sefa ozel

We saw a strong run-up in the stock market from the mid-June bottom to the recent top in August. The S&P 500/SPX (SP500) skyrocketed by approximately 19% in these two months, one percent shy of kicking off a new bull market. However, reality set in just as I published my recent “Next Drop Is Coming” article. Despite the powerful countertrend rally, we have not seen the hallmark signs of a sustainable bottom. Moreover, stock valuations remain relatively high, and we have not seen anything resembling a great reset. Furthermore, inflation remains sky-high, and the Fed is tightening monetary conditions. Finally, the stock market probably underestimates the seriousness of the inflation dilemma and the Fed’s commitment to bringing back price stability.

Jerome Powell used powerful words in his Jackson Hole Symposium remarks. The Fed chair talked about using the Fed’s tools forcefully. He also mentioned that a sustained period of below-trend growth would likely be required to resolve the inflation problem. Powell also noted that labor market conditions would probably be softening. Finally, the Fed Chair delivered a statement confirming that the dynamic of high-interest rates, slower growth, and a worsening labor market will bring pain to households and businesses. The stock market reacted, and it was not pretty. The DJIA dropped by 1,000 points, the SPX fell by 3.4%, and the Nasdaq tumbled by 4% in Friday’s session.

Inflation is so high and detrimental to the economy that the Fed is prepared to sacrifice growth and a strong labor market to bring down inflation. The Fed will likely implement restrictive and tightening monetary policy for longer than anticipated. However, the economy already is in a recession, and the downturn could run significantly longer and cut substantially deeper than previously expected. Moreover, consumer spending, corporate profits, and other crucial elements of the economy could continue crumbling in the coming quarters. Meanwhile, stock valuations appear disconnected from economic reality, and there will likely be more pain ahead. The stock market could experience considerable downside in the months ahead, and the S&P 500 may find its ultimate bear market bottom at around 3,000, approximately 25% below current levels.

Technicals – Continue To Deteriorate

The SPX 1-Year

SPX (StockCharts.com )

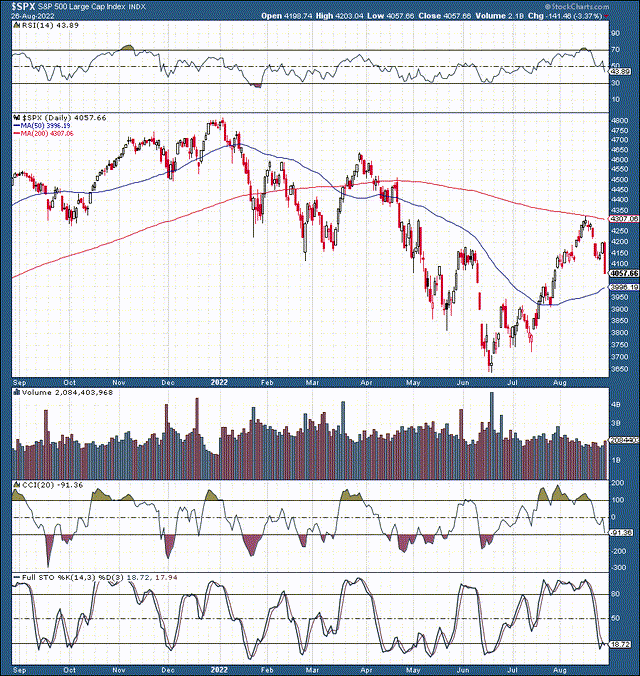

We saw a strong rally off the mid-June bottom we discussed in this Marketplace Prophet Report. The rally has been substantial, running 19%, just shy of entering a new bull market phase. However, since the top in mid August, the technical image has worsened considerably. We see the top out around critical resistance at 4,300-4,330, coinciding with the 200-day MA and the 19%-20% mark (off the bottom gain). Then, we see a failed attempt to move higher after the top and a possible right shoulder forming in a bearish head and shoulders formation. The neckline is around 4,000, roughly coinciding with the 50-day MA, and if the SPX falls below this crucial support point, selling could accelerate, and the SPX could decline substantially in the coming weeks.

