We Are

Stock price weakness for business development company Stellus Capital Investment Corporation (NYSE:SCM) is resulting in another buying opportunity for its 8.6% yield.

Stellus Capital’s stock price has recently dropped to $13, allowing income investors to purchase the BDC at a 9% discount to book value.

Stellus Capital pays a monthly dividend that is covered by core net investment income, and the BDC’s investment portfolio is diverse, protecting against economic downturns. All things considered, Stellus Capital is a buy in my opinion.

A Growing BDC With Strong Portfolio Quality

Stellus Capital is distinct from other business development firms due to its emphasis on relatively safe First Liens. First Liens are the highest forms of debt and are typically secured loans with a very low default probability.

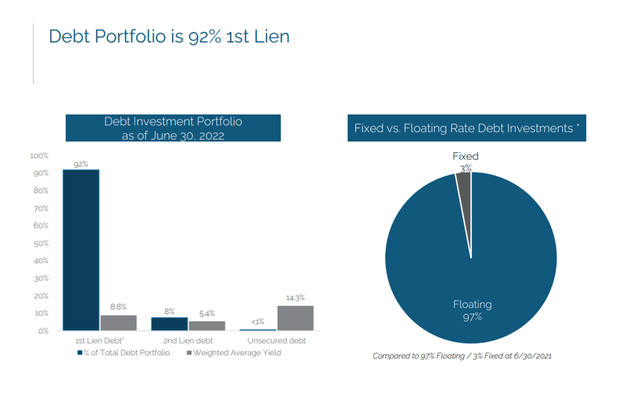

By focusing on First Liens, which account for 92% of Stellus Capital’s debt investment portfolio, the business development firm is laying the groundwork for strong portfolio performance even if macroeconomic conditions change.

The remaining 8% of Stellus Capital’s portfolio is made up of 8% secured Second Lien debt and less than 1% unsecured debt. Importantly, 97% of Stellus Capital’s investments are floating rate, which means they will benefit from higher interest rates.

Debt Portfolio (Stellus Capital Investment Corp)

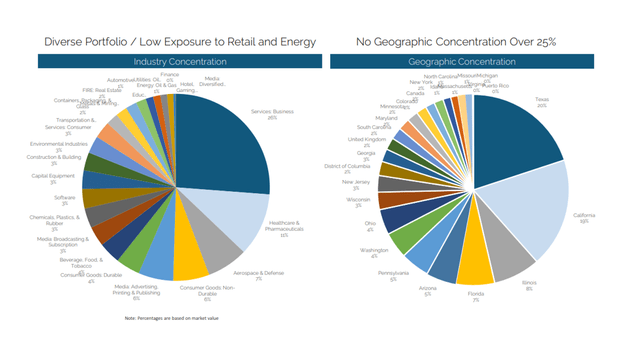

Stellus Capital’s investment portfolio was well-diversified and valued at $852 million in 2Q-22 (based on fair value). Stellus Capital has little exposure to the retail and energy industries, both of which are notorious for having volatile and vulnerable cash flows during recessions.

Rather, Stellus Capital, like many other business development firms, focuses on the Services Business (26% portfolio representation), Pharma (11%), and Aerospace & Defense (7%). These industries provide consistent revenue and cash flow, lowering the risk of default on Stellus Capital’s investment loans.

Portfolio Overview (Stellus Capital Investment Corp)

Dividend Coverage And Dividend Growth

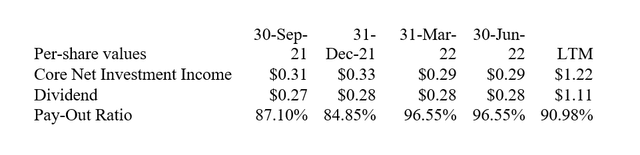

Stellus Capital has adequate dividend coverage, with core net investment income covering the dividend pay-out.

Stellus Capital earned $0.29 per share in core net investment income in the second quarter and paid out $0.28 per share (cumulatively) in the same quarter. The pay-out ratio in 2Q-22 was 97%, compared to a pay-out ratio of 91% over the previous twelve months.

Dividend And Pay-Out Ratio (Author Created Table Using BDC Information)

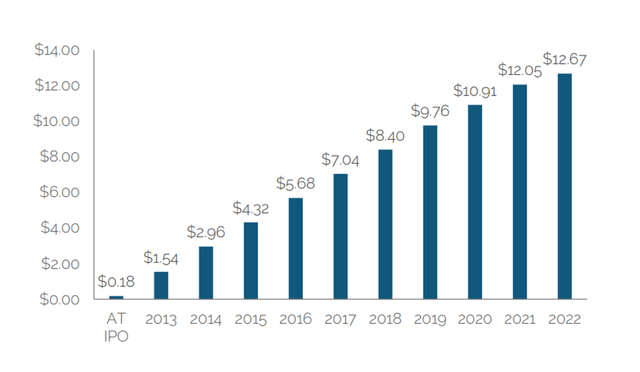

Stellus Capital has paid a cumulative dividend of $12.67 per share since its IPO and currently pays a monthly base dividend of $0.0933 per share.

At today’s price, the total dividend payout equals an 8.6% yield (not considering monthly supplemental dividends).

Stellus Capital most recently paid $0.02 per share supplemental dividends, which were announced up until September. I expect Stellus Capital to eventually return to paying only the $0.0933 per share dividend, which is the only dividend I consider when calculating the BDC’s dividend yield.

Cumulative Dividend (Stellus Capital Investment Corp)

Compelling P/B Multiple

Stellus Capital is now available at a higher discount to book value as a result of the recent stock decline. Stellus Capital’s net asset value at the end of the most recent quarter (2Q-22) was $14.32, so a stock price of $13.06 implies a 9% discount to net asset value.

As previously stated, the discount widened again in September, owing solely to general market weakness and a desire to take profits in those stocks that have performed well for shareholders in recent months.

Why Stellus Capital Could See A Lower Valuation

Stellus Capital, as previously stated, has a safety-first, diversified investment portfolio with net investment income sufficient to fund a generous monthly dividend over the last year.

Having said that, Stellus Capital’s diversification and portfolio resilience may be put to the test in a severe stress scenario, such as a deep recession resulting in higher investment losses.

In the absence of a recession, I believe Stellus Capital is a business development company that can expand its portfolio and even increase its dividend payout.

My Conclusion

The September pullback provides another opportunity to buy Stellus Capital stock. The business development company is well-managed, reliably covers its dividend with core net investment income, and Stellus Capital’s exceptional core focus on First Lien debt provides the BDC with an extra layer of security that other BDCs do not provide to their shareholders.

Stellus Capital also pays a monthly dividend, which may appeal to investors who prefer to receive distributions on a monthly basis.

Stellus Capital’s 8.6% dividend yield is attractive given the stock’s 9% discount to net asset value.

Be the first to comment