ArtistGNDphotography/E+ via Getty Images

Introduction

For the past two years, Valero (VLO), and refinery stocks in general, have been my favorite deep cyclical investments of the COVID era. I purchased two refiner stocks in March of 2020 and tripled my refiner weighting on November 16th of 2020. Valero stock was the cornerstone of that refiner investing strategy. I recently took profits in both of my Valero positions, and, since I’ve written about the general refiner strategy a lot on Seeking Alpha, it seemed appropriate to inform readers of my sale. However, it’s important to understand my Valero moves as part of a larger strategy, so in this article, I’m going to do my best to explain the wider portfolio and macro considerations that went into the sale of Valero. I think they are equally as important because my investing in deep cyclical stocks like refiners didn’t take place in a vacuum and context is really important.

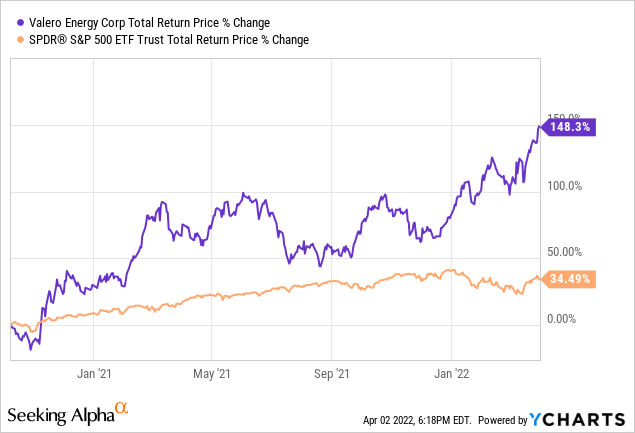

My last Seeking Alpha focus article on Valero was published on October 8th, 2020, and it was titled “The Cycle Will Turn Up. Valero is a Buy“. If you are interested in the methodology I used to purchase Valero or deep cyclical stocks in general, that article is a must-read. I take readers through the entire process. Since that article was published, here is how Valero stock has performed compared to the S&P 500 ETF (SPY):

I also picked Valero as the top pick from my investing service, The Cyclical Investor’s Club, for Seeking Alpha’s 2021 Marketplace Challenge and it’s up about 100% since the beginning of 2021. I don’t usually pound the table when it comes to undervalued stocks, but I did basically pound the table for Valero all the way into early 2021. (Since my personal positions were purchased at a different time from my last Valero article, my personal returns were not as good as the stock performance since my last article. The average total return of my two tranches of VLO was a little over 100% with an average holding period of 21 months.)

The Bigger Picture: “Refiner Strategy”

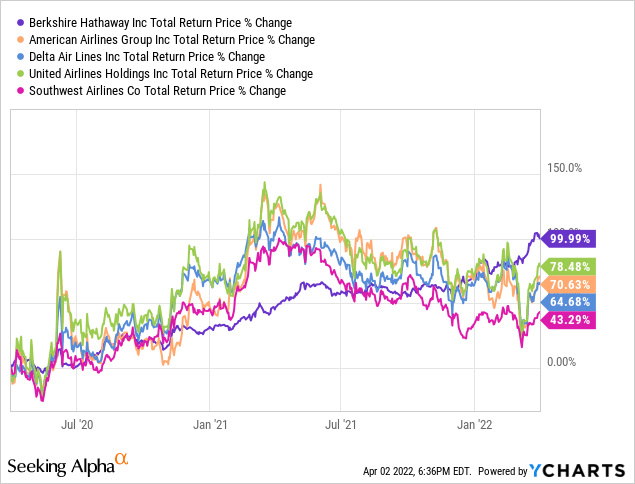

March of 2020 was a challenging time for the “Deep Cyclical” stocks that I typically specialize in. The fact is, deep cyclical stocks are by nature not easy investments to make. While tremendous gains can be had if an investor buys low enough, cyclicals, in particular, need to be very high quality because the risk of complete failure is always higher than it is for the stock of a less cyclical business. Because of the unique global challenges that COVID caused, I deemed many cyclical industries that I would normally invest in during a downturn simply too risky to buy in March of 2020. Those industries include airlines, cruise lines, hotels, travel stocks, auto-related stocks, and certain retailers. Despite what many investors say, Buffett was right to sell his cyclical airline positions during this time because he understood the dangers just as I did. Buying back Berkshire stock provided a much more dependable long-term return than any of the airline stocks due to their unique cyclical risk.