The general longer-term trend remains lower still. We see a series of lower highs and lower lows since the stock market entered an official bear market at the beginning of this year. The most recent lower high occurred at around 4,300, and the next lower low could occur at approximately 3,400 – 3,000, roughly 15%-25% below current levels.

Several Troubling Statements From Powell

The market did not expect Jerome Powell and the Fed to be this hawkish. The market looked for signs of a more dovish and accommodative Fed policy. Perhaps more importantly, the market looked for hints of a pivot. Instead, investors got a rude awakening as Jerome Powell came out with his guns blazing to fight inflation at the expense of everything else. Several phrases were particularly hawkish, so let’s examine what the Fed Chair said.

- Price stability over full employment – While the economy’s employment dynamic is relatively robust now, it probably will not remain so for long. Constructive nonfarm payroll reports have been the backbone of solid economic readings in recent months. Despite the slowdown in specific pockets of the economy, the unemployment rate is relatively low, and companies continue hiring. Unfortunately, as the Fed strives to cut down inflation and bring back price stability, the employment image will probably worsen in future quarters. As the Fed increases rates, the slowdown should intensify, and we should see companies cut back on hiring. Moreover, workforces could decrease, leading to worse-than-anticipated labor statistics, nonfarm payroll reports, and a much higher unemployment rate. A worsening labor market typically reflects poorly on stock market performance, and we could see considerable weakness in stock in the coming months.

- A sustained period of below-trend growth – Powell mentioned a sustained period of below-trend growth. Currently, the economy is in a recession. However, the market is likely pricing in a short and shallow recession. Considering the Fed’s hawkish statement, the economy may stay in a recession longer than expected. Moreover, due to the considerable slowdown, the recession may be much deeper than the market anticipates now. Therefore, we will likely need more valuation adjustments to account for the extended period of “below-trend growth” we may see ahead.

- Another “unusually large” rate increase – Powell mentioned another unusually large rate increase being needed at the September FOMC event, implying that another 75 basis point move is probable. This rate increase will put the benchmark above 3%, a significant level that should seriously impact growth. The benchmark has not been above 3% for a long time. In 2018, the Fed elevated rates to a similar level, which caused a significant slowdown, and the economy almost went into recession. This time, the economy is already in a recession, and further tightening could cause considerable damage to consumer spending, corporate profits, and the stock market.

Rate Probabilities

Fed Watch (CMEGroup.com )

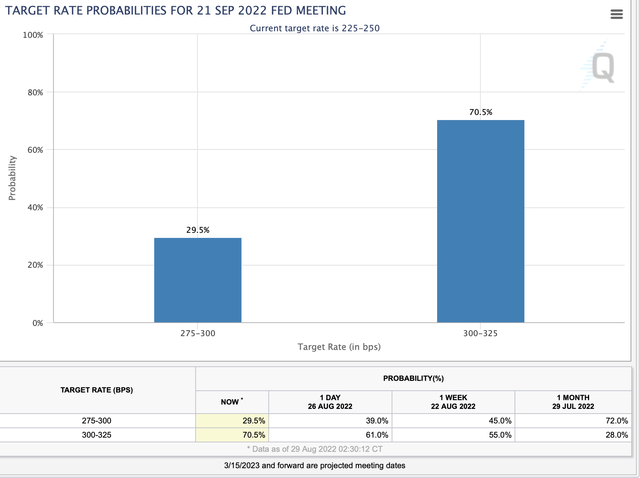

There’s a 70.5% probability of a 75 basis point hike at the September FOMC meeting. About a month ago, there was only a 28% chance of a 75 basis point move. Therefore, we see the Fed’s hawkish momentum is gaining here, and higher interest rates for longer are a negative catalyst for stocks.

Higher interest rates, lower growth, and a worsening labor market will bring pain to households and businesses.

Higher interest rates will increase borrowing costs, worsening consumer sentiment and confidence, impacting the ability to spend. Higher interest rates also will increase business borrowing costs, affecting the ability to grow, expand, invest, and pay down debt. Higher rates and slower growth also equate to less hiring and more firing, leading to a higher unemployment rate and less economic activity.

