LumerB/iStock via Getty Images

What is the Goal of This Article?

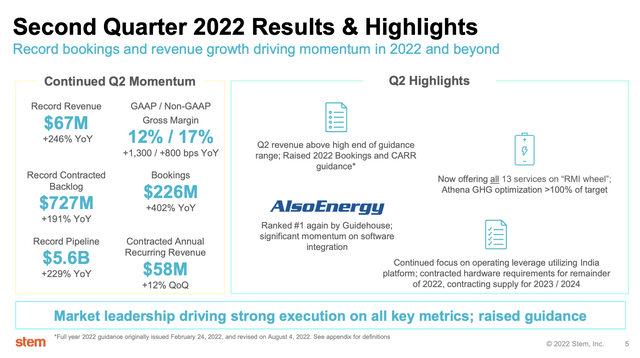

I always like to start my writing with letting my readers know what is my goal for the article. So let’s dive into why I am writing about a $2 billion market cap stock that most people have never heard of. I am writing about Stem, Inc. (NYSE:STEM), because I think all investors should be aware of this company and be open to learning more about it, as it is growing revenue at 246% year-over-year along with future bookings 402% year-over-year.

This stock could be a game changer for those who can stomach volatility and have a long time horizon with their investments. My goal is to educate readers on why Stem should be considered a software company more than a hardware battery storage company, and how this is just one of the many tailwinds that will drive the company to profitability in the future. We will also take a look at the risks that come with being invested in this company, as there is always two sides to any investment.

Q2 2022 Results and Highlights (Stem Inc. Q2 Earnings Presentation)

Why Would Stem Be Considered a Software Company?

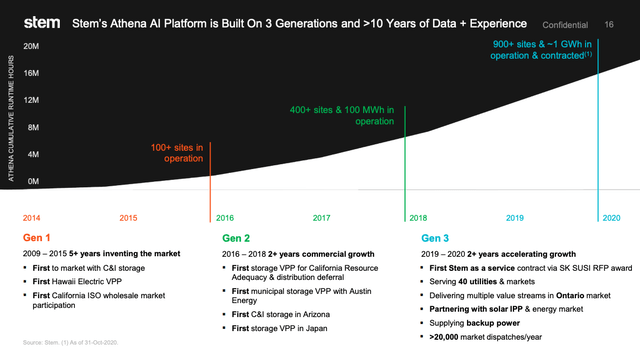

Yes, Stem does make a large portion of its current revenues via their hardware battery storage contracts, 60% to be exact. However, their AI-based software platform Athena is what makes the stock so compelling. This AI software has gone through three different generations and has over 10 years of data-driven results supporting it. This software platform is what differentiated them in the battery storage market, and allowed them to become the first virtual power plant for markets in Hawaii, California, Japan, and Arizona. Software and AI is created to deliver business outcomes, efficiency, automation, and true realized value, without huge CAPEX expenditures. The Stem Athena AI software platform does exactly this, as it captured the first mover advantage back in 2014 when it came to market.

Stem’s Athena AI Platform Generations (Stem Investor Presentation 2020)

The majority of employees that work at Stem do not focus or work in hardware-related solutions but on the software side of the house. It is the 80% gross margins and reoccurring revenues in software for their average 10 to 20-year contracts that likely has executives excited about future profitability. This software platform is able to take in weather, pricing, market costs, and power grid data to determine what is the best energy source to be utilized at that moment for a commercial or industrial customer. This software business is growing so much now that Stem is starting to sell their Athena software platform standalone to customers, to provide better cost savings and performance out of their current battery storage solutions.

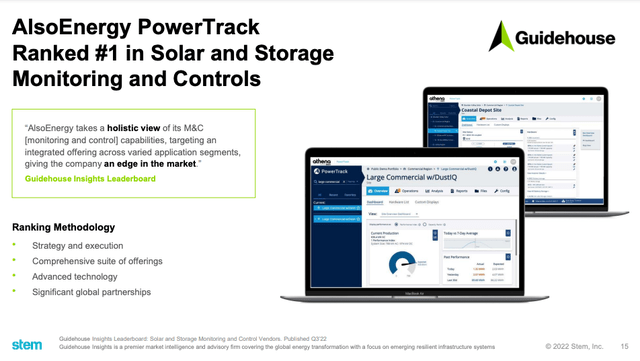

Stem took it a step further by purchasing AlsoEnergy Holdings to confirm they were a software company that wanted to be the global leader in AI-driven software intelligence for clean energy assets. AlsoEnergy’s main solution was a software product called PowerTrack that was a market leader in solar asset performance monitoring and controls. So now Stem wasn’t just able to intuitively decide what power should be used for a customer during energy intermittence or high-cost hours but would be able to maximize solar energy for customers at the source. The crazy part was Stem was able to integrate AlsoEnergy’s PowerTrack software into their Athena platform and create synergies within 8 months!

