Joe Raedle

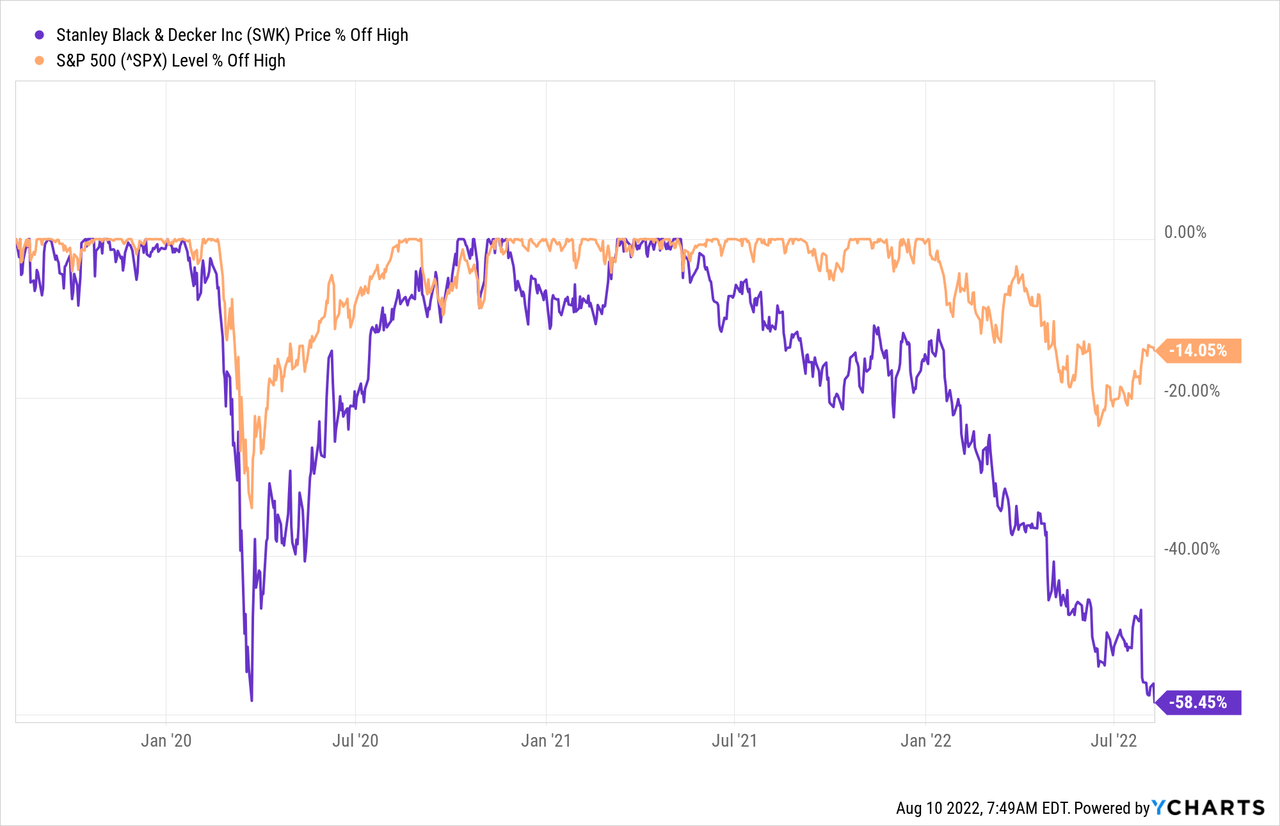

When trying to identify companies that could be interesting for dividend investors (or investors wanting to create a passive income) the short list of dividend kings would be a good starting point. One of the companies included in that list is Stanley Black & Decker, Inc. (NYSE:SWK). And the company is not only interesting due to its status as dividend king, but the stock is declining since the spring of 2021 and lost almost 60% of its previous value during the last few quarters. Only a few days ago, when the company reported second quarter results, the decline even seemed to accelerate.

