ijeab

Transcript

Through the course of the summer but specifically over the course of the last few weeks, risks of recession have only increased. If you look at Europe, we have been expecting a recession. This year is the case for the UK as well, and we are expecting a recession in the U.S. early next year.

It has become increasingly clear that developed market central banks plan to overtighten in order to fight inflation. And that means it could be painful for risk assets during this period.

Now, what does that mean for investing?

1) We prefer credit over equities

Number one, we continue to have our preference for credit over equities in developed markets because equities have yet to price in that recession, including earnings recession in the U.S. and also in Europe, whereas credit has a relatively more attractive valuation.

2) We prefer inflation-linked bonds over nominal bonds

We have a preference for inflation-linked bonds over nominal (government) bonds given how market pricing really tells us that market seem to be underappreciating the degree to which we’re going to have to live with inflation.

3) We’re negative government bonds

We’re still quite negative government bonds, but specifically in the case of Europe, European bonds, including UK government bonds.

____________

The new regime of macro volatility is playing out. Business activity is slumping and higher inflation persists. Central banks are responding with aggressive rate hikes without fully acknowledging the growth damage required. Expected policy rates have jumped further since we downgraded developed market (DM) stocks in July – and recession risks still aren’t factored in. We reaffirm our reduced risk-taking stance in our tactical views and favor credit over stocks.

Weak growth, higher rates: A tough combo

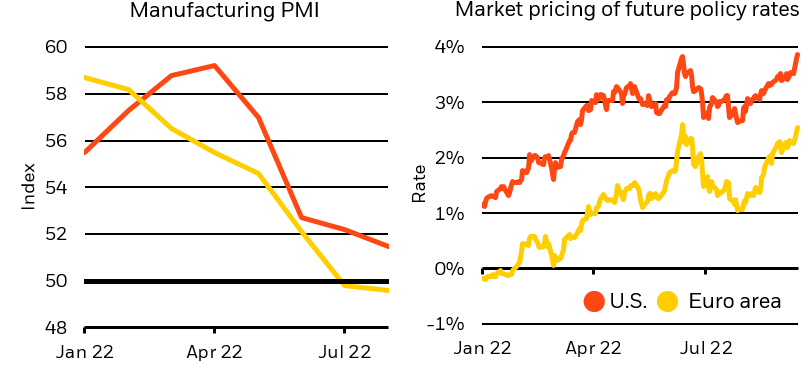

Manufacturing PMIs and policy rate pricing, 2022 (BlackRock Investment Institute, with data from S&P and Refinitiv Datastream, September 2022)

Notes: The left chart shows S&P Manufacturing Purchasing Managers’ Indexes – a value below 50 indicates contracting activity. The right chart shows the pricing of expected central bank policy rates via forward overnight index swaps. The rate shown is the one-year OIS rate expected starting one year from now.

Business activity is already stalling in the U.S. and Europe, as business surveys show (left chart). Yet, the Federal Reserve and the European Central Bank (ECB) are expected to hike rates aggressively with a singular focus on fighting inflation (right chart). Last week’s U.S. CPI report confirmed why we don’t see a soft landing for the economy: inflation is proving sticky as we expected, and central banks are following a whatever-it-takes approach to inflation. This suggests they will overreact to upside inflation surprises but not necessarily respond to downside surprises. The upshot? We expect a policy overtightening that causes recessions. Our whole portfolio approach prompts us to reaffirm our tactical views taking reduced risk. We favor credit given our view that a major default cycle is unlikely, and are underweight DM equities given the recession hit we see ahead.

Our investment views had already been based on a mild recession in the U.S. and a deeper one in Europe given the energy crunch – but we don’t think risk assets have come to terms with the combination of deteriorating activity and central banks pushing up rates more quickly. These developments prompt us to stick with our tactical positioning.

Reaffirming tactical views

Our relative preference for high-quality credit over equities still holds because of one big aspect: valuation. Higher spreads and government bond yields push up expected returns. And strong balance sheets imply investment-grade credit could weather a recession better than stocks. We like investment-grade credit, especially with short maturities, over high yield. This reflects our preference to be up in quality amid a worsening macro backdrop.

We’re underweight most DM equities for now. We haven’t bought the dips all year. The combination of an imminent recession and higher rates is still not fully reflected in equity valuations, in our view. If, and when, both of these are factored in, we would tilt back to neutral on stocks and start to consider signposts to turn more positive.

We are underweight U.S. Treasuries. Overall, we see long-term yields moving higher as investors demand greater term premium – the extra return that investors demand to compensate them for the risk of holding long-term bonds amid persistent inflation and high debt loads. That’s partly why we favor inflation-linked bonds – we expect inflation to persist, and this isn’t reflected in current pricing. We’ve also started to prefer short-term over long-term government bonds. We’re neutral European government bonds, but we think the market pricing of the ECB is unrealistically hawkish given the deteriorating growth outlook on the back of the energy crisis.

Our bottom line

The new regime of macro volatility is taking root with weaker growth, persistent inflation and volatile markets. Our whole portfolio approach prompts us to stick with our tactical views, especially with the macro deterioration since our last update. We like credit over equities on valuations. High-quality credit can also weather a recession better than stocks, we think. Persistent inflation keeps us away from longer-term nominal government bonds and makes inflation-linked bonds more attractive. Shorter-term government bonds are looking better because market pricing of policy rates looks too hawkish to us and recession risks are underappreciated. We think economic damage from rate hikes, and the energy crunch in Europe, will eventually lead central banks to stop hiking, but not anytime soon given persistently high core inflation.

Market backdrop

U.S. equities slumped and Treasury yields pushed near this year’s highs after data showing a renewed rise in U.S. core inflation in August, suggesting core higher inflation will persist. That prompted the market to price in a third straight 0.75% rate hike by the Fed next week and more big hikes for the rest of this year. We see the Fed hiking rates through year-end. Yet, we doubt the Fed will acknowledge the recession needed to bring inflation back to its 2% target in its projections next week.

The Fed seems determined to get inflation down to 2% without recognizing the extent of the contraction needed to do so, in our view. The upside surprise in the August U.S. CPI confirms why we expect the Fed to hike rates by 0.75% for a third straight time. The BoE has recognized the inflation-growth trade-off it faces and still seems determined to trigger a recession to fight inflation – especially after the UK fiscal response to the energy shock.

Be the first to comment