NicoElNino/iStock via Getty Images

In basketball, it’s hard to win games if your team only shoots three-pointers or only focuses on defense. Today, some investors might be making the same mistake and only focusing their equity portfolios solely on offense or defense. Pondering if it’s time to add in commodities? Should they start thinking about Treasury Inflation-Protected Securities, or TIPS? Should they start digging in the backyard for oil? Like in basketball, being balanced may lead to more successful outcomes. One way to help achieve this balance: factor investing.

Look To Score With Value

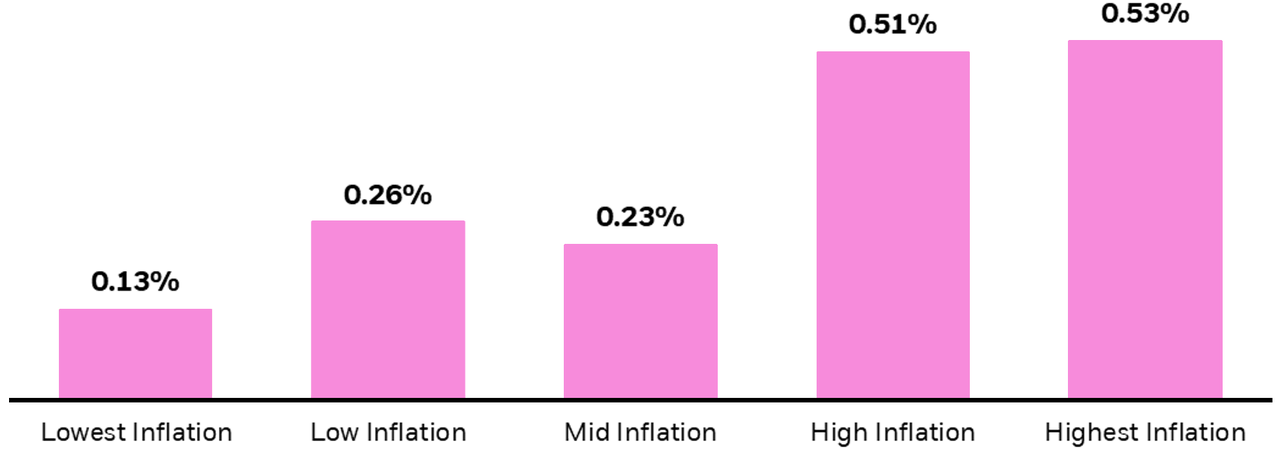

Amid rising inflation and rising interest rates, we believe value companies — firms that are priced cheap relative to their fundamentals — may be poised to rally. To test this theory of value stocks being a better hedge for inflation than growth, BlackRock analyzed data going back to the 1920s and found that historically this indeed has been the case.

Average monthly outperformance of value vs growth during various inflation regimes since 1926

Source: BlackRock with data from Kenneth R.French Data Library and Robert J. Shiller. Data from 7/1926 to 10/2021. Data uses the CRSP universe which includes all companies incorporated in the U.S. and listed on the NYSE, AMEX, or NASDAQ exchanges. Inflation is determined by using YoY changes in CPI and breaking into quintiles. “Value outperformance” represents the performance of value stocks minus growth stocks as defined by the Fama and French HML research factor (high book to price minus low book to price). Past performance does not guarantee future results.

