Kong Ding Chek/E+ via Getty Images

Sometimes, great and innovative companies that catch on quickly with consumers at their outset can become more of a niche novelty. Such is the case with Stitch Fix (NASDAQ:SFIX), the fashion e-commerce company that is known for having personal stylists send clients a “Fix” with pre-packed items that consumers can choose to either keep or send back.

Now five years past its IPO, Stitch Fix is struggling to hold onto its identity. Its founder and CEO has stepped down, and the company is increasingly looking more and more like a traditional e-commerce store with its “Freestyle” offerings. Though Stitch Fix has driven growth over the past few years by expanding its categories and its geographical coverage, the company is now looking like it’s out of options.

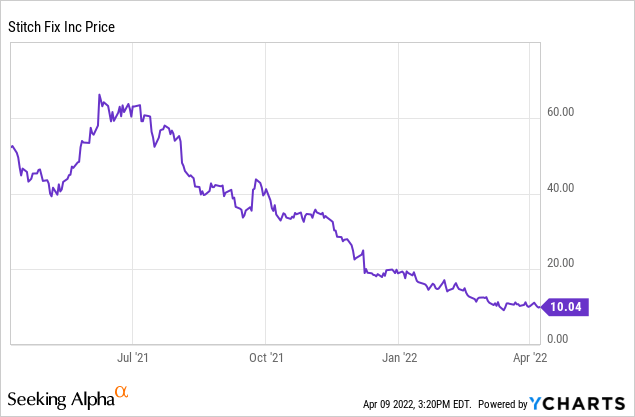

Year to date, Stitch Fix has shed about half of its value. And relative to all-time highs above $90 notched in January 2021, the company is trading at a mere fraction of what it once was.

Earlier this year in January, I issued a bullish “buy the dip” recommendation on Stitch Fix when it was trading in the high teens. I’ll admit here: that was an erroneous call. At the time, I had argued that investors were putting the cart before the horse for harshly judging Stitch Fix’s calendar 2022 guidance before seeing actual results decline.

The story has only seemed to get worse, however. Stitch Fix recently issued fiscal Q2 (January quarter) results, showing a flattening of revenues. Active clients still held stable, but that’s more a function of how Stitch Fix defines its clients (any buyer who made a purchase over the past 12 months – which masks any recent defections). Looking ahead, Stitch Fix is expecting revenue to decline, hit by a softening of the Fix business as well as tougher comps versus the pandemic period last year.

In my view, Stitch Fix is caught in a bind. All e-commerce stocks are down, but Stitch Fix is in worse shape especially because A) its products are fairly expensive and don’t quite fit into the “athleisure” trend that has picked up since the pandemic, and B) the kinds of clothes that Stitch Fix offers are better picked up in actual retail stores, which are now open across the country. Stitch Fix may have a small base of fans, but it’s unclear if the company is alienating its base by focusing so much on its direct buy “Freestyle” format.

Additionally, raw material price inflation plus logistics constraints will put immense pressure on Stitch Fix. The company has always offered free shipping and free returns, and unless the company begins to inflate prices as well (at the risk of churning an already-fleeting customer base), its margin profile will be at risk.

The bottom line here: I’m no longer as sanguine on Stitch Fix as I used to be. I am now bearish on this stock and recommend cutting losses here. There is tremendous value to be found in both the e-commerce and retail sectors (names I like in both of these spaces include Chewy (CHWY), Gap (GPS), and Farfetch (FTCH)) – but in the case of Stitch Fix, don’t get caught into this value trap. This is a company that started out with a really innovative and differentiated brand, but in trying to be “everything for everyone” the company is now having trouble retaining its customers and converting new buyers onto its rather confusing business model.

Steer clear here.

Q2 download

Let’s now cover Stitch Fix’s most recent quarterly results in greater detail, which sparked even more loss of confidence in this name.

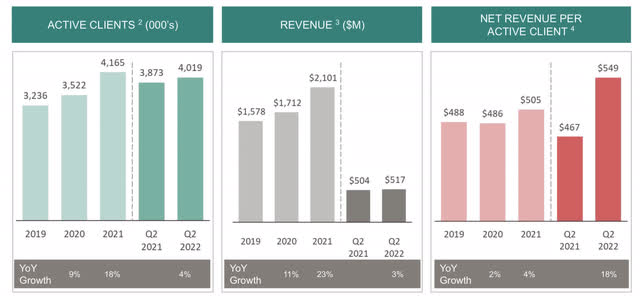

Stitch Fix Q2 key metrics (Stitch Fix Q2 investor deck)

As can be seen in the chart above, the best that can be said for Stitch Fix’s business is that it’s… quite flat. Revenue grew only 3% y/y to $517 million, basically in line with Wall Street’s expectations as well as the company’s prior guidance that it would grow at 0-3% y/y.

It’s important to note that growth decelerated sharply from 19% y/y growth in Q1. Sequentially, growth also declined -11% quarter over quarter versus Q1, which is atypical seasonality for Stitch Fix – which grew 3% from Q1 to Q2 of FY21.

