ChrisHepburn/iStock via Getty Images

Co-produced by Austin Rogers

In just the latest episode demonstrating how hot the industrial real estate sector is right now, LXP Industrial Trust (LXP) recently received a take-private buyout offer for $16 per share, a 22% premium over its unaffected stock price (prior to news of the buyout offer). The $4.5 billion offer came from activist investor Litt’s Land & Buildings.

Industrial property (LXP Industrial Trust)

This new (potential) takeout of a smaller industrial REIT comes after the $4 billion acquisition of Monmouth Real Estate (MNR) in 2021 by Industrial Logistics Properties Trust (ILPT). A fierce bidding war, attracting at least four major bidders, ultimately culminated in the externally managed ILPT securing the acquisition for $21 per share, 24% higher than MNR’s unaffected stock price.

If both MNR and LXP are acquired, there will be only a handful of smaller industrial REITs remaining that make attractive buyout prospects.

- Plymouth Industrial (PLYM) – $1.01 billion market cap

- Terreno Realty Corporation (TRNO) – $5.35 billion

- PS Business Parks (PSB) – $5.75 billion market cap

- STAG Industrial (NYSE:STAG) – $7.57 billion market cap

PLYM is a very small REIT that operates mostly in secondary markets on the Eastern half of the nation, and it wouldn’t be surprising to see it acquired. At an FFO multiple under 17x, PLYM could be an attractive buyout opportunity, but it wouldn’t be a major one for most of the potentially interested parties. Any of the larger industrial REITs could swallow it whole while barely moving the FFO needle. Most of them acquire the equivalent of PLYM’s total asset base (or more) in a given year. Adjusted for its high leverage, it also isn’t as cheap as it may seem.

TRNO, at an FFO multiple over 40x, is likely too expensive for a buyout.

Meanwhile, PSB could be an interesting buyout prospect for a multi-tenant industrial REIT like EastGroup Properties (EGP), but since Public Storage (PSA) owns over 40% of PSB stock, they would need to sign off on it.

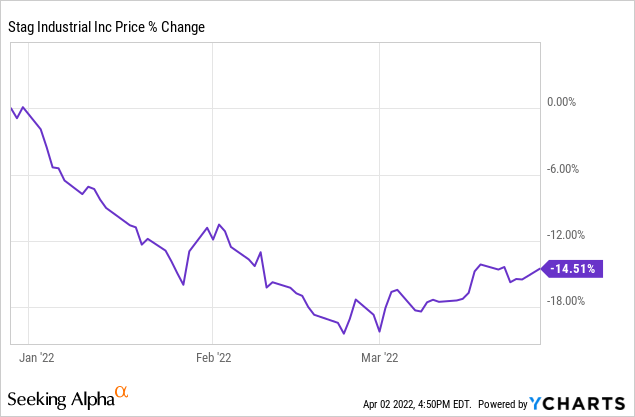

STAG, on the other hand, trades at about a 19x FFO multiple after its recent 15% dip and could be just the right size for one of the two large-cap industrial REITs, Prologis (PLD) or Duke Realty (DRE), if they are interested.

Let’s take a closer look at STAG to get an update on this monthly dividend-paying, fast-growing industrial REIT.

Update On STAG

STAG Industrial is an industrial REIT with 517 properties spanning a little over 100 million square feet of space across some 60 markets. Portfolio occupancy sits at 95.9%, which is around its historical average.

The REIT differentiates itself from the pack of other industrial REITs by being a value investor, targeting mostly secondary markets and properties with a value-add component. We can see this in an average rent per square foot comparison. STAG’s YTD average rent per square foot of $4.66 is over 30% below the nationwide average of $6.76 PSF.

Even so, the industrial portfolio is heavily leveraged to the thriving e-commerce sector, as 90% of ABR derives from warehouse/logistics properties and around 40% from tenants involved in e-commerce businesses.

