Samuel Corum/Getty Images News

I have received a number of messages over the past few weeks along the lines of the following; ‘if low rates did not justify the bull market, as you have previously claimed, do you think that rising rates justify the recent crash’. This is a very complicated question, and I will answer it here.

The Theory Does Not Match The Evidence

The key point I have been making over the past few years is that interest rates are just one of many factors that drive equity valuations. In theory, low real rates raise the present value of future cash flows and should support higher stock valuations. For any given level of future earnings and dividends, the lower the rate of interest, the higher the price that investors should be willing to pay for them. However, the reality is that there is simply no correlation between U.S. equity valuations and interest rates.

Extremely High Real Yields Did Not Prevent The Late-1990s Bubble

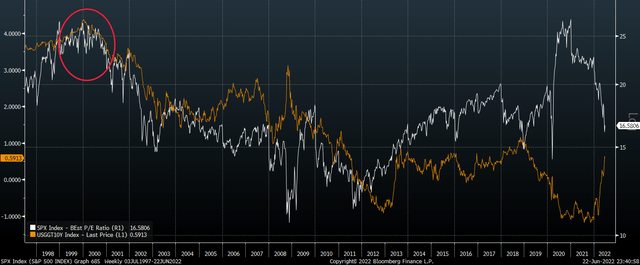

SPX Forward PE Ratio Vs 10-Year Inflation-Linked Bond Yields (Bloomberg)

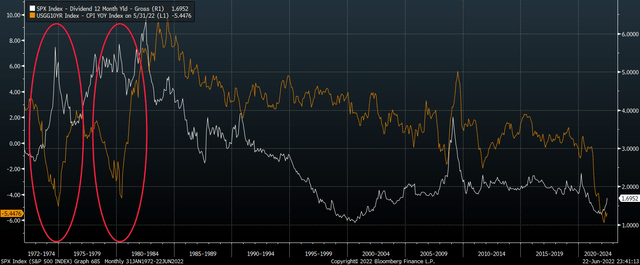

In fact, some of the highest real interest rates in U.S. history have occurred alongside the most expensive stock valuations, and vice versa. As the above chart shows, at the 2000 bubble peak, 10-year inflation-linked bonds (the difference between 10-year nominal rates and 10-year inflation expectations, which is a more forward-looking measure of real bond yields than those that are based on trailing CPI) were a whopping 4.4%. This did not stop SPX valuations from reaching record highs. Conversely, in 1975 and 1980 real yields were deeply negative yet equity valuations were extremely cheap as shown below.

Extremely Low Real Yields Did Not Prevent The 1975 And 1980 Crashes

SPX Dividend Yield Vs Spread of 10-Year UST Over CPI (Bloomberg)

Markets Move And Then The Narrative Follows

This should be all the proof one needs to understand that there are many more important factors at play impacting equity valuations than the cost of capital. The truth is that at any given time, stock valuations are driven primarily by speculative sentiment rather than fundamentals such as interest rates. Market valuations move up and down, and speculators, analysts, and pundits look for convenient narratives to explain them.

Take the late-1990s bull market, for instance. The extremely tight monetary conditions at the time undoubtedly encouraged long-term value-focused investors to sell stocks in favor of bonds, but speculators continued to drive up stock valuations to record levels regardless. As stock valuations rose, bullish speculative interest was reinforced, and a need arose to justify such extreme valuations. The dominant narrative at the time became that strong growth justified the rally, despite the existence of high real interest rates.

I wrote about this phenomenon of ex-post justification in ‘Faith In The Fed’s Ability To Support Stocks Is Unfounded‘ with regards to the widespread attempts to justify the post-Covid rally. My contention is that the period of low real yields seen in 2020-2021 was not the primary reason for the record price that speculators became willing to pay for expected future earnings. Self-reinforcing speculative buying was the main driver. As stock prices rose, the narrative that low rates justified such a rally was strengthened, encouraging further speculative buying.