And although a steep stock price decline alone does not make a stock a good investment right away, it is certainly justifying a closer look, and we start with the last quarterly results.

Quarterly Results

It was already obvious in previous quarters that Stanley Black & Decker was struggling a bit as the company already reported declining operating income for example. But the second quarter results might have felt a little like a punch to the face for many investors.

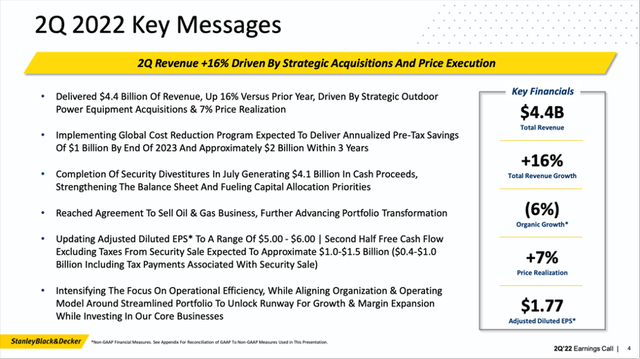

When looking at the top line, results looked solid. Stanley Black & Decker generated $4,393 million in revenue and compared to $3,798.8 million in revenue in the same quarter last year, the top line increased 15.6% year-over-year. However, organic growth was a negative 6% and the top line mainly increased due to strategic outdoor power equipment acquisitions (the acquisition of MTD Holdings Inc. as well as Excel Industries). And while the top line was still growing, operating profit declined from $594.7 million in Q2/21 to $354.4 million in Q2/22 – a decline of 40.4% year-over-year. And diluted earnings per share declined even 79.3% from $2.75 in the same quarter last year to $0.57 this quarter.

Stanley Black & Decker Q2/22 Presentation

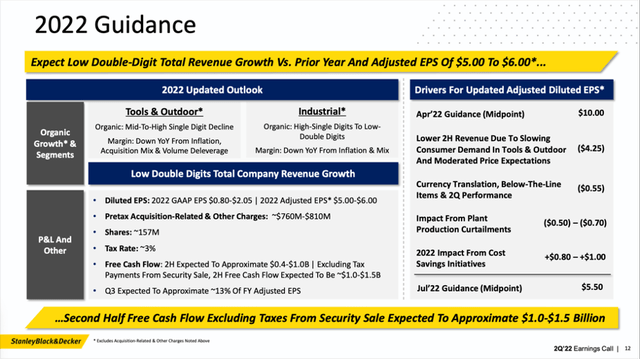

The biggest shock for investors were probably not the quarterly results, but rather the guidance for the full year. Stanley Black & Decker revised its 2022 earnings per share outlook to $0.80 to $2.05 on a GAAP basis (from $7.20 to $8.30 before). And non-GAAP diluted earnings per share are now expected to be between $5.00 and $6.00 (compared to $9.50 to $10.50 before).

Stanley Black & Decker Q2/22 Presentation

While cost savings initiatives might have a positive impact on earnings per share guidance (about $0.80 to $1.00), the lower second half revenue (primarily driven by slowing consumer demand) will lower the expected earnings per share in fiscal 2022 by about $4.25.

Recession: A Threat?

