Anchiy/E+ via Getty Images

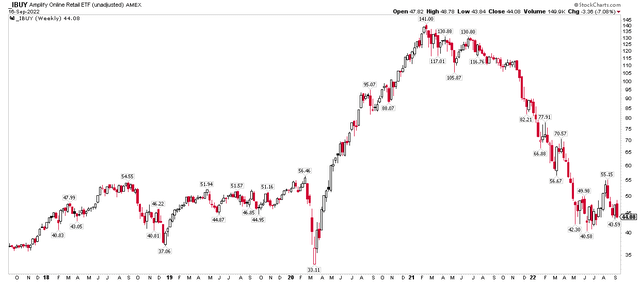

Online retail has more than completed a round trip of its Covid rally. The Amplify Online Retail ETF (IBUY) was $56 in early 2020 then cratered to $33 before the stay-at-home saga helped send online retailers to the moon.

IBUY peaked with many growth and speculative assets in early 2021 at $141. The fund then endured a stunning 71% drawdown to its June 2022 low. Unfortunately, the bounce since then has been weak. One online retailer reports results early this week and has been one of the poster children for the rise and fall of buying goods with just a swipe of a finger.

Online Retail ETF: Moving Back Toward the June Lows

According to Fidelity Investments, Stitch Fix, Inc. (NASDAQ:SFIX) sells a range of apparel, shoes, and accessories through its website and mobile application in the United States. It offers denim, dresses, blouses, skirts, shoes, jewelry, and handbags for men, women, and kids under the Stitch Fix brand. The company was formerly known as rack habit inc. and changed its name to Stitch Fix, Inc. in October 2011.

The California-based $533 million market cap Internet & Direct Marketing Retail industry company within the Consumer Discretionary sector has negative GAAP earnings over the past 12 months and does not pay a dividend, according to The Wall Street Journal. Importantly ahead of earnings this week, the stock has a massive 24.7% short float.

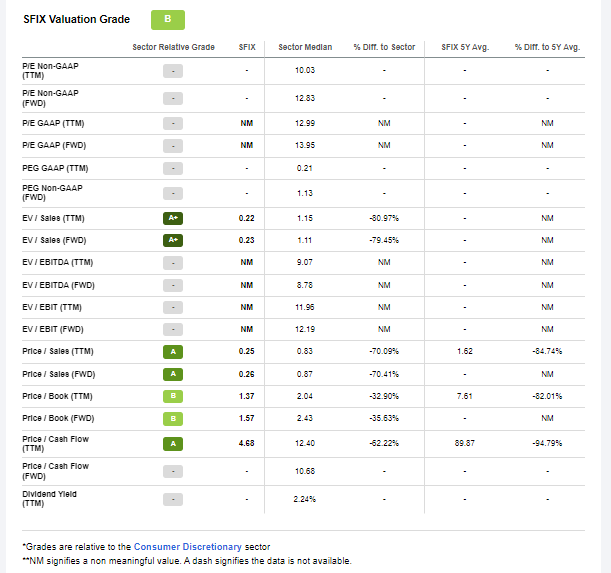

On valuation, Seeking Alpha has an overall B rating, but I am not so sanguine given Stitch Fix’s negative profits over the last year. While its sales multiples are low, the market demands near-term profits and free cash flow currently. Without bottom-line profits and low growth prospects for now, long-term value investors should stay away. I do see a near-term opportunity, though.