And, in many respects, deep cyclicals were the beneficiaries of a great deal of government stimulus and Fed stimulus for which we had no guarantee would happen during the heart of the market sell-off in March of 2020. Without help, it’s likely that almost all airlines and cruise lines would have gone bankrupt. In the end, I avoided some areas of the deep cyclical market where I would have performed better if I had bought them, like housing, autos, and RVs, which got a very unusual boost from COVID and COVID stimulus, exactly the opposite of what one would expect during a “normal” recession.

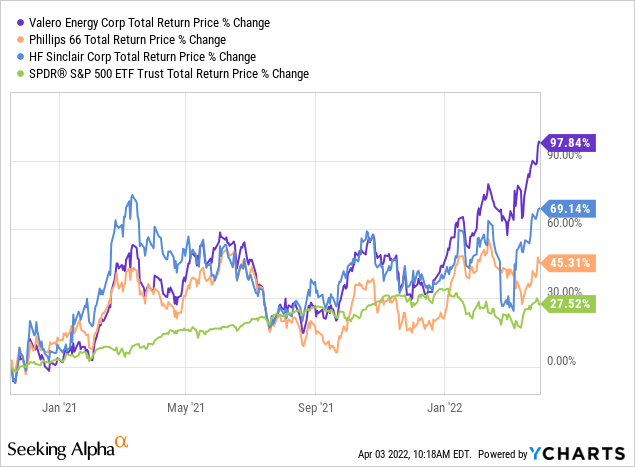

Left with few “safe” options in the cyclical universe, I turned to refiners Valero, HollyFrontier (now HF Sinclair (DINO)), and Phillips 66 (PSX), which I viewed as good options in terms of the risk/reward they offered among deep cyclical stocks. COVID would hurt them, but they had a high probability of survival and a full recovery. I bought my first two positions of VLO and DINO in March of 2020, and after the vaccines were announced in November of 2020, on the 16th of that month I tripled my overall weighting and added PSX to the mix as well. The money that I might otherwise have added to airlines and cruise lines and travel stocks during a downturn, I instead focused on the refiners. This is unusual for me to do, since I usually only take 1% weighted positions in deep cyclical stocks, and it created a situation where I had (and still have) a lot riding on refiners because my relative conviction for the group was much higher than most other cyclicals.

Setbacks and Catalysts

I always assume there will be setbacks along the way when dealing with deep cyclical stocks. The two primary ways I deal with these potential setbacks is to use a medium-term time frame of 2-5 years for my investments and to make sure that I buy at a low enough price that I can still make very good returns even if several things go wrong along the way and it takes five full years for a stock to reach its return goal. This means that I almost never buy a deep cyclical stock unless it has +50% total return upside potential, and the most common total return upside potential for the cyclical stocks I buy is +100%. If I get that typical 100% goal in five years that’s still about a 15% CAGR, which is at the low-end of the 15-20% long-term portfolio CAGR I aim for, but still would be a good investment return in most market environments.

This is how I framed my thinking in my last Valero article:

To conclude, I think maybe there is a 25% chance we get a perfect scenario where the dividend doesn’t get cut, earnings recover by 2023, and the stock returns up to 150% in a very short period of time. We probably have a 50% chance that the dividend gets cut somewhat, earnings take a little longer to recover, but eventually, it happens in 5 years and returns are still very good. Then maybe there is a 15% chance of positive, but poor returns, and a 10% chance it simply takes too long for demand to return and EVs eventually permanently hold fuel demand down, or some other calamity happens and an investor ends up losing money on this over the next few years.

We ended up getting that 150% return from the time the article was written, but it wasn’t quite a “very short period of time” which would have been more like one year. Instead, it took about 1.5 years. But as I noted in the article, there was always a range of possibilities the investment could take. What I try to do is get that range of possibilities as much in my favor as I can.

While with Valero the investment goals were achieved rather quickly and the only real setback was the Delta and Omicron COVID variants, HF Sinclair and Phillips 66 have experienced a rockier road.

The chart above starts on November 16th, 2020 when I tripled down on the refiners and added PSX to the mix. Typically, these three stocks trade mostly in tandem with one another and if I posted a very long-term chart you could hardly tell the difference between the three of them. And in fact, for almost the first year, you can see the stocks moving together. All three are doing well now and have outperformed the S&P 500, but Valero has more than doubled the total return of PSX, so we have a lot more divergence between the three than we normally see.