One additional worry here: net revenue per active client is up 18% y/y, while “active clients” (defined as someone who has made a purchase over the past twelve months) is also up 4% y/y. The fact that revenue grew only 3% y/y despite these metrics is an indicator that many of Stitch Fix’s 4.01 million so-called “active” clients are actually dormant. In fact, the company noted that it did a big referral push last year which ended in Q3 of 2021. If many of these referrals were one-time purchasers, we’ll see these active clients drop off sometime between next quarter in Q4.

Here’s some insightful commentary from CEO Elizabeth Spaulding’s prepared remarks on the Q2 earnings call discussing the recent weakness the company has observed:

There were two factors that largely impacted gross adds: First, conversion of new visitors as for Fix and Freestyle is not where we want it to be; second, given changes in iOS 14, marketing channels that have historically been effective for us are presenting challenges and effectively targeting clients. I’ll elaborate on each of these points further. However, as a result, we experienced lower gross client additions and also opted to pull back our marketing spend in the second quarter. We invested 6.8% of net sales for the second quarter relative to 8.3% in the same period last year.

Also, higher dormancies contributed to lower active clients for the quarter. As a reminder, we had higher dormancies in Q2 due to lapping of the high dollar referrals from last year, which we ended in Q3 of 2021.

I want to touch on the point I mentioned earlier about conversion and provide some further insight. In our efforts to launch and promote Freestyle, we chose to direct visitors coming to stitchfix.com towards the Freestyle experience. It is important to note that stitchfix.com is the primary landing page for customers interested in ordering a Fix. Therefore, in leading clients to the Freestyle experience first, we inadvertently created friction for those speaking of Fix. In an effort to mitigate this friction, we are beginning to direct stitchfix.com traffic to a clear and easy Fix onboarding path. We expect this to boost new Fix client conversion over time.“

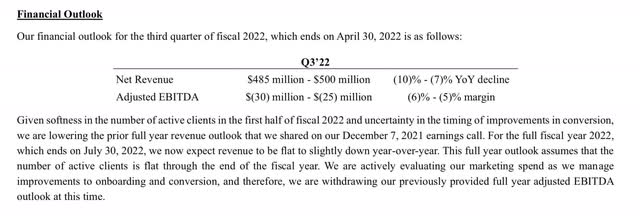

In simpler terms: Freestyle’s original intention was to add incrementality to Stitch Fix buyers (the company had hoped customers would continue to order Fixes while also picking up Freestyle add-ones), but it seems it’s cannibalizing Fix instead. Management’s confidence in the business has waned, as reflected in Stitch Fix’s forward guidance – it’s calling for revenue to decline between -10% y/y and -7% y/y in Q3:

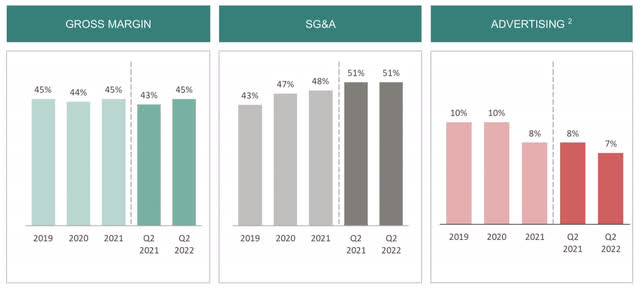

Stitch Fix outlook (Stitch Fix Q2 investor deck) Stitch Fix margins (Stitch Fix Q2 investor deck)

The news on profitability is a bit better. Gross margins increased two points y/y to 45% in the quarter, driven by higher order values, but declined two points versus Q1 due to an increase in inventory reserves (an additional worry for investors to mull over). The company did pull back 150bps of marketing spend, reacting to the lower performance seen in the Fix business.

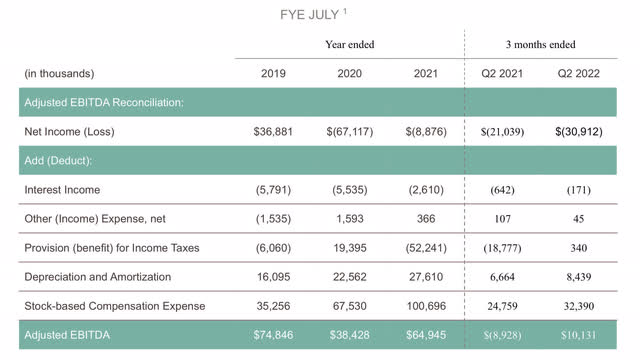

The y/y improvement in operating costs did help Stitch Fix to boost its adjusted EBITDA to $10.1 million, representing a 2% adjusted EBITDA margin, versus a -$8.9 million loss, or a -2% margin, in the year-ago Q2.

Stitch Fix adjusted EBITDA (Stitch Fix Q2 investor deck)

This being said, with Stitch Fix expecting revenue to decline, the story isn’t going to look so rosy going forward (guidance calls for EBITDA margins to slip to -5% to -6% in the quarter, and the company also withdrew its full-year profitability guidance citing uncertainty in the business).

Key takeaways

Stitch Fix’s fundamental profile has warped tremendously over the past year. Freestyle, originally touted as a move that could heavily boost growth for the company, is looking more and more like a blunder that is diluting Stitch Fix’s brand and making it look like just another one of its dozens of e-commerce competitors. With Stitch Fix’s grip on customers fading, I’d recommend pulling out of this name.

Be the first to comment