tifonimages/iStock via Getty Images

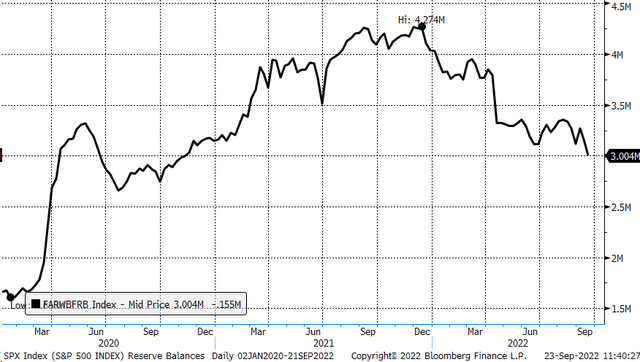

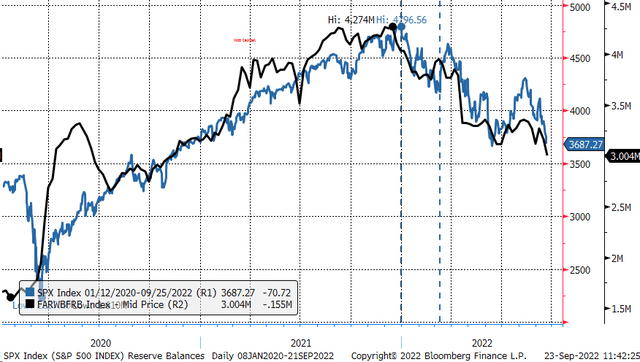

Liquidity in the market is draining faster than a pool at the end of the summer. The Federal Reserve balance sheet is in decline. Reserve balances have fallen to their lowest levels in this cycle, to just $3 trillion as reverse repurchase (repo) agreements and the Treasury general account rise.

Based on historical trends, changes in reserve balances appear to have a positive or negative impact on the S&P 500 and the stock market in general. The significant drop in reserve balance, and a new low for this cycle, are likely to weigh heavily on stocks.

This week, the Fed’s balance sheet fell by around $16 billion to $8.867 trillion from $8.883 trillion last week. The decline in the total size of the balance sheet was due to the roll-off of Treasury bills and notes. But ultimately, the big hit to reserve balances came from total reverse repo activity, which increased to $2.61 trillion from $2.52 trillion. Additionally, Deposits with Federal Reserve Banks other than reserve balances rose to $907.9 billion from $851.1 billion. These items act as liabilities, and when liabilities rise, the total reserve balances drop, and this week it fell to $3.00 trillion from roughly $3.16 trillion last week.

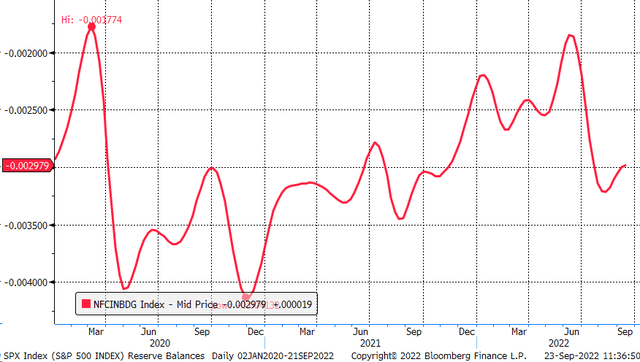

On top of reserve balances falling, conditions around margin and leverage tightened this week, as measured by the Chicago Fed National Financial condition index. Tighter financial conditions around margin also drain liquidity from the market as margin becomes less available.

The falling levels of reserves and tighter financial conditions are certainly a significant issue for markets, with an S&P 500 falling sharply this past week and on the cusp of making new lows.

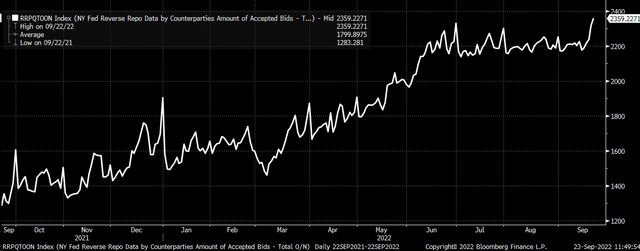

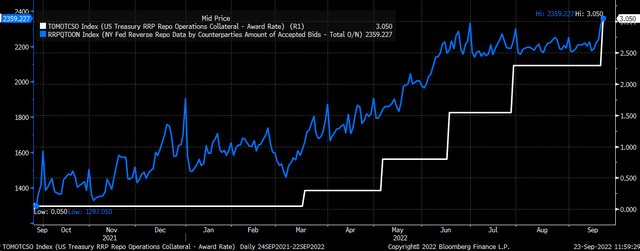

The most significant reason reserve balances fell sharply is the increased usage of the reverse repo facility into quarter end. The facility saw record usage on September 22, reaching $2.36 trillion. It is possible that the usage of this facility can still increase during the week of September 26. That will work to reduce reserves further if everything else remains unchanged.

Another reason we may see increased usage of the reverse repo facility rise is that the Fed just gave the market a raise. The Fed raised rates by an additional 75 bps at its September FOMC meeting on September 21, which pushed the interest rate on the facility to 3.05% from 2.3%. Most of the money that goes into repos is from money market accounts. With a rate of 3.05% and the stock market going down, one has to wonder if more money will continue to pile into the reverse repo facility even after quarter end. It just isn’t clear at this point.

Whatever the case, falling reserve balances remain a significant problem for markets. As long reserve balances continue to decline, the markets will continue to struggle significantly.

Join Reading The Markets Risk-Free With A Two-Week Trial!

(*The Free Trial offer is not available in the App store)

See why Reading The Markets has been one of the fastest-growing Seeking Alpha marketplace services in 2022.

Reading the Markets helps readers cut through all the noise by delivering stock ideas and market updates.

Be the first to comment