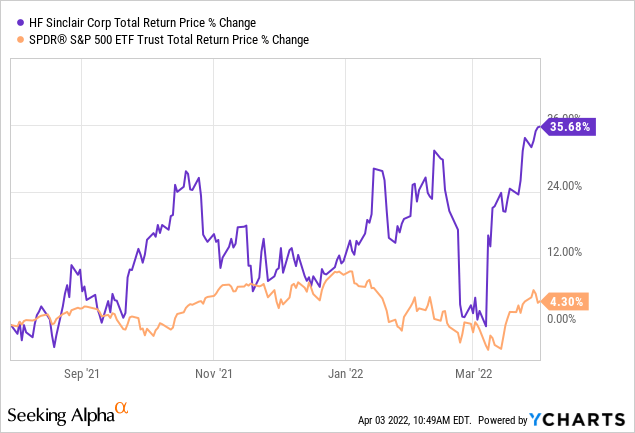

While all of the refiners suffered a setback in the second half of 2021 from the new COVID variants, both DINO and PSX experienced additional issues that investors did not like. DINO, unlike VLO, cut its dividend in order to have the money available to buy an additional refinery. Because I’m not a dividend investor, that didn’t bother me, nor did it affect my cyclical thesis for the stock in any way. But many investors nowadays are dividend investors, and so they sold then HollyFrontier, now HF Sinclair, because the dividend was reduced. In fact, I used DINO as an example in my July 30th, 2021 article “12 Reasons I’m Not a Dividend Investor” to explain why I didn’t see any reason to sell DINO based on the fact they cut their dividend.

Since that article, HF Sinclair has outperformed the S&P 500 by 8x.

But that move by DINO to cut their dividend created an additional temporary setback for the stock over this time period, and that is likely the main reason it hasn’t performed as well as Valero stock, yet, because Valero kept paying its dividend.

In PSX’s case, they have had numerous operational issues. First, they bought out the rest of Phillips 66 Partners for $3.4 billion in an all-stock deal. Unlike DINO’s purchase, which made sense to me because they were buying an additional refinery near the bottom of the cycle with money that would have otherwise been wasted on a dividend, PSX issued stock near the bottom of the cycle, diluting shareholders, in order to buy a non-refining business, which didn’t really fit with my overall refining thesis to begin with, and then they continued to pay their dividend. It’s not much of a surprise to me that their stock price has lagged. Additionally, they have had a variety of operational issues over this time period as well, some related to the weather, which weren’t really their fault.

Because of these additional setbacks, DINO and PSX, are lagging VLO’s performance so far. And that’s okay. The reason I only buy these stocks when they are very cheap is that recovery delays happen. They go with the territory. Unfortunately, now the Federal Reserve is aggressively raising interest rates and government stimulus is mostly over as well. Part of the reason refiner stocks have recovered over the past month or two is due to sanctions placed on Russian oil. This creates two areas of uncertainty going forward. The first is that the economy is likely to slow and has an increasingly high probability of entering a recession in 2023. Because these are deeply cyclical stocks, they could fall quite far during a bear market, so if the stock prices haven’t fully recovered by then, we might indeed have to wait a full five years for a recovery. The second is that the outcome of sanctioned Russian oil is mostly in the hands of Putin. I think if Russia were to pull out of Ukraine in the next few months, while the West might not ease up on sanctions, it would give China and India much more cover to buy discounted Russian commodities, so it’s possible the net effect for global oil and gas prices will be down, even if sanctions remain largely in place. This means that energy prices might not be as sustainably high as one might expect and the price of refiner stocks could fall quite rapidly between now and 2023.

When we put this all together, there is reason to be cautious about the medium-term performance of these stocks even though everything right now is pointing toward a rapid recovery of margins and profits for refiners.

My Strategy

Since I have an overweight position to refiner stocks, the overall outcome of how this turns out will have a disproportionate effect on my portfolio. So, in my case, I have a lot at stake. I can basically make a choice with these positions of going for extremely big gains for the whole lot of them and try to predict the top of the cycle with precision, or I can try to give myself a very high probability of getting very good returns without having to predict the top with a lot of precision. When I zoom out, and ask myself whether achieving a 100% total return in two years is good enough, or whether I would rather take on more risk and aim for more given where all the factors stand today? In the end, I have chosen to take a high-probability 40% CAGR over two years, and then move to a more defensive positioning until another really good opportunity comes along.

Once a deep cyclical stock passes my basic threshold of quality, it really then becomes a question of 1) how low of a price do I have a better-than-average chance of buying this stock, and 2) how much upside is there between that price, and its previous cyclical high price?

The theory behind using a previous cyclical high as a guideline for when to sell a deep cyclical is based on the idea that if the market was willing to pay a certain price in the past, assuming it was not in a super upcycle at the time, then, if similar conditions arise in the future, then the market is likely to be willing to pay that much again. I consider any price that is above the previous cyclical high to be unpredictable, so I don’t count on it happening, and I usually take profits or put a trailing stop on around the previous cyclical high.

