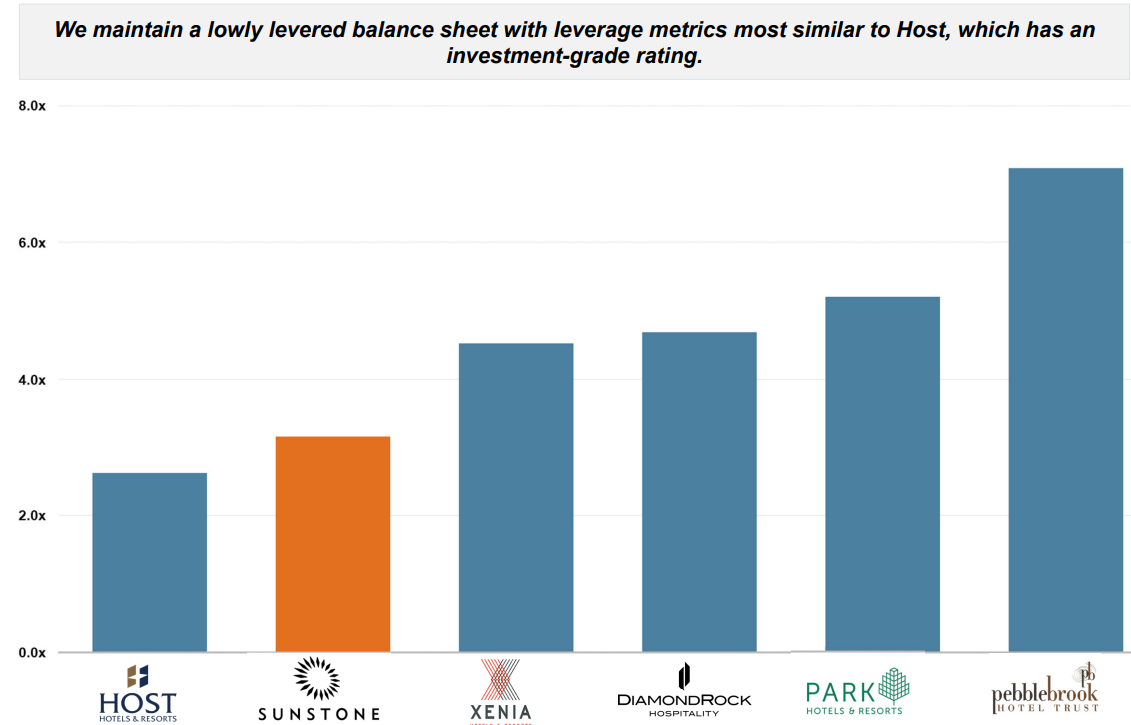

Sunstone Hotel Investors (NYSE:SHO) still has to report its second quarter earnings but I wanted to have a quick peek under the hood before the Q2 results come out as the REIT’s preferred shares have been performing very well as they are up about 15% from their lows a little while ago. I liked Sunstone and its preferred shares because SHO has one of the most robust balance sheets in the hospitality sector so I thought the preferred shares offered a better risk/reward ratio than other prefs.

The preferred shares are recovering well, but how high are the coverage ratios?

I currently own the I-series of Sunstone’s preferred shares, trading at (NYSE:SHO.PI). These preferred shares have a 5.70% preferred dividend which works out to be $1.425 per year based on the $25 principal value per preferred share. That means the yield based on the current share price of just under $22 is approximately 6.48%.

I will look at Sunstone from my perspective as an owner of the I-series but perhaps I should consider switching my exposure to the H-shares which are trading at $22.58 but have a much higher preferred dividend of $1.53125/share which means the current yield is just under 6.8%. The H-shares can be called from May 2026 on the I shares can be called from July 2026 on so there hardly is a difference there.