Stitch Fix Valuation Summary: Bearish Under the Surface

Seeking Alpha

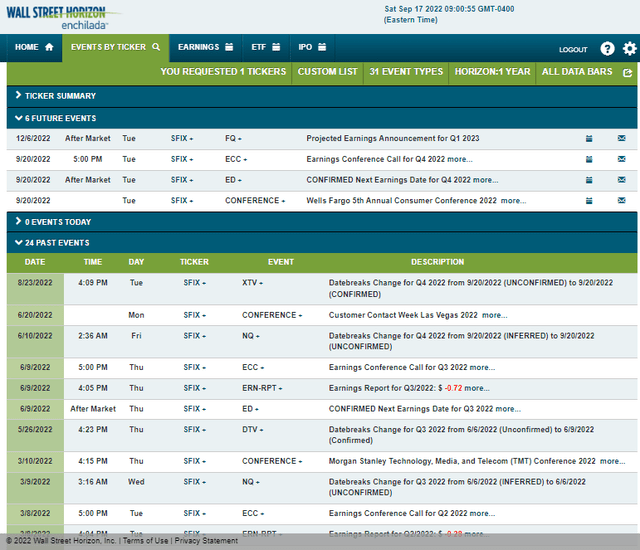

Stitch Fix’s corporate event calendar is busy this week. Data from Wall Street Horizon show that investors should expect volatility on Tuesday when two key events happen. First, Alexandra Viski-Hanka, IR Manager, and Hayden Blair are scheduled to speak at the Wells Fargo 5th Annual Consumer Conference which begins on the 20th. Then comes SFIX’s Q4 2022 earnings announcement Tuesday AMC and a conference call to follow. You can listen live here.

Corporate Event Calendar

The Options Angle

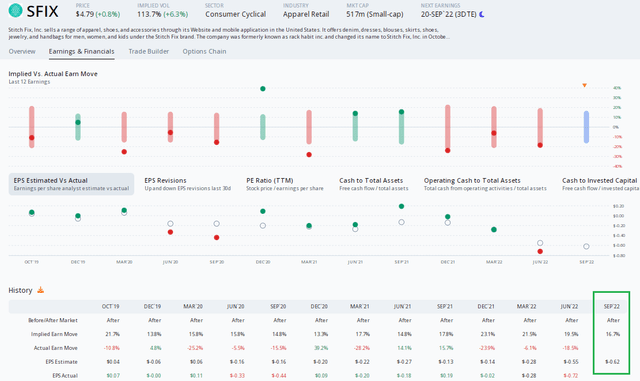

Digging into the earnings report Tuesday AMC, data from Option Research & Technology Services (ORATS) show a consensus EPS estimate of $-0.62 which would be a sharp decline from the same quarter last year. ORATS also reports that there has been one net downgrade of the stock since the prior quarterly report.

This is one of the biggest implied stock price moves I have seen recently. Options traders currently price in a massive 16.7% share price swing post-earnings using the nearest-expiring at-the-money straddle.

That big implied move is not surprising since the stock has routinely gone up or down 10% or more over the last three years of earning reports. SFIX has moved lower in each of the previous three reporting periods. Options are expensive here, so I would rather play the stock itself.

A Huge Post-Earnings Price Change Expected

The Technical Take

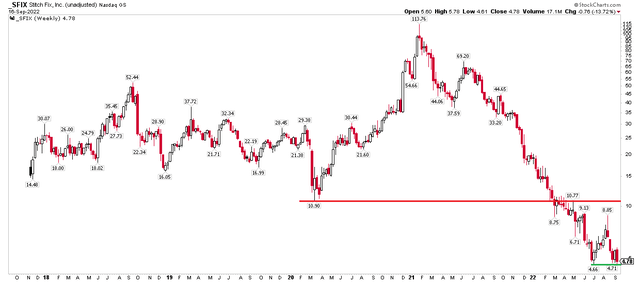

So what does the chart say about where SFIX may go post-earnings? I actually think a bullish risk/reward shapes up right now, so long as the stock is above $4.66.

Shares have found support on a few tests of the $4.66 to $4.71 range since early July. Will it keep holding? Perhaps not, but traders can book possible small losses for the chance of a big gain around earnings. I think being long shares with a stop under $4.60 makes sense. That big short interest could be a technical catalyst for a sizable move higher. With expensive options, I’m hesitant to suggest buying calls.

There’s resistance in the $10 to $11 range from the early 2020 low and the range highs from the first half of this year. A stock price double is a lot to ask for, so perhaps a near-term target in the upper $5s to low $6s is more reasonable based on nearer-term price action.

SFIX Stock: Holding Support Under $5

The Bottom Line

The fundamental backdrop for Stitch Fix is bleak, but the chart and short interest suggest a decent risk/reward ahead of earnings Tuesday afternoon. This is a trade, not an investment. I’d like to see earnings turn into the black for a long-term case to be made for owning the equity.

Be the first to comment