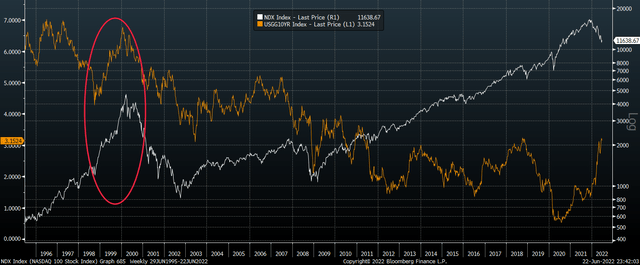

To be sure, while some long-term investors were undoubtedly encouraged to buy stocks relative to bonds due to low real yields, adding fuel to the fire, and the Fed could and should have hiked rates to dissuade such buying, there is little reason to believe that had they done so the bubble would not have occurred. We only have to look back to the late-1990s bubble to see how aggressive tightening measures failed to prevent the continuation of a market bubble. 10-year U.S. yields rose 250bps to 6.7% from October 1998 to March 2000 and the SPX rose 50% over the same period, while the Nasdaq 100 saw a staggering fourfold increase.

Nasdaq Rose 4x Amid Aggressive Fed Tightening In The Late-1990s

Nasdaq 100 Vs 10-Year UST Yields (Bloomberg)

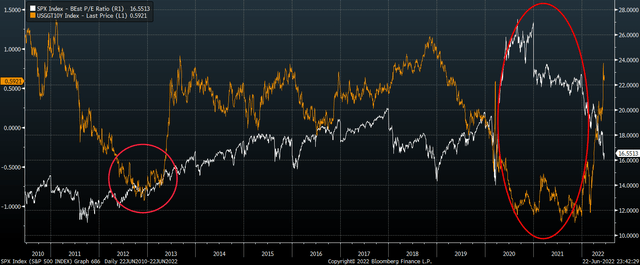

Had U.S. stock valuations remained low following the Covid crash, the narrative would have likely been that weak growth and financial instability risks justified cheap valuations, as was the case in 2012. Back then, 10-year real bond yields were just as low back then as they were in 2020-2021, yet SPX valuations were 30-40% lower than they were in 2020/21.

Real Yields Were Also Deeply Negative In 2012 But SPX Was Much Cheaper

SPX Forward PE Ratio Vs 10-Year Inflation-Linked Bond Yields (Bloomberg)

The Current Bear Market Is An Inevitable Consequence Of The Prior Bubble

Back to the question at hand; does the tightening of Fed policy justify the recent market crash? I believe that the market crash is largely a consequence of the bubble that preceded it, as the speculative excesses that built up during the bull market made such an event inevitable. That said, Fed tightening is certainly not helping matters. We now have a situation where speculators are rushing for the exits as their faith in the Fed’s ability to prevent a market crash evaporates, while at the same time long-term investors are being discouraged from buying stocks due to the rising cost of capital, despite higher long-term return prospects that cheaper valuations imply. While real yields remain deeply negative when using trailing CPI, forward-looking 10-year inflation-linked bond yields have risen significantly.

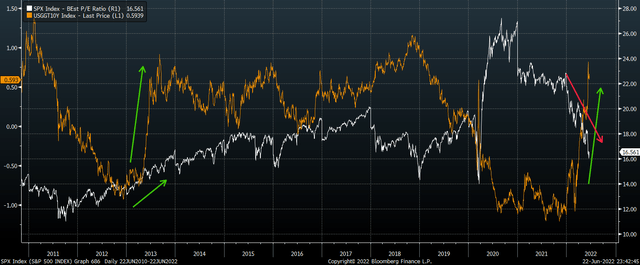

2013 Taper Tantrum Occurred Alongside Rising SPX Valuations

SPX Forward PE Ratio Vs 10-Year Inflation-Linked Bond Yields (Bloomberg)

To be clear, such a rise in real yields on its own would not be of particular concern. As the above chart shows, we saw a similarly large move in real yields in 2013, with 10-year real yields spiking above current levels, yet equity valuations continued to rise. The key difference now is that the market is in a clear downtrend and valuations remain significantly higher than back then. With this in mind, we are likely to see more selling until a capitulation event has occurred. Based on the relatively low level of the VIX, it seems that we are nowhere near such a point.

Be the first to comment