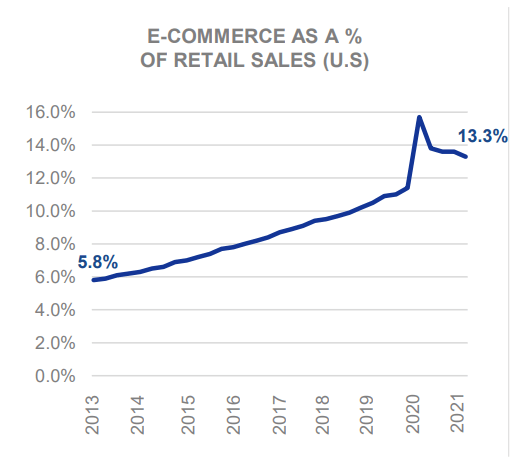

The trends for e-commerce look very favorable for continued growth. In the last five years, e-commerce sales have risen by about 167%.

E-commerce as a percentage of retail sales (STAG Industrial)

In the next five years, e-commerce sales are projected to increase by another 50% to $7 trillion by 2025.

Since the tenants are by and large seeing their sales grow substantially, it’s unsurprising that STAG’s same-store net operating income is increasing as well. Leases typically include 1-3% annual rent escalators.

What’s more, management guided for same-store NOI growth between 3.25% and 3.75% in 2021, and in the first nine months of the year, SSNOI sat at 3.4%. That’s well above its historic average of 1% on average SSNOI over its previous 6 years.

The latest acquisition volume guidance of $1.1 to $1.2 billion for 2021 was 10% higher than management’s initial acquisition guidance. The investment guidance for cap rates is a range of 5.25% to 5.5%, which is below STAG’s historical investment cap rates but still somewhat above average within the sector.

Compare STAG’s ~$1.15 billion of acquisitions in 2021 to the REIT’s average investment volume of $700 million over the previous 6 years. Also, compare STAG’s cap rate guidance to the average cap rate for prime industrial properties of 4.4%, according to JLL. The latter data point illustrates STAG’s targeting of value-add properties in secondary markets.

We will know more once they release full-year results, but it appears clear to us that the company’s growth is accelerating, both internally and externally.

Strong Backdrop For Industrial Real Estate

Industrial real estate has been on fire over the past two years, a period which came off of increasing strength during the 2010s due to the rise of e-commerce.

The sector has several major tailwinds in its favor:

- E-commerce sales, which as we saw above, have been growing and are projected to keep growing.

- Strengthening domestic supply chains in response to COVID-era shortages.

- Record low vacancy rate of 4.3% in Q3 2021.

- Development of new supply unable to keep up with demand, due to a number of factors.

- Rising inventory levels among corporate America in order to avoid future shortages.

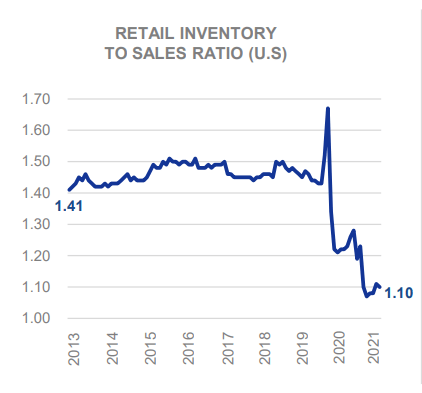

On that last point, note that throughout 2021, the inventory to sales ratio remained at extremely depressed levels, hence the prevalent empty shelves and “out of stock” messages shoppers would frequently see online.

Retail inventory to sales ratio (STAG Industrial)

It will take a while for businesses to get inventory levels back up to normal, and they will need to utilize warehouse space to do that.

Rent rates increased 7.1% year-over-year in Q3 2021 as industrial landlords leased 138 million square feet of space.

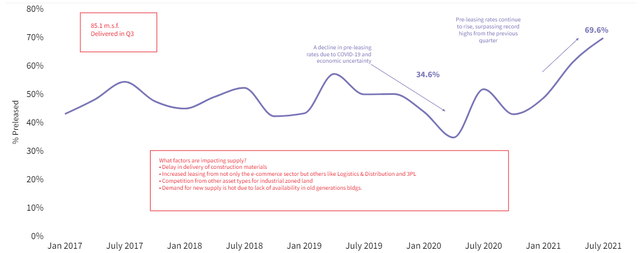

And developers are having trouble building enough new properties to meet demand. In the third quarter, nearly 70% of all new industrial properties under development had been pre-leased, which is the highest percentage in years according to JLL (JLL):

Industrial pre-leasing rates (JLL)

In the third quarter, net absorption was the highest it has ever been, with over 135 million square feet absorbed.

