Qwart/iStock via Getty Images

Food and beverage companies are a dime a dozen. In general, the space can be rather competitive. However, if you have an enterprise that operates in this industry that is capable of rapid growth, and positive cash flows, then you might well have a good opportunity to generate some attractive returns. One business in the plant and fruit-based food and beverage space that has struggled in recent years, but it is now forecasting strong upside moving forward is Canadian company SunOpta (NASDAQ:STKL). However, even factoring in that growth right now, shares don’t look to be anything special. More likely than not, the company is fairly valued, with near-term upside potential limited and long-term upside unlikely to beat that of the broader market. Because of that and because of uncertainty regarding the future, I have decided to rate the enterprise a ‘hold’ at this time.

SunOpta – A taste test for your portfolio?

Today, SunOpta operates as a food and beverage products company dedicated to producing plant and fruit-based items. Under the plant-based foods and beverages category, the company provides a full line of beverages, as well as liquid and powder ingredients, that utilize oat, almond, rice, soy, coconut, hemp, and other related ingredients. It also produces broths, teas, and various nutritional beverages under this category. On top of this, the company sells dry and oil-roasted in-shell sunflower and sunflower kernels and other similar products. During the company’s 2021 fiscal year, 58% of its revenue came from the sale of plant-based foods and beverages.

Under the fruit-based foods and beverages category, the company produces individually quick-frozen fruit for retail. Examples include strawberries, blueberries, mango, pineapple, and various berries and blends. It also provides these items and bulk frozen fruit for food service companies, namely for the production of toppings, purees, and smoothies. The company’s line of products also includes fruit snacks such as candy bars, twists, ropes, and bite-sized morsels. Recently, the company also introduced fruit-based smoothie bowls. 42% of the company’s revenue came from this category of products last year.

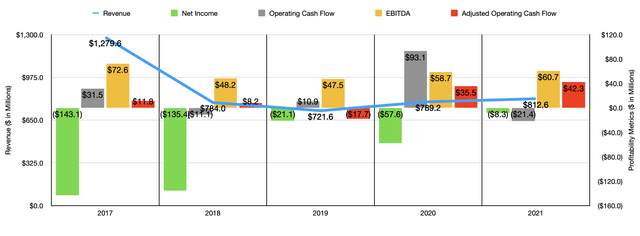

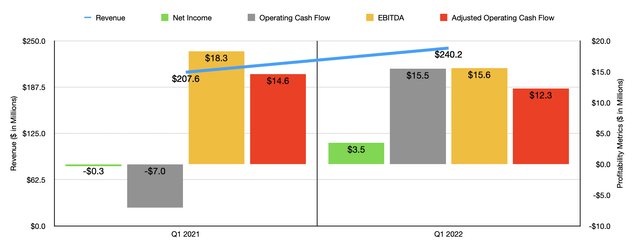

Over the past few years, the financial trajectory for the company has been quite mixed. Revenue contracted between 2017 and 2019, plunging from $1.28 billion to just $721.6 million. The company then saw an uptick to $789.2 million in 2020 before sales climbed further to $812.6 million last year. So far this year, financial performance is looking up from a revenue perspective. Sales in the first quarter of 2022 came in at $240.2 million. That represents an increase of 15.7% over the $207.6 million generated the same time one year earlier.

On the bottom line, things have been volatile as well. At least the good thing is that its net losses have drastically improved. The company went from losing $143.1 million in 2017 to generating a loss of just $8.3 million last year. Operating cash flow has been all over the place, ranging from a low point of negative $21.4 million last year to a high point of $93.1 million in 2020. If we adjust for changes in working capital, we can see that operating cash flow fell from 2017 through 2019. After bottoming out at negative $17.7 million that year, the metric then began improving significantly. Cash flow hit $35.5 million in 2020 before climbing up to $42.3 million in 2021. A similar trend can be seen when looking at EBITDA. After falling from $72.6 million in 2017 to $47.5 million in 2019, it began climbing, eventually hitting $60.7 million in 2021. Bottom line performance this year is a bit mixed. Net income has improved in the latest quarter, coming in at $3.5 million. That compares favorably to the $0.3 million loss achieved one year before that. Operating cash flow went from a negative $7 million to a positive $15.5 million. But if we adjust for changes in working capital, it would have declined from $14.6 million to $12.3 million. Meanwhile, EBITDA went from $18.3 million to $15.6 million.