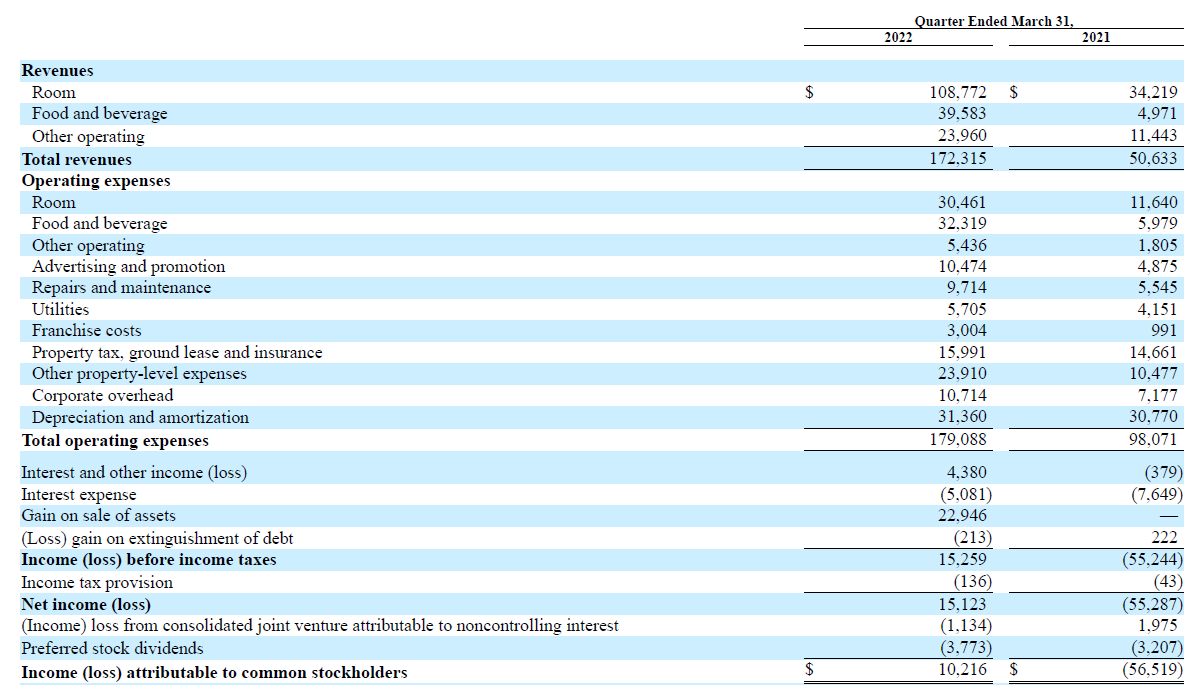

As expected, business really started to pick up again for Sunstone as the demand for hotels is increasing again. The REIT’s revenue more than tripled compared to the first quarter of last year but so did the operating expenses.

Sunstone Investor Relations

The income statement shows a net income of $15.1M thanks to the almost $23M gain on the sale of an asset, and after deducting the payments to non-controlling interests and the preferred dividend payments, the reported net income attributable to the common stockholders was $10.2M or $0.05/share.

It goes without saying the net income is never (really, never) a good metric to decide whether or not a REIT is an interesting investment. The FFO is a much better metric as it excludes the capital gains realized on the sale of assets but it also excludes the non-cash depreciation and amortization expenses.

