Investment Thesis

We believe that it is too late to invest in Steel Dynamics (NASDAQ:STLD) shares. First of all, that’s because during a recession, US steel prices could drop faster than we expect. That would put pressure on the company’s financial performance and share prices. Secondly decelerating construction activity in 2023 could open the way to lower semi-finished steel products prices which contribute up to 50% of current operating income of Steel Dynamics. We already see margin compression from main business due to decelerating hot-rolled steel prices, and this may happen to the semi-finished division.

Steel prices are falling dawn

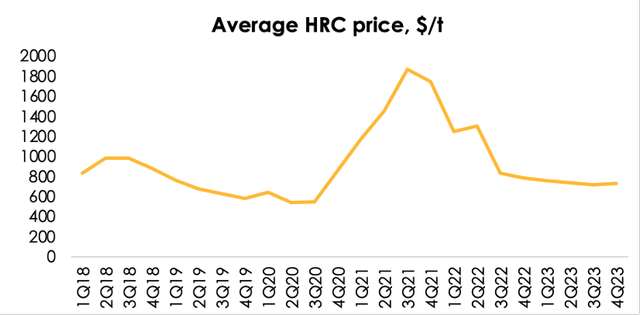

The performance of US steel prices is in line with our forecast. The average price of US hot-rolled steel totaled $834 in 3Q 2022, and the price dipped below $800 a ton in 4Q 2022. Steel prices continue to drop amid the country’s slowing industrial production. Despite the sharp drop by more than 50% in the third quarter, we don’t expect a repetition of that in the future as the country’s domestic demand still holds high.

Vladimir Zapletin

Invest Heroes

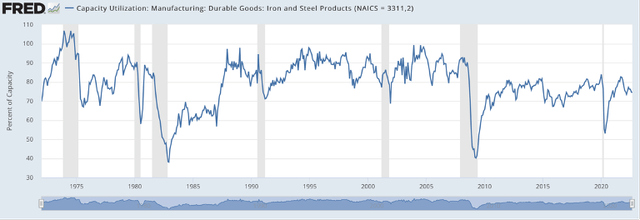

Over the last 12 years (excluding the slump during the COVID-19 pandemic) the average capacity utilization at US steel plants reached about 80%, according to FRED, while STLD’s capacity utilization reached about 90%. At times of recessions the industry’s capacity utilization slumped by an average of 30%. However, we don’t anticipate that STLD will follow in the footsteps of the rest of the industry because the company is subject to considerable influence of infrastructure projects that are normally started by the government at times of deep recessions. Also, we don’t see a serious decline in capacity utilization at US plants in the current quarter. Moreover, we have raised the average capacity utilization in the forecast period from 96% to 99% as the US will replace EU’s declining steel supply to the world market, while there will be no sharp decline in domestic demand.

According to the World Steel Association (WSA), steel demand will decline by 2.3% y/y to 1797 mln tons in 2022 amid high inflationary pressure caused by the energy crisis and a slowdown of the global economy. Here are the top four markets in terms of demand reduction: Russia + Ukraine (-9.2% y/y), Central and South America (-7.8% y/y), the EU countries (-4% y/y) and China (-4% y/y). At the same time, total demand in the US, Mexico and Canada will increase by 0.9% y/y.

Furthermore, it should be expected that steel supply in the EU will decrease more than demand. For example, according to the WSA, EU production dropped by 13% y/y in August. Production fell by 8.4% over 8 months. That means, EU steel supply will drop by at least 5.1% in 2022. That decline could be compensated by the US.

FRED

Short-term outlook is positive, but long term is negative

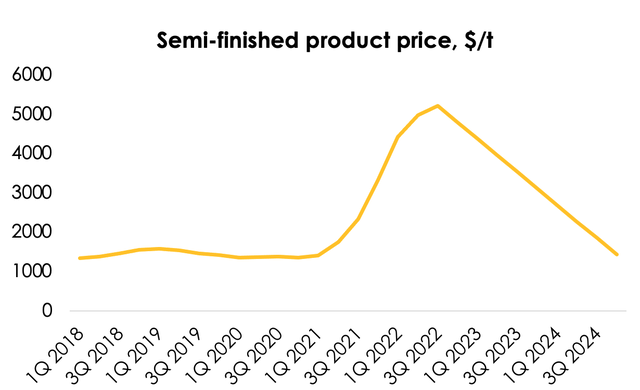

High semi-finished product prices significantly supported EBITDA margin of STLD due to strong demand from construction industry. It is worth mentioning that semi-finished product division contributes up to 50% of current EBITDA.

STLD sees a high volume of orders for products. We are confident, however, that demand for semi-finished product and prices will decline along with economic slowdown in 1Q 2023 and 2Q 2023.

Invest Heroes

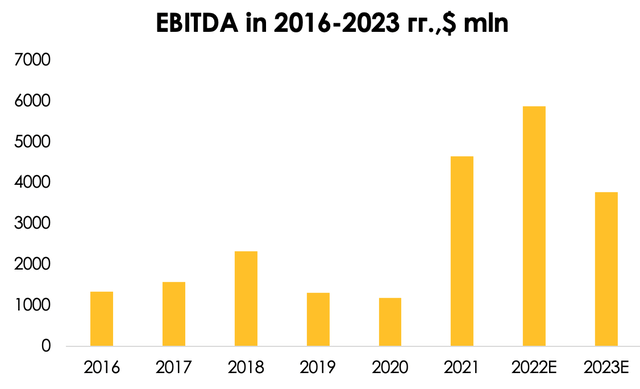

Due to falling realization prices in main business and in semi-product division we expect that EBITDA will be $5870 (+26% y/y) for 2022 and $3779 mln (-35% y/y) for 2023.

Invest Heroes

Moreover, we have mentioned divergence between STLD stock and HRC prices, according to Trading View. We believe that it is too late to invest in STLD shares.

Trading View

Valuation

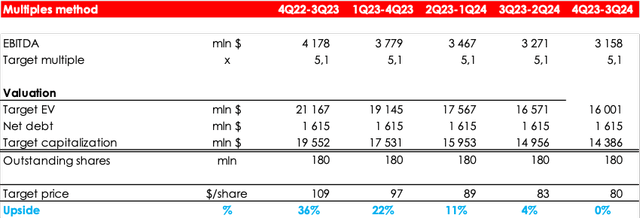

The fair value price for STLD stock is $92. In the base-case valuation, we are taking account of the future price decline in 2023-2024 by averaging the fundamental valuations over the two years ahead, from 4Q22-3Q23 to 4Q23-3Q24. The downside is -8%. The status is HOLD.

Invest Heroes

Conclusion

We believe that shares of Steel Dynamics are fairly valued by market participants. According to our estimates, future deceleration of steel prices in 2023-2024 is not priced in STLD stock, and it is too late to buy STLD shares. Moreover, we have mentioned divergence between STLD stock and HRC prices, usually STLD stock follows it closely. We stay neutral for company’s stock and believe that the best entry point for STLD shares will be under $70 per share.

The Fed and WSA data can be monitored to understand the economic situation.

Be the first to comment