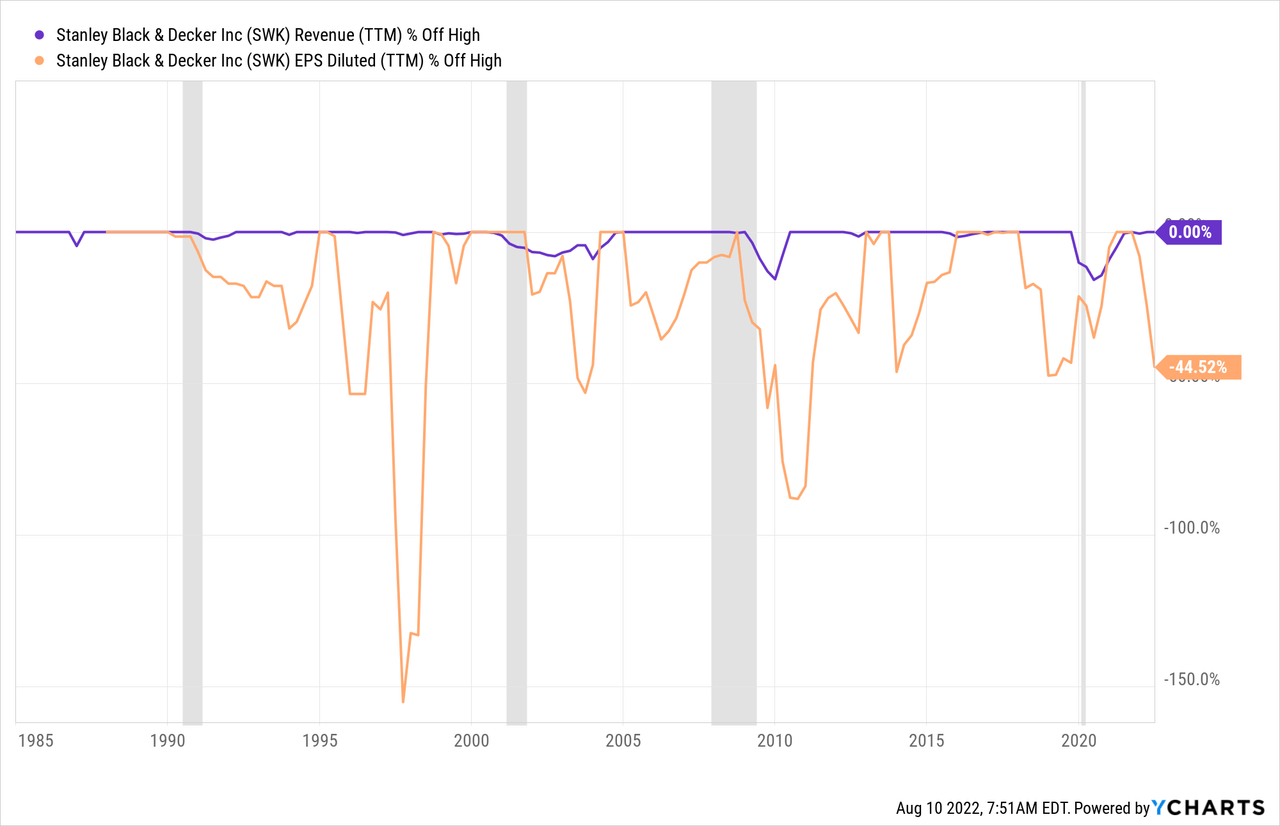

The very disappointing quarterly results (and guidance) might actually be the canary in the coalmine for a looming recession, which is certainly a risk for Stanley Black & Decker. The looming recession might also be in parts responsible for investors dumping the stock from their portfolios. And while there are companies we can see as rather resilient in times of recessions, Stanley Black & Decker is certainly not belonging in that category.

When looking at the numbers in the last few decades, Stanley Black & Decker was reacting to every recession. Revenue declined during every recession and during the last two recessions, the decline was about 15% each time. The decline can be seen as mediocre as there are certainly businesses with steeper revenue declines, but we can’t call Stanley Black & Decker recession-resilient. Earnings per share also reacted to every recession in the last few decades and when looking at TTM numbers, declines were sometimes extremely steep.

And it is not surprising that industrial stocks like Stanley Black & Decker usually suffer during recessions as the products aren’t essential and consumers will delay any purchase if possible leading to declining revenue in times of economic distress. On the other hand, we can argue that the stock declined already 60% and a potential recession and the negative consequences are already reflected in parts by the stock price and the further downside for the stock might be limited.

