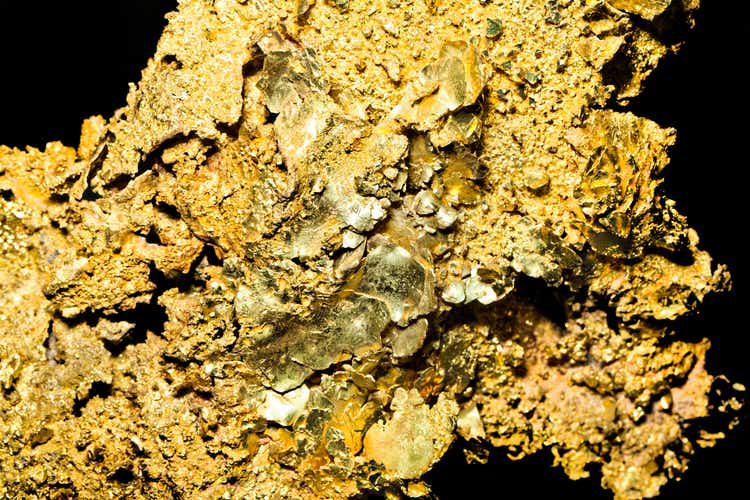

JodiJacobson

October to December is always an interesting quarter in India, especially regarding gold and silver prices and their associated demand. For several reasons, this October is proving to be a less-than-ideal month for gold dealers around the subcontinent. So far, the gold price trend continues to decline when compared to the previous months.

India is almost in the middle of its annual festive season, when demand for gold and silver peaks. Last Sunday, retail gold prices continued the general October downturn as one gram of 22-carat gold hit US $56.29 (Rs 4620). Just the day before, the price was US $56.96 Rs 4675. The 10-gram figures also declined, with 22-carats hitting US $562.90 (Rs 46,200) compared to the previous day’s US $569.60 (Rs 46,750).

It’s worth mentioning that Indians prefer to buy 24-carat gold. However, this, too, saw a drop in price to US $61.41 (Rs 5,040). Meanwhile, ten grams of 24-carat gold reached US $614.07 (₹50,400). Altogether, the 24K gold price has dropped roughly US $23.27 (Rs 1910) in about a week.

Inflation and Gold Price Trends May Keep Consumers Away

India is one of the world’s two biggest consumers of gold, the other being China. It’s also the biggest importer of silver. Physical gold-buying is all set to begin, just ahead of the Diwali festival. Of course, the low retail price was great news for consumers. Still, whether or not they’ll bite amid today’s high inflation rates is another question altogether. After all, lack of buyers is one of the primary reasons for the retail price drop in the first place.

In anticipation of an uptick in local demand, and perhaps as a gentle motivator, the Indian government reduced the base import price on gold earlier in the month. The price shift was minor, but significant, dropping from $533 per 10 grams to $531.

Unfortunately, inflation remains high almost everywhere in the world. For this reason, investors continue to look for better, safer places for their money. Generally, this means increased gold investment. However, the international prices of bullion are dollar-denominated. And as the dollar continues to grow in strength, the price of gold suffers the consequences.

For instance, global bullion prices currently range about $1,700 an ounce, with a net drop of around 8% in dollar terms in CY2022. Meanwhile, gold rates in the global markets rebounded a few days ago from two-month lows as the dollar rally paused. Spot gold price also rose 0.4% to $1,648.91 per ounce after falling nearly 3% last week.

Gold prices in India, too, nearly reflected the same ups and downs seen among global rates. On India’s MCX, gold futures were up 0.4% per 10 grams, while silver futures jumped 1% per kg. Both gold and silver saw some heavy sell-off in the first half of October. This followed downbeat US economic data and strong gains in the dollar index and US bond yields. In fact, the factors combined to make it the worst week for gold in two months. For silver, it was the worst week since September 2021.

India Remains at the Mercy of the Dollar and the Fed

In early October, gold-supplying banks reduced gold shipments to India in favor of focusing on China, Turkey, and other such markets. As several bank officials and vault operators told Reuters, the intention was to focus on areas that offered better premiums. Unfortunately, the move ignited fears of artificial gold scarcity in India. If this occurred, it would force Indians to pay large premiums for supplies during the festive season.

Again, Indian gold rates are influenced mainly by US interest rates and the dollar’s relationship with the Indian rupee. Ultimately, the declining gold price trend stems from the stronger US dollar and increased prospects that the Federal Reserve will continue its sharp rate hikes to tame inflation.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment