akinbostanci

Introduction

Straumann (OTCPK:SAUHF) is a Swiss company that is a leader in dental replacement and orthodontic solutions. Straumann’s products include dental implants, abutments, clear aligners, biomaterials, and computer-aided design/computer-aided manufacturing equipment. Especially their dental implants are selling well, Straumann holds nearly 30% of the global dental implant market. With the acquisition of Neodent in 2012, Straumann has half of the global premium market and about an eighth of the value market. Straumann brand is their premium brand while Neodent, Anthogyr, and Medentika are their value brands.

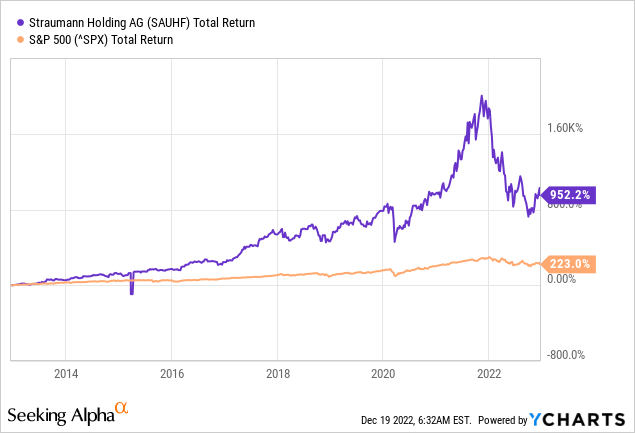

The stock’s total return is high, with 953% growth over the past decade (27% per year). The recent fall in the share price offers a buying opportunity to buy this strong Swiss company at a cheap price.

Although the company trades at a premium, the stock is still valued below its 5-year average PE ratio. The company can still gain significant market share. Because revenues, earnings and dividends are growing rapidly, the stock is worth buying.

Revenues Are Growing Strong

Straumann grows strongly with sales up 12% in third quarter 2022. The company is raising its revenue forecast for the full fiscal year 2022, expecting an increase in the mid-teens and profitability of about 26%.

Traditionally, the last two quarters of the year are softer than the first two because of summer vacations in many northern hemisphere countries. The company experienced strong organic growth, with revenue already up 18% in the first 9 months. Revenues in Latin America remained the fastest growing region with organic growth of 21%. Revenues in Europe, Middle East and Africa (+15%), North America (+9%) and Asia Pacific (+9%) grew strongly.

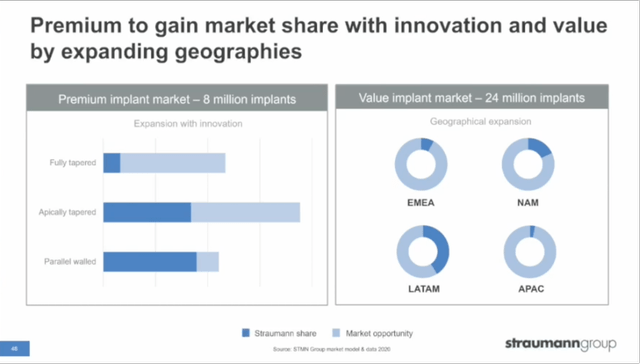

Capital markets 2021 day shows that the market opportunities for Straumann are solid. Market share in the Latin American market is already very high, but the company will still be able to capture a lot of market share in the EMEA and APAC regions.

Straumann’s market share (Straumann’s 2021 capital markets day)

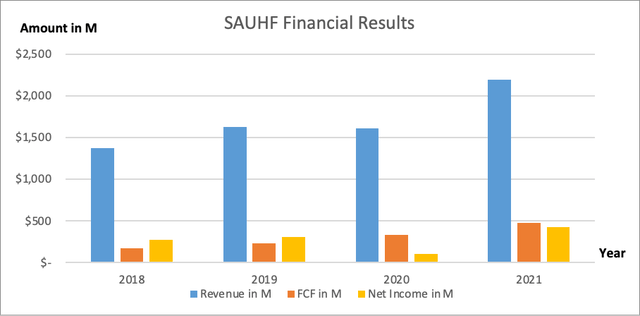

Over the past 4 years, Straumann has performed strongly. Sales decreased slightly in 2020 compared to the previous year but sales experienced a strong rebound in 2021 with 38% growth. Over the past 4 years, sales and net income have grown at an average annual rate of 12%.

The company has a high net profit margin and a free cash flow margin of 22%, a third of which is returned to shareholders.

Straumann’s Financial Results (Annual reports and author own graphical representation)

Dividends and Share Repurchases

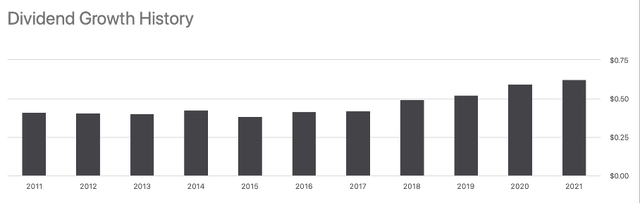

In addition to strong sales and earnings growth, the dividend is growing along with it. Over the past 4 years, the dividend per share increased an average of 10%. The dividend is $0.72 per share, representing a dividend yield of 0.64%.

Straumann’s Dividend Growth History (Seeking Alpha SAUHF ticker page)

The dividend per share is able to grow because it accounts for only a third of earnings and free cash flow. In 2021, it accounted for 20% of free cash flow. With the recent decline in free cash flow, the company paid out more dividends generated in free cash flow. These temporary headwinds provide an opportunity to buy the stock cheap, as its share price has fallen strongly from recent highs.

Straumann’s cash flow highlights (Annual reports and author’s own calculations)

Valuation Cheap Compared To 5 Year Average

Switzerland has the second highest GDP per capita in the world, making it a strong country. Stock valuations of Swiss companies tend to be very high due to the stability of the Swiss economy. Investors see the Swiss franc as a “safe haven” in times of economic turmoil.

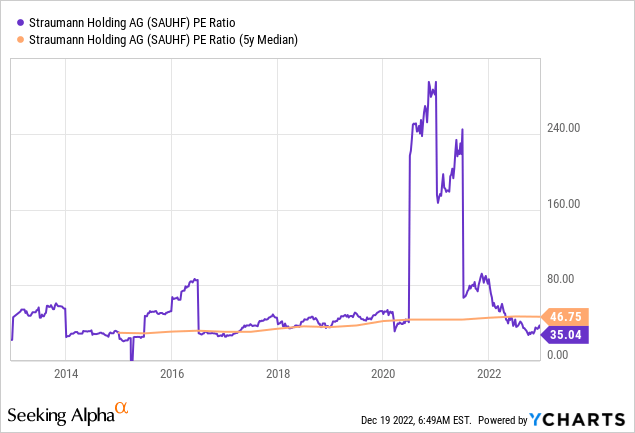

To chart the stock’s valuation, I use the PE ratio. Straumann’s PE ratio is 35, generally quite high. But the company’s strong growth justifies this high PE ratio.

Still, Straumann is attractively valued, due to the recent stock price decline, the PE ratio dropped sharply. The 5-year average PE ratio is 47, which places Straumann 26% below average.

Conclusion

Straumann is a Swiss company that is an international leader in tooth replacement and orthodontic solutions. In particular, the company is a leader in dental implants and holds nearly 30% of the market.

The company is growing rapidly and its share price has risen sharply. Over the past decade, the stock has risen an average of 27% a year. The recent decline in stock price provides a good buying opportunity to buy the stock cheaply.

Straumann managed to gain a considerable amount of market share in Latin-America, with a market share of nearly 50%. Other strong growth regions include Europe, the Middle East and Africa, North America and Asia. Sales in the third quarter of 2022 grew strongly by 12%, and the company expects full-year sales growth in the mid-teens, with profitability at 26%.

The Swiss economy is one of the stable economies in the world; many economists see the Swiss franc as a “safe haven.” Swiss stocks are valued higher than in other countries because of the stable nature of the economy. As a result, Straumann stands at a PE ratio of 35, which is currently quite high for U.S. companies. The 5-year average PE ratio is 47, which puts the company at a nearly 26% discount. The recent price decline, strong growth in sales, earnings and free cash flow make the stock worthy of buying.

Be the first to comment