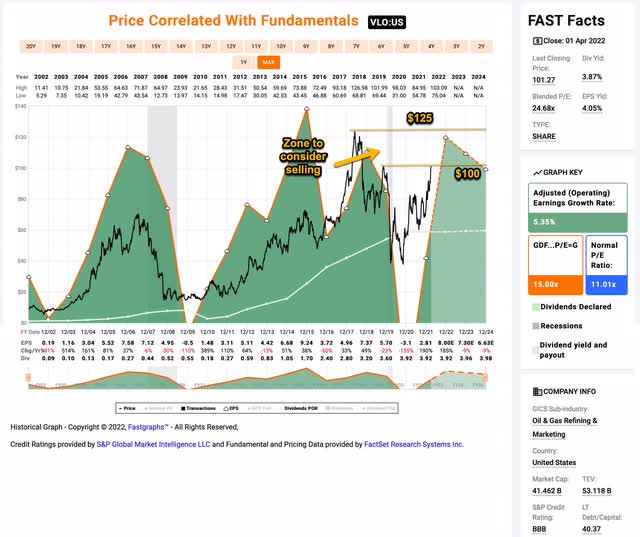

FAST Graphs

I think there are roughly two levels an investor could use as guides for when to take profits in Valero stock. One of them is based on its pre-pandemic 2020 highs, which is roughly $100 per share. And the other is based on early 2018’s highs of $125 per share. Good arguments can be made for using either one of these highs as a guide. I have chosen to use the 2020 highs as a guide to exit the stock because we are already seeing signs that the wider economy has entered late-cycle conditions (with the Fed raising rates etc.) and also the danger from macro developments changing. In addition, as I noted, I am overweight refiners, so I have a lot of eggs in one basket. For those reasons, I decided to take profits in Valero, even though I’m still holding DINO and PSX and I’m aiming for 100% total returns from both of those positions as well.

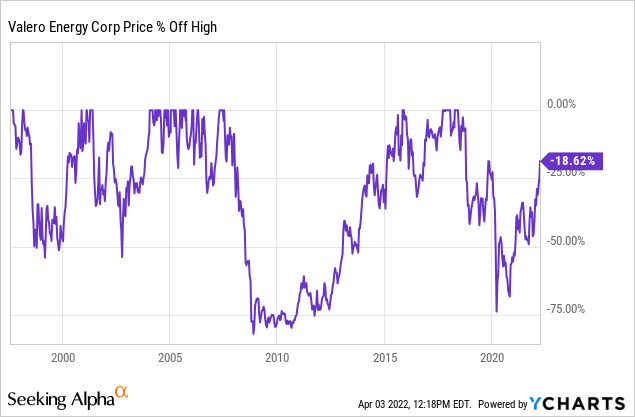

If an investor wasn’t in the same position that I am, and they think Valero has more upside, holding until about $125, or using a trailing stop, or slowly lightening one’s position between here and $125 are totally reasonable actions to take. That doesn’t necessarily mean Valero’s price will drop after it hits $125. Often good cyclicals like Valero go on to make higher highs. However, I think after that point, we are in uncharted territory and the risk/reward has shifted much more to the ‘risk’ end of the spectrum. Remember that this is a stock that routinely falls -65% to -80% off its highs as I show in the drawdown chart below.

I would much rather be waiting with cash to buy the next downcycle somewhere near the bottom than holding this stock on the way down.

Conclusion

I am a huge fan of Valero stock and this is the second time I’ve owned the stock and done well with it. And frankly, I hope the stock keeps rising over the near-term because that probably means my other refiners will as well. But because I have been heavily concentrated in this industry, and there are macro risks that are clearly on the horizon, and I’ve already done exceedingly well with these positions, I have sold all of my Valero stock for the time being.

I think Valero could potentially have 20-25% more upside over the next year, but after that, I would tilt more bearish on the stock. And for dividend investors, while Valero did manage to keep paying their dividend during the 2020 downturn, I think dividend investors got pretty lucky there wasn’t a cut. A longer downturn in the future, even if it’s not as severe as 2008’s downturn, could take Valero a lot longer to recover from and this isn’t the type of stock I would hold long-term just for the dividend. Additionally, as time goes on, electric and hybrid vehicles will eventually lead to a decline in the end markets for fuel, so, while I don’t think we are there, yet, demand destruction is coming down the road, and that’s a longer-term danger as well.

Be the first to comment