francisblack/iStock via Getty Images

Investment Thesis

Suncor Energy (NYSE:SU) is an oil mining company. Its biggest segment, Oil Sands, is well-positioned for high oil prices. If oil prices end 2022 approximately 10% lower than the current rates of $95 WTI, Suncor would still have Cdn $5.3 billion in free cash flow in 2022.

This implies that the stock is priced at approximately 11x this year’s free cash flows.

However, unquestionably, the biggest bullish argument here is its 4% dividend yield.

Why Suncor? Why Now?

Suncor Energy has 3 main segments. Oil Sands, Exploration and Production (E&P), and Refining and Marketing.

Suncor’s Oil Sand segment produces bitumen. Suncor takes bitumen and upgrades it into synthetic crude oil for refinery feedstock and diesel fuel, or blends it with diluent for refinery feedstock.

Suncor’s Oil Sand business makes up approximately 70% of its total adjusted funds from operations (”AFFO”). Consequently, whatever potential in the near term Suncor Energy has can be squarely attributed to its Oil Sand business.

With the price of oil at around $90 WTI, or slightly higher, this provides a strong tailwind to Suncor. And given that over the past several years Suncor, like many oil businesses, has had to operate in a very harsh environment with low oil prices, this has forced Suncor to dramatically improve its operations.

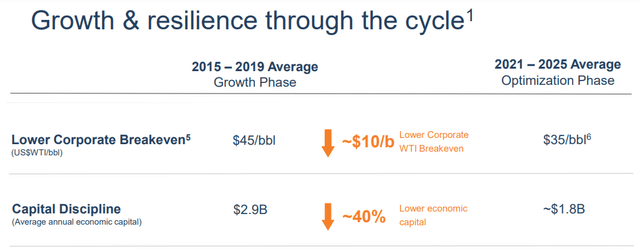

Suncor investor presentation

As you can see above, Suncor now believes that through its 2021-2025 optimization strategy, it can be breakeven at around $35 WTI. This provides Suncor with a very large margin of safety.

Suncor investor presentation

What’s more, note above that this $35 WTI figure includes its dividend payment to shareholders.

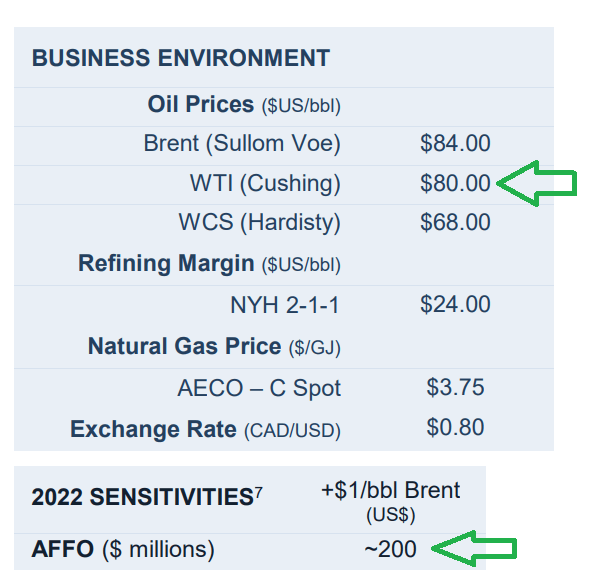

Suncor Q4 2021 investor presentation

Consequently, not only has Suncor planned its operations for around USD $84 on Brent, as you can see above, but for every USD $1 increase in Brent, Suncor will generate USD $200 million.

To illustrate this impact, consider that if Brent ends 2022 at around USD $90 (down from USD $100 right now), this would bring a further USD $1.2 billion in adjusted funds flows from operations.

Shareholder Returns Set to Increase

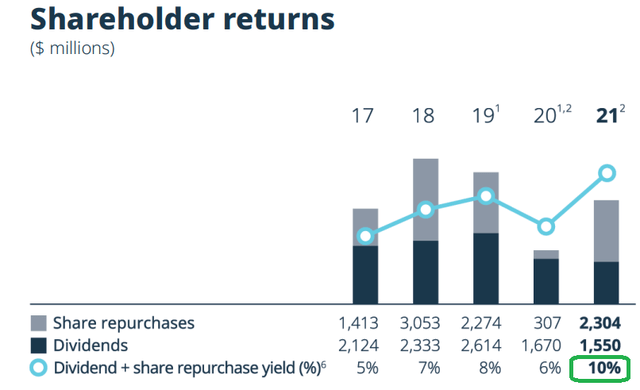

Suncor annual report 2021

In 2021, Suncor repurchased 6% of its shares at an average price of Cdn $27.45 per share. With the share price now above this figure, this turned out to be a good capital allocation strategy.

Moving on, starting January 2022, Suncor declared that it will be repurchasing 5% shares over the next twelve months, with the intention of completing this program in January 2023.

In practice, this means that with its current dividend yield of around 4%, investors are going to get at approximately 10% in capital returns in 2022.

SU Stock Valuation – Pluses and Minuses

So far, I’ve noted many of the positive considerations that investors can build their bull case on Suncor. The one aspect that I’m less bullish about is that despite the massive improvement on its balance sheet, as it stands right now, Suncor carries $13 billion of net debt.

Suncor Q4 2021 investor presentation

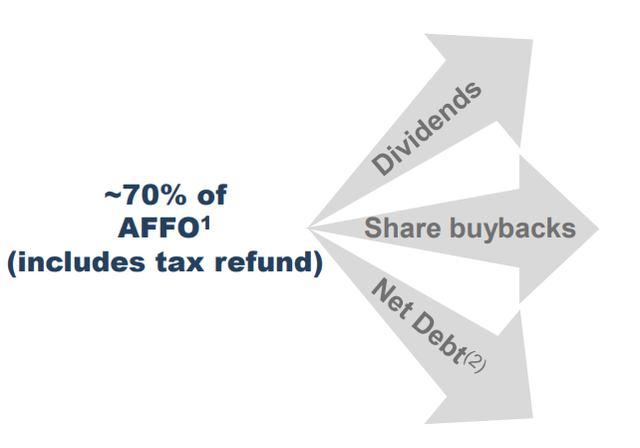

Clearly, for 2022, this will not be a problem, with oil prices so high, Suncor will have a stellar year regardless.

But as we think ahead to 2023, for the bullish thesis to work, investors require that there’s no demand destruction in oil prices for this investment to remain compelling.

Furthermore, consider that Suncor also carries approximately $3 billion of capital leases on its balance sheet that will also require capital to be diverted away from shareholders.

In practical terms, this means that even as Suncor this year targets a 50/50 capital return program, between paying down debt and returning capital to shareholders, this elevated debt profile including capital leases of $3 billion puts a ceiling on further capital returns to shareholders.

On the other hand, outside of oil and gas, there are not so many possibilities for investors to get a 10% return of capital.

The Bottom Line

Suncor Q4 2021 investor presentation

Boiled down, Suncor has capex requirements of $4.7 billion for 2022. Even if oil prices were to dip another 10% from the current prices right now ($95 WTI), Suncor would still have Cdn $5.3 billion in free cash flow in 2022. This means that Suncor is priced at around 11x this year’s free cash flow.

While this is not the cheapest oil play around, it is one that provides investors with a high dividend yield of 4% plus approximately 6% of buybacks, which are likely to be increased further throughout 2022.

That being said, within this sector, I believe that there are even better opportunities elsewhere. Whatever you decide, good luck and happy investing.

Be the first to comment