Balance Sheet: Debt and Inventory

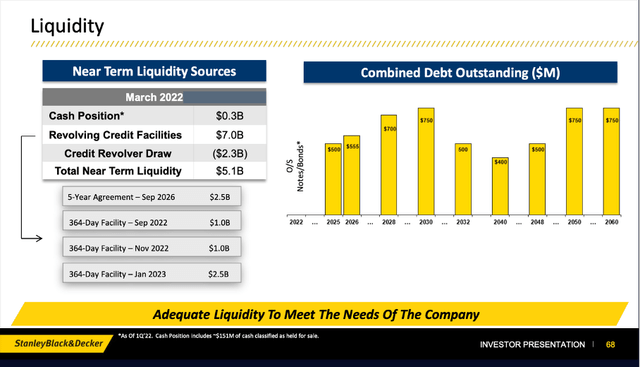

And not only the looming recession is a risk for Stanley Black & Decker. The company also has a balance sheet I would not call perfect right now. On July 2, 2022, the company had $5,833 million in short-term borrowings as well as $5,351.8 million in long-term debt. When comparing the total debt to the shareholder’s equity of $9,079.8 million, we get a D/E ratio of 1.23 which seems a little high but still acceptable. However, when comparing the total debt to the operating income Stanley Black & Decker could generate in the last four quarters ($1,566.6 million) it would take more than 7 years to repay the outstanding debt. And the company only has $282.3 million in cash and cash equivalent that could be used to repay the outstanding debt.

Stanley Black & Decker Presentation

Now one could argue, that about half of the total debt is short-term meaning it will be repaid in the next twelve months and only $5.4 billion in long-term debt will remain. At first, I was a little skeptical if Stanley Black & Decker will be able to reduce debt levels by $5.8 billion within the next twelve months, but it seems possible. When looking at the balance sheet, we find $851 million in current assets held for sale as well as $2,564 million in long-term assets held for sale. This will already generate $3.4 billion in cash that could be used repaying short-term borrowings.

Additionally, inventory levels are extremely high right now ($6,636 million in the last quarter compared to only $2.5 billion to $3 billion only a few quarters ago). And during the last earnings call management reassured it is committed to bringing down inventory levels:

Moving on to our aggressive plan to reduce inventory to generate strong cash flow in the second half. Our second quarter ending inventory balance was $6.6 billion, up approximately $400 million versus the first quarter and up versus historical levels of stock.

(…)

We are implementing actions to significantly reduce working capital by $1 billion to $1.5 billion in the second half of 2022, primarily from inventory reductions. There are five parallel work streams already underway to enact as sequential inventory decline with a sense of urgency.

At this point we don’t have to look at the five steps in detail. We just need to know management is focused on reducing inventory levels which will lead to additional cash, and it seems possible for Stanley Black & Decker to reduce debt levels about half during the next twelve months. And if that is the case, the balance sheet certainly is acceptable.

