zoranm/E+ via Getty Images

Introduction

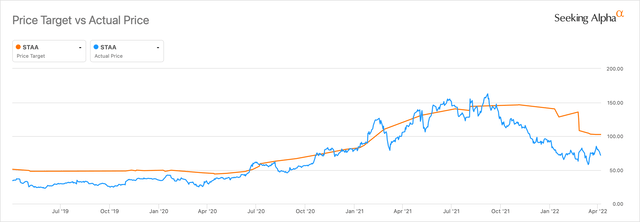

STAAR Surgical Company (NASDAQ:STAA) is at the top of my watchlist; a limit order placed at $65. STAAR Surgical is down over 50 percent from its 52-week high, STAAR Surgical is still trading at high valuations. But, with that said, STAAR has a long runway of growth ahead of it still. STAAR has a 20% 5-year average year over year revenue growth, and the future growth is expected to be just over 30%. Again, STAAR Surgical is trading at lofty valuations, with a TTM P/E GAAP near 140; they trade nearly 5 times the sector median P/E, which is about 29. That said, the recent FDA approval, an untouched market for Visian Implantable Collamer Lens (ICL) sales in the United States, demonstrating the first Visian ICL implants in the United States, and Covid fading, all make STAAR Surgical a great addition to a risk averse investor’s watchlist. As they continue to grow into their valuation, or as market volatility continues, it might be a good time to begin dollar cost averaging in, or just keeping a close eye on the share price. If you currently hold shares, now is a great time to continue to remain patient and not sell.

Background

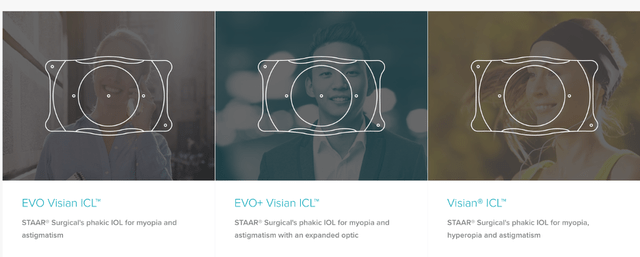

STAAR Surgical manufactures, designs, develops, and markets various implantable eye lenses. These lenses are intended to provide visual freedom to patients, lessening or eliminating the reliance on glasses or contact lenses. STAAR Surgical not only developed, but also patented and licensed the foldable intraocular lens (IOL) which is the first of its kind. To date, STAAR Surgical sells its Evolution in Visual Freedom (EVO) Visian ICL and Visian ICL lenses in over 75 countries. Moreover, the product has been implanted in more than 1M eyes spanning across the 75 plus countries. Used to treat hyperopia, myopia, and astigmatism, these ICLs are implanted behind the iris and in front of the patient’s natural lens to treat the previously stated refractive errors. The IOL, which is made from pliable materials, allowed surgeons first time to replace a cataract patient’s own natural lens with a minimally invasive surgery. These foldable IOLs became the standard of cataract surgeries throughout the world. This set them apart and established them as an innovator and first of its kind mover.

Differentiating itself from LASIK, STAAR Surgical’s EVO lens are put into a patient’s eye through procedure that is relatively quick. Specifically, there is no removal of corneal tissue. Additionally, the EVO lens can be removed, if desired. The process for implant consists of the EVO being placed into the posterior chamber of the eye directly. The earlier versions of Visian ICL lens within the United States were different. They required a preoperative peripheral iridotomy that is now obsolete with EVO. This sets STAAR Surgical as the leading disrupter and optimizes a patient’s comfort levels. Moreover, STAAR Surgical’s EVO does offer a lens-based alternative for refractive errors for those who use glasses or contacts for distance vision.

Price Targets (Seeking Alpha )

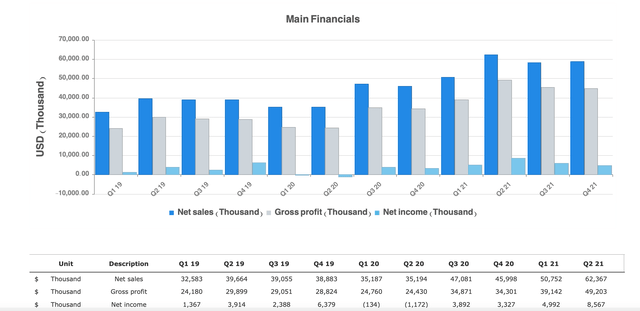

Financials

While there are tons of metrics to cover for the last quarter, I will highlight some of the numbers that stuck out to me. The most recent fourth quarter and full year 2021 earnings release showed a net sales increase of 28% from 46M to $59M million for the fourth quarter of 2021 when compared to same period a year ago. Sales increase was the result of ICL sales and unit growth of 33% and 36%. ICL sales represented 90% of total net sales for Q421. For the full year 2021, net sales of $230.5M for full year were up 41% when compared to $163.5M in the prior year. For reference, this growth is great when looking back at 2019 to 2020. I went back and looked at the full year results for 2020, and STAAR reached record net sales of $163.5 Million. For reference this was up only 9% from 2019. Again, for full year 2021 the increase in sales was driven by both ICL sales and unit growth. The respective results of those are 51% and 48%. It is worth noting that ICL sales represented 92% of total full year 2021 net sales. This is up from 87% when compared to 2020.

