Darren415

Investing in BDCs can feel like a popularity contest at times, with bigger names such as Ares Capital (ARCC) and Owl Rock Capital (ORCC) getting outsized attention. While both of these are well respected names in their own right, they are also subject to the law of big numbers, as it would take ever increasing amounts of capital for them to continue growing.

That’s why pays to be diversified when it comes to BDCs, as the smaller ones require less capital to significantly move the needle. This brings me to Stellus Capital Investment Corp. (NYSE:SCM), which is an up and coming BDC that also pays a high yield. This article highlights why SCM may be a good choice for those seeking higher income and diversification, so let’s get started.

Why SCM?

Stellus Capital is an externally-managed BDC that focuses on providing debt financing solutions to middle market companies in the U.S., with annual EBITDA in the $5-50M range. SCM went public in 2012 and received its first and second SBIC licenses in 2014 and 2019. Since IPO, SCM has invested over $8 billion across 300+ companies in 20 industries.

As one would expect from a smaller BDC, SCM has seen faster portfolio growth than a number of its bigger peers, as reflected by its 17% portfolio CAGR over the past 3 years, to $852 million across 83 different companies. Importantly, SCM didn’t sacrifice returns for the sake of growth, as it’s generated a strong return on equity of 9.5% since IPO, with a 5-year ROE of 9.8%. This has enabled SCM to pay $12.67 in cumulative dividends since IPO, which means that initial investors who held SCM in a tax-advantaged retirement account have already gotten 86% of their initial investment back.

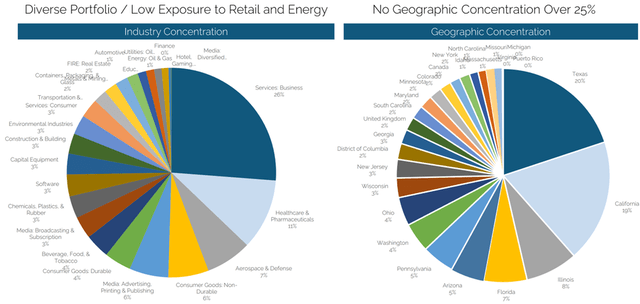

SCM’s portfolio is also well-diversified by geography and segment, with business services, healthcare, aerospace & defense, and consumer goods representing half of its investment portfolio. It also maintains a rather safe investment profile with 92% of the debt portfolio being first lien debt, which sit at the top of the capital stack. Much of the remaining debt portfolio (8%) is in the form of second lien debt, and less than 1% is allocated to unsecured debt.

SCM Portfolio Mix (Investor Presentation)

Meanwhile, SCM’s portfolio appears to be rather healthy with less than 4% of portfolio fair value carrying the higher risk ratings of 4 or 5 (less than 1% is in the highest risk rating of 5). Furthermore, SCM generated $0.29 in core net investment income per share during the second quarter, more than covering its $0.28 regular dividend on a per quarter basis (paid monthly).

Also encouraging, SCM generated significant realized gains on portfolio exits last year, totaling $23.7 million or $1.22 per share, and an additional $3.5 million during the first quarter. Management expects to generate additional realized gains over the next several quarters, and this resulted in the declaration of a $0.06 supplemental dividend for the third quarter. Management also stated that they expect to pay $0.34 per quarter (regular plus supplemental) for the foreseeable future. This equates to a high 10.4% dividend yield based on the current share price of $13.06.

Risks to SCM include potential for economic headwinds to its portfolio investments. At present, SCM has four loans on non-accrual, comprising 2.8% of the portfolio fair value, up from 3 loans on non-accrual comprising 0.7% of fair value at the end of Q1. This is something worth monitoring. NAV per share also declined by $0.29 on a sequential basis, but that was more of a function of widening credit spreads (market volatility), and this is something that most peer BDCs have also seen.

Nonetheless, I see SCM as being well-positioned for a rising rate environment, as 97% of its debt portfolio is floating rate. This is considering that most investors see a 75 basis point rate this month by the Fed as being a foregone conclusion. SCM also maintains a safe balance sheet, with regulatory leverage of 1.08x, sitting well below the 2.0x statutory limit.

Lastly, I see value in SCM at the current price of $13.06, equating to a 0.91x price to book value. This implies a potential one-year 20% total return (including dividends) should SCM return to its book value. Sell side analysts have a consensus Buy rating on the stock, with an average price target of $14.

Investor Takeaway

In conclusion, I believe that SCM is a good high-yielding investment opportunity at present. The company has generated strong growth in both its portfolio and dividend payments in recent years, while also maintaining a healthy balance sheet. Additionally, the company’s 97% floating rate debt portfolio should benefit from rising interest rates. As such, SCM is set up for potentially strong returns at the current price.

Be the first to comment