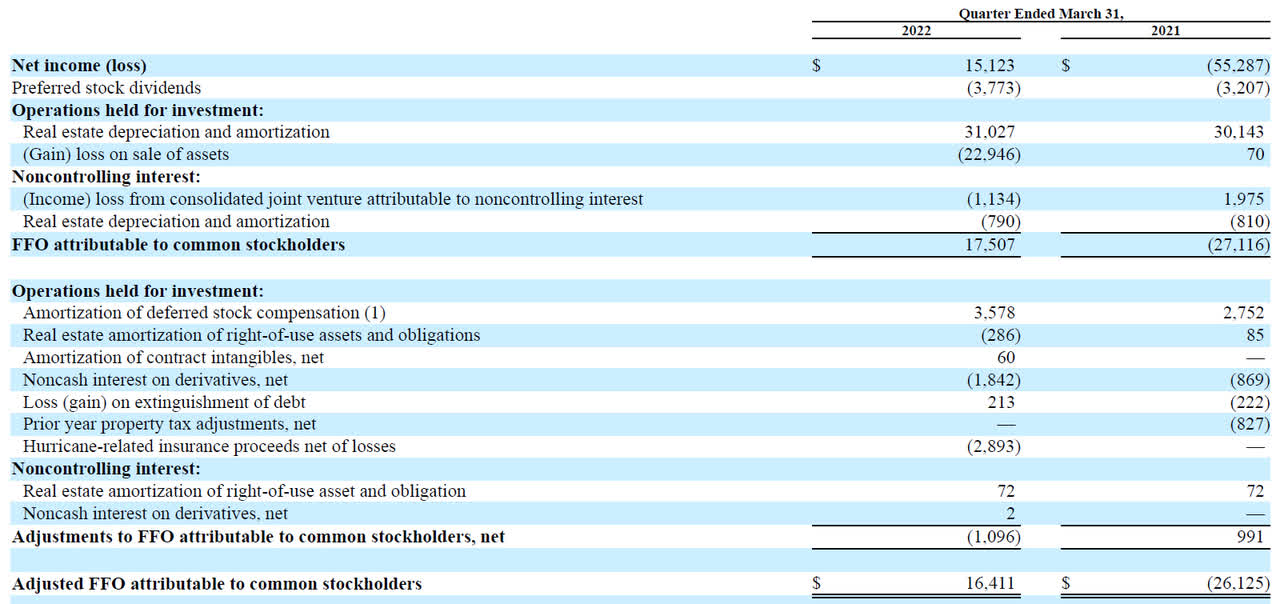

As you can see below, in Sunstone’s case, the FFO was $17.5M while the AFFO came in at $16.4M. This already is including the $3.8M in preferred dividend payments. Which means the preferred dividends were costing the REIT less than 20% of its AFFO.

Sunstone Investor Relations

Keep in mind we can’t just simply extrapolate the Q1 results to determine the coverage ratio of the preferred dividends. After all, the hospitality business is a very seasonal business to be in and the combination of seasonality and fewer COVID restrictions should result in a much higher FFO and AFFO per share in the next few quarters. So once we’re able to look back on the entire financial year, I think the coverage ratio of the preferred dividends will be far higher than the 500% based on the full-year AFFO result.