AlsoEnergy PowerTrack Rankings (Stem Investor Analyst Day Presentation)

Are These Products Delivering True Value?

The Athena AI software platform delivers an ecosystem of value to customers with forecasting and optimizing when to disperse battery energy, leverage the Grid, or renewable energy. This AI platform has over 24 patents and overall Stem maintains 87 patents on its software, storage, and solar assets.

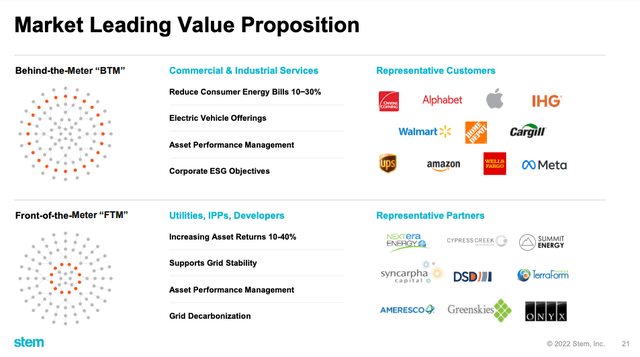

Stem has captured both what is called “Behind-the-Meter” (BTM) and “Front-of-Meter” (FTM) use cases and markets and is delivering quantifiable ROI. The FTM customer base is utility and asset owners of energy and helping them feed the power grid and power lines with the lowest energy costs, from the right resources. The BTM customer base includes all their major Fortune 500 customers like Apple (AAPL), Meta (META), UPS (UPS), Home Depot (HD) and others to help utilize the right energy at the right time to lower their utility bills.

Stem Inc. Fortune 500 Customer Examples (Stem Investor and Analyst Day 2022)

Here is just one customer example of this from a BTM perspective, The Gap, Inc. (GPS) has been a customer of Stem’s since 2018. The Gap distribution center in Fresno California needed better energy storage and utility bill optimization and by using Stem’s Athena AI solution they were able to save $60,000 annually on utilities. This has also led to another project of installing a 3.8MWh system at Gap in Ontario, Canada. This land and expand sales model works well at Stem, Inc. because it delivers quantifiable true realized value that can be expanded on whether they are BTM or FTM customers.

There are tons of use cases like this all over Stem’s website and it just makes sense they are able to land the biggest corporations as customers if their product is able to deliver undeniable true value. This is what is so exciting for me as an investor who works in the software industry, because this is what every software company is trying to deliver to their customer base as easily as possible. Stem is doing this throughout their customer base and I believe there is much upside to be had over time, with more of the U.S. gradually going to renewable energy as well as other countries around the globe.

What Risks Could Shareholders Face?

With any investment, there is a risk and reward scenario one must weigh in their thesis. These risk and reward situations differ depending on the macroeconomic timeframe we are in, as well as the goal of the returns for the investment, and most importantly the time horizon for accessing the returns. So as you may know by now we are in very uncertain macroeconomic times that we haven’t seen in decades. This presents an even bigger risk to companies with debt, need of potential future capital, declining short-term growth, and lack of profitability.

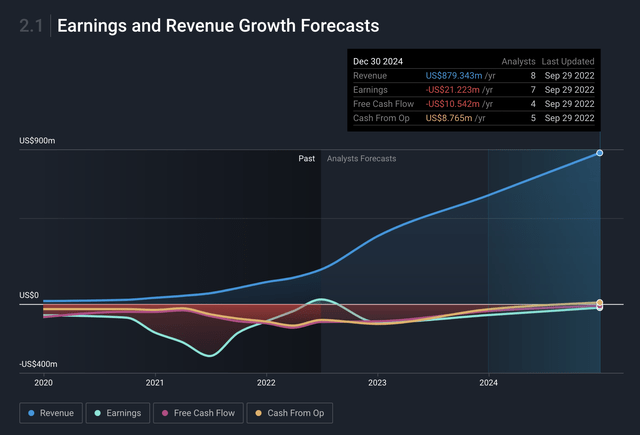

Earnings and Revenue Growth Forecasts (Simply Wall St. App)

Stem is temporarily profitable with a current P/E of 76, which is extremely high but this is because this is a company focused on growth, expansion, and in its infancy of potential. I say temporarily profitable because analyst estimates for forward profitability are negative, and the company is not guiding to full year profitability. The market may not like this and the moment another interest rate hike occurs it could cause a volatile drop like it did earlier in June to the stock. However, if you purchased Stem in June of 2022, you would be up roughly 96% to your initial position price. But looking back the hindsight will always be 20/20, as the Beta ratio for Stem is 2.23, so the stock fluctuates a lot more than the market.

