xtrekx/iStock via Getty Images

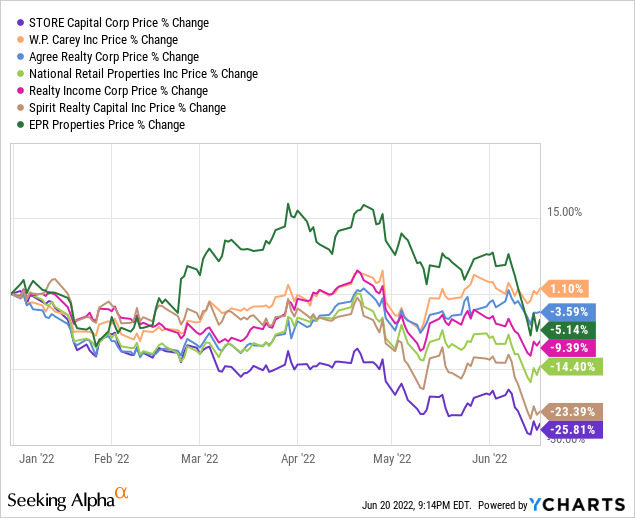

The bears are out in full force in the current market and REIT’s of all shapes and sizes have been thoroughly beat up. In the net lease sector, one name has been disproportionately hammered far greater than nearly all others, this name is STORE Capital Corp. (NYSE:STOR).

In this article, I would like to discuss why I believe the current market perception around STORE is misguided and why I believe shares, at current levels, present a compelling opportunity for long term shareholders.

Overview

I am certainly not breaking any news by stating that the markets in 2022 have not been kind to most stocks, real estate names included. STORE Capital, which operates in the triple net lease segment of the real estate market, has had a horrific year thus far and has fared much worse than nearly all of its net lease peers so far in 2022.

The reasons for this outsized decline in share price, in my opinion, has been rooted in three factors, the first of which was the departure of co-founder Christopher Volk as chairman of the board on December 28th 2021.

Mr. Volk holds a cult like following among long time STORE investors for his open communication and excellent execution during his tenure as CEO of STORE Capital, he has even authored a few articles here on Seeking Alpha which I personally enjoyed. His rather abrupt departure as chairman started the rumor mill churning almost immediately with investors surmising that something nefarious had occurred inside STORE.

In the months that have followed and with two extremely positive earnings calls under the company’s belt since his departure, nothing of any substance has surfaced to imply anything other than the company felt that they were well positioned to move on without carrying Mr. Volk’s sizable compensation package on the expense line.

CEO Mary Fedewa, who is also a co-founder of the company, appears to be very well qualified and a highly capable leader and while Mr. Volk will certainly be missed and the departure is likely to resonate for a while longer with the investor base, the transition of Mrs. Fedewa to the CEO role was, by Mr. Volk’s own words, “many years in the making” and by all accounts, the company is in very good hands going forward.

Macro-Economic Worries And Misperceptions

The second two concerns that the market has punished STORE with have been in regards to the company’s tenant quality and interest rate sensitivity. While net lease peers have been punished across the board, STORE has been kicked like a mule in comparison.

What makes STORE a bit unique is that they covet a specific niche of the triple net lease space that is usually in the range of $8-12 million per location. In addition, the company targets tenants that, for the most part, are not publicly traded and are not considered investment grade.

For some reason, the market appears to have chosen to go off the deep end in thinking about STORE’s tenants. The way the stock has nosedived, you would think that the company only rents to family video stores and pool halls.