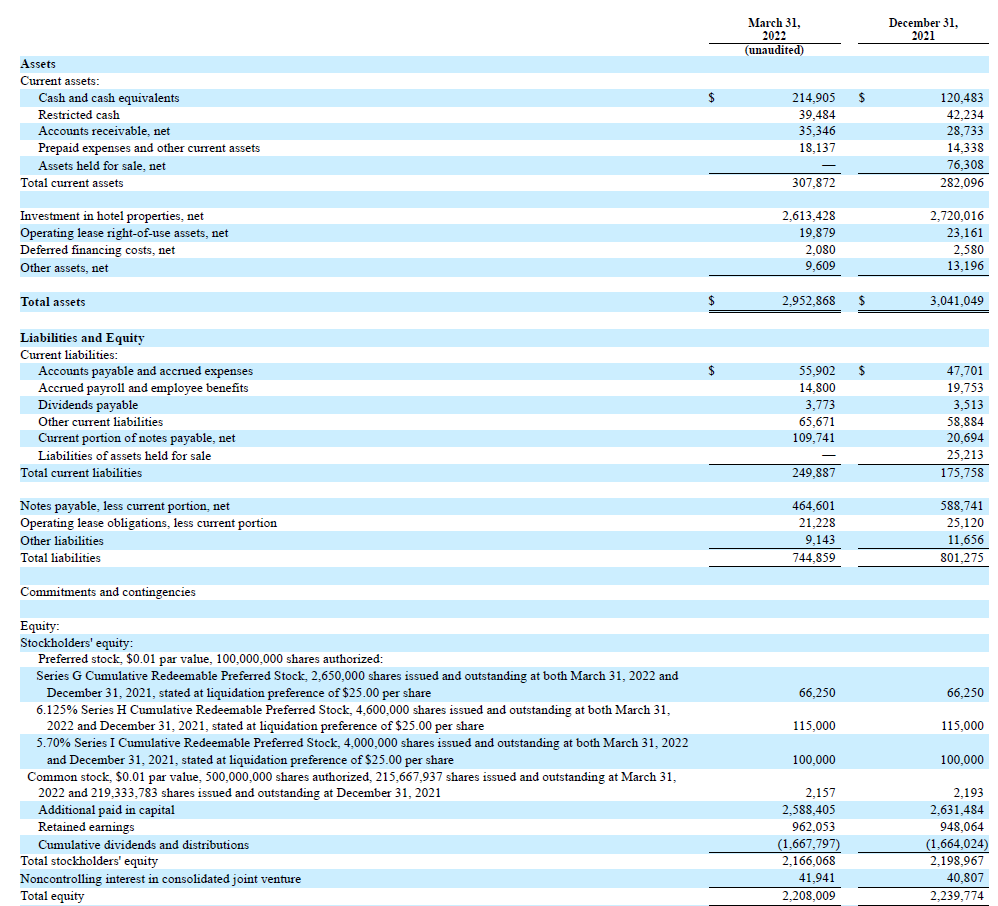

Sunstone is a buyer in the current market

One of the main reasons why I liked Sunstone’s preferred shares was the very strong balance sheet. As of the end of March, Sunstone’s balance sheet contained $255M in cash and restricted cash and just over $560M in debt (excluding leases) for a net debt of just over $300M. Based on $3B in total assets (including $1.07B in accumulated depreciation), the debt was negligible and this meant the $215M in preferred shares ranked senior to the remaining $1.95B in Sunstone equity. A very good position to be in, and that’s why I continued to add Sunstone preferreds as the share prices moved down.

Sunstone Investor Relations

Having an exceptionally strong balance sheet also means Sunstone had the possibility to act fast on M&A opportunities while some of its competitors are still licking their wounds.