Pain to households means consumers are pressured due to inflation and an economic slowdown. Pain to businesses boils down to worsening margins and less profitability because of inflation and slower economic growth. The Fed’s objective of achieving price stability entails bringing inflation back down to 2%. The Fed will either accomplish its goal or reconsider the “appropriate/target inflation rate.” However, the path of fighting inflation is not going to be an easy or quick one. Therefore, the market can forget about a policy “pivot.” Therefore, there will be more pain and the stock market will likely see fresh bear market lows in the fall.

The Inflation Snapshot

CPI inflation (TradingEconomics.com )

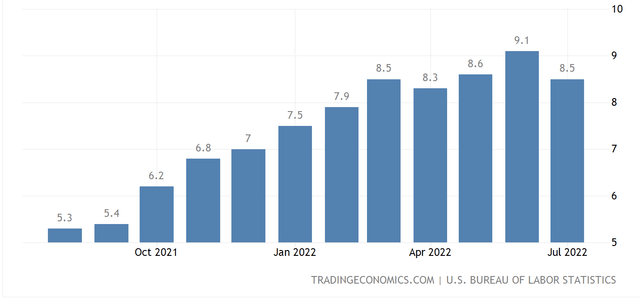

The CPI has surged to its highest point in decades, reaching levels not seen since the 1980s. Moreover, inflation is not just elevated. It’s high, floating around 8%-9%. The economy has not witnessed a similar inflation dynamic in a very long time. A few rate hikes and the benchmark at 3% will not solve the inflation issue. During the height of the inflation mess in the 1980s, the Fed jacked the funds rate up to 15-20%. Of course, in today’s world, 15%-20% is not likely, but the Fed could continue raising the benchmark rate to 4%-5%. A 4%-5% Fed funds rate is unprecedented in the post-financial crisis ultra-low rate environment. Therefore, we could see substantial weakness in stocks as the Fed continues raising interest rates to combat inflation.

Valuations – Still Too High

S&P 500 Shiller P/E Ratio

Shiller P/E ratio (multpl.com )

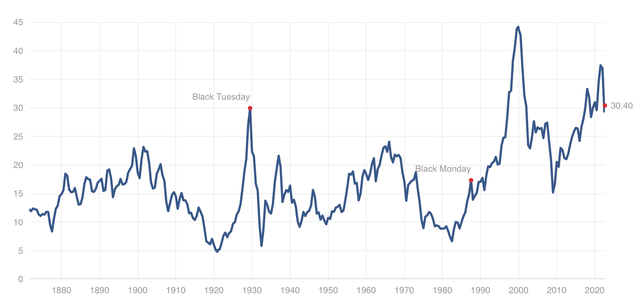

The CAPE ratio is still above 30, which is relatively high. The CAPE ratio climbed to its second highest level ever during the recent bull market (37-38), eclipsed only by the wild days of the dot-com bubble in 2000. While we’ve seen a correction in P/E ratios, it’s unlikely that we’ve seen the reset the market needs to begin a new uptrend.

Another factor to consider is that we’re no longer in an easy monetary environment. On the contrary, the Fed is raising interest rates and implementing QT. Moreover, the Fed should continue tightening monetary conditions as we advance. Furthermore, if the Fed showed us anything during the Jackson Hole Symposium, it’s that the Federal Reserve is remarkably hawkish. The Fed is prepared to sacrifice economic growth, the labor market, and near-term stock market performance to bring back price stability.

Therefore, we could see P/E ratios contract substantially as we advance. The historic mean Shiller P/E ratio is around 17, roughly 43% below its current level. We may not see the SPX drop to 2,300 (43% below current levels). Nevertheless, we should consider the probability of more downside in equity markets. Also, we should consider the likelihood of more downward earnings revisions and earnings declines in the coming quarters. Therefore, there is a high probability that the S&P 500 will go lower. My SPX bear market bottom target is 3,000, approximately 25% below current levels.

My Six Point Plan

- Increase my cash (dry powder) position

- Decrease “riskier” high multiple holdings

- Rotate to safer sectors (i.e., staples, healthcare, other)

- Diversify into precious metals and specific bond instruments

- Hedge (covered call, collar, put options, other)

- Reenter high-quality stocks at lower levels

Be the first to comment