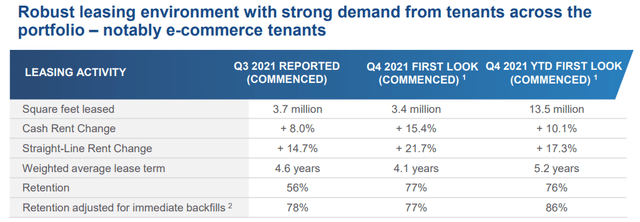

This pushed industrial rents up for industrial space by 10-15% in 2021. For STAG specifically, cash rents increased 10% year-over-year, while straight-line rents (incorporating future rent increases) rose over 17%.

STAG Industrial growth metrics (STAG Industrial)

A recent JLL survey of logistics experts shows that 75% of industry insiders believe demand for space will increase by at least another 5% over the next three years. And 28% see it increasing by 20% or more.

But with construction costs still high, available land limited, and new sustainability requirements complicating development projects, supply should continue having a tough time keeping up with demand. Nationwide average industrial rents are expected to rise another 5-10% in 2022 after the phenomenal year they enjoyed in 2021.

This is one reason why investors have flocked to industrial properties so rapidly in the last year or so.

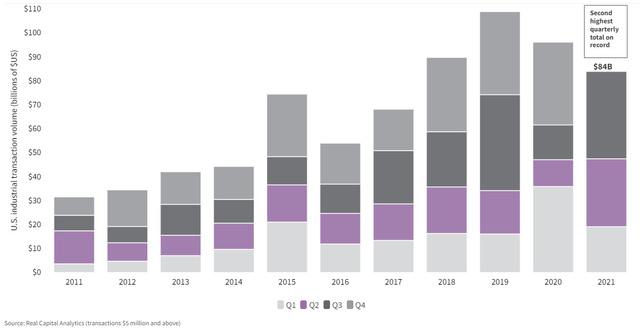

Total investment volume reached $84 billion in just the first nine months of 2021, already a higher investment volume than all but three years in US history.

Industrial real estate investment volume (JLL)

The fourth quarter will almost surely cause 2021 to set a new record for industrial real estate transaction volume. Globally, industrial real estate made up about a quarter of all commercial real estate transactions last year.

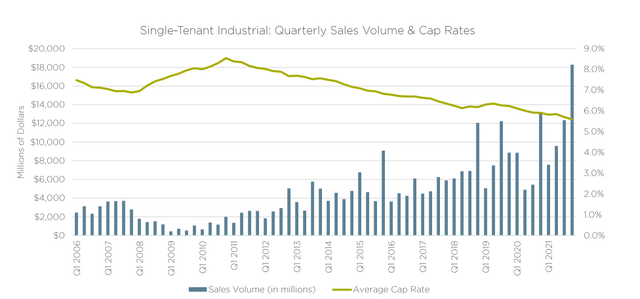

Largely as a result of this high investor demand, cap rates have compressed very quickly in US industrial real estate. One can see this by looking at STAG’s historical acquisition cap rates.

In 2016, STAG was acquiring properties for 8-9%+ cap rates. In 2018, it was acquiring properties for 7-8%. In 2019, it was acquired for 6-7%. In 2021, it was targeting acquisition cap rates in the range of 5.25% to 5.5%.

Now, some of this drop in cap rates is due to STAG acquiring higher-quality properties, but much of it is simply due to compressing cap rates in this sector. At this point, STAG’s target acquisition cap rate range is right around the average for single-tenant industrial net lease properties.

Industrial real estate cap rate compression (Stan Johnson Q4 2021 Net Lease Report)

Fortunately, STAG’s cost of capital has fallen along with cap rates, thereby allowing the REIT to maintain a healthy investment spread.

The Reinvention of STAG

To get a complete picture of STAG, one needs to go back in time about a decade, because STAG was not always as high quality of a REIT as it is today.