Although it’s great to cover what SunOpta has done historically, it’s also important to note what management is currently working on. For instance, the company is currently in the process of constructing a new 285,000 square foot plant-based beverage facility in Texas, with the goal of potentially increasing that to 400,000 square feet. The company sees this as a huge opportunity, with the ability to significantly expand its production of products. It won’t be until late this year that the facility, which will cost an estimated $118 million, will be operational. And also, separate from this, in 2021, the company acquired the Dream and WestSoy plant-based beverage brands and other related private label products they have a presence in North America. This will further help the company grow its top line moving forward.

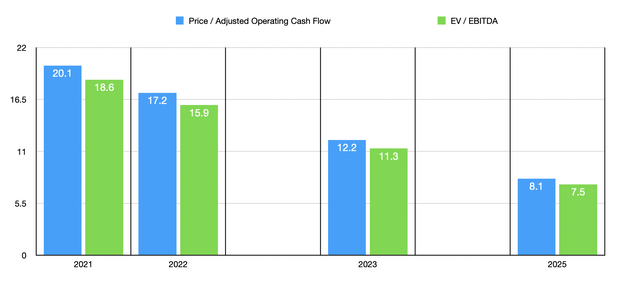

On June 3rd of this year, the management team at SunOpta laid out its long-term growth strategies. By focusing on opening new facilities, like the aforementioned one in Texas, the business plans to grow revenue over the next few years. Sales this year are forecasted to hit between $890 million and $930 million. At the midpoint, that would translate to a year-over-year increase of 12%. The company sees revenue climbing to $1.1 billion next year before hitting $1.3 billion in 2025. With this, the company also expects for EBITDA to improve. They currently anticipate this hitting between $67 million and $75 million this year. The goal is to hit $100 million in 2023 before increasing to $150 million in 2025. If we assume that operating cash flow, on an adjusted basis, will rise at a similar rate, we should anticipate a reading of $49.5 million this year, $69.7 million in 2023, and $104.6 million in 2025.

As the chart above illustrates, shares of the company should get cheaper over time if management’s forecasts are accurate. To put this all in perspective, I decided to compare the company to five similar firms. On a price to operating cash flow basis, these companies ranged from a low of 2.8 to a high of 106.7. One of the five companies was cheaper than SunOpta. Using the EV to EBITDA approach, the range was from 3.1 to 303.2. In this case, only one company was cheaper than our prospect.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| SunOpta | 20.1 | 18.6 |

| Adecoagro S.A. (AGRO) | 2.8 | 3.1 |

| Calavo Growers (CVGW) | 29.9 | 100.4 |

| Mission Produce (AVO) | 34.2 | 18.9 |

| Tattooed Chef (TTCF) | N/A | 303.2 |

| Vital Farms (VITL) | 106.7 | 105.1 |

Takeaway

Looking at SunOpta from the perspective of its valuation, we can see that shares of the business do look cheap compared to similar firms. On top of that, management has rosy expectations for the company moving forward. If the business can achieve the upside in fundamental performance that management believes is realistic, the business should ultimately increase in value over the next few years. But between the company’s historical performance and the inability to know what the future holds, in effect basically relying on something we don’t know will come to pass, any sort of investment is being done on speculative grounds. Also, while shares of the company might be cheap compared to similar firms, they don’t look cheap on an absolute basis. At present, they look closer to being fairly valued to me. Due to all of these reasons, I have decided to rate the business a ‘hold’ at this time, reflecting my belief that, relative to the risk investors are assuming, the upside for the company will more or less match the broader market moving forward.

Be the first to comment