Dividend

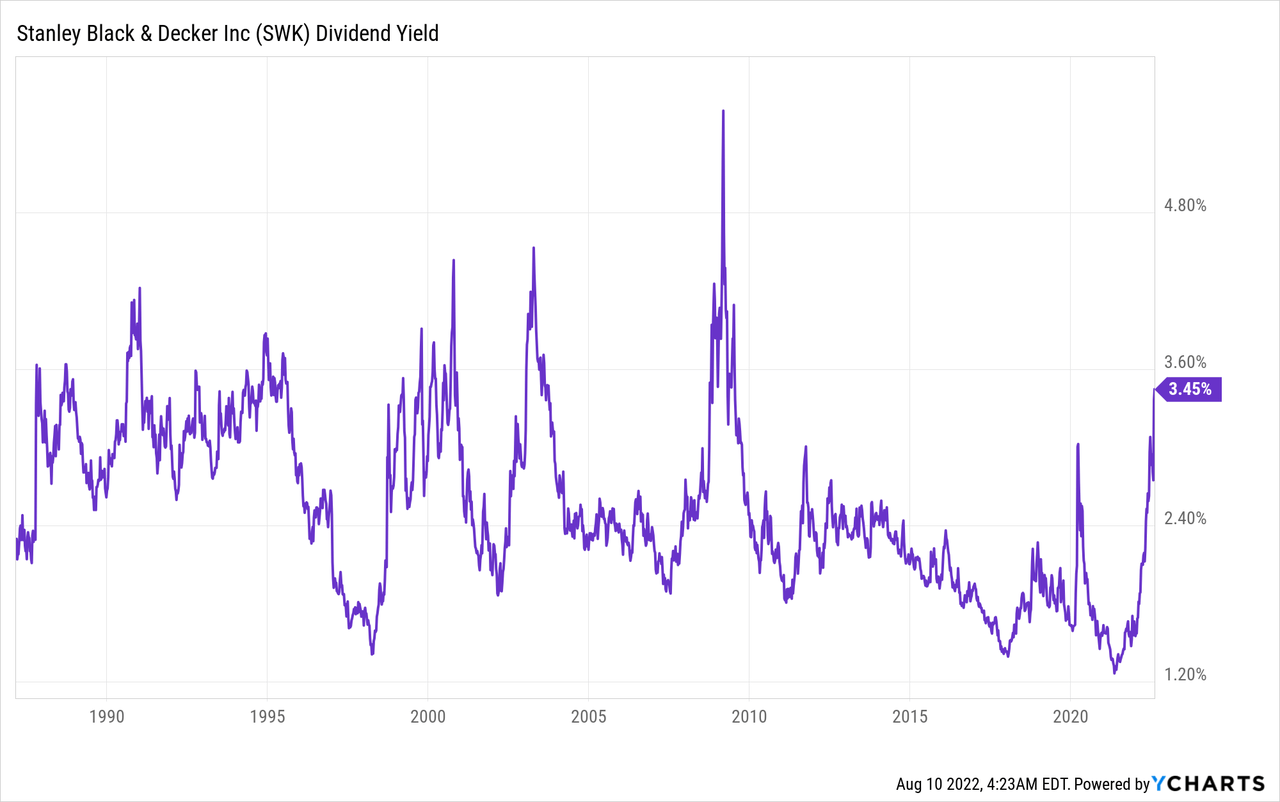

Of course, we also must look at the company’s dividend, as Stanley Black & Decker is one of the dividend kings (and has paid a dividend for 146 consecutive years). The dividend could also be one of the reasons to buy and own the stock. Right now, Stanley Black & Decker is paying a quarterly dividend of $0.80 resulting in an annual dividend of $3.20 and a dividend yield of almost 3.3%. While the stock had similar high dividend yields a few decades ago, it is one of the highest dividend yields during the last ten years (it was slightly higher for a few days in the spring of 2020).

The last dividend increase was only 1.3% from $0.79 to $0.80 – the company basically increased the dividend to keep its status as dividend king. But considering the looming recession and the lowered guidance, it makes sense to preserve capital and the dividend can be hiked again when Stanley Black & Decker can return on the path of growth. And in the last five years, the dividend was increased with a solid CAGR of 6.38%.

And with a payout ratio of 31% in fiscal 2021 we must not be worried about the safety of the dividend. We can expect high dividend growth rates in the years to come as this is one of the company’s long-term targets.

Intrinsic Value Calculation

When trying to determine if a stock is fairly valued or not, I often start by looking at simple valuation metrics and I prefer the price-free-cash-flow ratio as the most accurate. In case of Stanley Black & Decker, the company is reporting a negative free cash flow right now and the P/FCF ratio is therefore not meaningful. Instead, we can look at the price-earnings ratio. Right now, Stanley Black & Decker is trading for 15 times earnings – however that number might change in the next few quarters and get much higher as earnings per share will decline pretty steep (according to the company’s guidance).