When STAG went public and for a short period thereafter, management rapidly accelerated growth, which led to a correspondingly rapid rise in the dividend from 2011 through 2013 but also an increasing debt burden. In 2013, STAG got to the point where it was paying out nearly 100% of its free cash flow as dividends and also had a large debt burden to deal with.

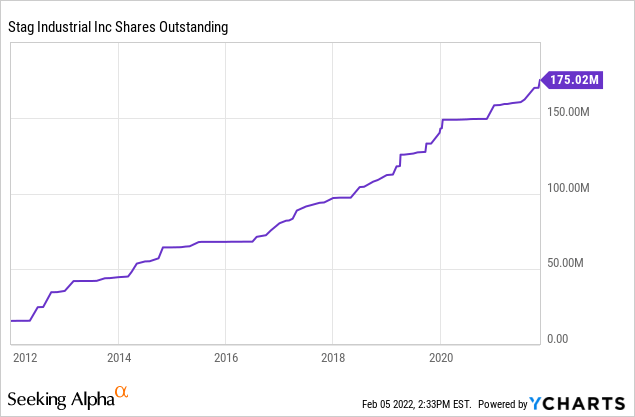

The CEO at the time, Benjamin Butcher, made a plan to thread the needle by continuing to grow the portfolio while simultaneously lowering leverage levels as well as the payout ratio. How does a REIT do this? By issuing equity for growth and raising the dividend only very slowly.

STAG Industrial expanding share count (STAG Industrial)

Since 2014, the dividend has crept up extremely slowly, with each raise to the monthly payout amounting to a mere fraction of a penny.

This made being a shareholder frustrating because the portfolio expanded while FFO per share grew slowly, and the dividend rose even slower – almost giving no growth at all.

But the plan has been working.

STAG’s payout ratio dropped from 91% of FFO in 2016 to 76% in 2020, although there are better measurements of true free cash flow than FFO, such as cash available for distribution. In 2020, STAG paid out 90% of CAFD. The difference mostly comes from cash rent versus straight-line rent. CAFD uses cash rent, while FFO uses straight-line.

A 90% FCF payout ratio is still high, but it’s still lower than it was for most of the 2010s. And it likely fell even further in 2021 as rents soared.

Moreover, in the Spring of 2021, STAG earned credit upgrades from both Fitch and Moody’s to BBB/Baa3 ratings. This will steadily lower STAG’s cost of capital as the REIT refinances debt in the coming years.

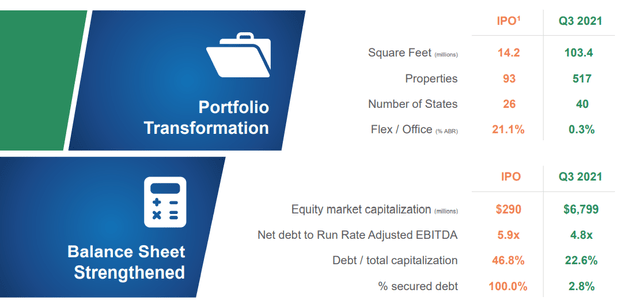

In Q3 2021, net debt to EBITDA sat at 4.8x, already on the low end of management’s 2021 guidance of 4.75x to 5.5x. That is down from 5.6x in 2015 and 5.9x at the time of STAG’s IPO in Q2 2011.

STAG’s evolution over the years (STAG Industrial)

STAG now appears to be in a strong position to continue growing, especially amidst such a strong demand for its target property type.

Bottom Line

Could STAG be an acquisition target for a larger REIT or fund? Perhaps. Its valuation discount to peers certainly makes it attractive for a buyout. It would immediately expand the FFO per share for a number of larger peers and also provide them a new pipeline of value-add-type opportunities.

But we never make investment decisions based on buyout prospects alone.

On its own, STAG makes a great way to gain exposure to the red-hot industrial sector while earning a near 4% dividend yield, well above the yields of most peers.

With STAG’s long reinvention process nearing completion, the REIT seems well-positioned to earn a higher FFO multiple and increase its dividend growth rate. Just to return to its highs of a month ago, it would need to appreciate by 20%, and it provides good diversification to our retail-heavy REIT portfolio.

If I had some extra cash laying around, I would likely make a small addition here.

Be the first to comment