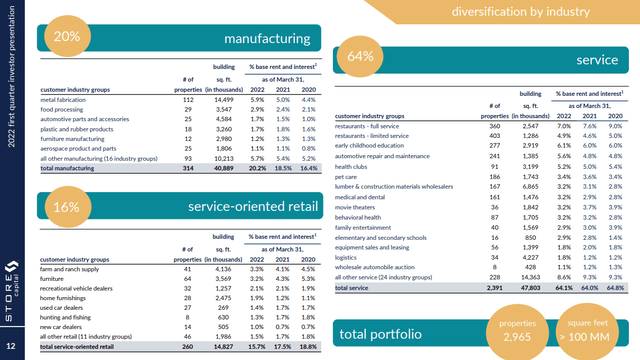

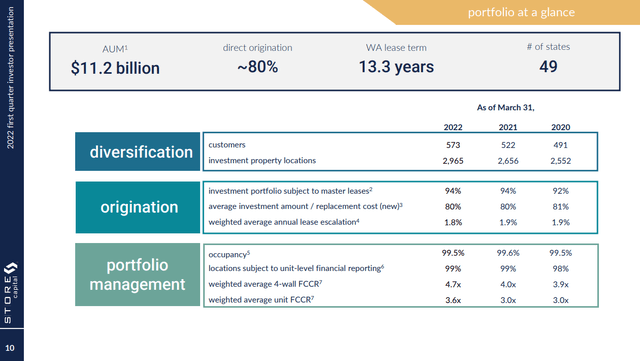

That sentiment, as you can see, is nowhere near the truth. The company has an extremely diverse set of tenants that span manufacturing, service and retail, with the greatest reliance placed on restaurants 11.9%, early childhood education 6.1% and metal fabrication 5.9%. These are not exactly segments of the economy that are likely to evaporate anytime soon.

In addition, the company focuses its portfolio on profit centers. This means that STORE actively looks to purchase and lease back only the locations that the underlying businesses simply cannot do without.

Tenant Financial Health

The focus on building a profit center portfolio has positioned STORE, in my opinion, as one of the more stable bets in the entire triple net lease space, even considering the lack of investment grade for a large portion of its tenants. One of the main reasons why is the in depth underwriting that the company does prior to signing a deal.

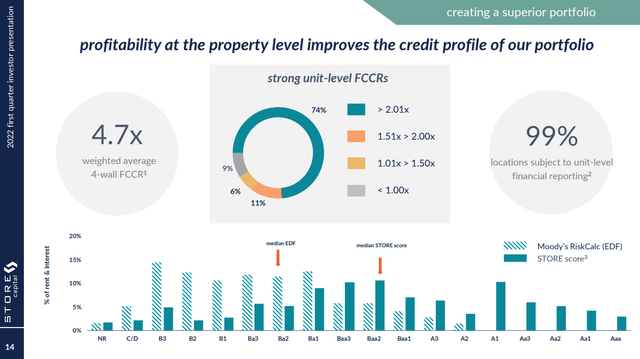

As you can see from the above slide, the company has a vastly different opinion of its own credit risk than the good people at Moody’s give them credit for. STORE calculates the risk of its portfolio based on unit level profitability, with the assumption that a tenant would rather cut off its own arm, than to give up a highly profitable location.

The median Moody’s risk score of STORE’s tenants is Ba2, just below investment grade, but taking into account the profit center focused “STORE score”, this raises the company’s internal risk calculation to that of Baa2, which is considered an investment grade rating.

In addition, its tenants have been performing remarkably well heading into the potential recession with dramatically improving unit level financials.

As you can see, the weighted average fixed charge coverage ratio (FCCR), which is a metric used to calculate the ability of a company to cover its fixed obligations such as lease costs and interest expenses has risen at a pronounced rate so far in 2022 from the lows set in 2020.

For reference, a fixed charge coverage ratio of over 2, indicates solid financial health, 1.5 to 2 indicates stability and below 1 means that the company is struggling to pay its fixed costs.

STORE as of March 31st, had 9% of its locations with below a 1 FCCR. A majority of these tenants are likely to be in the movie theater and health club sectors, these are sectors that nearly all of the company’s peers have as much, or more exposure in than STORE. While 9% is certainly nothing to sneeze at, it is far from the apocalyptic state that the markets current valuation assigned would have you believe.

Interest Rate Risk

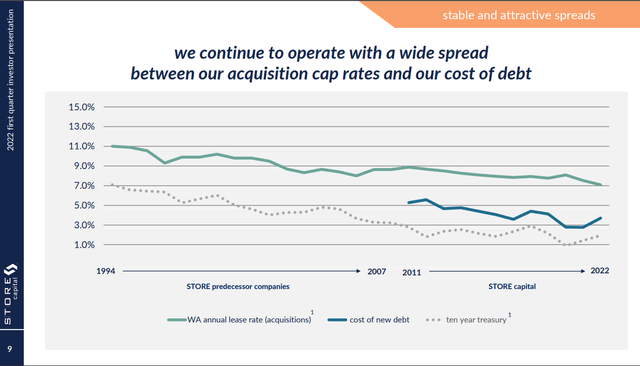

The stock market, of late, appears to also believe that STORE is more at risk due to rising interest rates that many of its brethren. I find this sentiment to be misguided given STORE’s very healthy balance sheet and its historic dramatic CAP rate spreads earned.

