Galeanu Mihai/iStock via Getty Images

The S&P 500 has entered bear market territory this year due to the surge of inflation to a 40-year high and fears that the resultant interest rate hikes of the Fed may cause a recession. Most stocks are hurt by high inflation and are vulnerable to recessions. However, this is hardly the case for Suburban Propane Partners, L.P. (NYSE:SPH). Thanks to the essential nature of propane, the company is fairly resilient to recessions. In addition, the stock is offering an 8.5% distribution yield, which can offset the impact of inflation on the real value of investment portfolios.

Business overview

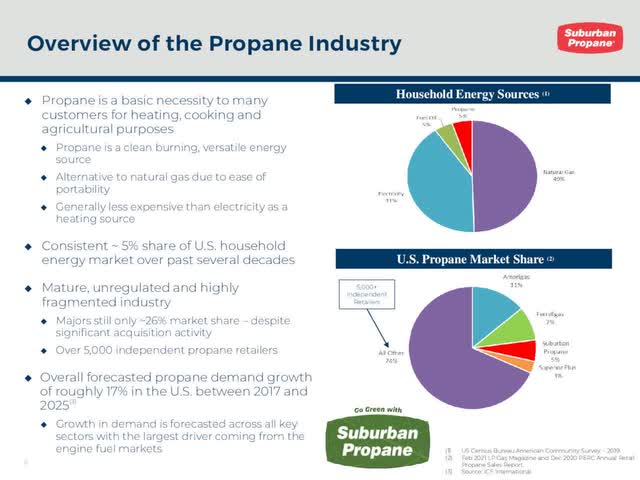

Suburban Propane Partners was founded in 1928 and became a Master Limited Partnership [MLP] in 1996. It is the third-largest propane distributor in the U.S., with a market share of 5%. It serves approximately one million customers in 41 states, but it is mostly concentrated on the U.S. coasts, which are the most attractive propane markets.

Propane is a basic necessity to the customers of Suburban, as it is used for heating, cooking and agricultural purposes. Like natural gas, propane is much cleaner than fossil fuels, such as coal and fuel oil, and hence it is not affected by the environmental policies that aim to reduce the emissions of carbon dioxide. It is also important to note that propane is usually cheaper than electricity as a heating source and hence it is preferred by customers.

Moreover, Suburban acquired a 39% stake in Oberon Fuels in late 2020 in an effort to shift towards renewable energy sources. Oberon Fuels produces low-carbon, renewable dimethyl ether transportation fuel and is focused on the research & development of an affordable pathway to zero-emission transportation through its proprietary production process. Overall, Suburban is largely immune to the secular shift from fossil fuels to clean energy sources. This shift has accelerated since the onset of the pandemic, and hence some energy stocks, such as oil producers, are likely to be vulnerable to this shift in the upcoming years. Suburban certainly stands out with its resilience to this transition.

Suburban is also resilient to the highly inflationary environment prevailing right now. The company has repeatedly proved resilient to the fluctuations of the price of propane, as it has consistently managed to pass increased propane prices to its end customers. Moreover, as propane is a basic necessity for consumers, the latter do not curtail their consumption even during rough economic periods. To cut a long story short, Suburban has a business model that is defensive during inflationary periods and during recessions.

Growth prospects

The propane industry is highly fragmented, with more than 5,000 independent propane retailers currently in operation. It is also remarkable that the five largest retailers comprise a total market share of only 26%.

Suburban Propane Partners business overview and growth prospects (Investor Presentation)

Moreover, the total consumption of propane in the U.S. is expected to grow approximately 17% between 2017 and 2025. Thanks to this growth and the high fragmentation of the propane industry, Suburban has ample room for future growth.

It is also important to note that Suburban has a history of successful acquisitions. It has performed 11 acquisitions during the last decade and has successfully integrated its smaller peers in its network. Given the high fragmentation of the industry, Suburban is likely to continue pursuing growth via acquisitions for many more years.

A risk factor for Suburban is its high sensitivity to the weather conditions, which are unpredictable. The company posts excessive profits during harsh winters whereas it reports lower profits during abnormally warm winters, such as the ones experienced in 2012, 2016 and 2017. Consequently, only the investors who can remain patient during the inevitable downturns of this business should consider purchasing the stock.

On the other hand, it is important to realize that the stock is currently priced based on adverse (warm) weather conditions. Even in the adverse years 2016 and 2017, Suburban posted free cash flows per share of $1.95 and $2.22, respectively. In other words, due to its recent correction, along with the broad market, the stock of Suburban is currently trading at only 7.8 times its free cash flow in 2016, which was its worst year in the last decade. Therefore, the stock seems to have much more upside than downside potential right now.

Distribution

Suburban is offering an 8.5% distribution yield. When a stock offers such an exceptional yield, it usually signals that a distribution cut is just around the corner, but this is not the case for Suburban. Thanks to its efficient business model, the retailer spends markedly low amounts on capital expenses and hence it enjoys excessive free cash flows. To be sure, the company has posted strong free cash flow per share every single year in the last decade.

Moreover, given its free cash flow per share of $2.90 in the last 12 months, Suburban has a distribution coverage ratio of 2.2 (=2.90/1.30). Even if the 10-year low free cash flow per share of $1.95 is used as a basis, the stock still has a solid distribution coverage ratio of 1.5. Therefore, Suburban covers its dividend with a wide margin of safety.

The only point of concern is the amount of net debt (as per Buffett, net debt = total liabilities – cash – receivables), which stands at $1.4 billion. This amount is much higher than the market capitalization of $965 million of the stock, and hence it raises some concerns. However, interest expense consumes only 26% of operating income and hence debt is manageable.

Moreover, Suburban can easily continue servicing its debt thanks to its ample free cash flows. The aforementioned amount of net debt is only 8 times the annual free cash flows of the MLP, and hence it is undoubtedly manageable. To cut a long story short, Suburban is offering an 8.5% distribution, which has a wide margin of safety thanks to the strong distribution coverage ratio, the defensive business model, and the healthy balance sheet of the company.

Final thoughts

Investors are facing two major threats this year, namely 40-year high inflation and the risk of an upcoming recession. Suburban is fairly resilient to both threats and has become remarkably cheaply valued thanks to its 13% correction in recent weeks. As its 8.5% distribution has a wide margin of safety, the stock is attractive in the current inflationary environment. Nevertheless, due to the volatile performance that results from the inevitable sensitivity of propane consumption to weather conditions, only patient investors, with a long-term perspective, should consider purchasing the stock.

Be the first to comment