Sunstone Investor Relations

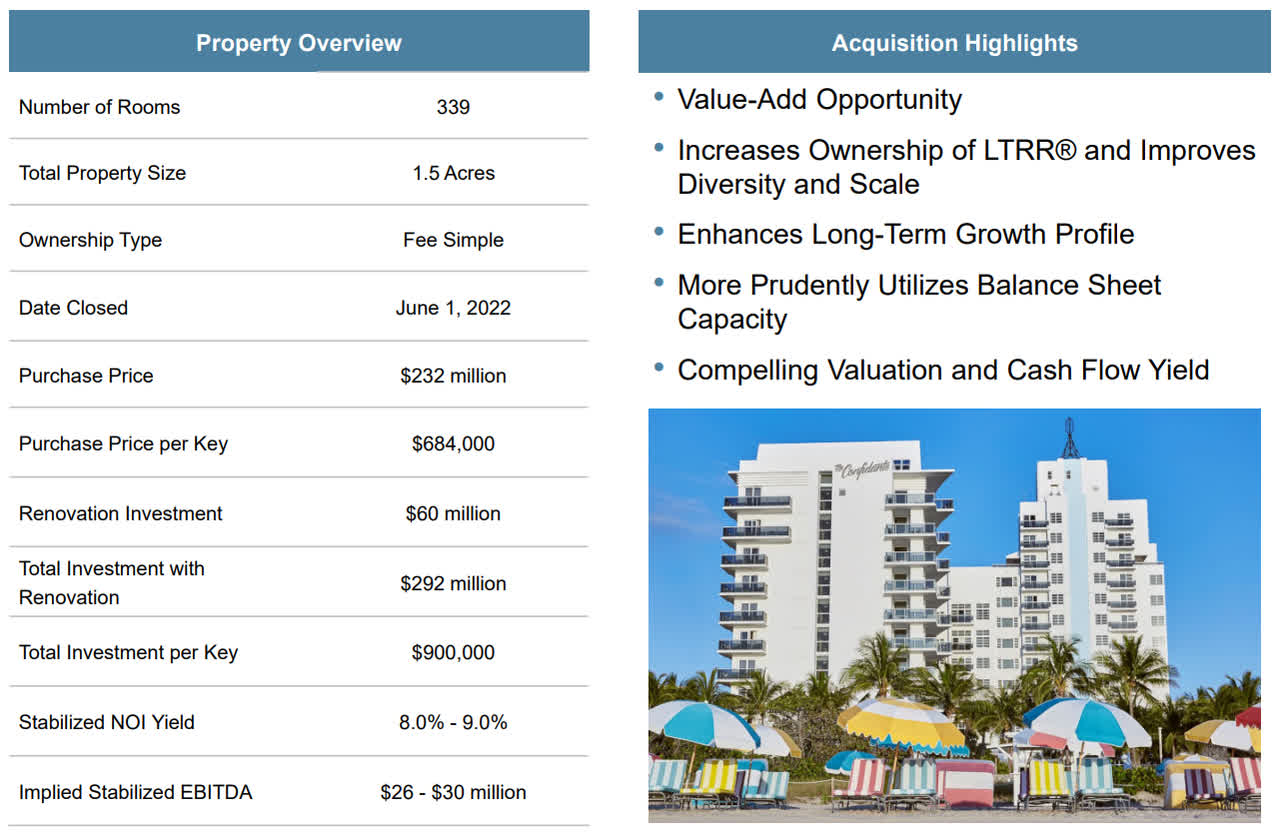

And Sunstone jumped in with both feet. In June, it closed the acquisition of the Confidante Miami Beach hotel for $232M. SHO will invest $60M to reposition the hotel under a new brand which should result in an 8%-9% operating yield on the total investment.

Additionally, the REIT also acquired the 25% of the Hilton San Diego Bayfront hotel from Park Hotels & Resorts for $102M in cash and assuming a $55M mortgage. This implies a 6.6% capitalization rate based on the expectations for 2022.

Sunstone Investor Relations

The Confidante acquisition will be reflected on the Q2 balance sheet. And although the acquisition of the San Diego Bayfront was expected to close by the end of Q2 but I don’t think that has happened yet so the impact will only be visible in the third quarter financials.

Investment thesis

Sunstone Hotel Investors spent quite a bit of cash on buying back shares in the first few months of the second quarter as the REIT repurchased 1.9M shares at $11.01/share, bringing the total amount spent on stock buybacks at $64.6M since the start of the program. This means Sunstone has just over $435M available under the existing authorization. I’m a bit surprised the company isn’t buying back its preferred shares at a discount to par but I guess having to pay just 5.7-6.125% for what essentially is a perpetual security isn’t bad. And perhaps there’s a rule preventing SHO from buying back preferred shares before they can be called.

In any case, I remain very confident in the risk/reward ratio of both of Sunstone’s preferred share issues. I’m currently “stuck” with the lower yielding I-series but I think it makes sense to start buying the H-series as the yield is 30 bp higher. Unfortunately, I’m holding my I-series with a full-service broker so from a transaction fee point of view it doesn’t make much sense to sell the I shares and buy the H shares as it would take me about 7-8 years to make up for the transaction fees.

Both preferred share issues are attractive, and at this point I would favor buying the H-series over the I-series for the higher yield.

Be the first to comment