Andrii Dodonov/iStock via Getty Images

STORE Capital (NYSE:NYSE:STOR) is an all American Real Estate Investment Trust (REIT) which owns a variety of service oriented retail locations. They have $11.2 Billion in Real Estate Assets across 2,965 locations in the USA. Their customers (tenants) include the likes of Burger King, Fleet Farm, Camping World and more. From my research this is the highest yielding dividend stock in Warren Buffett’s portfolio (Berkshire Hathaway) (BRK.A), as it has a 5.8% yield. The REIT also has an exceptional 99.5% occupancy rate, with a 13.3 year weighted average lease term, which is higher than the industry average.

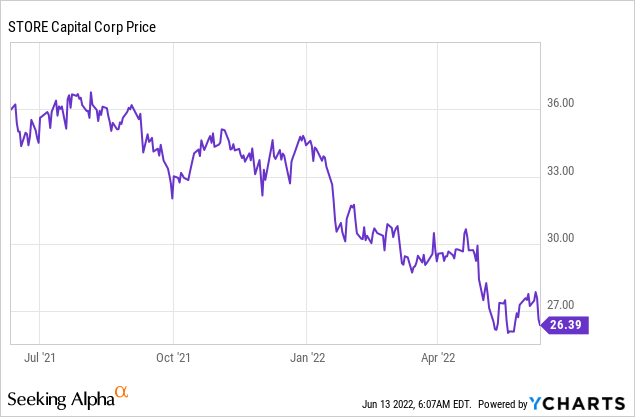

The stock price fell off a cliff during the pandemic crash of 2020 as its customers retail locations were shut down. However, the stock bounced back fast and increased by ~147% from the lows. Since August 2021, the stock price has spiralled down by a substantial 27%.

The stock is now undervalued relative to historic valuation multiples and the majority of its peers, thus this looks to be a great stock for income investors. While simultaneously the company has beat earnings expectations for the first quarter of 2022. Let’s dive into the Business Model, Financials and Valuation for this Juicy 5.8% dividend yielding stock.

Solid Business Model

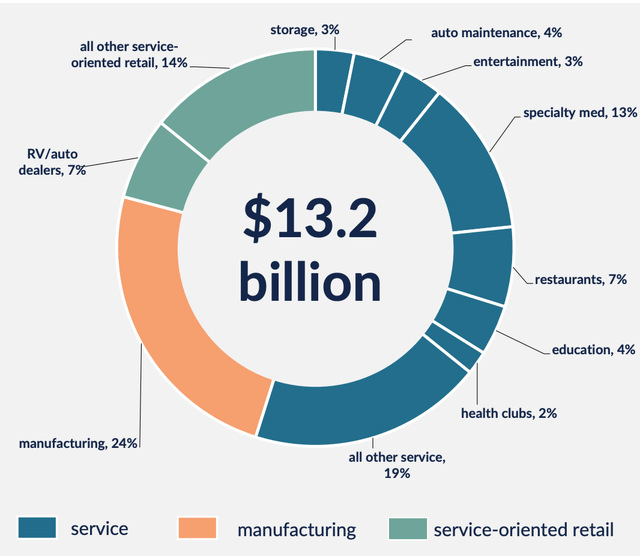

STORE Capital is a Real Estate Investment Trust (REIT) which specializes in buying and then leasing Real Estate to service, manufacturing and service-oriented retail industries. Their acquisition pipeline totals $13.2 billion in property value, which is rented to 573 customers across multiple Industries, which include; Manufacturing (24% of value) to RV/Auto dealers (7%) and even Restaurants (7%). The beautiful thing about this REIT is it’s extremely well diversified, across industries and customers.

Store Capital (Investor presentation)