It is certainly true that higher interest rates will lead to increased cost of debt, this is unavoidable, however, CAP rates are not static and have already begun to rise in response to rising interest rates as CEO Mary Fedewa stated on the Q1 earnings call.

We believe cap rates have bottomed. And we are currently seeing upward movement of approximately 25 basis points, which we should see the benefit of in the second half of the year.

Second, we are currently negotiating rent escalations on new opportunities in the range of 2.25% to 2.5% a year, up from about 2%. We anticipate seeing this in the contracts we fund in the second half of the year.

Now, CAP rates do generally need time to adjust, so it is highly likely that acquisitions during this period of rapidly rising rates may have a narrower spread, however you really must think about the business model of a purchase, leaseback transaction to see that the company is quite well positioned.

STORE is specifically built to reduce its tenant’s cost of capital and the product that they provide is actually more attractive in a rising rate environment given the tenant profile that the company focuses on is not investment grade. The company is in a terrific position to ask for ever increasing CAP rates and or yearly increases given the value proposition that they bring to the table.

In my opinion, STORE is in a better position to increase CAP rates than many of its peers given that funding for investment grade tenants tends to stay open, even during recessions, whereas STORE’s clientele is presented with dwindling sources of funding, giving the company a stronger negotiating position than its peers in the net lease sector.

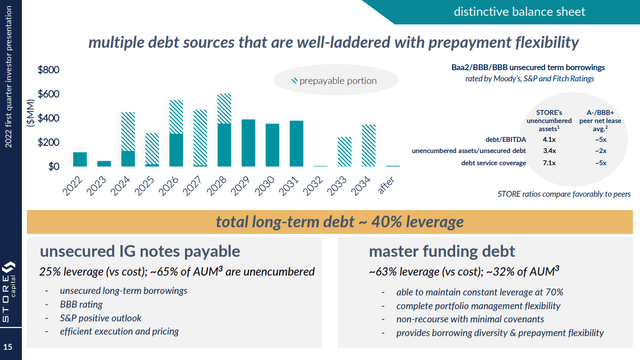

STORE’s weighted average interest rate is currently 3.9%, much improved from the 4.2% of 2021 and this is thanks in large part to the proactive management of the company to take advantage of low interest rates to prepay large portions of higher interest debt. A nice example of this was highlighted by the CFO Sherry Rexroad on the Q1 call.

Subsequent to quarter-end, we entered into $600 million of unsecured floating rate bank term loans, including a $400 million 5-year loan and a $200 million 7-year loan, which complements our debt maturity schedule. We also entered into interest rate swap agreements, which effectively convert the floating rates on this debt to an attractive weighted average fixed rate of 3.68%.

We used the proceeds from this debt transaction to prepay, without penalty, $134 million in STORE Master Funding notes that had a coupon of 5%, generating annual interest savings of $1.8 million. We also paid down the outstanding borrowings on our revolving credit facility, with the remainder to be used for growth.

This type of proactive financial management is key to STORE’s success and has left the company’s debt maturity profile in great shape with multiple options for prepayment, should a window of opportunity arise to do so.

The key takeaway from this section is that in my opinion, the company is certainly not in any greater danger than others in the net lease category and in fact, may end up, once rates stabilize, with an opportunity to widen its CAP rate, cost of debt spread given the greater benefit that it provides to its tenants during this time period.

Bottom Line

In my opinion, the market is acting irrationally in punishing STORE Capital much more than its peers in the net lease segment. Is this environment an ideal one for the company? No, it certainly is not, however the punishment doled out by the market of late is simply obscene.

Given the company’s focus on profit centers and its vast diversification across industries and geography, along with the increased value add that the company provides to its customers during this period, in my opinion, STORE has entered “no brainer” territory for long term focused investors.

The company currently yields a whopping 6.03% with only a 70% FFO payout ratio. In addition, over time, I see no reason for the company not to revert to its historic 16 P/FFO ratio valuation. This valuation currently stands at a paltry 11.78 times 2022 estimates.

Given the current yield of over 6% and the expected long-term growth in FFO of 5.5%, investors can potentially lock in 11.5% yearly returns going forward even without a reversion to historic valuations. Returns like that tend to get my attention rather quickly and I am currently buying as much as I can stomach at current levels.

Please let me know your thoughts in the comment section below. Thank you for reading and good luck to all!

Be the first to comment