Financials (STAAR Surgical website)

Gross profit margin for Q421 was 76.3% compared to the prior year period of 74.6%. The things that had an impact on gross margin include a mix of ICL sales and geographic sales, and an increase in manufacturing project expense. The Q421 general and administrative expenses also increased, from $9.5M 2021 to $11.5M. STAAR states that the increase was related to increase compensation expense, services, and facility costs. With inflation having risen so much, I see the facility expenses and frankly, I am surprised they are not higher. Q421 selling and marketing expenses were $17.1 million compared to the prior year quarter of $11.8 million. STAAR also had an increase from $11.8M in marketing to $17.1M in Q421. Due to an increase in both advertising and promotional expenses, I believe the longer-term returns will warrant the spend. For fiscal year 2022, STAAR Surgical remains on its previously provided outlook of net sales near $295M, representing roughly 28% growth year over year. This would also represent another record year of net sales. I believe with the recent FDA approval, the forward-looking earnings and full year guidance will be raised significantly to reflect a large market in the United States.

Growth and Scalability

On the 28th of March, the U.S. FDA approved STAAR Surgical EVO/EVO+ Visian Implantable Collamer Lens. The EVO is used for the correction of myopia and myopia with astigmatism. Not even 2 weeks later, on April 6th, STAAR announced the first implants of the EVO ICL within the U.S. What is stunning is that activities outside the U.S. accounted for approximately 96% of total sales during 2021. In my opinion, the FDA approval now opens a large addressable market that had not been priced into the stock yet. During the press release on the 28th of March, STAAR Surgical CEO Caren Mason stated, “Following FDA approval, prospective patients in the U.S. and their doctors may now consider EVO for achieving Visual Freedom from the limitations, ongoing maintenance and inconvenience associated with glasses and contact lenses.” STAAR Surgical also stated in recent press release that further EVO ICL procedures either have already occurred or will occur in the following states: California, Colorado, Missouri, Texas, and Utah. For the first patient to receive the EVO ICL in the United State, the EVO implantation procedure, was completed in approximately 7-8 minutes for each eye.

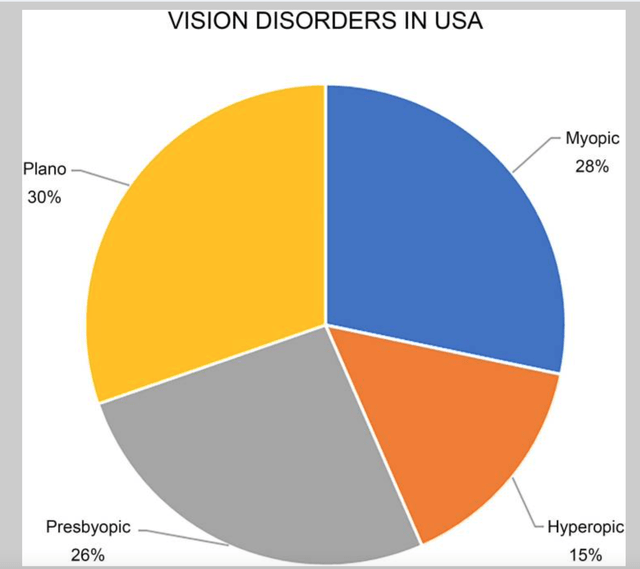

Vision Deficiencies (The 25th Anniversary of Laser Vision Correction in the United States)

According to the National Library of Medicine and the National Center for Biotechnology Information’s article, The 25th Anniversary of Laser Vision Correction in the United States, over the last 25 years, 20–25 million eyes were treated with less than 800,000 eyes being treated per year for the last ten years. According to the article, approximately 75 percent of adult Americans have a visionary problem that requires correction. That is an estimated number of nearly 230M people. Of the 230M, roughly 50 percent wear glasses, and around 14 percent wear contact lenses. If STAAR can grab 10 percent, that would equate to 2.3M people, in the U.S. alone.

Found in the article, Enhancing Night Vision with the EVO Visian ICL, to date, more than 800,000 US military personnel have undergone successful refractive surgery as part of the Warfighter Refractive Eye Surgery Program or referred to as WRESP. This is an initiative designed to reduce the limitations and constraints caused by the wear of corrective eyewear. While majority of procedures performed were laser based surgeries, the ECO Visian ICL is available for U.S. Servicemembers, but on at selected US Army WRESP centers. Most notably related, STAAR Chief Medical Officer Dr. Scott Barnes has seen 3,000 ICL implants under his direction while serving as Colonel at Fort Bragg. If moving forward military offers EVO ICL nationwide, STAAR stands to benefit from that tailwind greatly.

Risks

Some of the risks pertaining to STAAR Surgical’s business consist of possible disruptions to their supply chain or change in forecasted product demand. Additionally, they noted in the 10-K, supply for raw materials could be impacted due to shortages and looming COVID-19. Additionally, the market price of STAAR Surgical is likely to remain volatile. This could steer investors away. The closing price of the stock has ranged from $57 to $162 and back down per during the past 18 months. Political and economic conditions consisting of a possible recession, rate fluctuations, COVID-19, and a continuation of these may continue to weigh on the share price. Lastly, and the most notable is related to stock ownership. STAAR Surgical stock ownership is concentrated amongst a few investors. This may affect 3rd party acquisition and buyout. Additionally, a larger sale from current investors could cause a greater decline in share price. The largest investor owns nearly 18 percent of outstanding stock. The four largest investors own nearly 50 percent of outstand stock. These all are things to keep in mind, but none serve as a major headwind in my opinion.

Final Thoughts

With share price volatility and high PE, it can be daunting to buy shares at these levels. Thankfully, you can add the stock to your watchlist and buy when it suits your risk/reward level. STAAR has price estimates ranging from $72 per share to $165 per share. With a $3.4B market cap and high PE, the volatility is to be expected. STAAR has already rewarded shareholders with over 600% returns since 2018, and I fully expect them to return in the next 5 years too. STAAR Surgical still has a lot to prove before I feel comfortable to make it a full position in my portfolio. However, I am getting closer to pulling the trigger and picking up a starter position in the $65-$75.

Be the first to comment