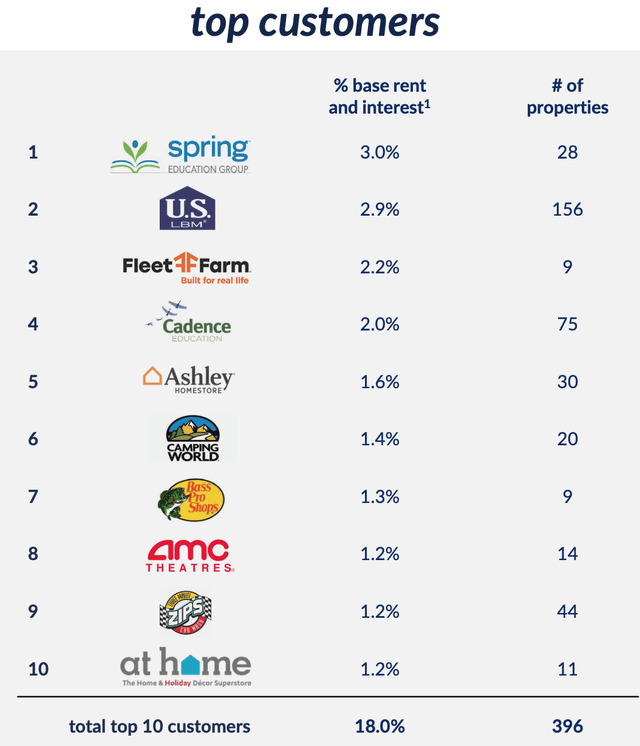

The majority of STORE Capital’s top 10 tenants are less vulnerable to online disruption, for example Spring Education Group and Cadence education are Private Preschools. Now although online education is increasing in popularity for University level education, a Preschooler is unlikely to have the ability or desire to hop onto a Zoom call.

Other tenants include US LBM, which is one of the largest building products distributors in the US. While Ashley Homestore and At Home who specialise in Furniture and thus these stores entice people to go into the physical shop. Then we have Camping world and Bass Pro Fishing shops, which are self explanatory. The only real “risky” tenant I see on the list below is AMC Movie Theatre’s, which I will elaborate on in the “Risks” section.

Top customers (Investor Presentation)

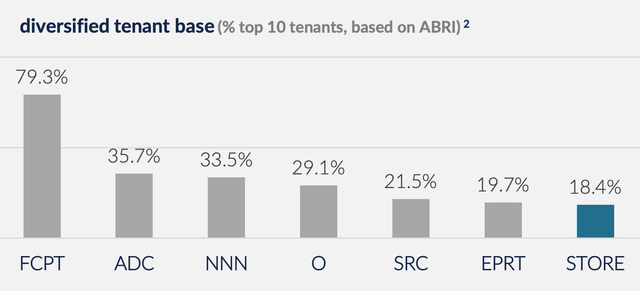

The REIT’s top 10 customers make up just 18% of their base rent plus interest. This is less than other competitors in the REIT industry, for example Four Corners Property Trust (FCPT) has an eye watering 79.3% of rents coming from the top 10 tenants, this adds a greater risk for investors.

Diversified Tenants (Store Capital)

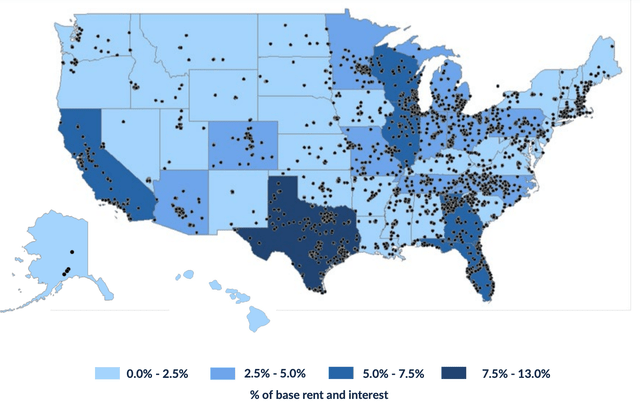

STORE Capital is also well diversified geographically across the majority of the US with a slight focus on the East Coast, South and Mid West regions.

Store capital Geographically Diverse (Investor presentation)

They have an exceptional 99.5% occupancy rate, with a 13.3 year weighted average lease term, which is higher than the industry average. Only 4.9% of their leases are expected to expire within the next 5 years which is significantly lower than competitors.

S.T.O.R.E stands for Single Tenant Operational Real Estate. Their tenants sign “Triple Net Leases” which means the tenant is liable for building maintenance and all bills. This is great as it means the company is unlikely to see unforeseen charges and thus offers lower risk to investors.