Another risk besides the market collapsing and taking more growth stocks with it is a bad move by management. Stem could have been questioned with the AlsoEnergy acquisition but one would have to look at the longer picture and the scalability it would offer, to appreciate management’s decision. Now, in my opinion, there are still lots of cross-selling and synergistic activities to focus on before Stem needing to go acquire or merge with anyone else.

Is the Future Growth Opportunity Bigger Than The Risk?

As long as Stem doesn’t go out and put themselves in a situation where they need to borrow more capital at high rates and they manage their cash burn, then the risk is minimal. The risk is more minimal for the investor that has a long time horizon, because this will give Stem time to grow its software stand-alone contracts and acquire new customers, including standardized company contracts. This is not to mention the immediate customer base the AlsoEnergy acquisition presents to Stem with them having 41,000 customer sites operating across 200 countries. There are a lot of cross-sell and bundle opportunities for Stem to pursue current and net new customers.

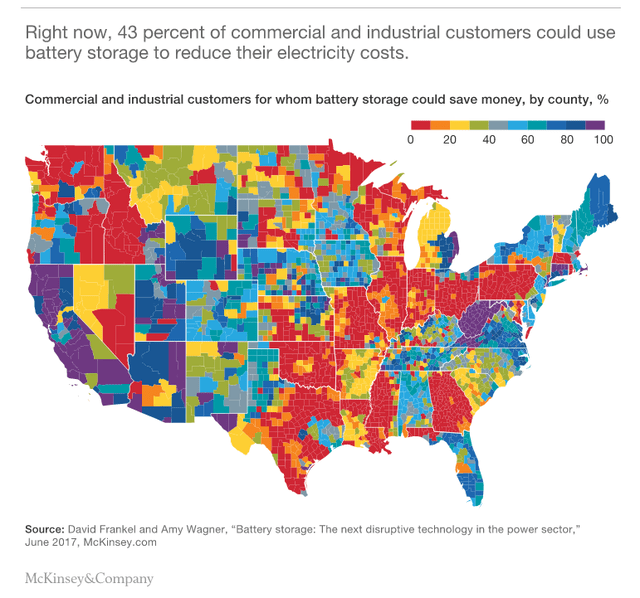

The battery storage markets are big in certain states like California, Massachusetts, and Texas, however, this is a trend that will be much bigger in the overall country in the future and globally. The projected global battery storage that the country could benefit from is huge, as you can see from this study by McKinsey.

Battery Storage: The Next Disruptive Technology in the Power Sector – June 2017

Battery storage implemented with AI software to make the smart decisions as when to use what energy source seems logical and something we could see happen over time. I am not saying that the country needs to abandon fossil fuels but a strategic, well thought out, long-term process towards a future like that makes sense, but this won’t happen overnight. So to see the full potential returns I would say Stem is for a longer-term growth investor.

What Should Investors Pay Attention to Next?

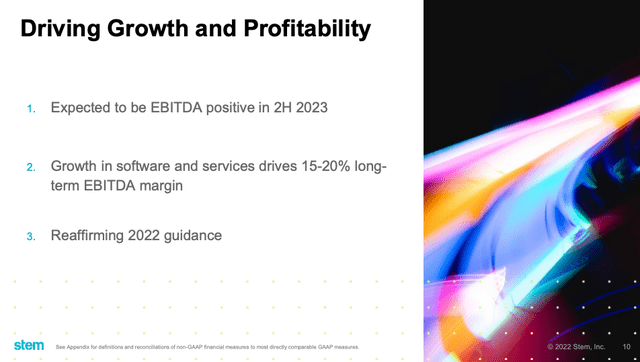

Investors should go back and watch the video presentation of the Investor and Analysts Day Stem just recently held. I would also recommend reading the transcript so you can ensure you don’t miss the little nuances throughout the presentation like their focus on execution and the goals of being EBITA positive by the second half of 2023. I was extremely impressed with their Analyst Day presentations and plan on writing about all the value an investor can gather from just that event alone.

Stem’s Three Main Goals for 2022 (Stem Investor and Analyst Day 2022)

The presentation had me kicking myself for not investing more in Stem when it was $7 a share just this past June, as I was nervous about their cash to debt situation. However, when you look at their cash burn annually, they can make it at least another two to three years before needing any more capital. I believe the triple-digit growth and bookings growth will continue. Stem has a backlog of $5.6 billion in the pipeline and $200 million in bookings and they manage their battery orders with OEMs a year in advance. So I do not see this company being drastically hurt by supply chain issues in the long term, and I believe we will start to see synergy wins between the AlsoEnergy team and Stem.

I advise investors to go back and watch and read any event data that Stem has hosted and pay attention in the next earnings calls around software sales growth, synergies with AlsoEnergy, big commercial standardization wins, and most importantly around them getting to EBITA positive by the second half of 2023. This isn’t one of my biggest positions but it is in my Top 20 and it could be one of the best-yielding ones in the long run, only time will tell.

Be the first to comment