Defense (Can Help) Win Championships

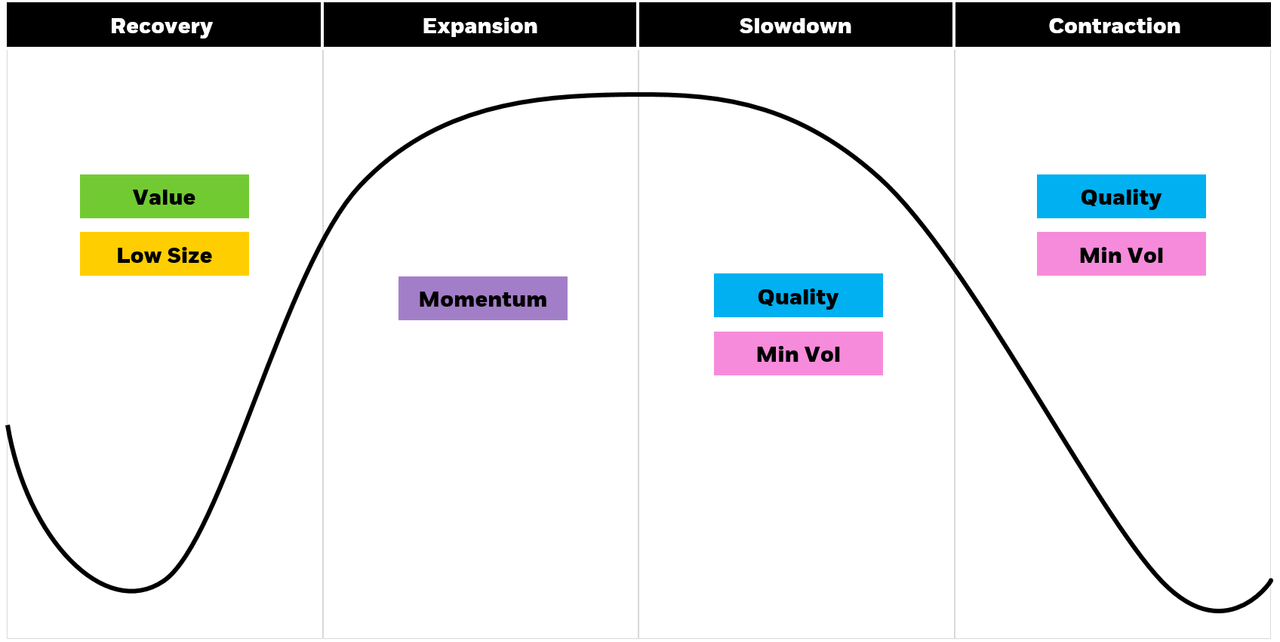

As geopolitical tensions have increased, we think investors can seek to navigate uncertainty by pairing value with more defensive, high-quality exposures. Quality provides a natural ballast to pro-cyclical value as the two factors tend to be negatively correlated — quality has tended to outperform when value underperforms, and vice versa. This demonstrates the potential diversification benefit of pairing value and quality stocks.

Demonstrating Factor Cyclicality

For illustrative purposes only.

Companies with strong balance sheets and stable earnings can provide resiliency amid adverse economic conditions. Simply put, high-quality firms have historically fared better when markets were volatile1, or the business cycle was maturing2. For inflation, quality companies can flex their pricing power to combat rising input costs, which we believe is an advantage relative to traditional value ballasts such as growth.

For risk-averse investors, rising tension from the conflict between Russia and Ukraine has caused a flight to perceived safe havens like US treasury bonds and cash. But timing the market is very difficult:

Leveraging minimum volatility as part of a long-term core can help investors stay in the game when the shots aren’t falling and volatility creeps back into equity markets. Minimum volatility equity strategies aim to weather the ups and downs of the market better as they tend to hold more low volatility stocks, and stocks with low correlations for diversifying potential. When it’s hard to score, sometimes the best offense is a good defense. Minimum volatility can help investors stay invested in the equity market.

Summary

Higher inflation, an economic reopening, and rising rates, may be a tailwind for the value factor. But just like a basketball team does not want to consist of only three-point shooters, barbelling value exposure with a more defensive factor, like quality or min vol, may give investors the opportunity to stay in the game and capture a potential value rally.

1 Source: BlackRock as of 12/31/21. Refers to potential risk reduction during the Chinese Market Crash as Jun 2015 – Aug 2015, 2018 Vol Spike as Feb 2018 – Mar 2018, and the Covid-19 Crisis as Feb 2020 – Mar 2020. Quality is measured by the MSCI USA Sector Neutral Quality Index.

2 BlackRock as of 12/31/21, with data from Refinitiv, IBES, IDC, and NBER, as of March 31, 2021. Quality performance refers to the excess return of quality stocks over the Russell 1000 Index. “Quality” is defined as the top quintile of stocks ranked in the Russell 1000 Index using a proprietary research screen that assesses companies on operating and capital allocation quality. “Maturing business cycle” refers to Midcycle periods, which are calculated by splitting expansions into halves and recessions into halves, with midcycle being the first half of the expansion phase.

Investment involves risk. The two main risks related to fixed income investing are interest rate risk and credit risk. Typically, when interest rates rise, there is a corresponding decline in the market value of bonds. Credit risk refers to the possibility that the issuer of the bond will not be able to make principal and interest payments. There may be less information available on the financial condition of issuers of municipal securities than for public corporations. The market for municipal bonds may be less liquid than for taxable bonds. A portion of the income from tax-exempt bonds may be taxable. Some investors may be subject to Alternative Minimum Tax (AMT). Capital gains distributions, if any, are taxable. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. Past performance is no guarantee of future results.

This post originally appeared on the iShares Market Insights.

Be the first to comment