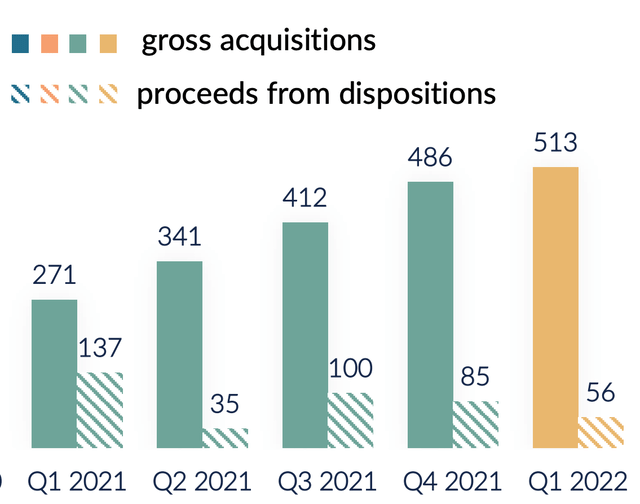

This REIT operates with a growth by acquisition strategy, which has been accelerating over the past few years. They did $513 Million in gross acquisition volume in the first quarter of 2022 alone, while they disposed (sold) $56 million worth of locations which didn’t fit with their strategy. STORE Capital aims to invest into “Profit Center” real estate which basically means the facilities are a primary part of the business profitability, for example as you see with a Burger King or a School. Their direct customer relationships account for ~80% of STORE’s acquisitions, which shows customers see value in them as a landlord.

Gross Acquisitions (Investor presentation)

Growing Financials

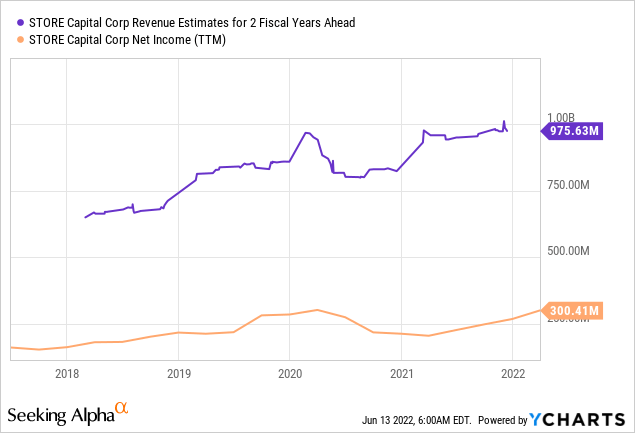

As of the full year 2021, STORE Capital Generated $783 million in revenue with the majority of this coming directly from rentals, this was up 12% year over year. While total expenses came in at $564 million, which increased at a similar rate, 11% year over year. For the first quarter of 2022, STORE Capital beat Wall Street expectations, with adjusted Funds from Operations [FFO] per share of $0.57 vs. $0.52 average analyst estimate, this was up slightly from $0.56 in Q4 2021 and up substantially from $0.47 in Q1 2021.

First Quarter total revenue was $222.1M, which beat consensus estimates of $212.1M and was higher than the $209.2M achieved in the prior quarter. The company has raised its guidance for the rest of 2022 and forecasts adjusted FFO per share of $2.20-$2.23 up from the prior range of $2.18-$2.22.

According to the CEO, Mary Fedewa:

“As we moved into 2022, we leveraged the momentum we built in 2021 and closed $513M of diverse and granular investments in profit center real estate, which was a record first quarter for us”

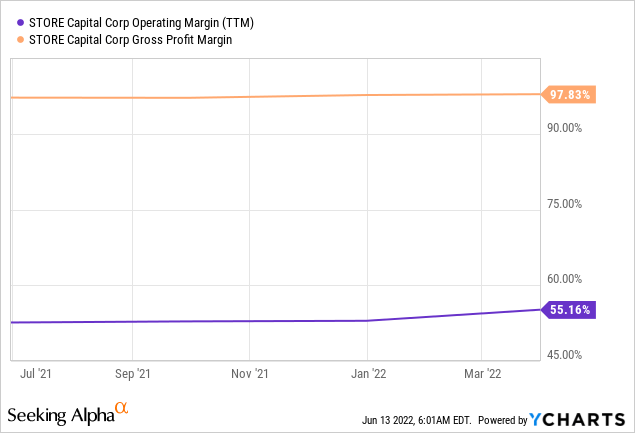

They sold 11 properties in the first quarter, which gave them a net gain of $6.1M. The company operates with a very high gross margin of 97% and operating margin of 52%.

Their balance sheet for Q122 shows $9.2 billion in real estate investments and $39.3 million in cash, which is less than the $166 million in 2020 However, a low cash position does make sense, as REITs are legally required to pay out at least 90% of their taxable income to shareholders as dividends each year.

In terms of debt they have $1.7 billion in unsecured notes and $2.4 billion in non recourse debt obligations. The company operates with a fixed-charge coverage ratio (FCCR) of 4X. This is very positive as FCCR is a measure of a firm’s ability to cover its fixed charges, such as debt payments, interest expense, and equipment lease expense.

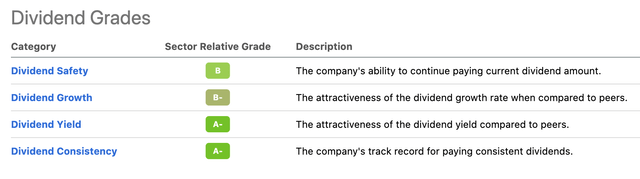

They currently pay a monster 5.84% dividend which is A- grade according to Seeking alpha. They also have achieved an A- grade for dividend Consistency and B- for Dividend after 7+ years of growth.

Dividend Grades (Seeking Alpha)

Fair Valuation

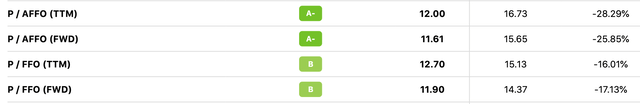

The Price to Funds from operations (P/FFO) ratio is 12, which is cheaper than the sector median of 16.73, while the adjusted price to Funds from operations (P/AFFO) is 12.7, which is also lower than the sector median of 15.13.

Price to Funds from operations (Store Capital)

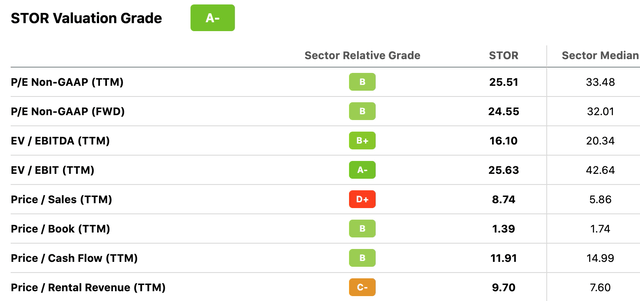

The Seeking Alpha Valuation Grade is also at A- for STORE Capital at the time of writing.

Risks

Brick and Mortar Uncertainty

The future of brick and mortar retail locations has been uncertain for many years and this was accelerated by the lockdown of 2020. Ecommerce has a 20.4% penetration rate according to a Digital Commerce 360 and the industry grew 9.2% in Q421. Thus many Brick and Mortar retail locations are being disrupted by online businesses. STORE Capital does try to mitigate many of these industry risks by focusing on Manufacturing (24% of rental value) and “Service Oriented” businesses. Their largest customer is “Spring Education Group” is a chain of private pre schools, these are very unlikely to be completely disrupted by online technology, even with Zoom classes. However, AMC is a top 10 customer which has undergone many issues in the past due to declining movie theatre visits. This was a highly shorted stock in the past and the target of a very public short squeeze. The good news is this chain makes up just 1.2% of their rental income.

High Inflation

The annual inflation rate in the US unexpectedly accelerated to 8.6% in May 2022, after a short decline to 8.3% in April. Inflation increases input costs for businesses such as materials and squeezes the consumer with higher food and electricity costs. STORE Capital’s customers/tenants and their Brick and Mortar retail locations have a higher cost structure than online competitors, which makes them more vulnerable to supply chain issues and inflation.

Low Industry growth

STORE Capital has a large portion of customers which are unlikely to be disrupted by Ecommerce growth. However, their selected customers are also not really benefiting from new industry growth trends such as what you would see with a Data Center REIT (see my other posts).

Final Thoughts

STORE Capital is a tremendous REIT which gives investors exposure to a diverse range of service retail and manufacturing locations. They pay a healthy 5.8% dividend, which is expected to be stable and even grow. The stock is the 2nd cheapest in the industry and on an EV to EBITDA multiple basis. The only major risks seem to be the headwinds from online shopping and food delivery, which may cause a decline in the value of the properties long term. But apart from that, this stock looks like a great one for long term income investors.

Be the first to comment