I don’t know how useful P/E ratios are right now for a cyclical business like Stanley Black & Decker and it is probably better to use a discount cash flow calculation. When using a DCF calculation, we must answer the question what free cash flow we are considering as realistic in the next few years. And we also must answer the question what growth rates could be realistic in the years to come. For fiscal 2022 as well as fiscal 2023 I would be cautious and assume a rather low free cash flow due to the recession ($0 in fiscal 2022 and $500 million in 2023). For fiscal 2024, I would assume a free cash flow of $900 million (more or less the average free cash flow between 2016 and 2021 – I excluded the quarters with a negative free cash flow) and we are cautious and assume only a growth rate of 5% till perpetuity. When using these assumptions as well as a 10% discount rate and 145.4 million outstanding shares, we get an intrinsic value of $105.15, and the stock would be slightly undervalued.

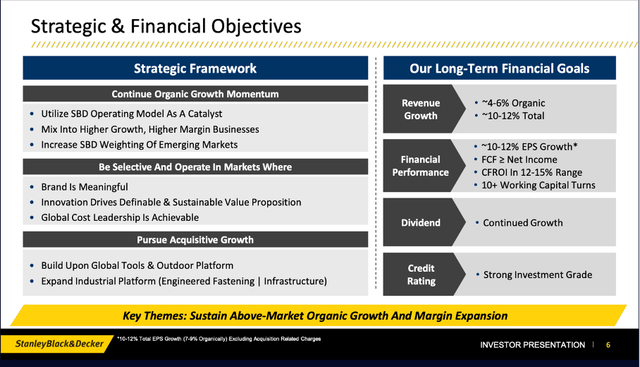

Stanley Black & Decker Presentation

However, when looking at the long-term financial goals of Stanley Black & Decker our assumptions seem too pessimistic. Management is expecting revenue growth of 10% to 12% (with 4% to 6% growth being organic) and earnings per share are also expected to grow with a CAGR of 10% to 12%. When working with the same assumptions as above but calculate with 10% growth (instead of 5%) till fiscal 2023 followed by 6% growth till perpetuity, we get an intrinsic value of $163.28, and Stanley Black & Decker would clearly be undervalued at this point.

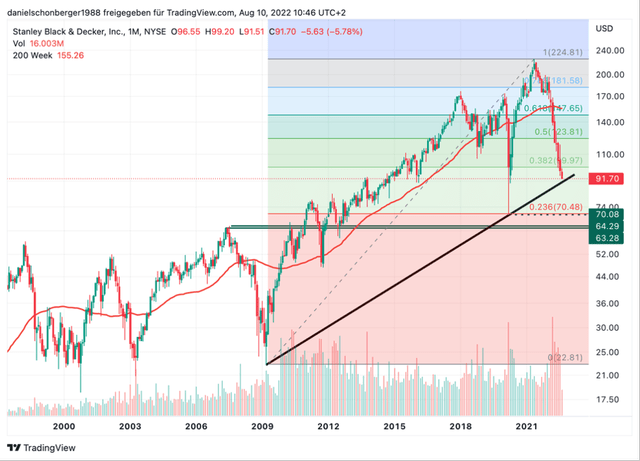

Technical Picture

Aside from looking at the fundamental business, we can also take a look at the chart and can see that SWK is at a support level right now. The black trendline, which is connecting the 2009 lows as well as the COVID-19 low might be a strong support level for the stock – especially as the stock appears to be oversold. And that combination might lead to the stock bouncing off the trendline in the coming weeks.

However, I don’t want to rule out further declines for the stock. In my opinion, it could break the trendline and decline as low as $70 in the coming months. At that price level we not only have the 23% Fibonacci retracement of the last upward wave (beginning in 2009), but also the COVID-19 crash lows. And around $65 we also find the highs before the Great Financial Crisis, which can also provide a support level.

Conclusion

In my opinion, we can call Stanley Black & Decker at least fairly valued right now as it seems to be trading below the calculated intrinsic value – even when using rather cautious assumptions. Nevertheless, the probability for a recession and bear market that is still upon us is rather high. I would assume the stock to decline further in such a scenario and if the stock should decline further, a good entry point would be around $65-70. Despite being a “Buy” from a fundamental point of view, I would rate the stock as “Hold” as I expect lower stock prices in the coming quarters.

Be the first to comment