Petmal/iStock via Getty Images

RThis isn’t the first time that we’ve discovered a European small-cap more profitable and undervalued than it’s US competitor. A good example was our detailed analysis of FormFactor versus Technoprobe. Despite the recent IPO in an unfavourable time, the Italian gem Technoprobe delivered a 16% return against the flat price of its US competitor. Today, we would like to present another example of Italian success in the form of Aton Green Storage (not currently traded in the U.S.) and compare it to Stem Inc (NYSE:STEM).

Both Stem Inc and ATON provide energy storage solutions and software to manage energy costs. More specifically, they deal with what in jargon is called BESS: Battery Energy Storage Systems. Generally speaking, a storage system is a device that allows excess energy storage and the ability to use it when needed rather than transferring it to the grid, this maximizes self-consumption and sufficiency. It is possible to save on electricity bills, making the home more self-sufficient and at the same time significantly reducing harmful emissions. Most of their products are modular and custom-made. Moreover, thanks to their respective AI system, they also have developed a system that allows their customers to operate as the manager of the entire energy needs of the home, allowing an intelligent and efficient use of renewable energy.

Stem’s market-leading Athena software uses advanced artificial intelligence and machine learning to automatically switch between battery power, onsite generation and grid power. Source Stem Inc website.

Whereas ATON created the Energy Management System, a software with fully-integrated solutions that provide machine learning solutions to maximize B2C and B2B client needs.

ATON AI

STEM AI

Both companies are exposed to B2B and B2C clientele. Of course, we recognise that the larger market and subsequent potential lies with Stem Inc being present in the US, but we note that ATON is the leading player in Italy and one of the first movers in Europe.

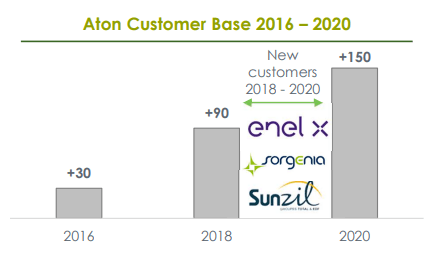

More specifically, ATON is dealing with ENEL (OTCPK: ENLAY), Sunzil, a joint venture between EDF and Total (NYSE: TTE), and Sorgenia.

Aton clientele base

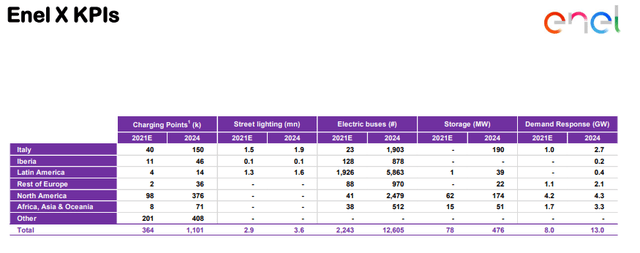

We already reviewed the topic in our analysis of ENEL but it is important to touch on Enel X. Electrification and urbanisation drive infrastructure investments and new services to clients. We already analysed this topic when we looked at the IONITY Joint Venture between the German automakers. Enel X is currently offering a comprehensively vertically integrated solution already present in many European countries, and it is expanding its reach by deploying incremental CAPEX year on year. This latest snap represents ENEL X’s future achievement. What is important to add is the fact that ATON has been chosen as the main supplier of white-labeled residential energy storage systems. In Italy alone, Enel would like to add 120 thousand charging points and this milestone will create a clear and bright future for the Italian company.

ENEL X Forecast

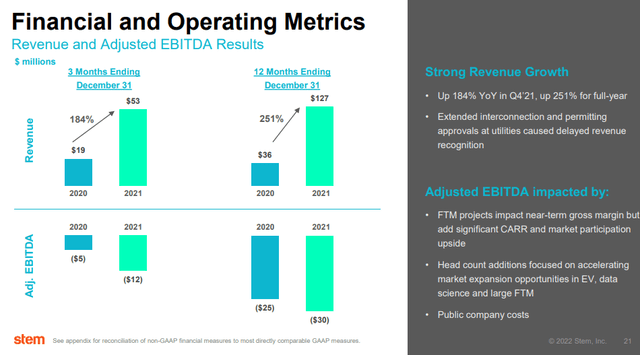

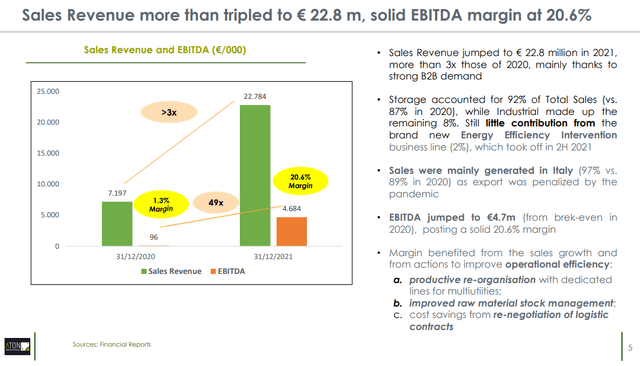

Going to the financials: we see similarities on a different scale. Both ATON and Stem more than doubled their revenues from 2020 to 2021. ATON posted revenue growth of 216% whereas Stem increased its top-line sales by 241%. Looking at EBITDA margin, we note that Stem is still navigating in negative territory, whereas for the Italian counterparts EBITDA margin stood at a positive 20.4%. Of course, Stem is paying the growth trajectory on a much larger scale and this is evident in the P&L analysis.

Stem Financials ratio

Aton Financials ratio

Conclusion & megatrend to consider

With this analysis, we firmly believe in Stem Inc’s potential and long-term opportunity, but we are offering SA readers another entity to check that it is exposed to the European market.

We are confident in the sector for the following reason:

- Energy storage is a megatrend, the Russia/Ukraine conflict is another lesson that Europeans are learning. BESS coupled with roof-top solar PV will not solve the situation, but self-consumption and electricity bill reduction will provide benefits.

- BESS will play a central role in Electric Vehicles and the reference market is already exploding.

- Government incentives for the above points are a nice plus to add. In particular, in Italy, the approved superbonus at 110% will boost ATON revenue growth and profitability.

- Local storage systems and AI will maximize grid efficiency with savings and less energy being lost in transportation.

We intensively cover the energy sector, we have provided a details analysis of the Superchargers And Electric Vehicles but we are also interested in analysing and scouting the companies that are transforming their operations. The last recent publications are the following:

- Enel: 6.6% Dividend Yield – Once In A Decade Opportunity

- Total: Our Favourite Pick In The Renewable Energy Transition

- Superchargers And Electric Vehicles: Chickens And Eggs

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment