AlbertPego/iStock via Getty Images

Introduction

Following a difficult and largely lackluster decade for the shareholders of Star Bulk Carriers Corp. (NASDAQ:SBLK), the booming operating conditions of 2021 saw massive dividends that if continued would see a yield of 25.42%. Despite these immense rewards, sadly they came at the expense of deleveraging and thus risk leaving a severe future headache, as my previous article highlighted. Since half a year has subsequently elapsed, it now seems timely to provide a follow-up analysis that reviews how they stand to fare in this different macroeconomic outlook, which disappointingly sees them unprepared for higher interest rates.

Executive Summary & Ratings

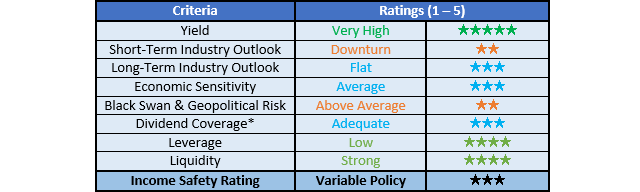

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

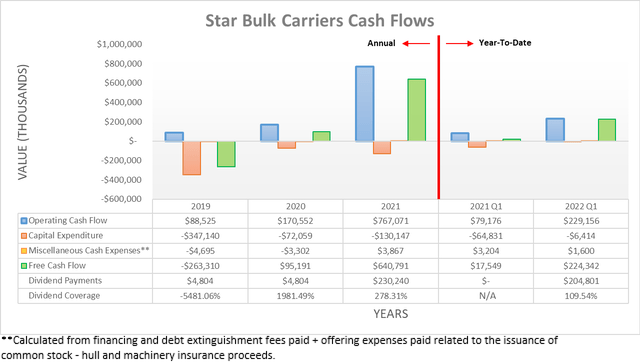

After seeing a very strong cash flow performance during the first nine months of 2021, this continued throughout the fourth quarter and then into the first quarter of 2022, with operating cash flow of $292.4m and $229.2m respectively. Thanks to their variable dividend policy, as outlined within my previously linked article, their dividends surged even higher with payments of $204.8m during the first quarter of 2022 almost equaling their total payments of $230.2m for the entirety of 2021. Despite being very impressive, when looking ahead, risks are sitting on the horizon, with talk of a recession at the same time as higher interest rates.

Whilst shareholders are lining their pockets right now, it should be remembered that the broader shipping industry is notoriously volatile. The past twelve months have been wonderful, although this did not result from a permanent change within their industry but rather fiscal stimulus and supply chain upheaval following the Covid-19 pandemic, and, more recently, the Russian invasion of Ukraine rerouting the trade of dry bulk commodities as Western sanctions clamp down upon the former.

Since no one can see the future, it obviously remains to be seen exactly how much a recession would impact demand for the seaborne trade of dry bulk commodities such as iron ore and coal, which comprise large portions of the market. Although it would almost certainly pose a significant headwind as demand for these commodities is normally tied with economic expansions. This makes it probable that a recession or, at minimum, an economic slowdown would see their booming operating conditions end, thereby sending their cash flow performance plunging and thus leaving higher interest rates burdensome, with the vast majority of their debt carrying variable interest rates, as per the quote included below.

“All of our bank loans bear interest at LIBOR plus a margin except for DSF $55.0 million Facility described above.”

– Star Bulk Carriers 2021 20-F.

It can be seen that only a relatively insignificant $55m of their debt is not exposed to a variable interest rate based upon the LIBOR rate. After plunging during 2020 as the Covid-19 pandemic swept the globe, the LIBOR rate has surged higher during 2022 at the fastest pace in the last decade as central banks rush to tighten monetary policy, as the graph included below displays.

Whilst the $10.4m of interest SBLK paid for the first quarter of 2022 was easily dwarfed by their operating cash flow of $229.2m, thereby only amounting to the equivalent of circa 4.50%, this could quickly change within the next twelve months. Given that inflation is sitting at the highest level since the 1980s and the Federal Reserve is expected to make multiple further 50bpts to 75bps interest rate hikes during the coming months, likely followed by other central banks, the LIBOR rate appears very likely to continue climbing higher and soon surpass its decade-long peak during 2019.

Even if a recession or economic slowdown only pushed their operating cash flow back to the $170.6m they saw during 2020, which was actually still a solid performance historically, this would still make these higher interest rates burdensome. Despite the rock-bottom LIBOR rates during 2020, they still paid $61.6m of interest, thereby sitting at the equivalent of circa 36% of their operating cash flow. Phrased another way, if not for their debt, their operating cash flow would have been roughly 36% higher during 2020. This is already undesirable, but given the outlook for interest rates to continue climbing to levels not seen in over a decade, possibly even longer, they will likely see an even larger burden placed upon their operating cash flow, which could consume 50% or more of what otherwise would have been their result.

Apart from further hindering their dividend prospects, this also highlights the first of the two ways they are unprepared for higher interest rates outside of these booming operating conditions due to their lack of deleveraging.

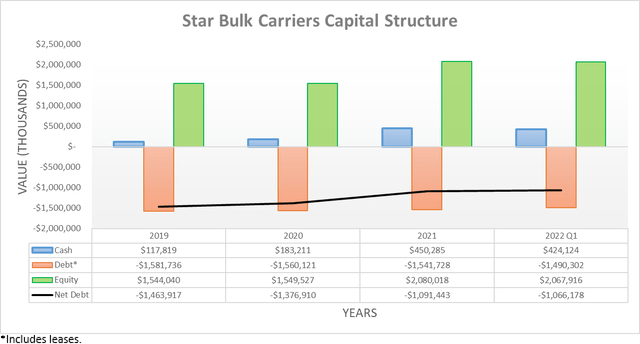

When moving to their capital structure, it shows that their net debt currently sits at $1.066b. This is down 13.39% versus its previous level of $1.231b when conducting the previous analysis following the third quarter of 2021. It was expected to see their net debt remain unchanged when conducting the previous analysis, but they instead elected to actually repay more of their periodic maturities with cash rather than issuing new debt, unlike throughout the first nine months of 2021 preceding my previous analysis. Even though this modestly lower net debt helps, realistically, it does not go nearly far enough. As also subsequently discussed, it should cease during the remainder of 2022 and the first half of 2023.

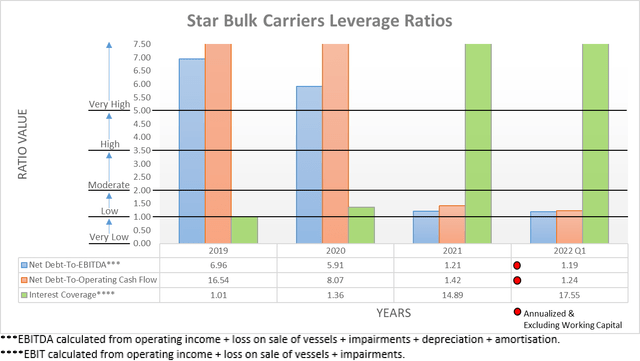

It was not a surprise to see their modestly lower net debt translate into modestly lower leverage on the back of their continued very strong financial performance, which now sees their net debt-to-EBITDA and net debt-to-operating cash flow sitting at 1.19 and 1.24, respectively. Despite representing an improvement versus their previous respective results of 1.71 and 1.96 when conducting the previous analysis following the third quarter of 2021, the change is only minimal because they still remain within the low territory of between 1.01 and 2.00.

Whilst low leverage does not sound problematic, especially given their interest coverage of 17.55 during the first quarter of 2022, this ignores that their leverage is being suppressed by their booming operating conditions and the resulting very strong financial performance. If utilizing their cash flow performance from 2020, which as a reminder was still historically solid, their net debt-to-operating cash flow on their current net debt would surge back to circa 6.25. This once again would see their leverage sitting well above the threshold for the very high territory of 5.01, as was the case before these booming operating conditions, and thus displays the downside of their massive dividends that came at the expense of deleveraging.

Their ability to service their debt would also plunge to distressed levels even if they only saw this same modest downturn back towards their 2020 levels. Despite the rock-bottom interest rates during 2020, they only saw an interest coverage of 1.36, and given the previously discussed outlook for higher interest rates, this would very likely drop well below 1.00, thereby leaving their financial position overburdened and thus highlighting the second of the two ways they are unprepared for higher interest rates.

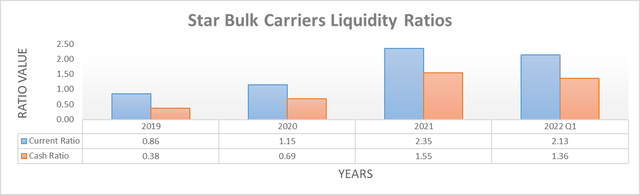

When looking elsewhere, their already strong liquidity further improved slightly with their respective current and cash ratios increasing to 2.13 and 1.36 versus their previous respective results of 1.81 and 1.20 when conducting the previous analysis following the third quarter of 2021. Despite being positive, this does not help ease the pressure from higher interest rates, and depending upon the severity, length and timing of a potential future downturn, it could also be drained as their operating cash flow plunges.

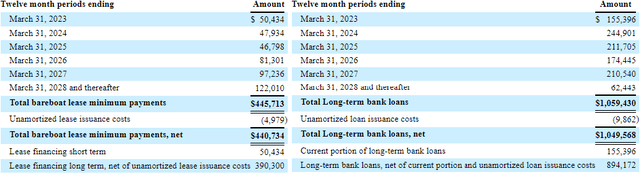

When looking at their debt maturities, they face nothing until 2023, as the tables included below display. In fact, even during 2023, they are not facing any debt maturities until the third quarter, as per slide six of their first quarter of 2022 results presentation. Whilst this supports their liquidity for the next twelve months, it also means that they are unlikely to deleverage any further, as mentioned earlier, and thus leaves them unprepared for higher interest rates at the same time as a downturn.

Conclusion

Concerns over interest rates may seem trivial at the moment given the vast free cash flow that they are generating, although it should be remembered that these booming operating conditions cannot last forever, especially with talk of a recession on the horizon. Due to their lack of deleveraging in favor of massive dividends, they are unprepared for higher interest rates that, combined with even only a modest downturn, leave their ability to service their debt at distressed levels. Despite their otherwise very desirable massive 20%+ dividend yield, this leaves me to believe that maintaining my hold rating is appropriate, with the potential to downgrade to a sell rating in the future.

Notes: Unless specified otherwise, all figures in this article were taken from Star Bulk Carriers’ SEC filings, all calculated figures were performed by the author.

Be the first to comment